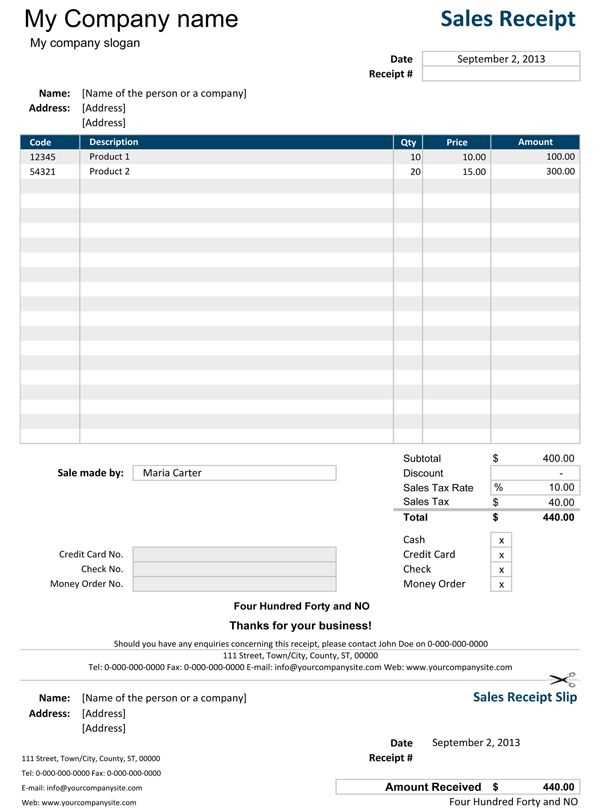

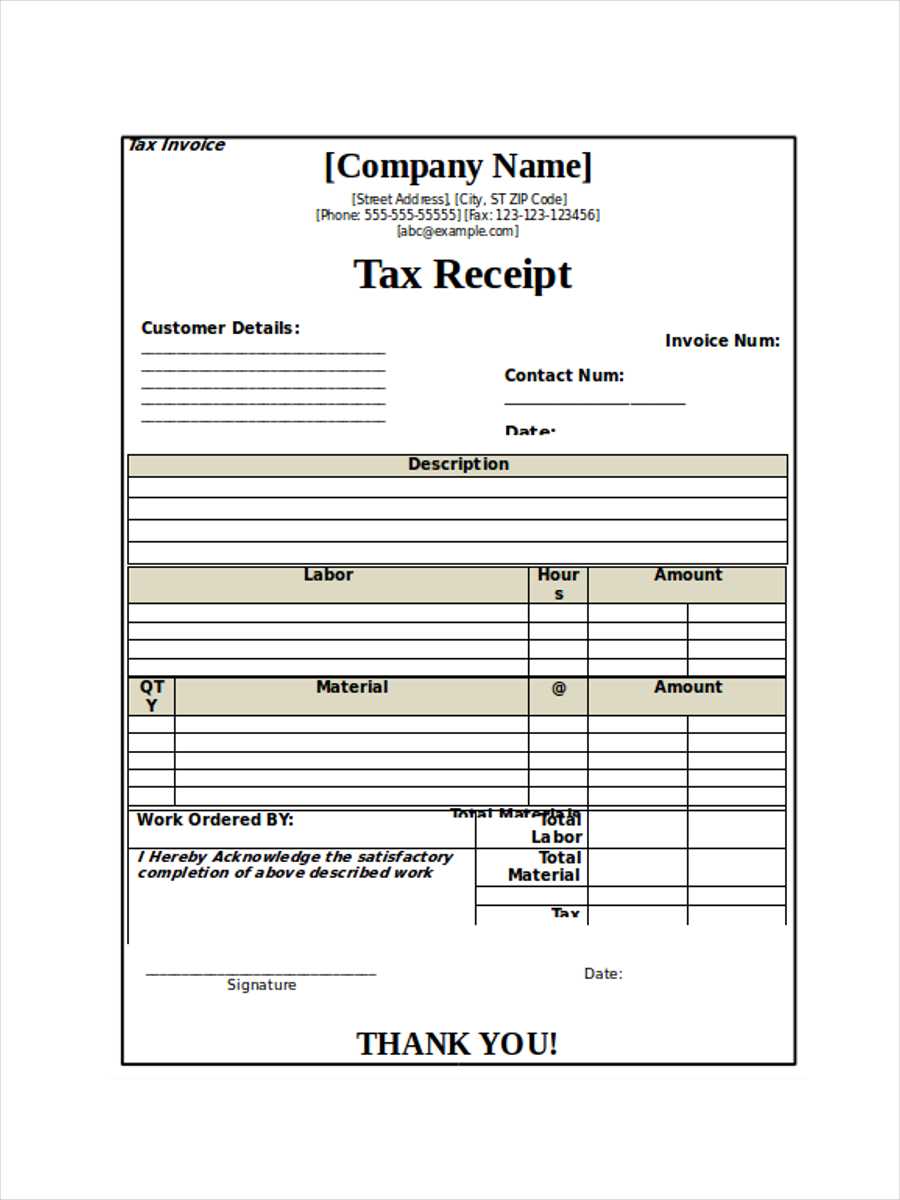

Need a quick and structured way to generate tax receipts? An Excel template simplifies the process, ensuring accuracy and consistency. By setting up a well-organized spreadsheet, you can automate calculations, format receipts professionally, and keep records in order.

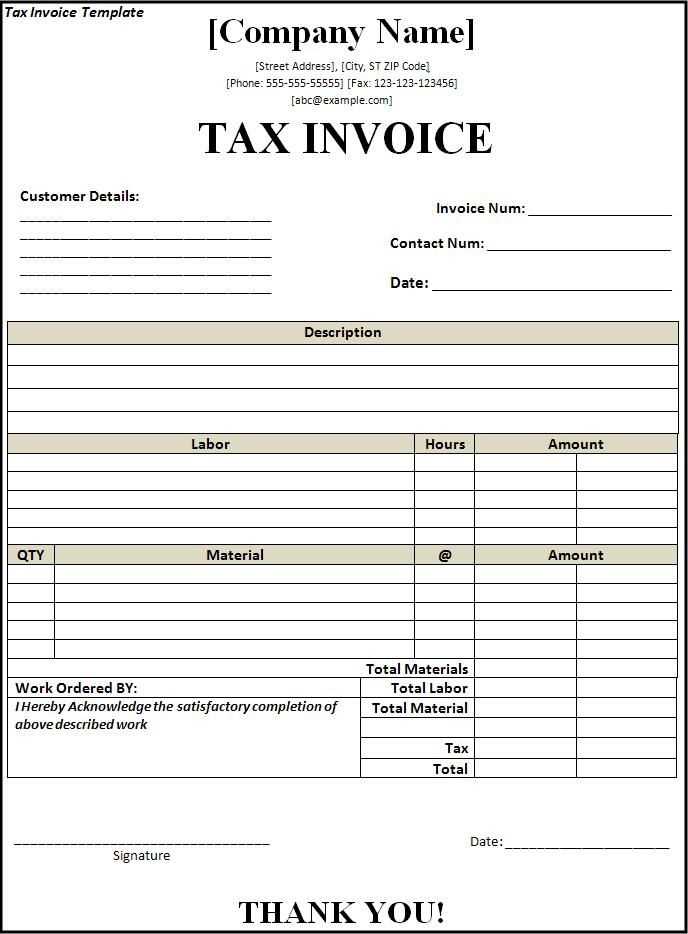

Begin with a structured layout that includes fields for payer details, transaction date, itemized amounts, and tax breakdown. Use formulas to automate total calculations and apply formatting to highlight key figures. Conditional formatting can improve readability, making tax rates and final amounts stand out.

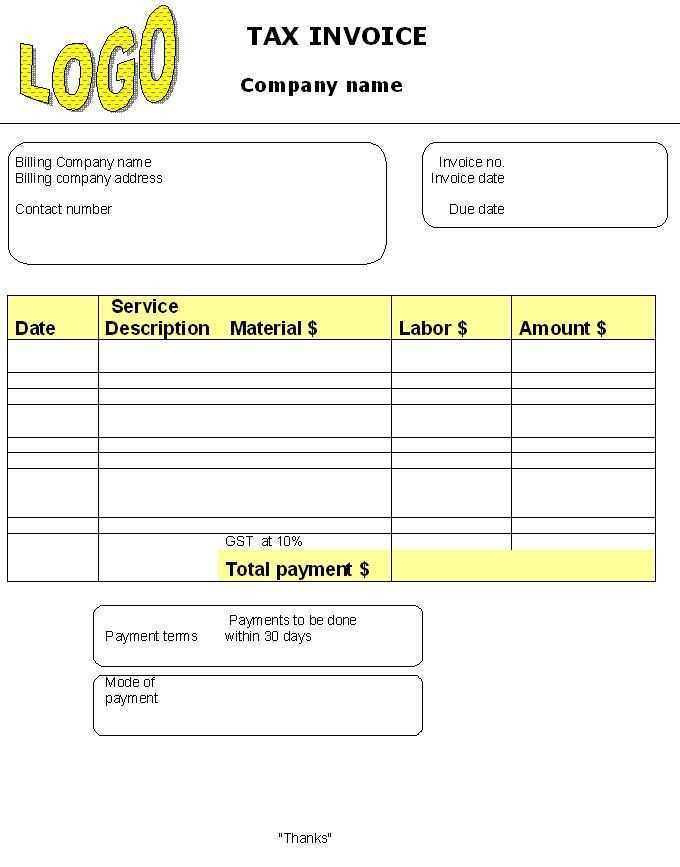

Customizing the template is straightforward. Adjust the header to include your organization’s name, add a logo for branding, and modify column labels to match specific reporting needs. If recurring entries are common, use dropdown lists and data validation to speed up input and reduce errors.

Saving receipts as PDFs directly from Excel ensures a professional presentation and simplifies record-keeping. By integrating print-friendly formatting and structured cell alignment, you create a polished document that is easy to share and store.

Excel Tax Receipt Template

Use predefined formulas and structured formatting to streamline tax receipt creation. Start with a dedicated sheet where each row represents a transaction, including date, amount, payer details, and a unique reference number. Automate calculations by applying SUM functions to track totals dynamically.

Customizing the Layout

Structure the receipt using merged cells for clarity. Insert a header with the organization’s name and tax ID. Use conditional formatting to highlight overdue amounts or errors. A print-friendly design ensures proper alignment on physical copies.

Automating Data Entry

Speed up input by creating dropdown lists for payment methods and categories. Implement VLOOKUP to fetch donor information from a separate database. Use macros to generate PDF receipts instantly, reducing manual work.

Structuring Data Fields for Accurate Documentation

Ensure each entry follows a consistent format to maintain clarity and prevent errors. Use separate fields for payer details, transaction specifics, and payment breakdown. This approach improves readability and simplifies data validation.

Define Mandatory and Optional Fields

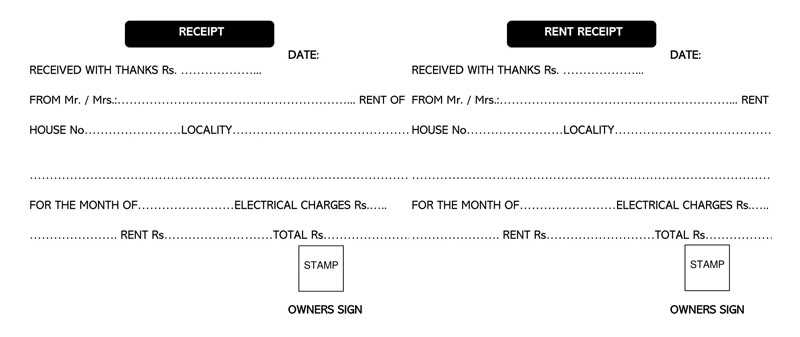

Label required fields clearly, such as name, date, and amount. Optional sections like notes or tax-exempt status should remain accessible but not interfere with core data. Structured input reduces missing or inconsistent information.

Use Standardized Number Formats

Apply a uniform format for monetary values and dates. For example, use YYYY-MM-DD for dates and two decimal places for amounts. This consistency supports automated calculations and prevents misinterpretation across different systems.

Automating Calculations to Reduce Manual Input

Use built-in formulas to eliminate repetitive calculations. Apply =SUM() for total amounts, =IF() to automate tax adjustments, and =ROUND() to ensure precision. This prevents errors and speeds up processing.

Predefine Tax Rates

- Store tax percentages in a dedicated cell and reference them in formulas.

- Use =A2*$B$1 to apply a fixed tax rate across multiple rows.

- Update the tax rate in one place without adjusting individual calculations.

Automate Date and Invoice Numbers

- Apply =TODAY() to auto-fill the current date.

- Use =TEXT(A1+1,”0000″) to generate sequential invoice numbers.

- Combine with =CONCATENATE() for custom numbering formats.

With structured formulas, data entry becomes minimal, reducing the risk of mistakes and ensuring consistency.

Customizing Formatting for Professional Presentation

Adjust column widths to ensure all details remain visible without unnecessary spacing. Set the alignment of text and numbers to improve readability–left-align descriptions and right-align monetary values.

Use conditional formatting to highlight overdue amounts or discrepancies. Apply bold or color changes to totals for quick identification. Ensure font consistency by selecting a professional typeface such as Arial or Calibri and maintaining uniform size across the document.

Incorporate borders and shading to distinguish sections, making it easier to follow transaction details. Format date fields consistently (e.g., MM/DD/YYYY) to avoid confusion. Before finalizing, print a test copy to verify legibility and alignment.