A well-structured receipt ensures clarity for both businesses and customers. Whether you run a small shop or offer freelance services, a simple receipt template helps track payments and meet legal requirements. In the UK, receipts should include key details to be valid and useful.

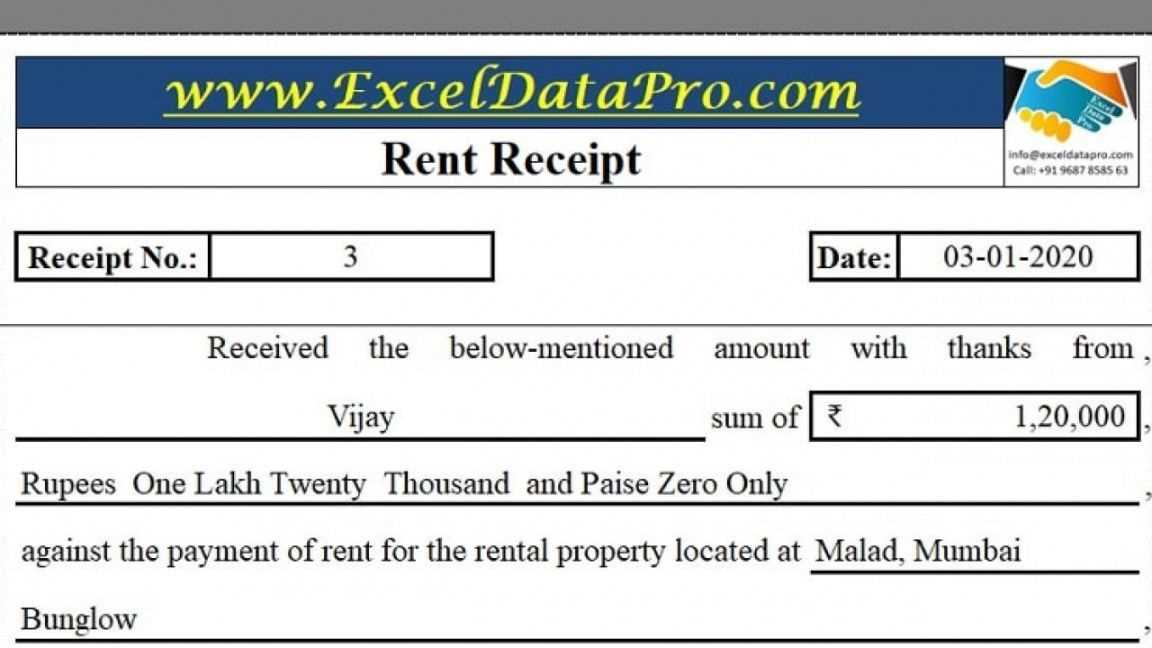

Every receipt must show the date of the transaction, the seller’s name or business details, a description of the goods or services, the amount paid, and applicable taxes. If you are VAT-registered, the receipt should also display a VAT number and a breakdown of tax charges.

Digital or printed, receipts serve as proof of purchase and can prevent disputes. Using a structured template saves time and ensures consistency. Free templates are available in formats like Word, Excel, and PDF, allowing easy customization. Adding your company logo, contact information, and payment terms can further enhance professionalism.

For sole traders and small businesses, keeping receipts well-organized is essential for tax reporting. HMRC may request them as evidence of income and expenses. Choosing a simple template that includes all necessary details helps avoid issues during audits or financial reviews.

Here is the corrected version with redundant repetitions removed:

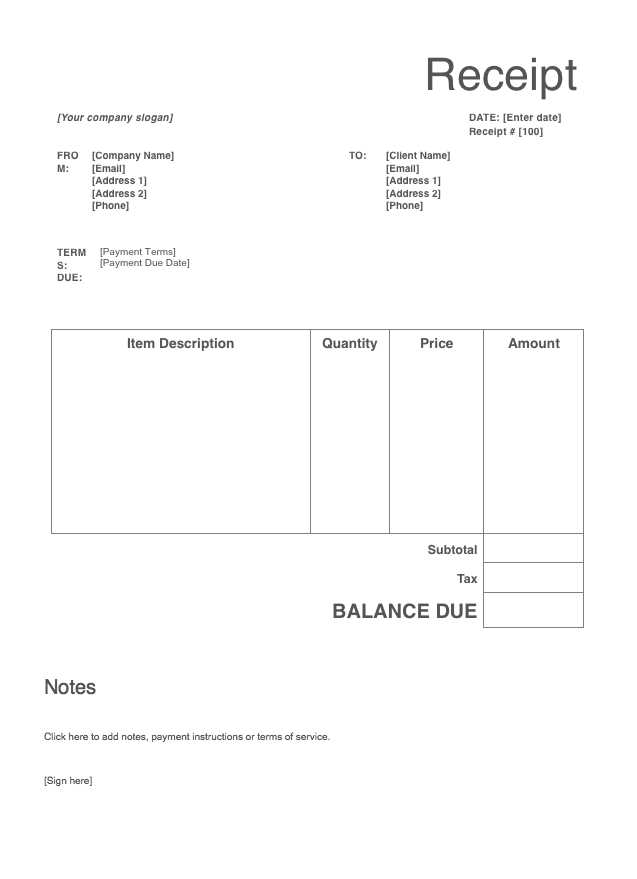

To simplify your receipt template, remove unnecessary duplicate sections and streamline the layout. Focus on the essential details: date, amount, description, and payment method. This keeps the receipt clear and functional without clutter. When setting up your template, ensure the font is legible and the sections are logically ordered.

Key Elements of the Receipt

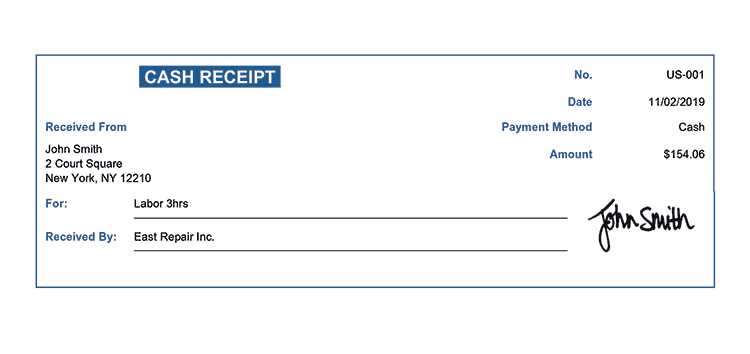

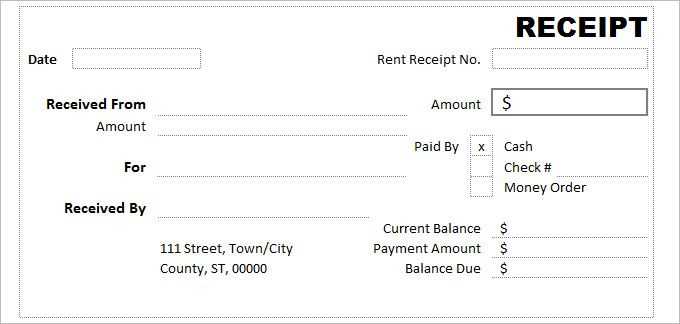

The main fields should include the seller’s information, the transaction date, a clear breakdown of items or services, the total amount, and payment method. Avoid repeating these details within the document. Make sure your template accommodates various types of payments, such as credit card, cash, or bank transfer.

Formatting Tips

Use a simple layout with a clean, readable font. Align text properly to avoid visual confusion. It’s helpful to include space for signatures or any legal disclaimers, if required. Keep the structure minimal but functional to maintain clarity without overloading the user with information.

- Simple Receipt Template UK

When creating a simple receipt template for the UK, focus on the key details that ensure the document is clear and legally sound. The template should include the business name, address, and contact information. Ensure there is a unique receipt number for tracking purposes.

Key Components of a Simple Receipt

Include the date of the transaction and a brief description of the items or services provided. List the price of each item and the total amount paid, making sure to specify any applicable taxes. The payment method (cash, card, bank transfer) should also be clearly stated.

Formatting Tips

Use a clean, easy-to-read font and organize the information in a structured format. Highlight the total amount and payment method for clarity. It is also beneficial to add a thank you note or additional terms if needed.

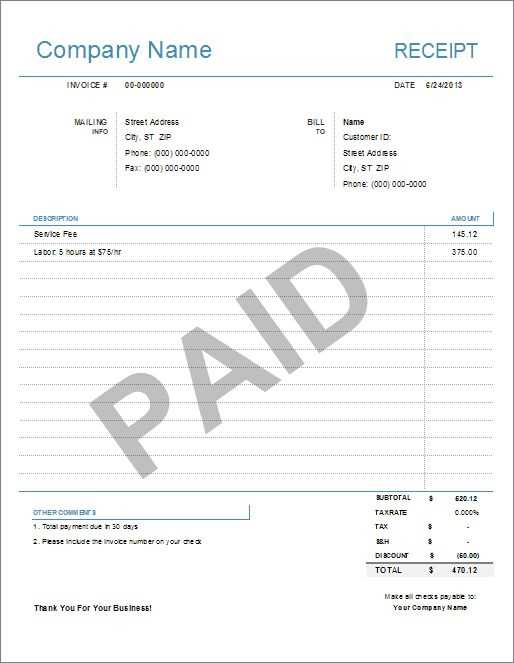

To create a simple and clear invoice, include the following key details:

1. Invoice Number

Assign a unique invoice number for easy reference and tracking. It helps maintain organized records and prevents confusion.

2. Date of Issue

Indicate the date the invoice is issued. This is important for both payment deadlines and recordkeeping.

3. Business and Customer Information

Include the name, address, and contact details of both the seller and the buyer. This ensures clarity about who is involved in the transaction.

4. Description of Goods or Services

Clearly list the products or services provided. Include quantity, unit price, and total price for each item to avoid confusion.

5. Total Amount Due

Provide a clear total amount due, including applicable taxes or additional charges. This gives the customer a straightforward view of the total cost.

6. Payment Terms

Specify the payment due date and any late fees that might apply. Make sure the customer understands when and how the payment should be made.

7. Payment Methods

Include accepted payment methods, whether by bank transfer, cheque, or another method. This offers clarity on how the payment should be processed.

8. Business Registration Information

If applicable, include your business registration number, VAT number, or any other legal identifiers required by your country’s tax laws.

Incorporating these elements ensures a simple and effective invoice. This format aids in clear communication between both parties and helps avoid any confusion in payment processing.

Ensure the bill includes the necessary elements to meet legal standards. This will help you avoid disputes and penalties. Here’s what should be included:

Key Information

The bill should clearly state the following details:

| Detail | Explanation |

|---|---|

| Business name and address | Include the full legal name and physical address of the business issuing the bill. |

| Customer’s details | The customer’s name and address should be clearly mentioned on the bill. |

| Invoice number | Each bill must have a unique invoice number for tracking purposes. |

| Date of issue | The date the bill is issued should be clearly displayed. |

| Payment terms | State the due date and any early payment discounts or late payment penalties. |

| VAT (if applicable) | Clearly show the VAT rate applied, along with the VAT amount, if VAT applies. |

| Breakdown of products/services | List the items or services provided, with quantities, individual prices, and total amounts. |

Format and Layout

Maintain a clean, readable layout. Use clear headings for each section, and ensure text is legible. Avoid clutter, as a neat presentation enhances clarity and reduces confusion for both parties.

Following these steps ensures your bills meet legal standards while keeping transactions transparent and well-documented.

Tailor your proof of purchase template to match specific business requirements. If you’re running a service-based business, include detailed service descriptions, such as duration, type, and technician name. For retail businesses, add itemized lists, with clear prices, quantities, and any discounts applied. This will give customers a transparent breakdown and reinforce trust.

For Subscription Services

If you offer subscriptions, clearly display subscription terms, renewal dates, and payment intervals on the receipt. Specify whether the payment is for a recurring period or a one-time fee, and make sure customers can easily understand what they’re paying for.

For B2B Transactions

In B2B transactions, include relevant tax information, invoice numbers, and a detailed description of the purchased goods or services. Specify payment methods, such as credit terms or installments, to ensure both parties have a clear understanding of the financial arrangement.

Customizing these elements will help avoid confusion and ensure that the proof of purchase aligns with the unique needs of your business and customers.

When creating a simple receipt template for the UK, use a clean, easy-to-read format that includes the necessary details. This helps ensure clarity for both the customer and the business.

Key Elements of a Receipt

- Business Name and Contact Information: Include your company name, address, and phone number for easy contact.

- Date and Time: Ensure the receipt includes the exact date and time of the transaction.

- Description of Products or Services: List each item purchased along with its price. If applicable, include quantities.

- VAT Information: For UK receipts, display the VAT rate and total VAT amount for businesses registered for VAT.

- Total Amount: Show the total amount paid, including tax (if applicable).

Layout Tips

- Use a simple, clean font for readability.

- Align text neatly to make it easy to follow each section.

- Ensure there’s enough space between items for a clear visual separation.