Creating a tax receipt template ensures smooth record-keeping and helps in staying compliant with tax regulations. A clear, detailed tax receipt provides transparency for both the issuer and the recipient. Whether you are running a small business or managing personal finances, having a template that covers key details will streamline your financial documentation process.

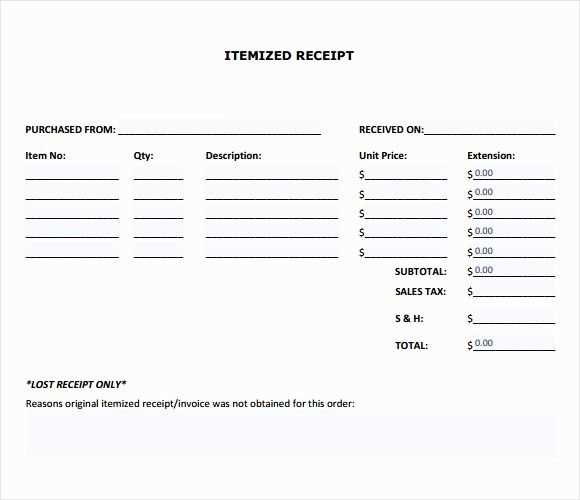

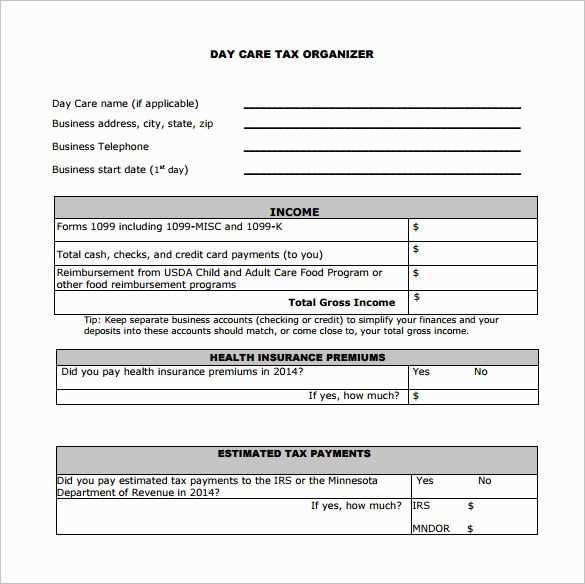

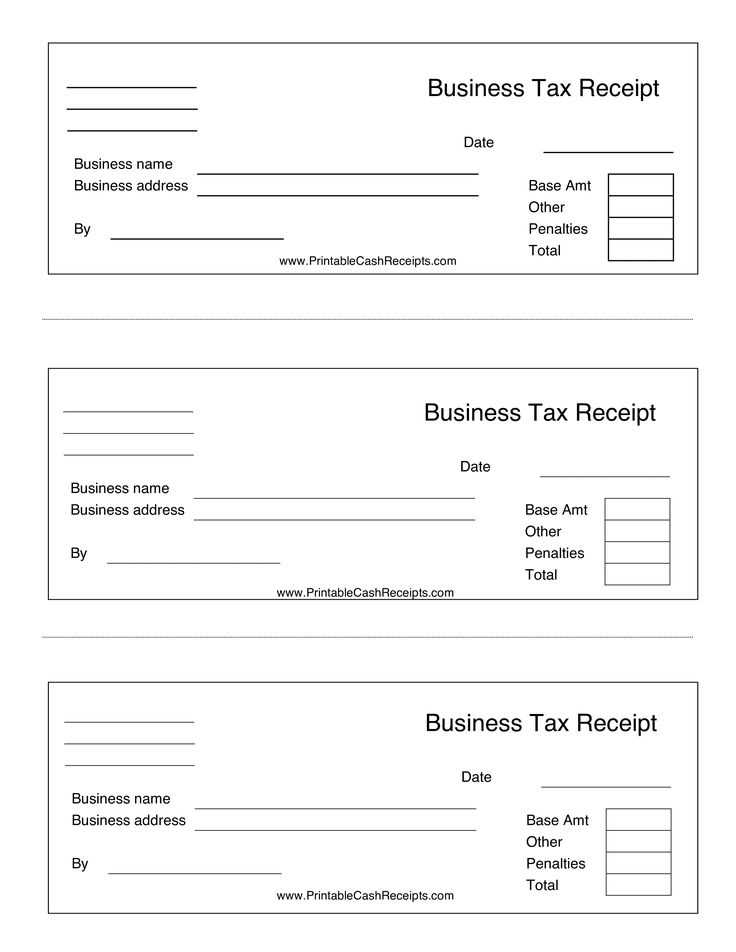

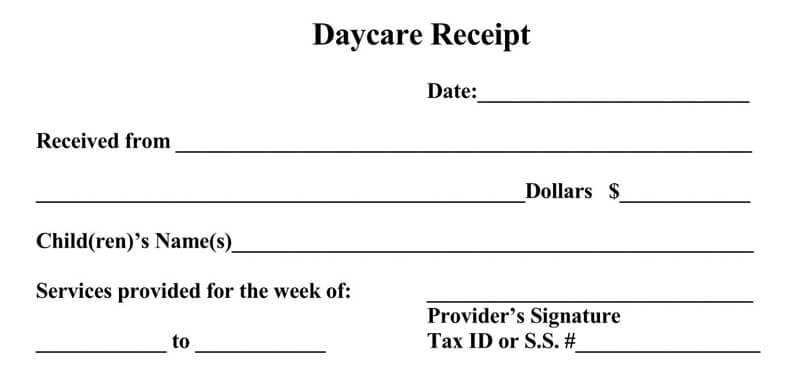

Key components of a tax receipt include the recipient’s name, date of transaction, items or services purchased, payment amount, and applicable tax rates. Customizing the template to reflect these aspects ensures all necessary information is captured accurately. Consider including a unique reference number for each receipt for easy tracking and organization.

Ensure that your template is easy to fill out and adapt. You may choose to include fields for specific tax breakdowns, such as federal or state tax, depending on your location. This clarity will not only make the receipt more informative but also help recipients with their own tax filing.

Best practices for creating a tax receipt template include using clear, readable fonts, aligning text properly, and keeping the design simple yet functional. Avoid cluttering the document with unnecessary details, but make sure that all financial data is well-organized. Saving the template in an editable format, such as a Word or PDF document, will allow quick adjustments as needed.

Remember to save the receipts in a secure, easily accessible location. These documents can be crucial during tax filing or audits, making accurate record-keeping a priority for your financial health.

Here is the corrected version:

Ensure your tax receipt includes accurate details: the name and address of the seller, the date of the transaction, and the description of the goods or services purchased. Always include the total amount paid, as well as any applicable taxes. A clear breakdown of the tax rate and the amount charged is required for transparency. Double-check that the receipt displays the correct business identification number or tax ID, and confirm that any relevant transaction numbers are included. If the purchase was made online, a valid payment reference number should also appear on the receipt. Avoid leaving out important details like return policies or terms of service, if applicable. Clear, complete receipts help maintain smooth transaction records and ensure compliance with tax regulations.

Tax Receipt Template: A Detailed Guide

How to Include Required Information in a Tax Receipt

Formatting Your Template for Different Tax Authorities

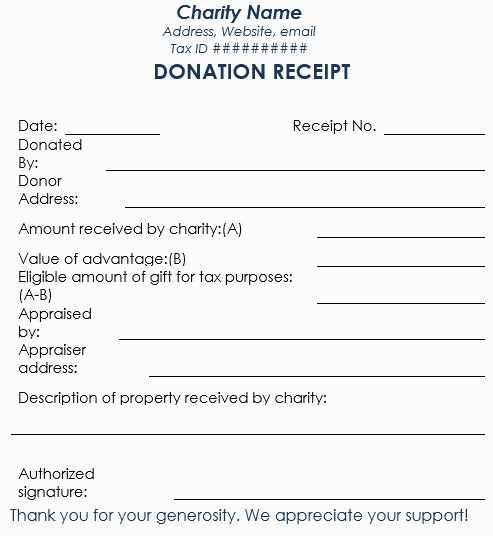

Customizing Your Template for Nonprofit Donations

Begin by ensuring your template includes all mandatory details. For tax receipts, essential information typically includes the donor’s name, the donation amount, the date of the donation, and a clear statement confirming whether any goods or services were provided in exchange for the donation. If the donation is for a nonprofit organization, include the organization’s tax-exempt status and federal tax ID number.

Tailor your template to fit the specific requirements of various tax authorities. For example, in the U.S., the IRS requires a statement of no goods or services for charitable contributions over $75. In Canada, receipts must reflect the charity’s registration number. Ensure that the language used aligns with the relevant tax laws in your jurisdiction to avoid delays or complications.

For nonprofit donations, customize your template to reflect the nature of the donation. Specify if the contribution is cash or in-kind, and offer detailed descriptions for non-cash items. If the donor’s contribution is in-kind, the receipt should not include a value estimate of the item, as this responsibility lies with the donor. Include a thank-you message to emphasize appreciation for their support, which can foster future contributions.