Using a well-structured stock gift receipt template simplifies record-keeping and ensures compliance with tax regulations. Whether you’re donating shares to a charity or gifting them to a family member, proper documentation protects both the giver and the recipient. A clear receipt should include details like the stock name, number of shares, valuation date, and fair market value.

Key elements to include:

- Donor and recipient details: Full names and contact information.

- Stock information: Name of the stock, ticker symbol, and number of shares.

- Valuation details: Date of transfer and stock price per share.

- Tax-related notes: A statement confirming whether the recipient is a tax-exempt entity.

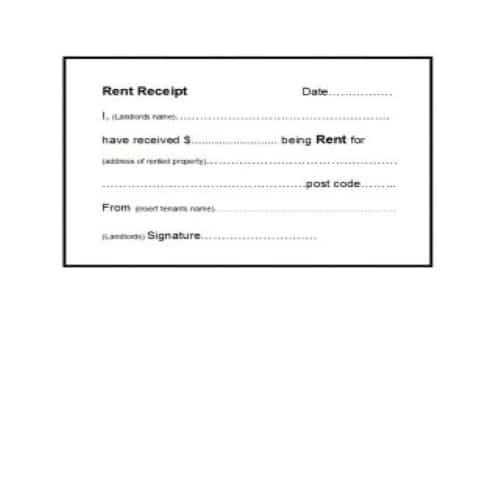

- Signature section: Space for authorized signatures from both parties.

A well-drafted template not only provides clarity but also helps avoid legal or financial misunderstandings. If gifting stocks to a nonprofit, confirm their acceptance policy and preferred transfer method. Some organizations require additional forms or brokerage instructions to process the donation correctly.

Consistency in record-keeping simplifies reporting and ensures compliance with tax laws. Customizing the template to match specific requirements can make the process more seamless and professional.

Here’s the revised version without excessive repetitions:

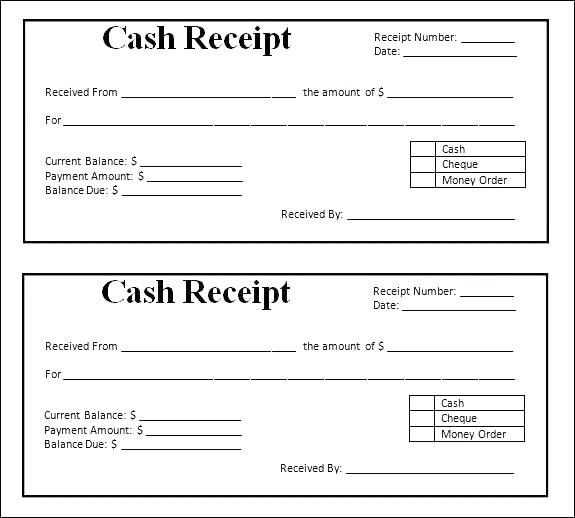

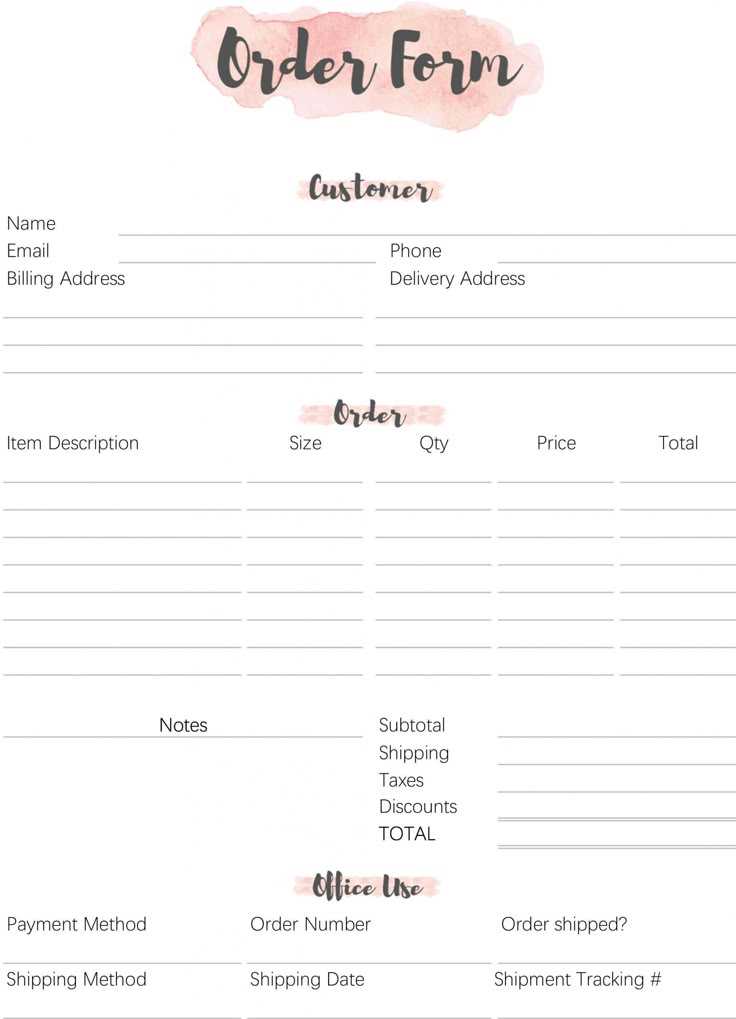

To create a stock gift receipt template, ensure it includes the item description, quantity, and price. This provides clear details for both the giver and recipient, making exchanges straightforward.

Key Elements

Start with a brief title, such as “Gift Receipt” or “Stock Gift Receipt,” followed by the seller’s name and contact information. Include the date and transaction number for future reference.

Detailed Information

List each item with its name, a short description, quantity, and the total value. If applicable, add any return or exchange policy for smooth customer service. Include a footer for thank-you notes or gift-specific messages.

- Stock Gift Receipt Template: Key Aspects and Practical Use

To create a useful stock gift receipt template, make sure it includes the necessary details to clarify the transaction. This ensures both parties understand the value and specifics of the stock gift. Here’s a breakdown:

- Recipient Information: Include the recipient’s name and contact information. This ensures clarity on who is receiving the gift.

- Stock Details: List the stock’s name, ticker symbol, quantity, and current value. Being specific helps avoid misunderstandings about the gift’s value.

- Transaction Date: State the date the gift was transferred. This provides an official record of the transaction.

- Gift Giver Information: The giver’s details should also be included for future reference, especially in case of any disputes or inquiries.

- Terms of Transfer: Clearly explain any conditions or restrictions that apply to the gift, such as whether it can be sold immediately or if there are restrictions on transferring the stock.

Including these components will make your stock gift receipt template clear, actionable, and professional. By specifying the key aspects of the transaction, you avoid potential confusion down the line.

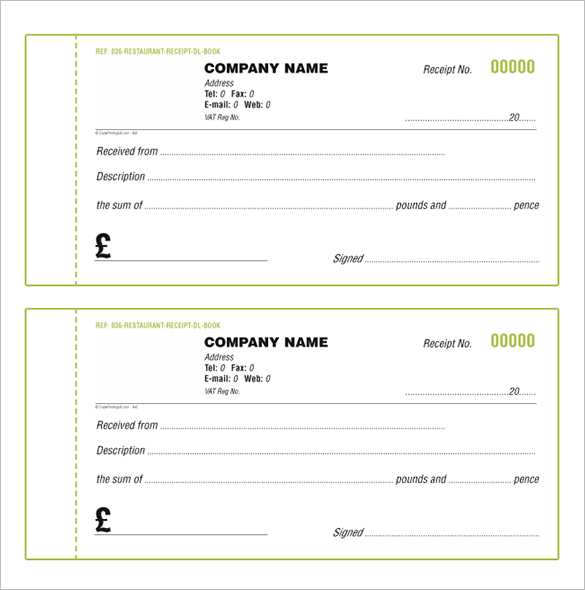

To create a proper securities donation receipt, ensure it includes the following details:

1. Donor Information

Include the full name, address, and contact details of the donor. This ensures the receipt is properly attributed and can be verified if needed.

2. Donated Securities Details

List the name of the securities, the quantity, and their fair market value at the time of donation. The value is determined by the price on the date the donation was made, and this must be confirmed for tax purposes.

3. Date of Donation

Indicate the exact date the donation was received. This date is crucial for tax reporting and the donor’s deduction eligibility.

4. Acknowledgment of No Goods or Services

Clearly state that the donor did not receive any goods or services in exchange for the donation. This is a necessary requirement for charitable tax deductions.

5. Charitable Organization Information

Provide the organization’s name, address, and tax-exempt status. This ensures the receipt complies with IRS regulations for tax-exempt donations.

Start by clearly identifying the donor and the recipient organization. Include the donor’s full name, address, and any relevant identification number, such as a tax ID. For the organization, make sure the legal name and address are included as well.

Include Specific Information about the Donation

Detail the number of shares donated, along with the stock’s description. Include the name of the company, the type of stock, and the number of shares. It’s also necessary to state the fair market value of the shares on the date of the donation. Make sure this information is accurate, as the IRS may request it for tax purposes.

Provide the Date of the Donation

Clearly state the exact date the shares were donated. This is important for both record-keeping and determining the donation’s value for tax purposes.

Don’t forget to include the donation’s value at the time of transfer, which should be backed up with appropriate documentation, such as a valuation statement from a professional appraiser or a brokerage statement that reflects the market value of the shares on the transfer date.

Finally, ensure that the receipt is signed by an authorized representative from the receiving organization to confirm the transaction. This adds validity to the receipt and ensures that it is recognized by tax authorities.

When gifting equity, accurate documentation plays a key role in compliance with tax regulations. Make sure the gift is properly recorded, with clear evidence of the transfer of ownership. This protects both parties in case of audits or disputes.

Tax Implications of Equity Gifts

Gifting equity can trigger tax obligations. The donor may be subject to gift tax depending on the value of the equity transferred. The IRS sets annual exclusions, but amounts exceeding the threshold may require filing a gift tax return.

Reporting Requirements for Recipients

The recipient of an equity gift must report the fair market value of the gifted stock on their tax return. This value will serve as the cost basis for any future capital gains tax calculations. It’s crucial to obtain a clear valuation at the time of the transfer to avoid discrepancies later.

| Gift Tax Limitations | Reporting Requirements |

|---|---|

| Annual exclusions for gifts | Fair market value as the cost basis for the recipient |

| Gift tax return filing for amounts above the exclusion | Detailed record-keeping for potential audits |

How to Modify Stock Gift Receipts for Clarity

To improve the clarity of your stock gift receipts, consider replacing overly repetitive words with precise synonyms. For example, if “gift” appears repeatedly, alternate with terms like “present” or “token.” This prevents redundancy while maintaining the document’s meaning.

Ensure Clear Item Descriptions

Use specific terms for the items being gifted. Instead of using vague descriptions like “stock item” or “product,” describe the item in more detail, such as “shares” or “equity.” This enhances understanding and avoids ambiguity.