When creating an advance payment receipt, it’s important to include all the necessary details to ensure clarity and transparency for both parties involved. This document should clearly outline the amount paid in advance, the date of payment, and the services or products covered by the payment.

Start by including the payment amount, followed by the payment method used, such as credit card, bank transfer, or cash. It’s also helpful to specify whether the payment is partial or full. Mentioning the terms of the advance, such as whether it’s refundable or non-refundable, can prevent future misunderstandings.

Clearly state the purpose of the payment by referencing the specific goods or services the advance is for. This helps both parties track the transaction and avoids confusion about what the payment was applied to. Be sure to include the date of payment, as this serves as a reference point for future transactions.

Include contact information for both parties, including names, addresses, and phone numbers. This ensures that in case any issues arise, both parties can easily reach each other for clarification or resolution. It’s also a good practice to include a unique receipt number for better record-keeping.

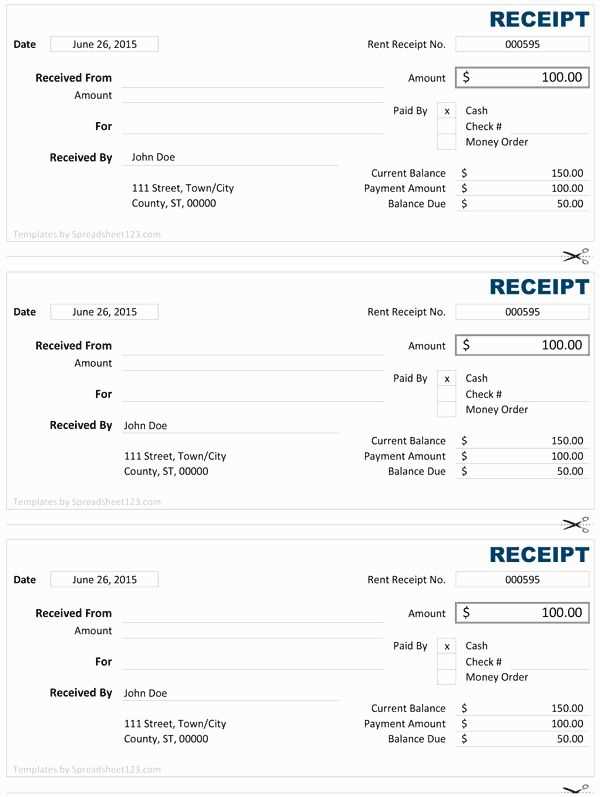

Advance Payment Receipt Template

To create an accurate advance payment receipt, include the following elements:

Key Elements of an Advance Payment Receipt

- Receipt Number: Assign a unique number for easy reference.

- Transaction Date: Specify the date when the payment was made.

- Client Information: Include the full name or business name, address, and contact details of the payer.

- Company Information: Include your company’s name, address, and contact details.

- Amount Paid: Clearly state the exact amount paid, including the currency used.

- Payment Method: Specify whether the payment was made by cash, credit card, bank transfer, etc.

- Purpose of Payment: Indicate the purpose, such as a deposit for goods, services, or contract agreements.

- Balance Remaining: If applicable, mention any outstanding balance after the advance payment.

- Signature: Ensure both parties sign to acknowledge the payment.

Formatting Tips

Keep the layout simple and clean for readability. Use clear headings, consistent fonts, and enough spacing between sections. Ensure all fields are completed accurately to avoid confusion. This template serves as proof of payment and protects both parties involved in the transaction.

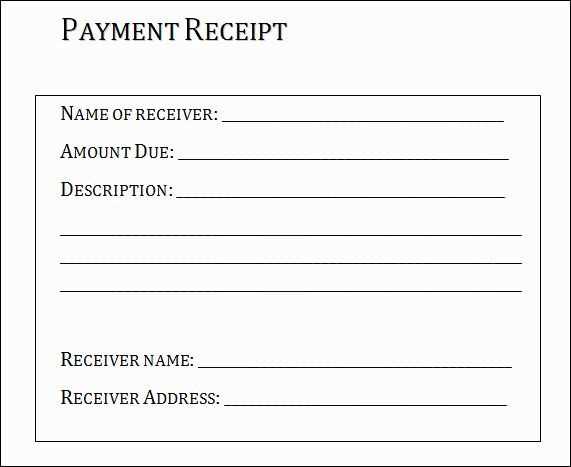

How to Create a Clear Payment Confirmation

Begin by including key details like the transaction date, payment amount, and recipient information. These elements build clarity right away.

- Payment Amount: Clearly state the exact sum received, including any taxes or additional charges.

- Transaction Date: Include the date the payment was processed to avoid confusion.

- Payment Method: Specify whether the payment was made by credit card, bank transfer, or another method.

Provide a reference number or unique ID for easy tracking of the payment in your records.

- Reference Number: This serves as a unique identifier for the transaction and can simplify future inquiries or audits.

Ensure the document is formatted in an easy-to-read way. Use bullet points and sections to organize information logically, making it accessible at a glance.

- Clear Sections: Divide the confirmation into sections such as “Payment Details,” “Recipient Information,” and “Transaction ID.”

- Readable Fonts: Use legible fonts and a clean layout to ensure the document is easily digestible.

Include any additional notes if necessary. For example, specify if the payment is partial or full, or if it’s related to a recurring transaction.

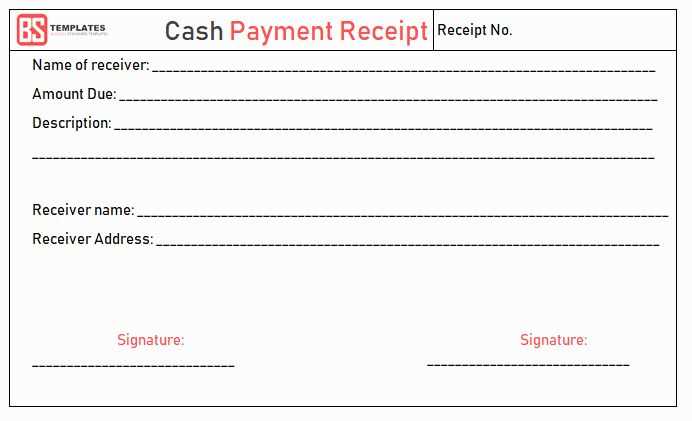

Key Elements to Include in a Receipt

Include the name of your business or company, along with its contact details. This ensures the recipient knows where the payment was made. Clearly state the date of the transaction and a unique receipt number for reference.

Details of the Transaction

List the items or services purchased, along with the individual prices. Include any discounts, taxes, or additional fees applied. This helps the customer verify exactly what they paid for and how the total was calculated.

Payment Method

Indicate how the payment was made–whether it was via credit card, cash, bank transfer, or another method. This provides transparency regarding the transaction process and confirms the method used for payment.

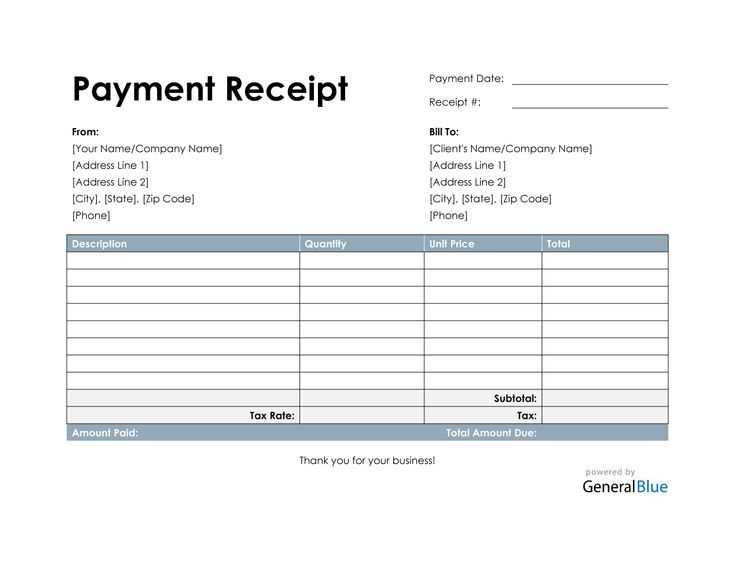

Best Practices for Formatting a Receipt Template

Ensure the layout is clear and structured, with sections separated logically. Begin with the company’s name, contact details, and logo at the top for easy identification. Include a clear receipt title, such as “Advance Payment Receipt” to distinguish it from other documents.

Provide an easily readable transaction summary, including the date, receipt number, and payment amount. Make sure the payment details are presented in a straightforward manner with the total prominently displayed. Use larger font sizes for key information like amounts or dates to draw attention.

For itemized lists, ensure each line includes the description, quantity, price per item, and total price. This format avoids confusion and makes it easy to reference specific items. If discounts or taxes apply, show these separately under the main total for transparency.

Include payment method details, such as “Paid via Credit Card” or “Bank Transfer” for clear records. Avoid ambiguous labels and ensure each payment method is distinct for easy identification.

Conclude the receipt with clear instructions for follow-up actions or customer support, if needed. Keep the footer minimal with only necessary information, like return policies or terms of service.