Every construction project, whether a small home repair or a large-scale renovation, requires clear and accurate financial records. A well-structured building work receipt ensures transparency, simplifies bookkeeping, and protects both the contractor and the client. To create a receipt that covers all key details, include the contractor’s name, client’s information, date, project description, and a clear breakdown of costs.

A standard receipt should outline materials used, labor charges, and any additional expenses. Listing each item separately prevents confusion and helps resolve potential disputes. If the project includes phases, specifying completed work and pending tasks adds further clarity.

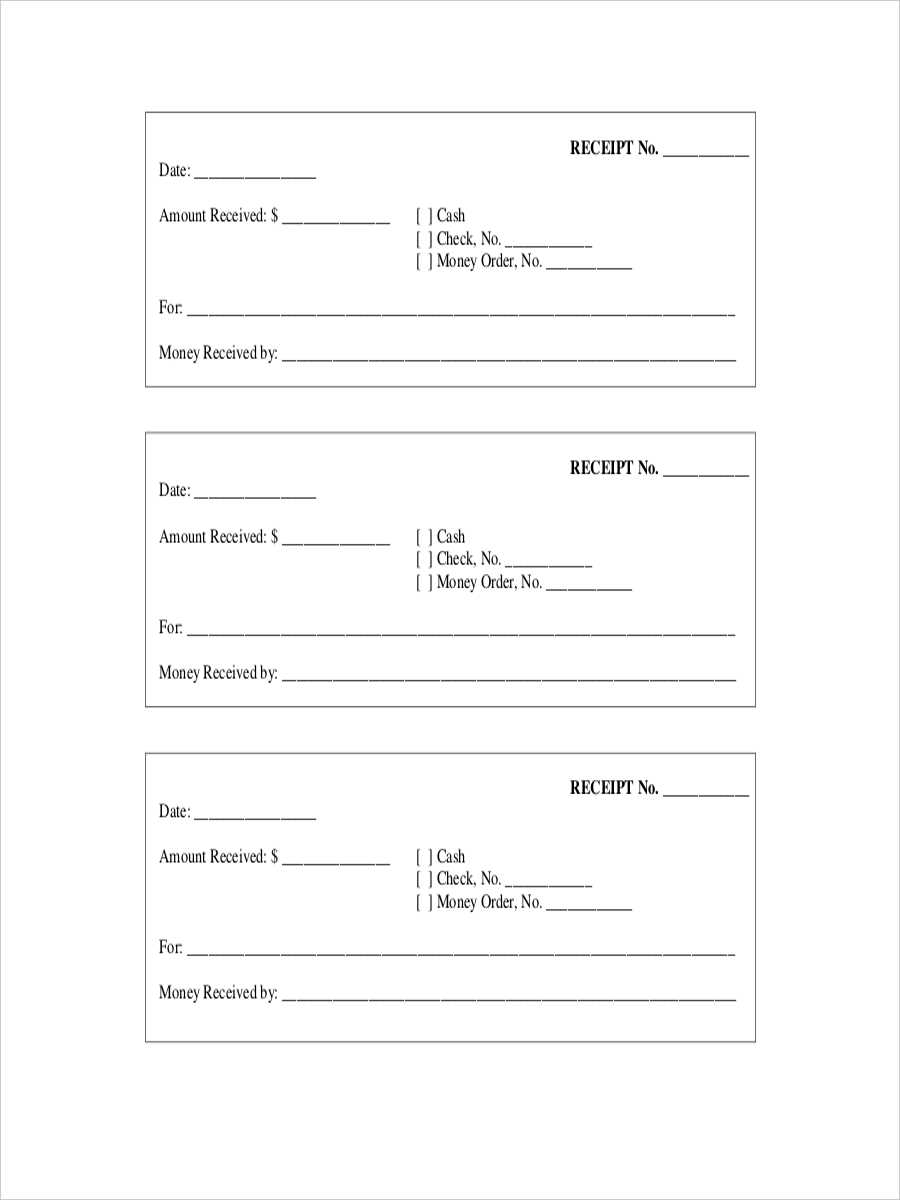

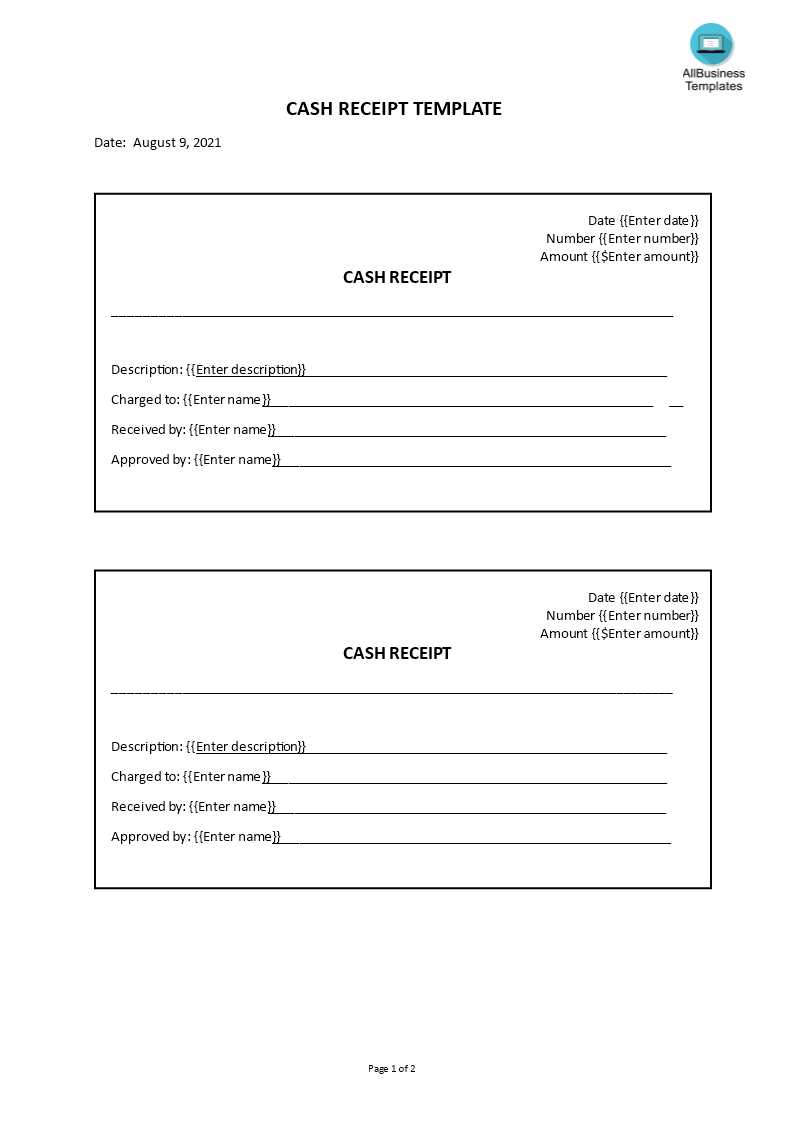

For tax and legal purposes, always include the payment method, receipt number, and a note on whether the amount is final or subject to additional charges. Adding a signature field for both parties reinforces authenticity. Using a structured template saves time and ensures consistency across different projects.

To streamline the process, consider digital solutions such as editable PDFs or invoice-generating software. These tools allow for quick modifications, easy sharing, and automatic calculations, reducing the risk of errors. Whether you create a custom template or use a pre-designed format, keeping receipts detailed and organized is essential for smooth project management.

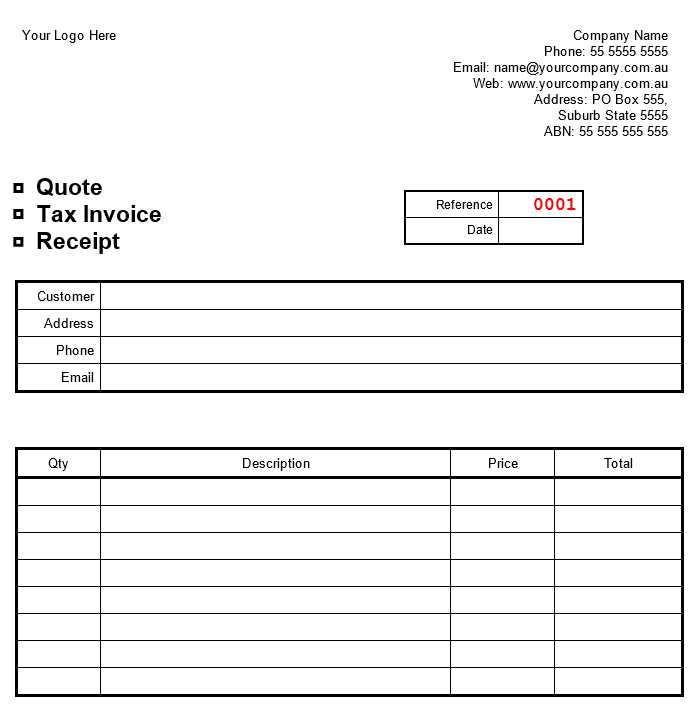

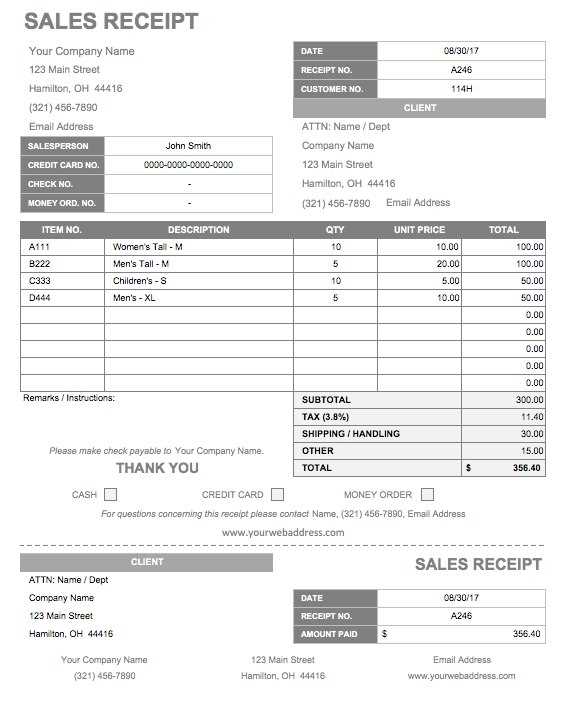

Building Work Receipt Template

A well-structured receipt ensures clarity in transactions and protects both contractors and clients. Include these key details for accuracy:

Essential Information

Start with the contractor’s business name, address, and contact details. Include the client’s name and project location for reference. Assign a unique receipt number and specify the issue date.

Detailed Breakdown

List all services and materials with descriptions, quantities, and individual costs. Summarize the total amount, including tax calculations if applicable. Specify payment method and confirm if it’s a full or partial payment.

Add a section for terms, such as warranties or late payment policies. A signature line for both parties provides an extra layer of confirmation.

Using a clear format reduces disputes and ensures smooth financial tracking. A digital or printed copy should always be provided to the client.

Key Elements to Include in a Building Work Receipt

Include these essential details to ensure transparency and accuracy in every transaction:

- Business and Client Information: Clearly state the contractor’s name, address, contact details, and tax identification number. Include the client’s full name and address.

- Receipt Number and Date: Assign a unique receipt number and specify the date of issue for proper record-keeping.

- Description of Work Performed: List the services provided with details such as project type, materials used, and labor involved.

- Itemized Costs: Break down charges for materials, labor, permits, and additional expenses. Specify unit prices, quantities, and total amounts.

- Total Amount Paid: Display the final amount paid, including applicable taxes. If a deposit or partial payment was made, indicate the balance due.

- Payment Method: Mention whether payment was made by cash, check, credit card, or bank transfer.

- Contractor’s Signature: A signature or stamp adds authenticity and confirms receipt of payment.

Providing a clear, detailed receipt helps prevent disputes and establishes trust between both parties.

How to Structure a Clear and Professional Receipt

Use a structured format with clearly defined sections. At the top, include your company name, logo, and contact details. Below, add the receipt number and date for easy reference.

Clearly list the customer’s name and contact information. This ensures proper record-keeping and simplifies communication if any issues arise.

Break down the charges in an itemized list. Include a description of each service or material, quantity, unit price, and total cost. Align figures properly for readability.

Show the subtotal, taxes, and final amount due separately. If applicable, specify any discounts or additional fees. Use a bold or slightly larger font for the total amount.

Specify the payment method and transaction details. If paid in cash, mention the amount received and change given. For card payments, note the last four digits of the card or transaction ID.

Add a brief statement about warranty, refund policy, or terms of service if relevant. Keep it concise and easy to understand.

Conclude with a thank-you message or a note encouraging future business. A friendly closing leaves a positive impression and builds trust.

Legal and Tax Considerations for Construction Receipts

Specify all mandatory details. A valid construction receipt must include the contractor’s name, business address, tax identification number, and the client’s details. Clearly list materials, labor costs, and applicable taxes. Missing or incorrect information can lead to disputes or tax issues.

Apply the correct tax rate. Sales tax regulations vary by location. Check whether construction services, materials, or both are taxable in your jurisdiction. If exempt, note the exemption reason and keep supporting documentation.

Keep receipts organized for audits. Store digital and physical copies for at least five years, depending on local regulations. Use accounting software or cloud storage to prevent loss and ensure easy access during tax audits.

Issue receipts promptly. Delayed receipts can cause bookkeeping errors and tax reporting discrepancies. Always provide receipts immediately after receiving payment to maintain accurate records.

Differentiate between deposits and final payments. If a client makes an advance payment, specify whether it’s a deposit, partial payment, or final balance. Misclassifying funds may affect tax liability and contractual obligations.

Include a disclaimer if necessary. Some construction work may involve warranties, liability limitations, or conditional terms. If applicable, reference these policies on the receipt or attach a separate document.

Consult a tax professional for compliance. Tax codes change, and construction businesses often qualify for deductions related to equipment, labor, or material costs. A specialist can help optimize tax filings and avoid penalties.