A well-structured computer repair receipt template helps track transactions, detail services provided, and maintain transparent communication with clients. It should include key elements such as service descriptions, costs, and payment details.

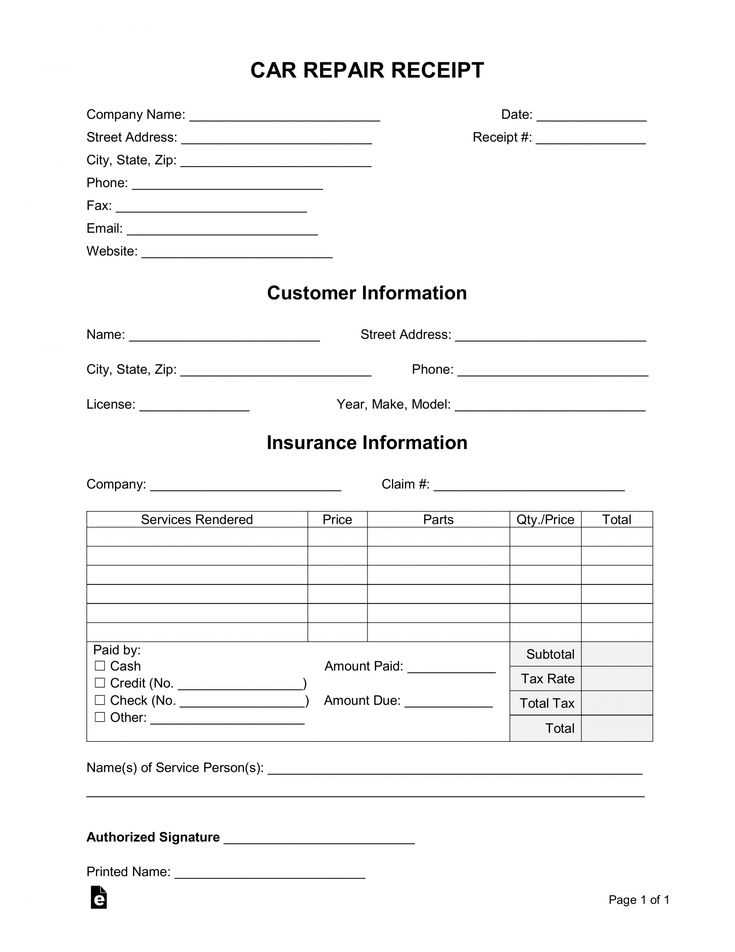

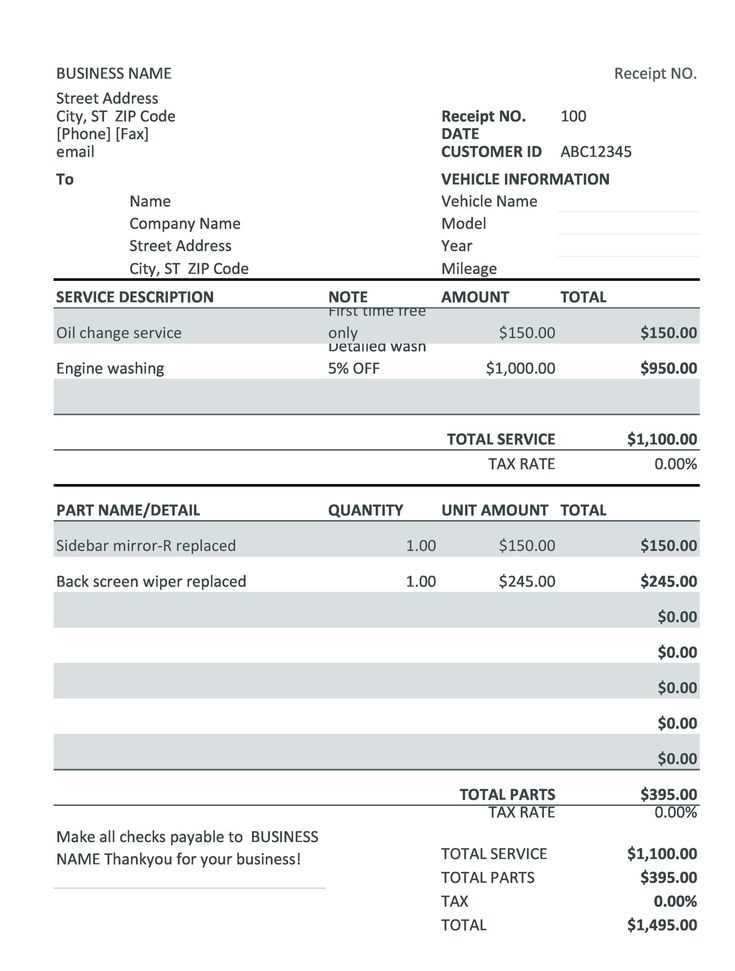

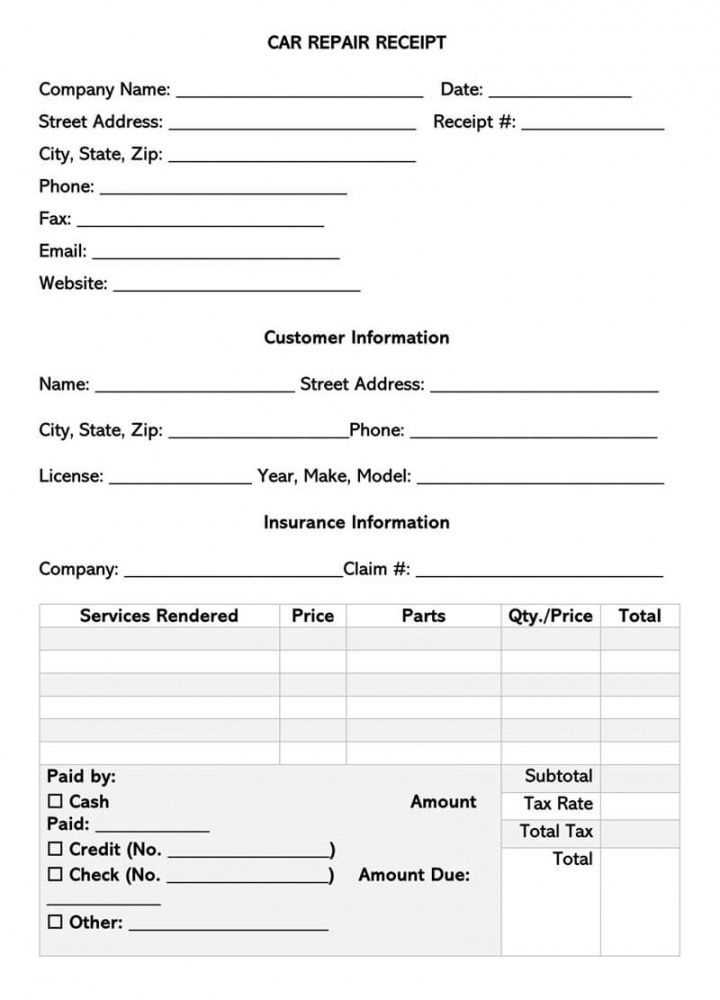

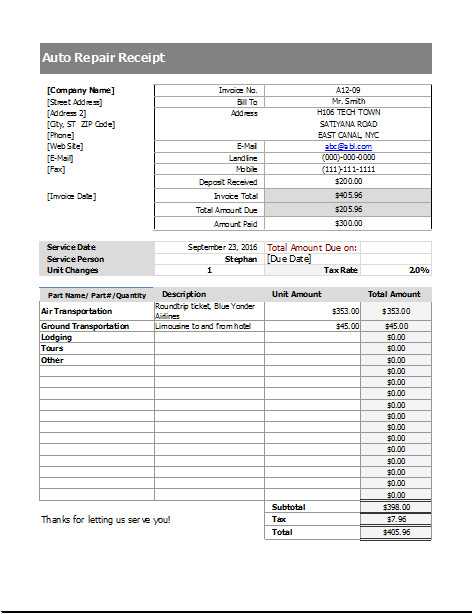

Essential components: The receipt must list the customer’s name, contact information, and the repair technician’s details. A breakdown of services, including diagnostics, part replacements, and labor fees, ensures clarity.

Clear payment terms prevent disputes. Indicate the total cost, taxes, and accepted payment methods. If offering warranties, specify their conditions directly on the receipt to avoid confusion.

Using a standardized template streamlines record-keeping and simplifies financial tracking. Whether for printed receipts or digital invoices, a professional format enhances credibility and customer trust.

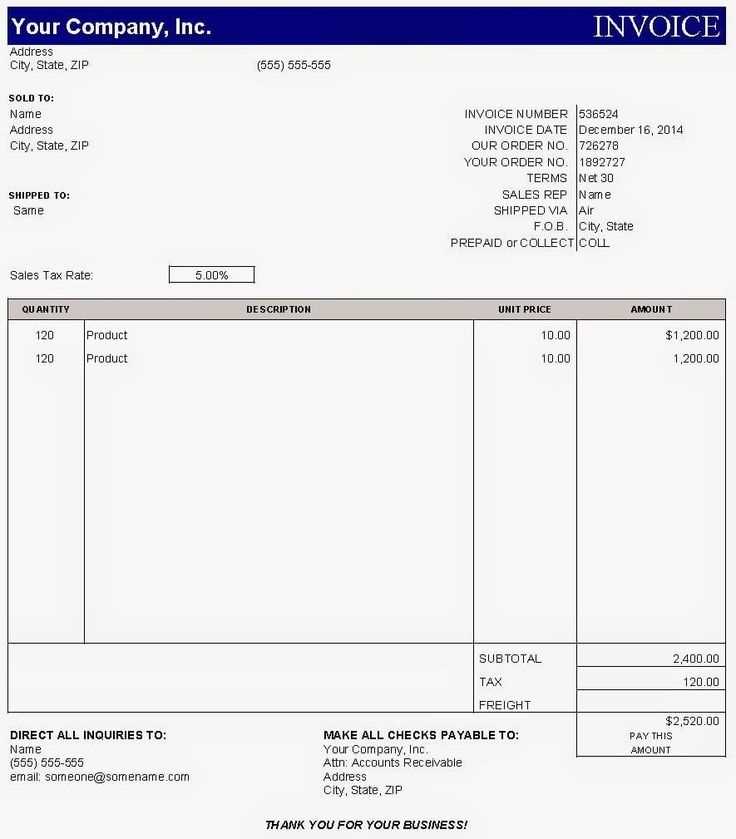

Computer Repair Receipt Template

A well-structured receipt simplifies transactions and ensures clarity for both repair technicians and customers. Include these key details to create a professional and functional document:

- Business Information: List the company name, address, contact details, and tax ID if applicable.

- Receipt Number: Assign a unique identifier to track payments and service history.

- Customer Details: Include the client’s name, phone number, and email for follow-ups.

- Service Breakdown: Specify the work performed, such as hardware replacement, software installation, or diagnostics.

- Parts Used: Detail components installed, including model numbers and costs.

- Labor Charges: Indicate hourly rates or fixed fees for services rendered.

- Total Amount: Summarize charges, taxes, and discounts for transparency.

- Payment Method: Note whether the customer paid via cash, credit card, or other means.

- Warranty and Terms: Clarify coverage for repairs and any service limitations.

- Authorized Signature: Leave space for approval from the technician or customer.

Using a standardized receipt template prevents disputes, improves record-keeping, and enhances customer trust. Digital formats with auto-fill options can further streamline the process.

Key Components of a Repair Receipt

Include the business name, address, contact details, and logo at the top. This ensures clarity and makes it easy for customers to reach out if needed.

List the customer’s full name, phone number, and email. Accurate details prevent confusion and help with follow-ups.

Specify the device details, including brand, model, serial number, and reported issues. This creates a clear record of the item received.

Break down the services performed, such as diagnostics, part replacements, or software updates. Use clear descriptions instead of technical jargon.

Itemize costs, including labor, parts, and taxes. Transparency builds trust and helps customers understand the charges.

Include the total amount due, payment method, and any deposit received. If applicable, mention a due date for outstanding balances.

State warranty terms, including coverage duration and what is or isn’t included. A clear policy reduces misunderstandings.

Provide the technician’s name and signature, along with the customer’s signature if required. This confirms agreement on the work completed.

Add a brief note on data privacy, especially if the repair involved accessing sensitive files. Customers appreciate knowing their information is handled securely.

How to Customize a Receipt for Your Business

Include your company name, logo, and contact details at the top to create a professional appearance. Use a clear, readable font and align elements properly for easy scanning.

Add unique invoice numbers for tracking and record-keeping. Incorporate the date, payment method, and customer details to maintain accuracy and transparency.

List each service or product with descriptions, quantities, and prices. Apply taxes and discounts automatically to avoid miscalculations.

Insert a notes section for warranty details, return policies, or personalized messages. If digital receipts are an option, add a QR code linking to support resources.

Save the template in a format that allows quick edits. Ensure compatibility with accounting software for smooth integration and automated data entry.

Legal and Tax Considerations for Repair Receipts

Include the business name, address, and tax identification number on every repair receipt. This ensures compliance with local tax regulations and simplifies bookkeeping.

Essential Tax Documentation

Maintain copies of all receipts for at least five years. Tax authorities may request documentation during audits, and missing records can lead to penalties. Digital backups help prevent data loss.

Itemize charges clearly, separating labor, parts, and taxes. Some jurisdictions require specific tax rates for services and goods, so verify local regulations to avoid miscalculations.

Legal Protection for Businesses

A detailed receipt serves as proof of service, reducing disputes with customers. Include terms of service, warranty details, and disclaimers to clarify liability. If repairs involve data handling, a privacy clause may be necessary.

Consult a tax professional to ensure compliance with local and federal requirements. Tax laws change, and incorrect reporting can result in fines or audits.