Key Details to Include

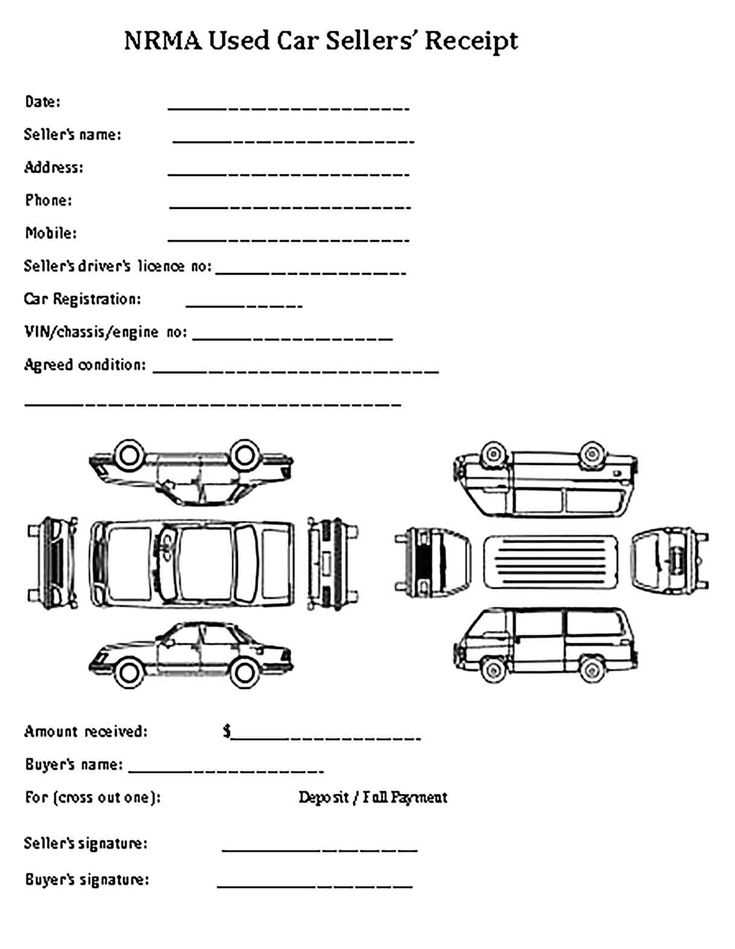

A car purchase deposit receipt must clearly outline the transaction details. To avoid disputes, include the following:

- Date of Transaction: The exact date the deposit was made.

- Buyer’s Information: Full name, address, and contact details.

- Seller’s Information: Name, address, and phone number.

- Vehicle Details: Make, model, year, VIN, and mileage.

- Deposit Amount: The sum paid and the payment method.

- Balance Due: The remaining amount required to complete the purchase.

- Conditions: Whether the deposit is refundable or non-refundable.

- Signatures: Both parties should sign to confirm the agreement.

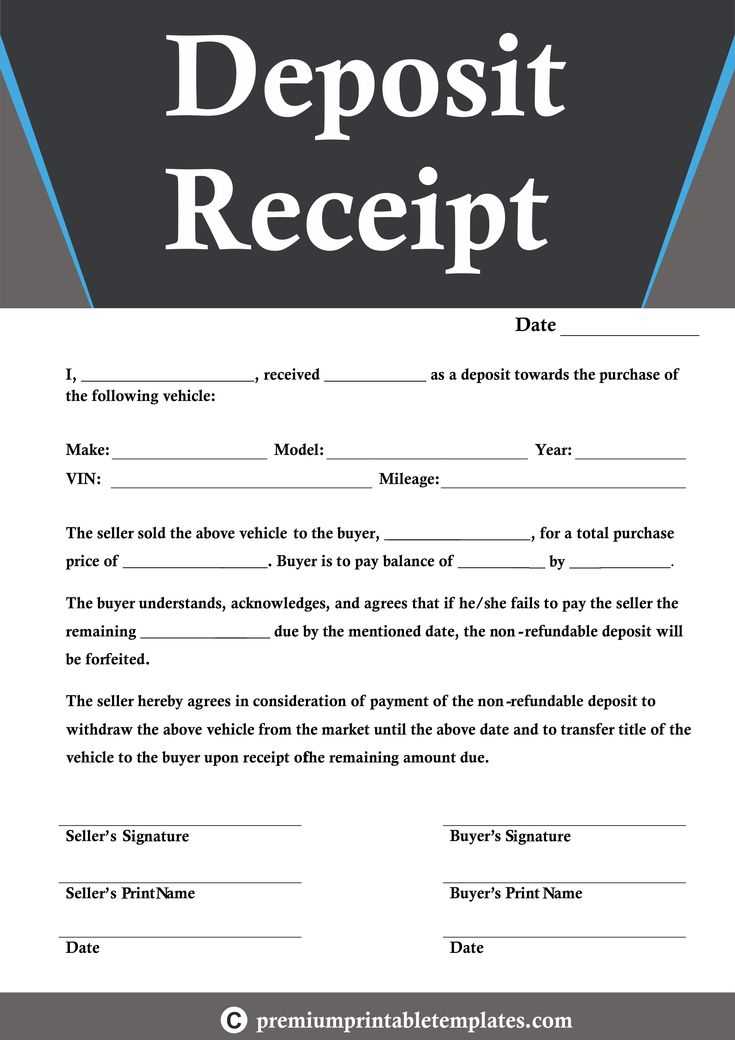

Sample Template

Use this format to create a clear and professional receipt:

Car Purchase Deposit Receipt Date: [Insert Date] Buyer Information: Name: [Buyer’s Name] Address: [Buyer’s Address] Phone: [Buyer’s Contact] Seller Information: Name: [Seller’s Name] Address: [Seller’s Address] Phone: [Seller’s Contact] Vehicle Details: Make: [Car Make] Model: [Car Model] Year: [Car Year] VIN: [Vehicle Identification Number] Mileage: [Mileage] Payment Details: Deposit Amount: [Amount] Payment Method: [Cash/Check/Other] Balance Due: [Remaining Amount] Terms: ☐ Refundable ☐ Non-refundable Signatures: Buyer: ______________________ Seller: ______________________

Final Steps

Make two copies of the signed receipt–one for the buyer and one for the seller. If payment is made electronically, attach proof of the transaction. For additional security, notarization may be an option.

Car Purchase Deposit Receipt Template

Key Elements to Include in a Deposit Receipt

How to Write a Legally Binding Receipt

Common Mistakes to Avoid When Drafting

Key Elements to Include in a Deposit Receipt

A proper deposit receipt must contain the buyer’s and seller’s full names, contact details, and addresses. Specify the vehicle’s make, model, year, VIN, and agreed purchase price. Clearly state the deposit amount, payment method, and the date it was received. Include any terms regarding the deposit’s refundability and both parties’ signatures.

How to Write a Legally Binding Receipt

Use clear language, avoiding vague terms. Mention the seller’s obligation to deduct the deposit from the total price upon completion of the sale. If the deposit is non-refundable, explicitly state the conditions. Both parties must sign and date the receipt. Providing a duplicate copy ensures both retain proof of the agreement.

Common Mistakes to Avoid When Drafting

Failing to include the refund policy leads to disputes. Omitting key details such as VIN or payment method weakens the document’s validity. Handwritten receipts without signatures lack legal weight. Ensure the document is legible, structured, and free from ambiguous terms.