A well-organized cash receipt journal is a key tool for tracking all incoming payments. With a clear and structured format, it helps ensure accurate accounting and provides a reliable record of all transactions. A cash receipt journal template streamlines this process, offering a ready-made structure to record payments in a consistent and easy-to-manage way.

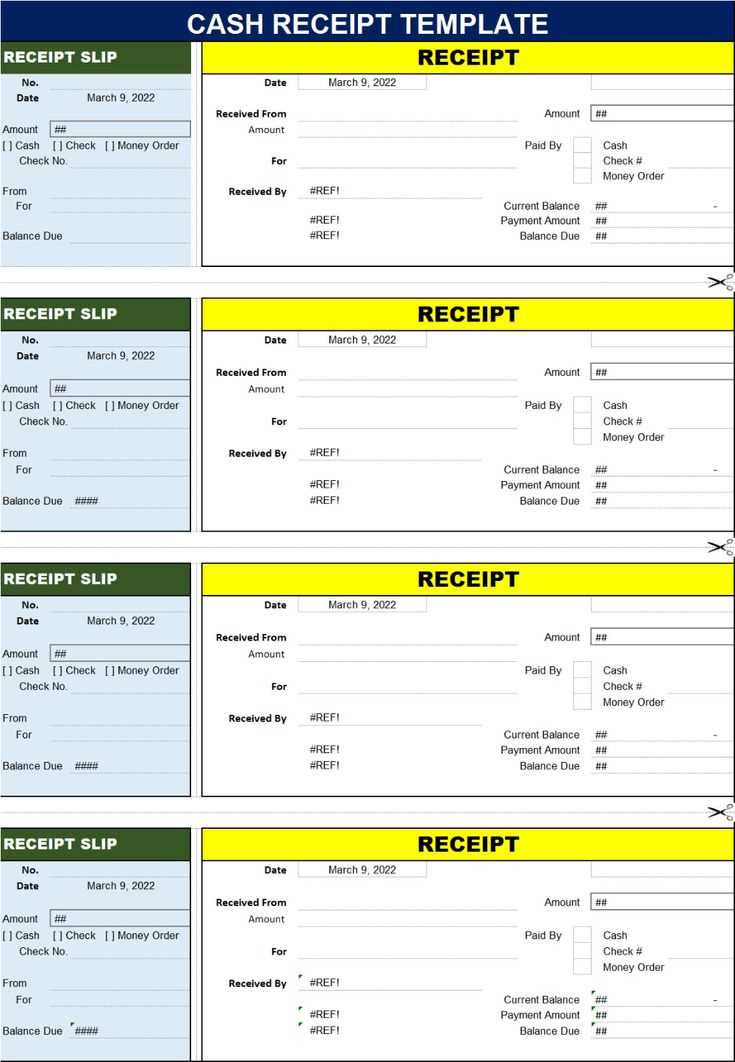

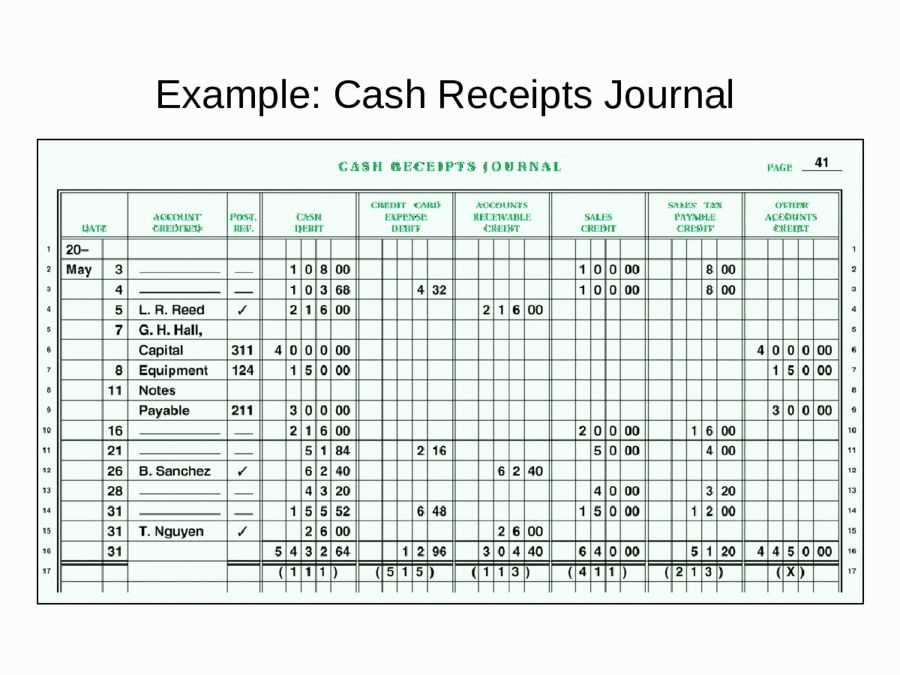

Make use of columns to capture vital transaction details such as the date, payer’s name, payment amount, and payment method. You can also include reference numbers to easily match receipts with specific invoices or accounts. This organized approach reduces the risk of errors and helps you stay on top of your cash flow.

By adopting a cash receipt journal template, businesses can save time on manual entries and improve accuracy. It allows you to quickly spot discrepancies and ensure that all cash transactions are properly accounted for in your financial records. Keep it updated regularly to maintain smooth operations and financial clarity.

Here is the corrected text:

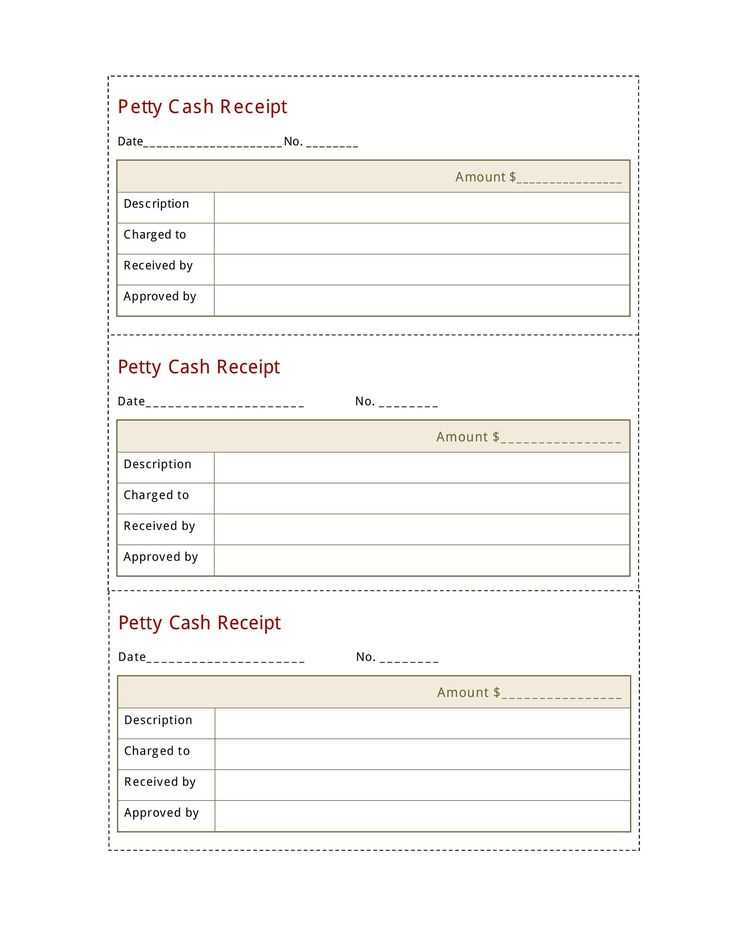

For a cash receipt journal template, focus on capturing key transaction details. Ensure that each entry includes the date, source of the payment, amount, and the corresponding account affected. This will streamline the tracking process and prevent errors. For instance, record payments received by check, cash, or other methods, while clearly indicating the transaction type in the description column.

Structure and Layout

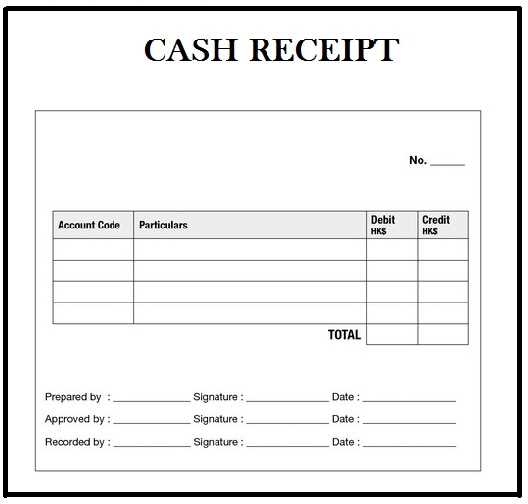

Keep the columns simple but comprehensive: Date, Receipt Number, Payment Source, Account Debited, and Amount. This basic layout ensures that all necessary information is documented without overcomplicating the journal. Keep the receipt number consistent for easier reference, and make sure to categorize each payment correctly to reflect its impact on financial reports.

Accuracy and Consistency

Verify all amounts and accounts regularly to ensure the integrity of your cash receipts. Consistent data entry reduces discrepancies that may arise during reconciliation. Periodically reviewing the journal helps maintain smooth accounting practices and ensures that the financial statements remain accurate.

- Cash Receipt Journal Template

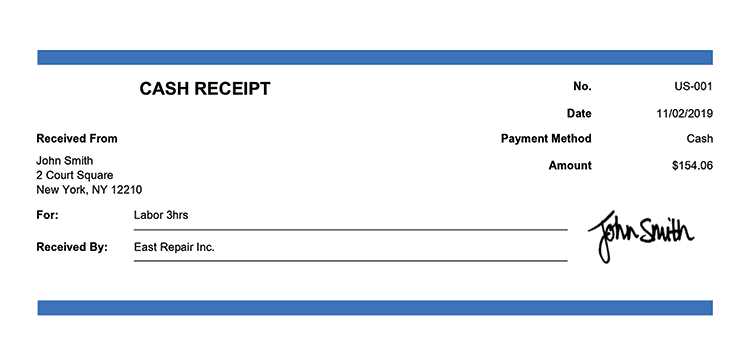

A well-structured Cash Receipt Journal Template simplifies tracking incoming cash flows. It should capture all critical transaction details like date, payer, receipt number, amount, and account impacted. This ensures accurate accounting and easy reference for both financial statements and audits.

Key Components

The template should include these columns for clarity:

| Date | Payer | Receipt Number | Amount | Account Debited | Account Credited | Description |

|---|---|---|---|---|---|---|

| MM/DD/YYYY | John Doe | 00123 | $500.00 | Cash | Accounts Receivable | Payment for Invoice #123 |

| MM/DD/YYYY | XYZ Corp. | 00124 | $1,000.00 | Cash | Accounts Receivable | Payment for Invoice #124 |

Best Practices

Always double-check the receipt amounts and the corresponding accounts. Regularly update the journal to maintain up-to-date cash flow information. A reliable template can prevent discrepancies and improve cash management.

First, set up a basic table structure with columns that clearly outline key details for each cash receipt. These columns typically include: Date, Receipt Number, Customer Name, Description of Payment, Amount, Payment Method, and Account Credited. Make sure each entry is organized in chronological order, providing a clear, traceable record of all transactions.

Step 1: Record Every Transaction

After receiving a payment, immediately log the details into your journal. For each entry, note the receipt number, customer name, the service or product purchased, and the payment amount. Always ensure that you record the payment method (e.g., cash, check, credit card) to maintain clear distinctions between different transaction types.

Step 2: Update the Ledger

Once a cash receipt is logged in the journal, transfer the information to the appropriate account in your general ledger. This ensures the journal serves as a reference point and aligns with your financial records. Regularly reconciling the cash receipts journal with your bank statements can help identify discrepancies and keep your accounting accurate.

Tip: Set a routine for updating your cash receipt journal–whether it’s daily, weekly, or after each transaction–so you stay on top of your records. The more consistent you are, the easier it will be to track payments and maintain clear financial documentation.

Include the date of the transaction in a clear and consistent format. This allows for easy sorting and referencing later. Ensure that the receipt number is unique for every entry, helping you track and verify each transaction efficiently.

Next, record the payer’s name or company details. This information is necessary for identifying the source of the funds. Keep a section for payment method, whether it’s cash, check, or bank transfer, as it’s important for distinguishing different types of receipts.

Another key element is the amount received. List it clearly and ensure that the correct currency is used. If applicable, include tax or additional fees, specifying their amount separately for transparency.

Don’t forget to add a description of the purpose of the payment. A brief note will help you recall the transaction’s reason and clarify the nature of each entry when reviewing the journal later.

Lastly, allocate space for any relevant references or invoice numbers. This enables you to cross-check payments against other records and ensures that all data ties back to specific transactions or agreements.

Be precise with dates and amounts. Failing to accurately enter these details can lead to discrepancies between records and cause confusion in financial reporting.

- Omitting Payment Method Information: Always include the payment method (cash, check, or credit card). This helps in identifying payment sources and ensures clarity when reconciling accounts.

- Not Including Transaction Descriptions: Describing the purpose of the receipt, such as “sale of goods” or “service payment,” prevents ambiguity and makes future referencing easier.

- Neglecting Customer Details: Include customer name and contact details when applicable. This ensures traceability of the transaction and helps in case of any issues.

- Failure to Validate Totals: Double-check your totals before finalizing. This prevents mathematical errors that could impact the overall financial accuracy of your receipts.

- Inconsistent Formatting: A clean and uniform format makes receipts easier to read and follow. Avoid inconsistent font sizes, misaligned text, and different styles.

- Not Updating the Template: If your receipt format changes or new fields need to be added, make sure to update the template. Outdated templates can cause confusion and may not align with current business practices.

Avoid these common mistakes to ensure your cash receipt templates are clear, accurate, and useful for both your business and your customers.

Use a clean, well-organized format for your cash receipt journal to ensure accurate financial tracking. Include columns for the date, receipt number, payer name, account debited, and the amount. Each entry should be clearly defined with no ambiguity in its description. This will help you quickly identify transactions and keep everything in order.

Make sure to separate different payment types, such as cash, check, or credit card, in your journal to streamline data entry and reporting. This practice aids in tracking which payment methods are used more frequently, improving financial analysis.

Record all receipts promptly after transactions to maintain real-time accuracy. This minimizes the risk of forgetting any transactions and helps avoid discrepancies in the accounting records. Also, ensure that all entries are supported by relevant documentation, such as receipts or invoices, to validate the accuracy of the entries.