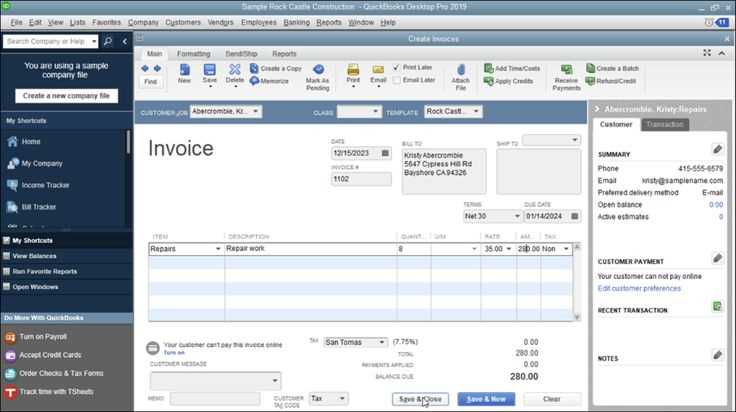

To create a tax receipt template in QuickBooks Online, begin by navigating to the “Sales” section in your dashboard. From there, select the “Sales Receipt” option. This will allow you to start a new receipt that can be customized to fit your business needs.

Next, customize the receipt layout by clicking on the “Customize” button. QuickBooks offers several template options, but for a tax receipt, you’ll want to ensure that the tax details are prominently displayed. Edit the fields to include necessary information like tax rates, itemized products or services, and the total tax amount.

Once your template is set up, you can save it for future use by clicking “Save Customization.” This ensures that each time you generate a receipt, it automatically includes all the required tax details and adheres to your business’s specific format.

Here is a version where the repetitions are reduced:

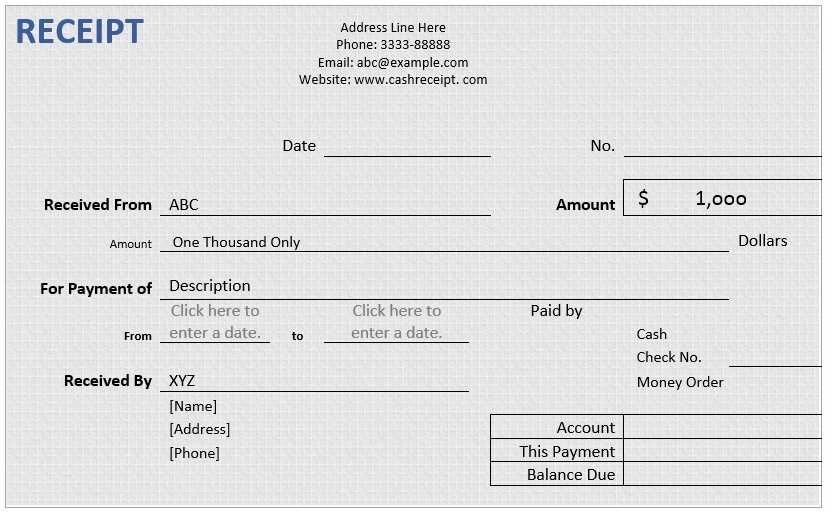

To streamline your tax receipt template in QuickBooks Online, focus on minimizing repeated details. Avoid adding the same information multiple times in different sections of the receipt. For example, include the company name and address only once at the top of the document, and avoid repeating it under the “Itemized Details” section. Instead, ensure each piece of information is clearly placed in its respective field, such as tax amount, product descriptions, and quantities.

Use QuickBooks Online’s customization tools to remove redundant fields. If you don’t need a section, disable it. For instance, if you don’t require a “Notes” field, remove it to keep the receipt clean and concise. You can also limit the number of columns in the itemized list to only what’s necessary, reducing visual clutter and focusing on the most relevant data.

Lastly, simplify the language used in your template. Instead of using lengthy descriptions, opt for straightforward terms and abbreviations that still convey the necessary information. This will make the receipt easier for both you and your customers to read and understand.

- Create a Tax Receipt Template in QuickBooks Online

To create a tax receipt template in QuickBooks Online, follow these steps:

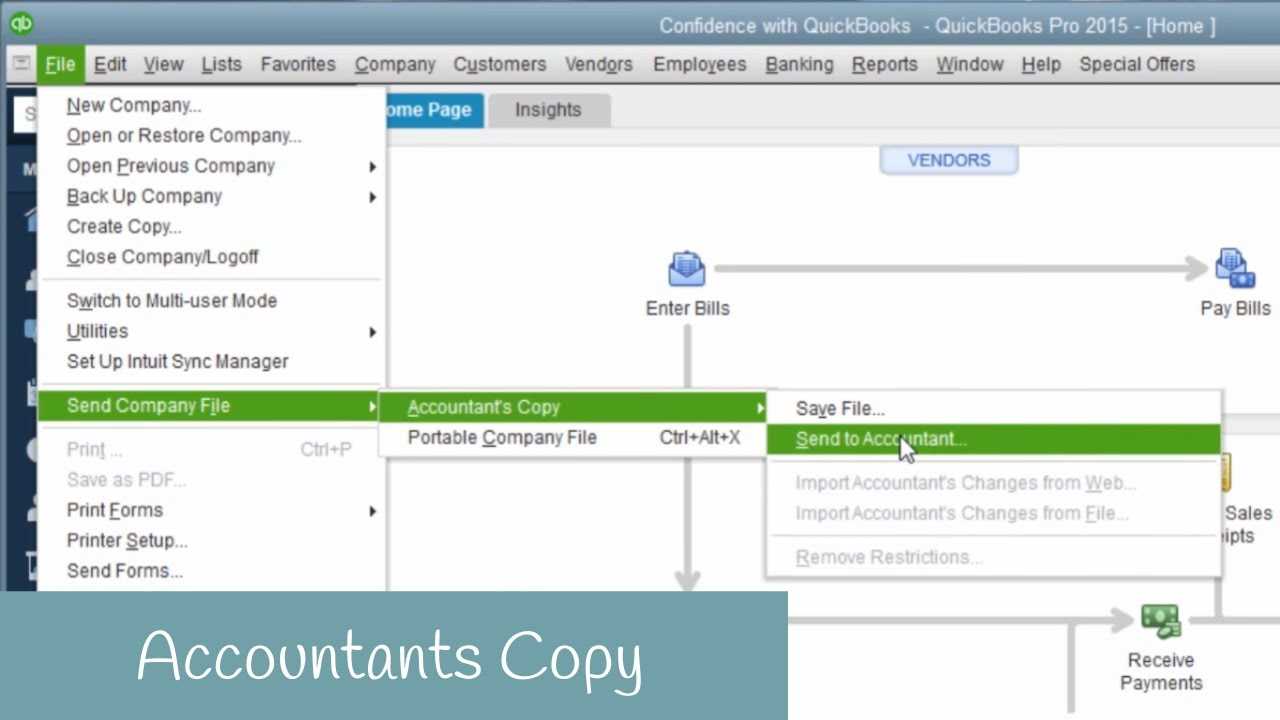

Step 1: Access Your Custom Templates

Log into your QuickBooks Online account, then go to the gear icon in the upper right corner. Under the “Your Company” section, select “Custom Form Styles.” This is where you can manage and create templates for invoices, receipts, and other forms.

Step 2: Choose to Create a New Template

Click on the “New Style” button, and then choose “Sales Receipt” from the options. This will allow you to customize a template specifically for tax receipts.

Step 3: Customize the Template Layout

QuickBooks Online offers several customization options. Choose a design that fits your needs. In the “Design” tab, you can adjust the colors, fonts, and layout to match your branding. You can also adjust where the fields like “Tax” and “Amount” are placed on the receipt.

Step 4: Add Tax Information

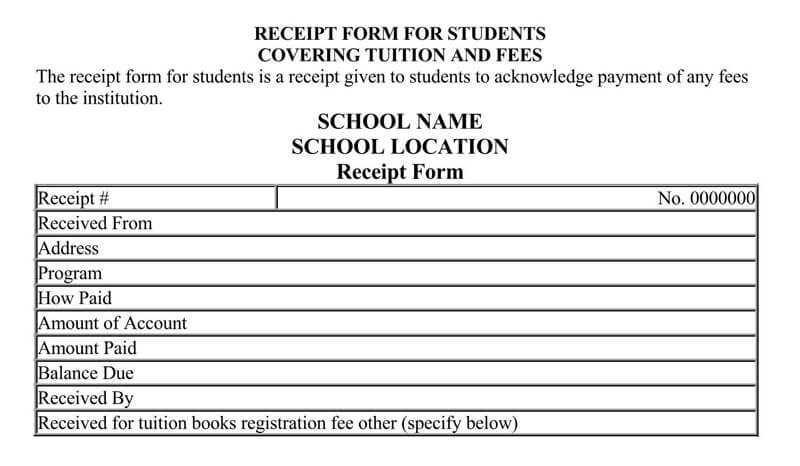

In the “Content” tab, ensure that you add fields for tax details, such as sales tax, tax rate, and the total amount with tax included. You can customize these sections to match the exact information required by your tax authorities.

Step 5: Save and Apply the Template

Once you’ve finished customizing the template, click “Done” to save your changes. The template will now be available for use when generating tax receipts in QuickBooks Online.

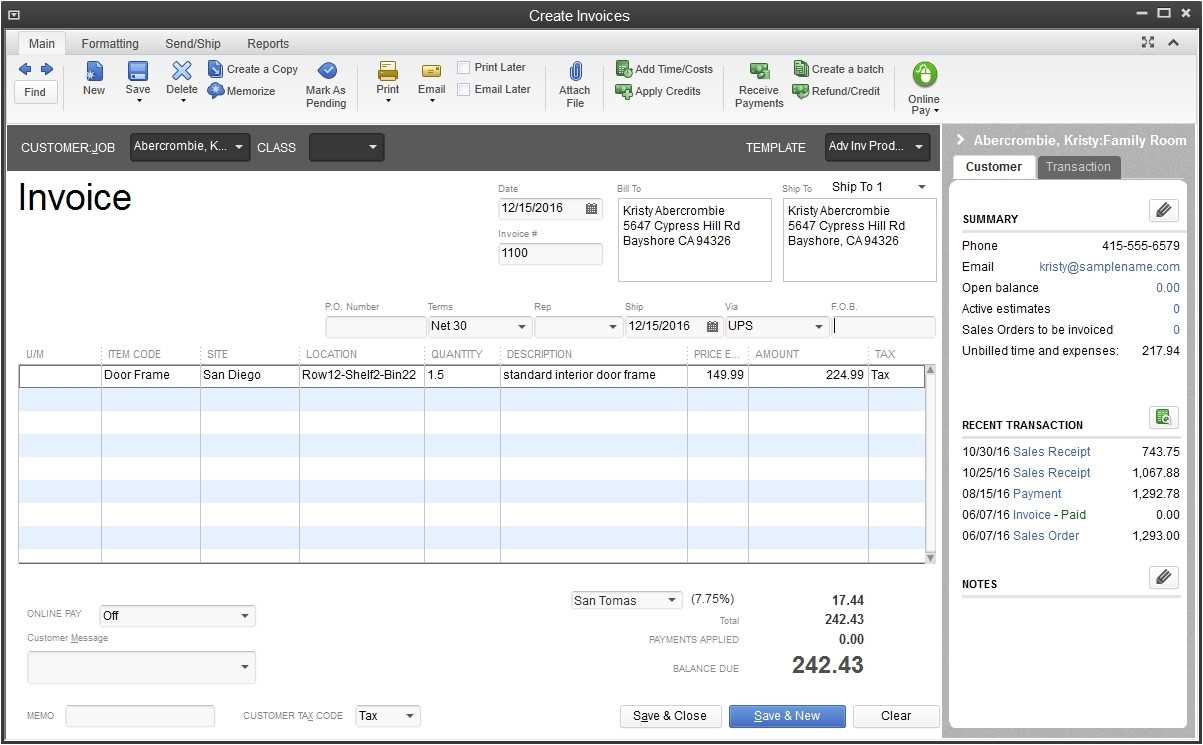

To set up your tax receipt template in QuickBooks Online, begin by opening the “Settings” menu in the top right corner and selecting “Custom Form Styles.” This will allow you to create a new template specifically for tax receipts.

Once in the form styles section, click on “Create New” and choose “Sales Receipt” as the template type. Afterward, click “Customize” to start editing the design of the tax receipt.

Configure the Template Layout

Adjust the layout by selecting from available options like “Standard,” “Simple,” or “Modern.” Each style can be tailored to match your preferences, such as adjusting the font size or adding your company logo. You can also decide whether to show the details of the items or just summarize the total amount for tax purposes.

Set Up Tax Information

Next, configure the tax details. Go to the “Content” tab, where you can add the tax rate and ensure the “Sales Tax” section appears on the receipt. You can customize tax labels if needed. For businesses in different regions, make sure the correct tax categories are selected to align with your local tax requirements.

When you’re satisfied with the look and information displayed on the receipt, click “Done” to save your changes. Your tax receipt template is now ready for use in QuickBooks Online, making it easy to issue professional receipts with accurate tax data every time.

Adjust the tax receipt template in QuickBooks Online to match your business branding and requirements. Begin by accessing the “Custom Form Styles” section in the settings. From there, choose “Edit” next to your tax receipt template.

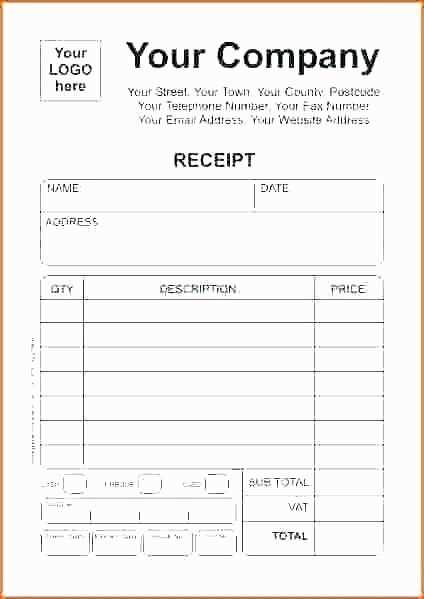

Modify key elements such as your business logo, contact information, and the color scheme to align with your company’s identity. QuickBooks allows you to upload your logo directly onto the receipt, making it instantly recognizable to your customers.

Ensure that all necessary tax information is included. You can customize fields like the tax rate, total tax, and any specific tax details related to your products or services. Adjust the layout to make sure the receipt is clear and easy to understand, placing critical information in prominent positions.

If needed, add or remove sections to suit your business needs. QuickBooks provides options to include a payment method, additional notes, or even customer references on the tax receipt. These adjustments can enhance communication and provide a professional appearance for your business transactions.

After making these changes, preview the receipt to ensure it looks as intended. Once satisfied, save your updated template and start using it for your transactions. This process makes your tax receipts not only functional but also aligned with your business style and professionalism.

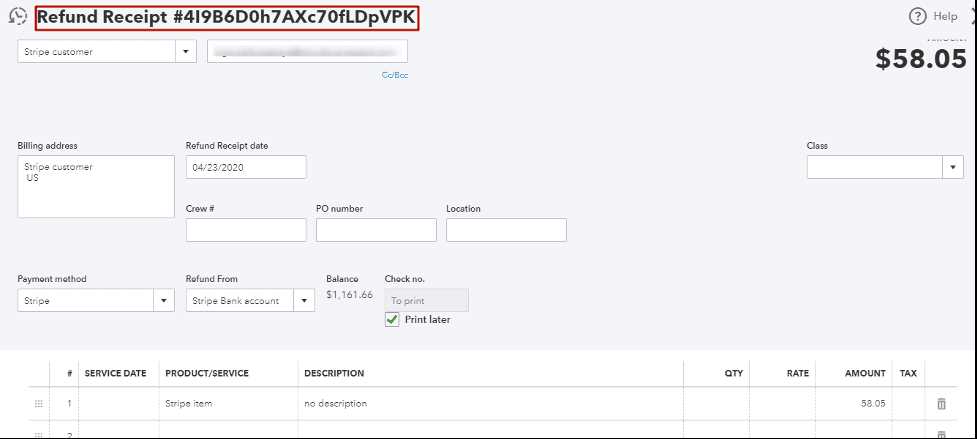

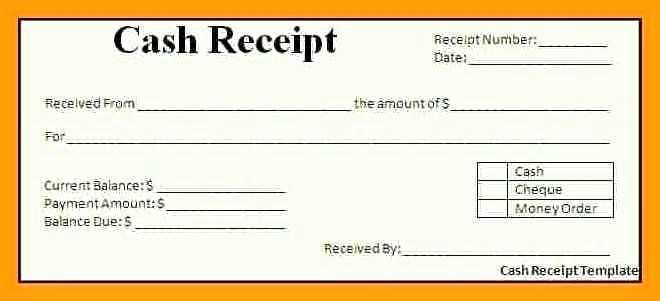

To download and send your tax receipt in QuickBooks Online, follow these steps:

- Go to the “Sales” tab in the left-hand menu.

- Click on “Invoices” or “Receipts,” depending on which document you need.

- Select the specific receipt you want to download.

- Click on the “More” button (three dots) in the upper right corner.

- From the drop-down menu, choose “Print or Preview” and select “Save as PDF.” This will allow you to download the receipt to your computer.

To send the tax receipt via email:

- While viewing the receipt, click on the “Email” button.

- Enter the recipient’s email address.

- Write a brief message if needed, then click “Send.”

Your tax receipt is now downloaded and sent to the recipient. This method ensures both the download and email process is quick and straightforward.

This way, the key terms are still clear, but repetition is minimized.

Use concise wording and avoid unnecessary repetition. Instead of repeating the same term, opt for synonyms or restructure the sentence to keep clarity. This approach helps maintain focus while ensuring that key points are communicated effectively. For example, instead of repeatedly stating “tax receipt,” vary the wording with “payment summary” or “transaction record” in appropriate contexts. Keep your language precise to avoid redundancy, and ensure each term serves a distinct purpose in the flow of your document.

Additionally, consider grouping related concepts together in a clear, organized manner. This reduces the need to reiterate terms in separate sections. When designing the template, use bullet points or sections to break down the content logically, which allows you to present important information without unnecessary repetition.