Need a Zelle payment receipt template for personal or business transactions? A well-structured receipt ensures clarity, proof of payment, and compliance with financial records. While Zelle itself does not generate official receipts, you can create one manually or use a customizable template to meet your needs.

A complete receipt should include key details: sender and recipient names, transaction date, amount, reference number, and a brief description of the payment purpose. Adding a section for confirmation messages or bank references can further validate the transaction.

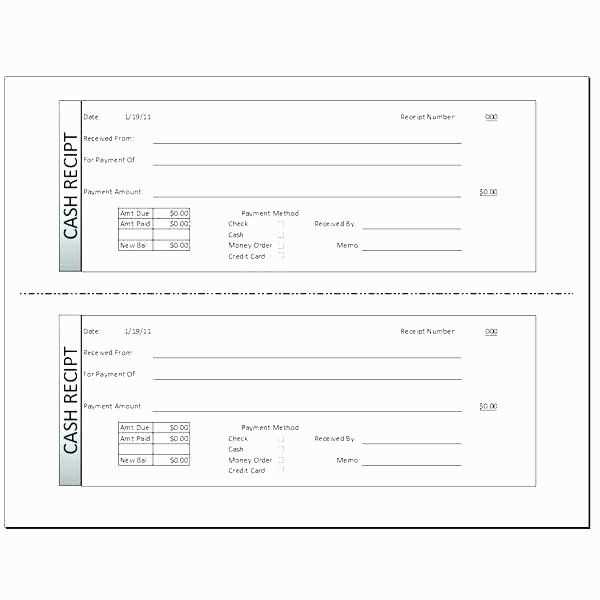

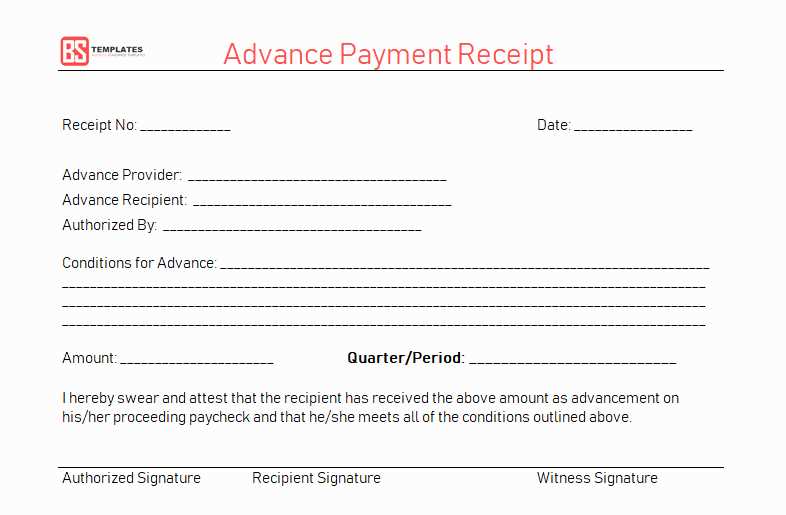

For a professional touch, consider using a pre-designed template with a structured format. Many templates are available in Word, PDF, or Excel formats, allowing easy customization. If you prefer automation, online invoicing tools can generate Zelle receipts with minimal effort.

To ensure authenticity, always verify details before sharing the receipt. Providing accurate transaction references helps prevent disputes and makes record-keeping more reliable. If needed, you can request confirmation from the sender or recipient within the Zelle app to cross-check payment details.

Here’s the corrected version with redundant repetitions removed:

When creating a Zelle payment receipt, focus on clarity and accuracy. Include the transaction date, amount, and sender/receiver details. Make sure to list the payment reference or ID to provide a traceable record. Avoid clutter by excluding unnecessary phrases that don’t add value to the receipt’s purpose. Each receipt should serve as a clear confirmation of the transaction.

Ensure the sender’s and receiver’s names are clearly stated, along with their associated emails or phone numbers. Always provide a unique transaction ID that can be used for tracking purposes. Avoid any repetitive statements, like restating the transaction amount multiple times, as it only adds unnecessary length. A concise, clear format makes the receipt easier to understand and verify.

Incorporate a thank-you message at the bottom to maintain professionalism and customer satisfaction. Keep the tone formal yet friendly, without overloading the receipt with unnecessary details. The goal is to make sure the recipient can confirm and verify the payment quickly.

- Zelle Payment Receipt Template

Creating a Zelle payment receipt is straightforward but requires clarity. A well-organized receipt can help confirm the details of a transaction. Ensure to include the following elements for accuracy:

Key Details to Include

First, list the sender’s and receiver’s names along with the payment amount. Include the date and time of the transaction. If possible, add a transaction ID or reference number to help track the payment. Also, make sure to note the method used (Zelle) and the bank name, especially if there are multiple ways to pay via Zelle.

Template Example

Here’s a simple structure you can follow:

Transaction Date: [Insert Date] Sender Name: [Sender's Full Name] Receiver Name: [Receiver's Full Name] Amount: [Amount Transferred] Transaction ID: [Unique ID] Payment Method: Zelle Bank Name: [Bank Name]

Feel free to adjust this template to fit your needs, adding or removing information as necessary. Always ensure all critical details are visible for future reference.

A payment receipt should clearly state the transaction details. Include these key elements to make the receipt accurate and reliable:

Transaction Information

Start with the payment date and time, which helps both parties track the transaction. Mention the amount paid and the method used, such as Zelle, to ensure clarity about the payment process.

Parties Involved

List both the payer’s and payee’s details. This includes the payer’s name, email address, or phone number, and the payee’s business or personal name along with their contact details. This identification ensures no confusion over the transaction parties.

Payment Reference or ID

Include a unique payment reference or transaction ID that Zelle generates for the payment. This helps verify and trace the payment if needed later on.

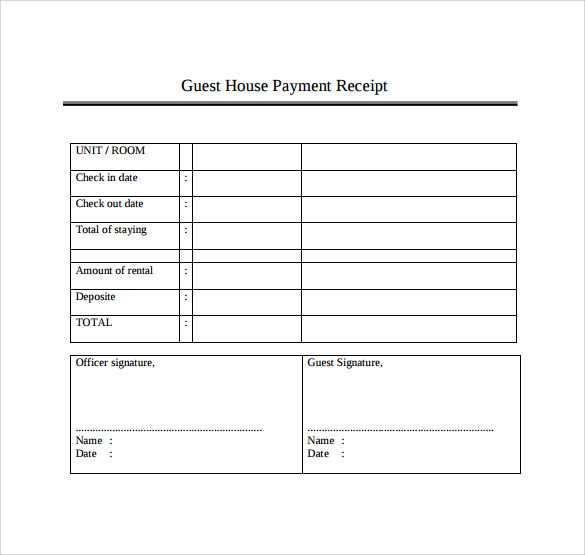

Amount Breakdown

Provide a breakdown of the total amount. If the payment involves multiple items or services, itemize them with prices. This breakdown improves transparency and ensures both parties are clear on what the payment covers.

Purpose or Description of Payment

Describe the reason for the payment. Whether it’s for a product, service, or a loan repayment, a brief explanation can avoid misunderstandings.

Receipt Footer

Finally, include a footer that confirms the payment has been received, along with any additional notes or disclaimers if applicable.

| Element | Description |

|---|---|

| Transaction Date & Time | Exact date and time when the payment was made |

| Payer Details | Name, email, or phone number of the payer |

| Payee Details | Business or personal name of the payee with contact info |

| Payment Reference ID | Unique ID provided by Zelle for the transaction |

| Amount Breakdown | Detailed breakdown of payment if applicable |

| Payment Purpose | Short description of what the payment is for |

| Receipt Footer | Confirmation and additional notes or disclaimers |

To create a custom Zelle receipt, focus on providing the key details that are important for both the sender and recipient. First, include the payment amount, the date of the transaction, and the sender’s and recipient’s names. This ensures transparency and accuracy. If possible, add the confirmation number for the payment, as it serves as a unique reference to track the transaction. These details are critical for both parties in case of any issues or disputes.

Designing the Layout

Keep the layout clean and simple. Use headings and bullet points to organize the information logically. Start with the transaction details at the top, followed by payment references and contact information. A clear and readable font will enhance usability, especially for recipients reviewing the receipt on mobile devices.

Adding Additional Customization

If you want to add a personal touch, consider including your business logo or a thank-you note at the bottom of the receipt. This can help build a more professional and customized experience. However, avoid cluttering the receipt with unnecessary elements that could distract from the main information.

By focusing on the essentials and organizing the receipt well, you can create a custom Zelle receipt that is both professional and easy to understand.

Use a clear and concise email format to send payment confirmations. Begin with a straightforward subject line, like “Payment Confirmation for [Transaction ID].” In the body, include the following details: transaction date, amount paid, recipient’s name, payment method, and a unique confirmation number. This information helps both parties track the payment easily.

If you’re sending a confirmation via text message, keep it short yet informative. Include key transaction details, such as the payment amount and the recipient’s name. Consider adding a link to a secure page where the recipient can review the full transaction details.

For more formal transactions or for clients expecting a professional record, use a PDF receipt format. This allows for easy printing and ensures the information remains unchanged. Include the same details you would in an email, plus additional data such as your business’s contact information and payment reference number.

In all formats, ensure that the tone is polite and direct. Providing clarity and confirmation in your payment receipt will help avoid confusion and establish trust. Make it easy for the recipient to verify the payment with the information provided. Keep the design simple, especially for text messages, to ensure the confirmation is easy to read and understand at a glance.

Creating a clear and functional Zelle payment receipt template is straightforward. Start by including the following essential elements:

- Sender’s Name: Specify the full name of the person who made the payment.

- Recipient’s Name: Include the full name of the person receiving the payment.

- Payment Amount: Clearly state the total amount transferred.

- Payment Date: Mention the exact date and time of the transaction.

- Transaction ID: Provide the unique identifier for the payment to ensure traceability.

- Payment Method: Specify “Zelle” as the method used for the transaction.

Example Layout

- Receipt Header: “Zelle Payment Receipt”

- Sender’s Details: Full Name, Email Address, and Phone Number

- Recipient’s Details: Full Name, Email Address, and Phone Number

- Transaction Summary: Payment Amount, Date, and Time

- Confirmation: A statement confirming successful payment and transaction ID

This template provides a simple, professional record for all Zelle transactions, ensuring transparency and accountability for both parties involved.