Key Details to Include

A final sales receipt confirms that a transaction is complete and non-refundable. To avoid disputes, include the following:

- Business Information: Name, address, and contact details.

- Transaction Date: Clearly state the purchase date.

- Itemized List: Describe products or services, including quantity and price.

- Total Amount: Display the subtotal, taxes, and final cost.

- Payment Method: Specify whether payment was made by cash, credit card, or other means.

- Final Sale Statement: Use clear wording such as “All sales are final. No refunds or exchanges.”

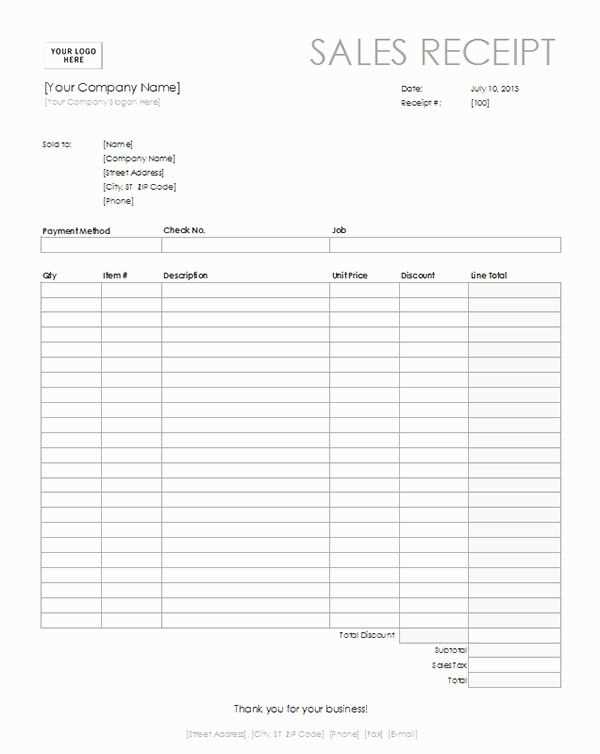

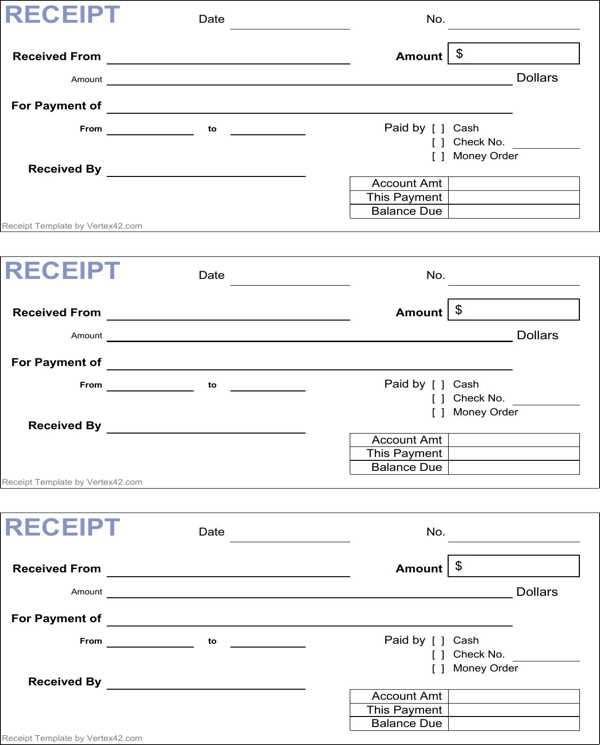

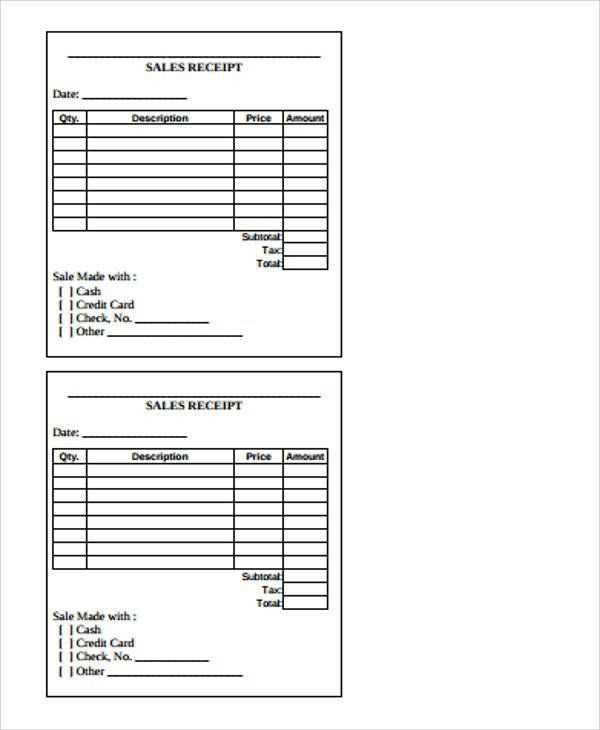

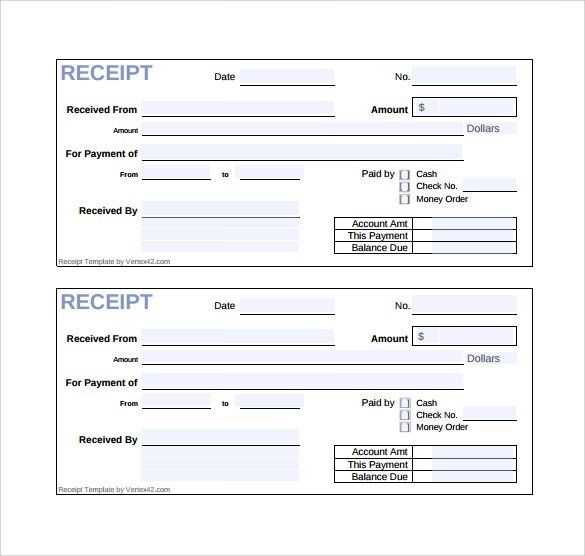

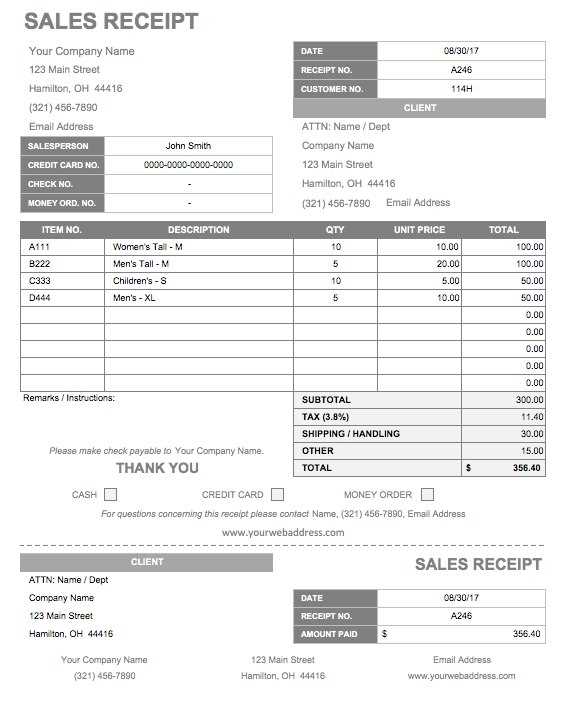

Sample Template

Customize the template below to fit your business needs:

Business Name Address: [Your Address] Phone: [Your Contact Number] Email: [Your Email] Date: [Transaction Date] Customer Name: [Customer’s Name] Items Purchased: ------------------------------------- Description | Quantity | Price ------------------------------------- [Item 1] | [X] | [$XX.XX] [Item 2] | [X] | [$XX.XX] Subtotal: [$XX.XX] Tax: [$XX.XX] Total: [$XX.XX] Payment Method: [Cash/Credit Card/etc.] Final Sale Policy: All sales are final. No refunds or exchanges. Thank you for your purchase!

Best Practices

- Ensure the final sale policy is visible at checkout.

- Provide digital and printed copies when possible.

- Use clear and concise language to avoid misunderstandings.

All Sales Final Receipt Template

Key Elements to Include in a No-Refund Receipt

Include a clear statement such as “All Sales Final – No Returns or Exchanges” at the top. Specify applicable exceptions, such as defective products under warranty. Provide a date and detailed item descriptions to avoid disputes. Ensure the customer acknowledges the policy by including a signature line or checkbox for digital receipts.

How to Clearly Word a No-Refund Policy on a Receipt

Use direct language like “No refunds will be issued after purchase.” Avoid vague terms that could lead to misunderstandings. If specific conditions apply, list them concisely. Place this information near the payment details to ensure visibility.

Customizing a receipt for different businesses means adjusting the wording to match industry needs. A retail store may emphasize exchanges, while a service provider may highlight non-refundable deposits. Tailor the policy based on customer expectations while maintaining legal compliance.