Using a well-structured donation tax receipt template ensures compliance with tax regulations and simplifies record-keeping for both donors and organizations. A proper receipt includes key details such as the donor’s name, donation amount, date, and organization information. Without these elements, donors may face challenges when claiming deductions.

Charities and nonprofits should provide clear and accurate receipts to maintain transparency and trust. The receipt must state whether any goods or services were exchanged for the donation. If the contribution was purely charitable, a statement confirming this is required.

For organizations issuing receipts, using a template saves time and ensures consistency. A structured format reduces errors and meets the legal requirements set by tax authorities. Whether for one-time or recurring donations, having a standardized template streamlines the process.

Here is a version without unnecessary repetition of words, preserving the meaning:

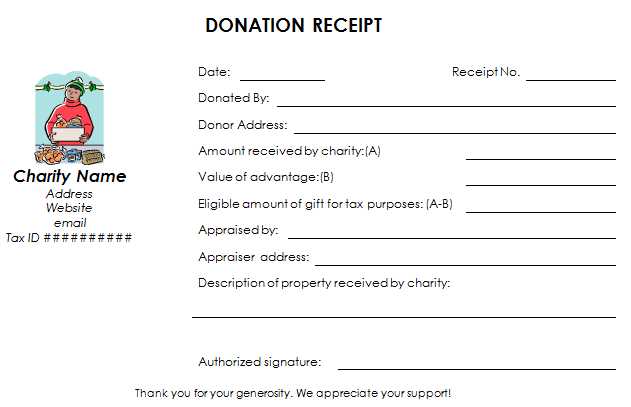

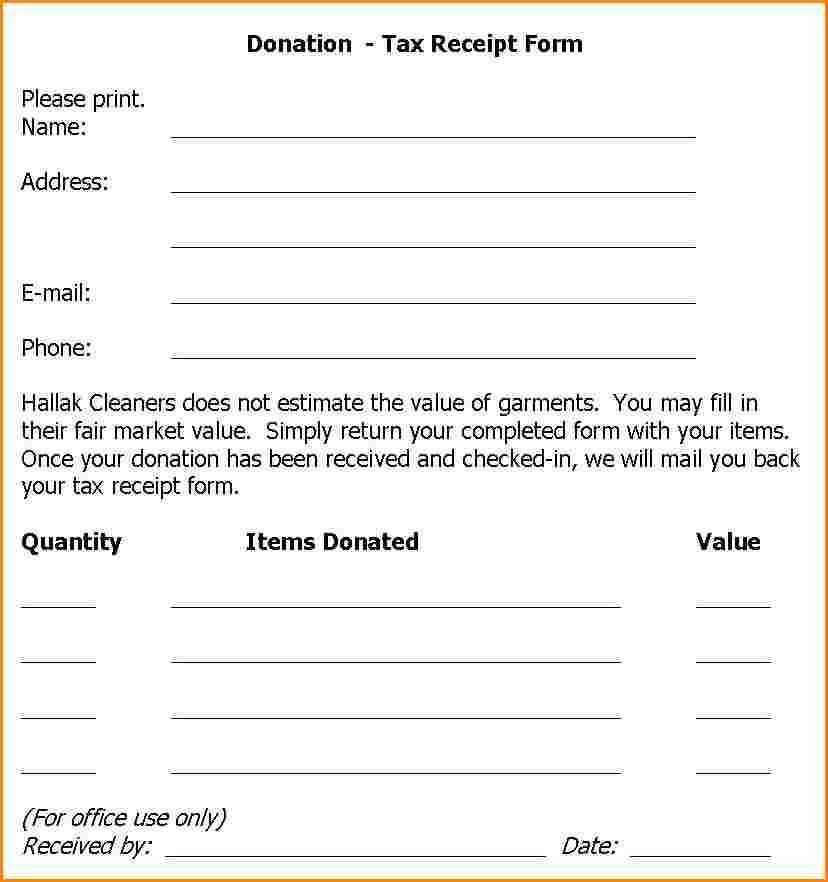

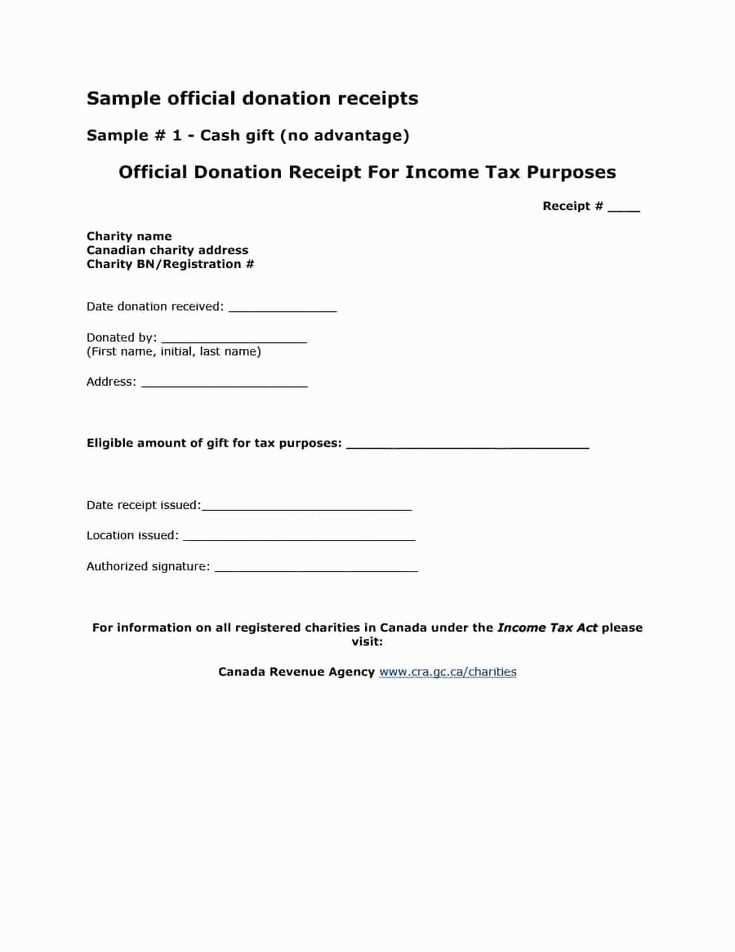

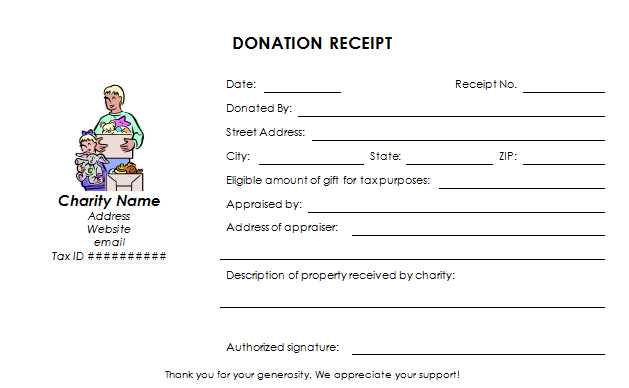

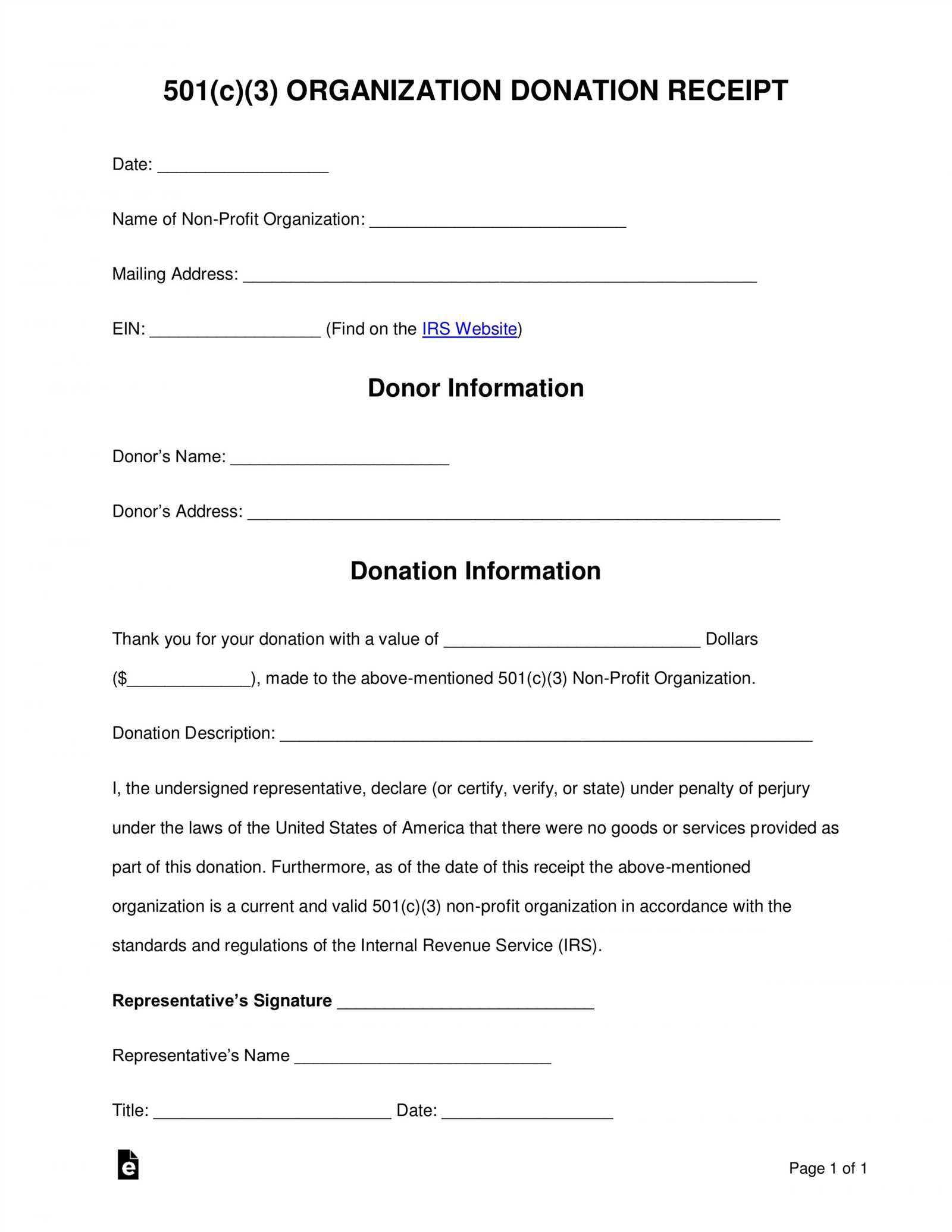

When creating a donation tax receipt template, ensure it includes key elements for clarity and compliance. Begin with the donor’s full name and address, followed by the organization’s legal name and address. Include the donation date and a detailed description of the contribution, whether monetary or in-kind. Ensure the amount donated is clearly stated, and if it’s a non-monetary donation, provide a description of the item’s nature and condition.

Providing Accurate Information

For tax purposes, the receipt must also indicate whether any goods or services were provided in exchange for the donation. If so, the template should note the fair market value of those items. This helps the donor distinguish between the tax-deductible portion and the non-deductible amount.

Finalize the Document

Conclude the receipt with a signature from an authorized representative of the charity. Adding a unique receipt number can help both parties track the transaction. Make sure to provide the donor with a copy and retain one for your records.

- Donation Tax Receipt Template

Use the following template to create a donation tax receipt that meets necessary legal and tax requirements. Make sure to include these key details for accuracy.

Key Elements of a Donation Tax Receipt

| Item | Details |

|---|---|

| Donor’s Information | Full name (or organization name) and address of the donor. |

| Donation Date | Exact date the donation was made. |

| Donation Amount | Cash donations should be listed with the amount, while in-kind donations should include a description and estimated fair market value. |

| Charity Information | Legal name of the charity, its tax identification number, and its address. |

| Goods or Services Received | Note any goods or services provided to the donor in exchange for the donation, and estimate their fair market value. |

| Authorized Signature | Signature of a representative from the charity who is authorized to provide tax receipts. |

Formatting Tips

Keep the layout clear with clean fonts and adequate spacing. Each section should be clearly labeled for easy reading. You can also include a thank-you note to show appreciation for the donor’s generosity.

Tax receipts need to be clear and precise. Include these key elements to ensure they meet legal requirements and provide clarity for donors:

- Donor’s Information: Include the full name of the donor. This ensures proper documentation and avoids confusion during tax filing.

- Organization’s Information: Add the legal name of the organization, along with its address and tax ID number. This helps the donor verify the donation’s legitimacy.

- Date of Donation: The receipt should indicate the exact date the donation was made. This is essential for tax records and determining the appropriate tax year.

- Amount of Donation: Clearly state the total amount donated. If the donation was in kind (goods or services), list the fair market value of the donated items.

- Statement of Goods or Services: If the donor received something in return for the donation, state its value. This reduces the tax-deductible amount accordingly.

- Organization’s Authorization: Include a statement that the organization is a registered charitable entity, often with a tax-exempt status, confirming the tax-deductibility of the donation.

- Receipt Number or Identifier: For organizational tracking, assign a unique receipt number to each donation.

By incorporating these elements, a donation receipt can serve both as a record for the donor and a valid document for tax purposes.

Different countries have distinct legal requirements for donation tax receipts. Below is an overview of key rules in various regions.

- United States: Nonprofit organizations must provide a written acknowledgment for donations of $250 or more. This includes the amount donated and a statement that no goods or services were exchanged in return. Donations below $250 can rely on less detailed receipts, but they must still include the name of the charity and the donation amount.

- Canada: Canadian tax law requires organizations to issue a receipt for donations of $20 or more. The receipt must include the donor’s name, the amount donated, and the charity’s registration number. It must also confirm whether any goods or services were provided in exchange.

- United Kingdom: In the UK, charities must issue receipts for any donation, but there are no specific requirements for the format. However, the receipts must be clear enough to support tax claims under Gift Aid, which allows charities to reclaim 25p for every £1 donated by a taxpayer.

- Australia: The Australian Taxation Office (ATO) mandates that receipts must include the charity’s name, ABN (Australian Business Number), the donation amount, and the date of donation. For donations above $2, a receipt is necessary for claiming tax deductions.

- Germany: Receipts for donations in Germany are required for amounts exceeding €200. For amounts below this threshold, a bank statement can serve as proof of donation. The receipt must include the donor’s details, the donation amount, and the charity’s tax-exempt status.

- France: In France, donors can claim tax deductions for donations above €66. The receipt must show the amount of the donation, the name of the charity, and the charity’s official status. For amounts exceeding €153, the receipt should include specific information about the donor’s identification.

Each country has specific regulations that must be followed to ensure that donations are properly acknowledged and tax-deductible. Make sure to verify the precise legal requirements for your location to avoid issues during tax filing.

Include the name of your organization, the donor’s full name, the date of the donation, and the exact amount given. Specify if the donation was in cash, goods, or services. If applicable, describe the donated items and their estimated value. Add a statement confirming the donor did not receive any goods or services in exchange for the contribution if this is true. Include your organization’s tax-exempt status and your EIN number for the donor’s tax records.

Use a clean and professional layout, with clear headings for each section of the receipt. Include your organization’s logo and contact details at the top. For online donations, include a unique transaction number or receipt ID. This helps both your organization and the donor track the donation more easily.

If the donation involves goods or services, include a brief description along with their fair market value. Indicate whether the donation is fully tax-deductible or if only part of it is, based on the value of the benefits received. Maintain a balance between offering enough detail for the donor’s tax filing and keeping the receipt visually clear and concise.

Tax Receipt Details: A Clear Guide

Ensure the receipt contains specific details like the date of the gift, the amount, and the donor’s information. These points are necessary for accurate records. Including an acknowledgment of the charitable purpose behind the contribution helps clarify its intent.

Double-check that the receipt specifies whether any goods or services were provided in exchange for the gift. This distinction impacts the deduction amount. Additionally, clearly state that the donor did not receive any substantial benefit beyond the gift’s value.

For transparency, include the name and contact details of the organization issuing the receipt. A signature from an authorized representative can also add credibility to the document.

To make the process easier, set up an automated system that generates receipts based on donor information and contributions. This method helps maintain consistency and reduces the chance of errors.

Ensure all relevant financial year details are correct, especially if the contribution spans multiple years or was part of a series of payments. Double-checking these elements will help with accurate reporting.