Need a rent receipt template that meets UK requirements? A properly formatted document helps tenants keep track of payments and gives landlords a clear record. Whether you’re renting a single room or managing multiple properties, a structured receipt ensures transparency for both parties.

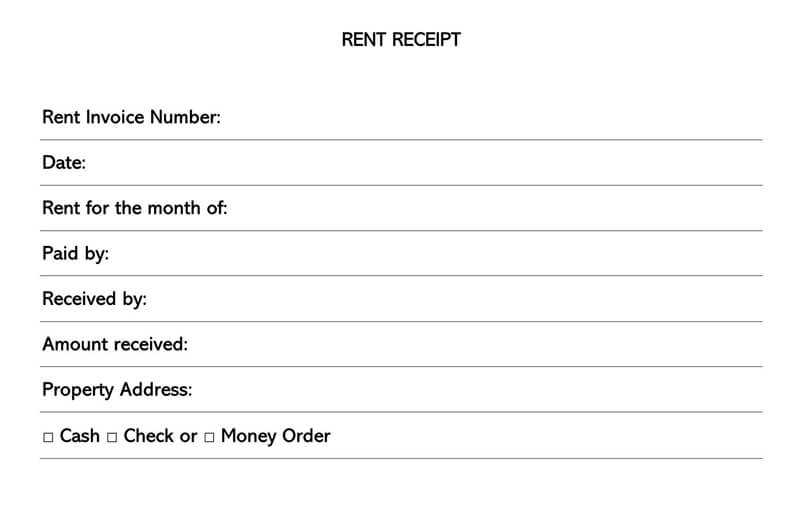

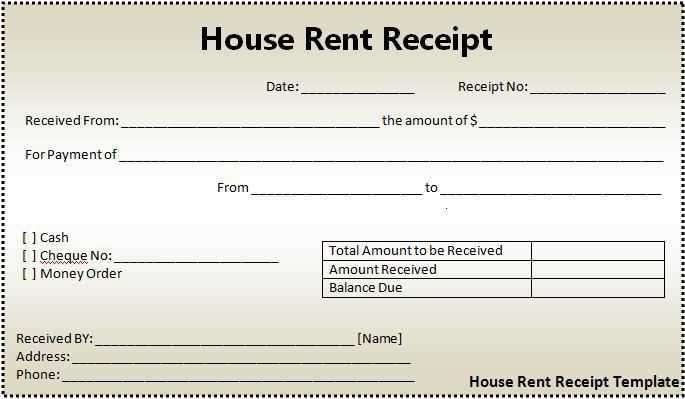

Each receipt should include essential details: tenant and landlord names, rental property address, amount paid, payment date, and method of payment. Adding a unique reference number can also simplify record-keeping. If VAT applies, the receipt should reflect that correctly.

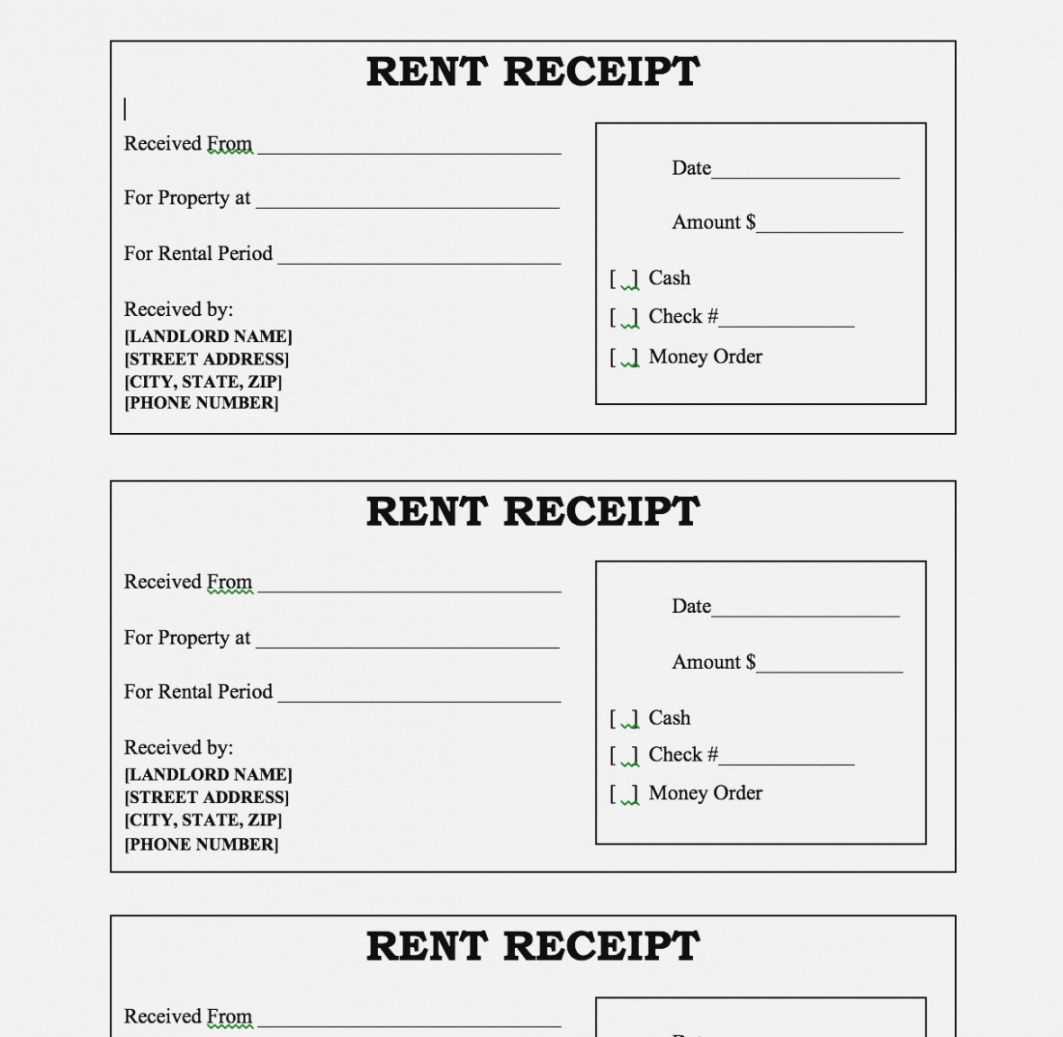

For those managing multiple rental agreements, using a pre-designed template saves time. A digital or printable version ensures easy distribution. Many templates are available in Word, PDF, and Excel formats, making them adaptable for different needs. Some also feature automatic calculations, reducing manual errors.

A well-structured rent receipt is more than just a formality. It helps resolve disputes, simplifies tax reporting, and keeps rental records organised. Whether you’re a tenant needing proof of payment or a landlord ensuring proper documentation, a reliable template is a must.

Free Rent Receipt Template UK

Download a structured rent receipt template to keep accurate records of tenant payments. A well-formatted receipt should include key details to confirm transactions and meet legal requirements.

Essential Information to Include

- Date of Payment: Clearly state when the rent was received.

- Tenant’s Name: Ensure the receipt specifies who made the payment.

- Rental Address: Include the full property address to avoid confusion.

- Amount Paid: Display the exact sum received in numbers and words.

- Payment Method: Specify whether the payment was made in cash, by bank transfer, or another method.

- Landlord’s Name & Signature: Authenticate the document with the landlord’s details.

Printable & Digital Formats

Use a printable template for handwritten receipts or a digital version with editable fields for convenience. PDFs are ideal for secure sharing, while Word documents allow customization. Keeping both physical and electronic copies ensures reliable record-keeping.

Access a free template to streamline rent tracking and maintain transparent documentation for both landlords and tenants.

Key Legal Requirements for Rent Receipts

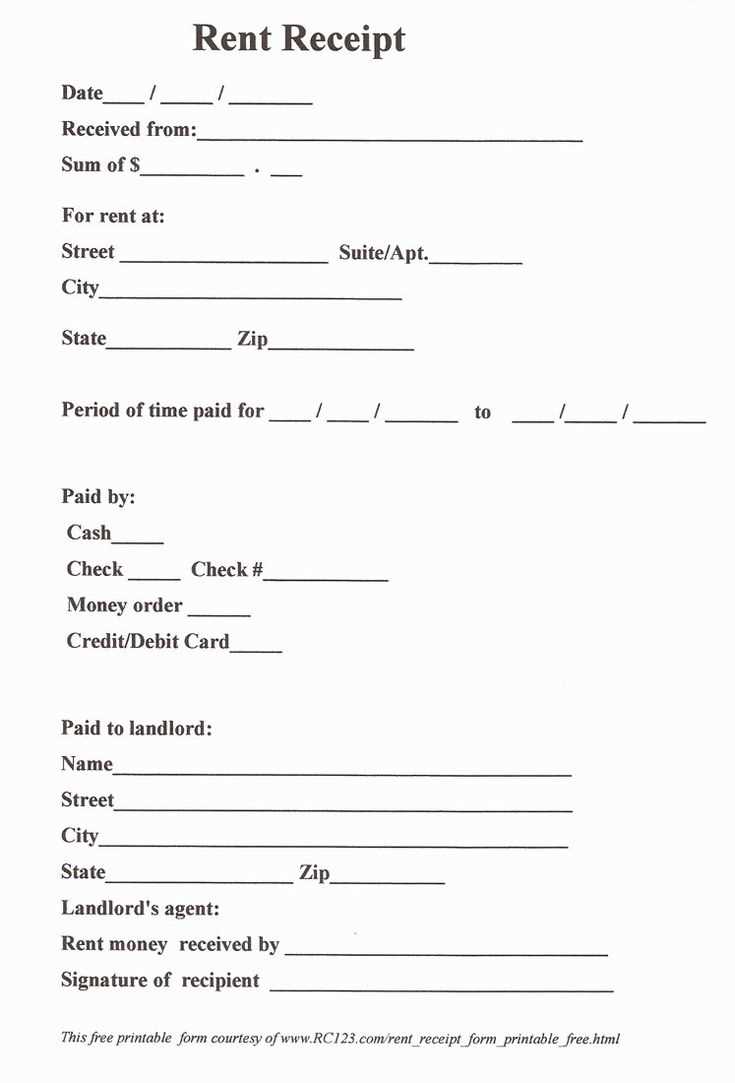

Include full payment details. A rent receipt must clearly state the amount paid, the date of payment, and the rental period it covers. Use the exact figures and avoid rounding amounts.

Identify both parties. Clearly list the tenant’s and landlord’s full names. If an agent collects the payment, their details must also be included.

Specify the payment method. Indicate whether the rent was paid in cash, by bank transfer, or another method. If paid electronically, referencing a transaction ID enhances transparency.

Provide a property reference. Include the full rental address to avoid ambiguity, especially in multi-unit buildings.

Sign for verification. The landlord or agent must sign the receipt for validity. If issued electronically, a digital signature or email confirmation serves as proof.

Issue receipts for cash payments. If rent is paid in cash, a written receipt is legally required. This protects both parties and prevents disputes over unverified payments.

Retain copies. Both landlords and tenants should keep copies for record-keeping. A digital or paper trail ensures compliance with tenancy agreements and tax regulations.

How to Customize a Rent Receipt Template

Adjust the header by including the landlord’s or property management company’s name, address, and contact details. Use a clear, legible font to ensure readability.

Modify the date format to match local conventions. For the UK, use “DD/MM/YYYY” to avoid confusion.

Ensure the tenant’s full name and rental property address are correctly placed. Double-check for accuracy to prevent disputes.

Specify the payment method by adding checkboxes or dropdown options for cash, bank transfer, or standing order. This helps maintain clear financial records.

Adjust tax-related fields if needed. In most UK rental agreements, VAT is not applicable, so remove any unnecessary tax sections.

Insert a unique receipt number for tracking purposes. A structured format like “RR-YYYY-MM-XXX” ensures consistency.

Leave space for the landlord’s signature or a digital authorization stamp. This adds authenticity and prevents future misunderstandings.

Test the template before using it regularly. Print a sample or save it as a PDF to check layout and accuracy.

Best Practices for Record-Keeping and Storage

Store all rent receipts in a dedicated folder, either physically or digitally, with clear labels for quick retrieval. Organize documents by date and category to prevent confusion during tax season or legal disputes.

Use cloud storage with encryption to protect digital copies from loss or damage. Choose a service that offers automated backups and multi-factor authentication for added security.

Retain receipts for at least six years to comply with tax regulations. Regularly review records to remove outdated files and ensure everything is up to date.

Convert paper receipts into digital format using a scanner or mobile app. Save them as PDFs with standardized naming conventions to maintain consistency.

Restrict access to sensitive records by setting permissions on digital folders and using locked filing cabinets for physical copies. Only share documents with authorized individuals when necessary.

Check records periodically for completeness and accuracy. Missing or unclear information can lead to disputes, so ensure all receipts contain dates, amounts, payment methods, and signatures where applicable.