What to Include in an Acknowledgment Receipt

A well-structured acknowledgment receipt confirms the receipt of money, goods, or documents. It should contain:

- Receipt Title: Clearly state “Acknowledgment Receipt” at the top.

- Date: The exact date when the receipt is issued.

- Recipient’s Name: The full name of the person or company receiving the item.

- Issuer’s Name: The individual or organization issuing the receipt.

- Description of Items: Specify the details, such as amount received, item description, or document name.

- Signature: Include a signature line for both parties.

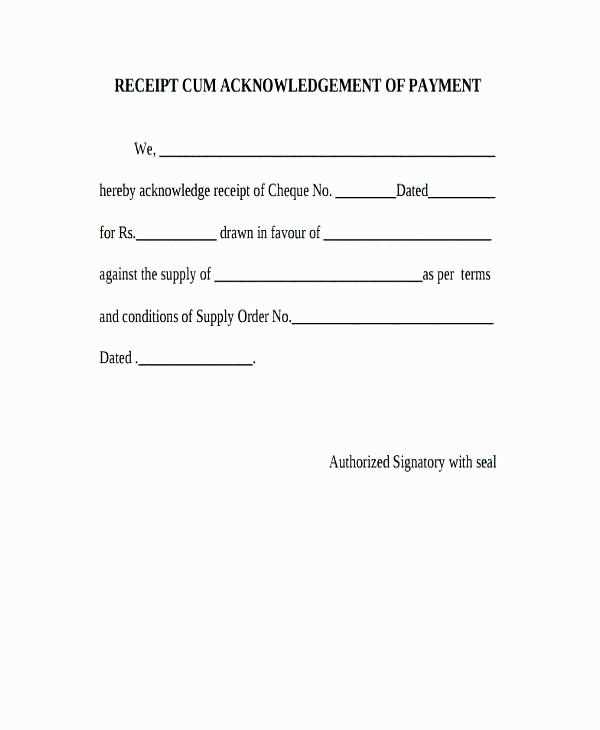

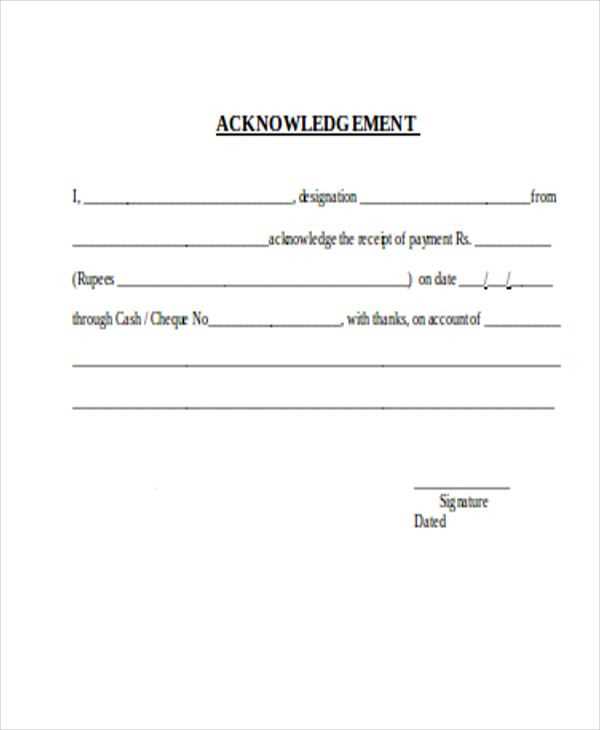

Sample Acknowledgment Receipt Template

Use the following format to create a professional acknowledgment receipt:

ACKNOWLEDGMENT RECEIPT Date: [Insert Date] Received From: [Full Name / Company Name] Received By: [Your Name / Company Name] Amount / Item Description: [Specify Details] Purpose: [Reason for Receipt] Signature: ____________________

Best Practices for Issuing Receipts

- Use Clear Language: Avoid vague descriptions; specify item names, amounts, or document types.

- Keep a Copy: Maintain digital or physical records for reference.

- Verify Details: Ensure accuracy before signing or handing over the receipt.

A properly formatted acknowledgment receipt serves as proof of transaction and helps prevent misunderstandings.

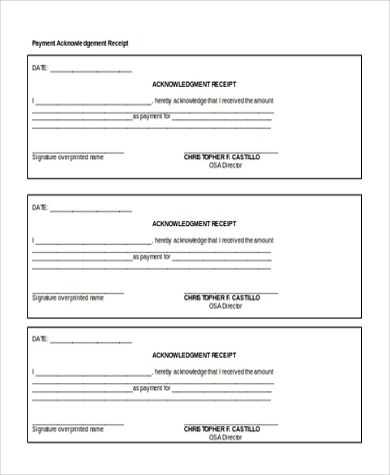

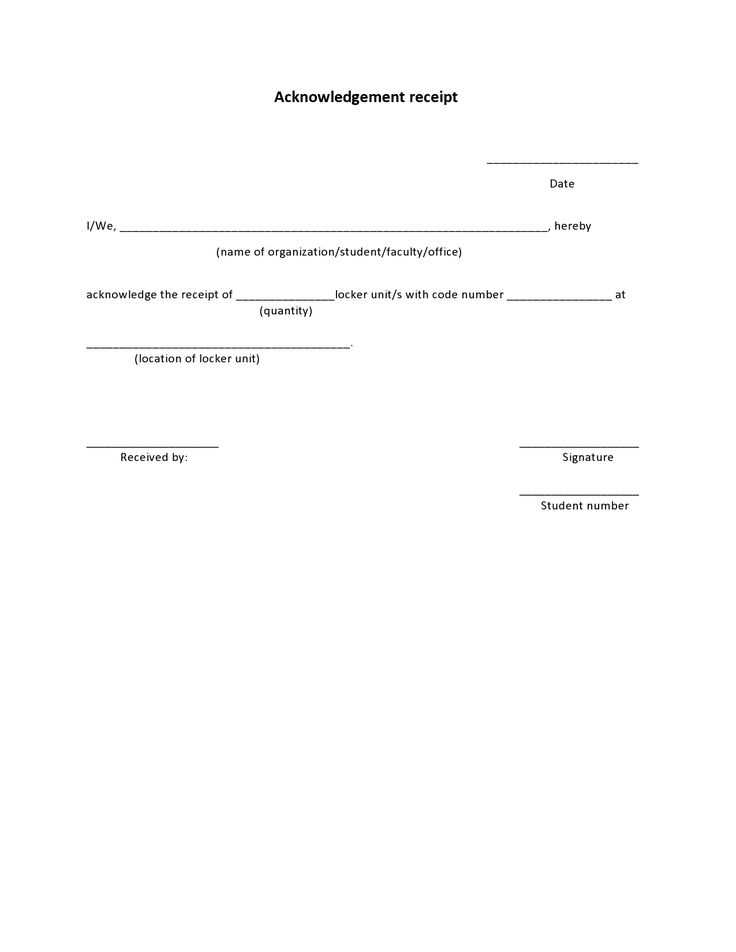

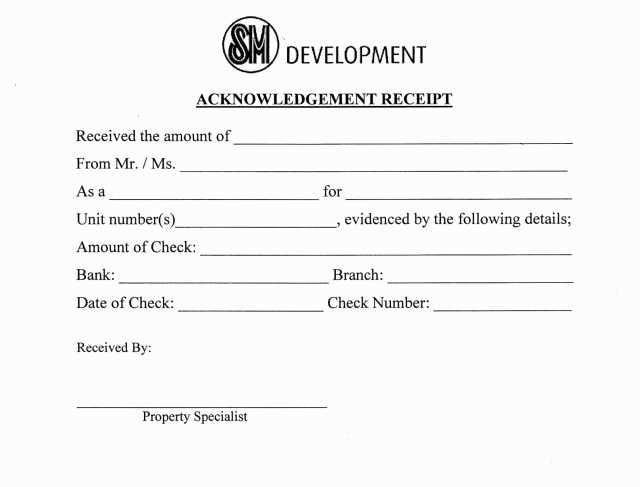

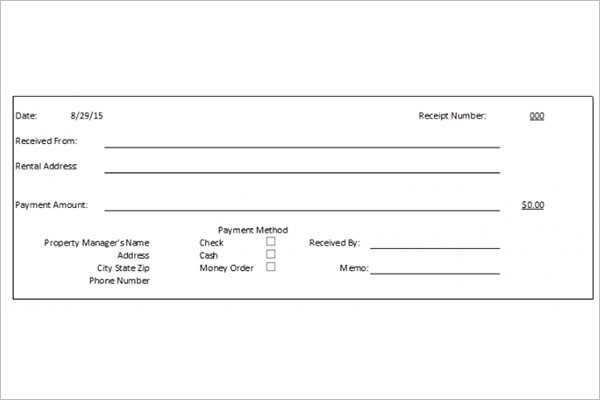

Template Acknowledgment Receipt

Key Elements to Include in a Receipt Template

Include the recipient’s full name, date of acknowledgment, and a clear description of the received item or service. Specify the amount, payment method, and any reference numbers. Add the issuer’s name, signature, and contact details for verification. If applicable, mention return policies or terms. Ensure all information is formatted for quick reference.

How to Format an Acknowledgment Receipt for Legal and Business Use

Use a structured layout with distinct sections for clarity. Keep text concise and avoid unnecessary details. Use legible fonts and consistent spacing. If electronic, include digital signatures and encryption for security. For physical copies, ensure carbon duplicates or scanned backups exist. Store receipts in an organized system for compliance and record-keeping.

Common Mistakes to Avoid When Creating a Receipt

Avoid missing crucial details like dates, signatures, or item descriptions. Double-check all numerical values for accuracy. Do not use vague language–be precise about amounts and conditions. Avoid cluttered designs that make information hard to find. Ensure legal compliance by using standardized formats and confirming the receipt aligns with tax or financial regulations.