A well-structured receipt template simplifies financial record-keeping and ensures compliance with Singapore’s tax regulations. Whether you run a small business or manage corporate transactions, a properly formatted receipt includes essential details such as GST requirements, business registration numbers, and itemized charges.

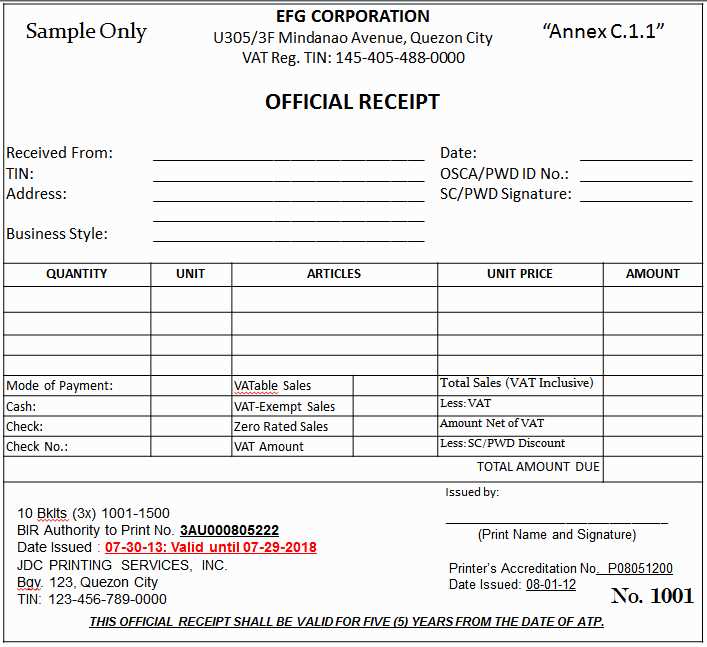

Singapore tax laws mandate that receipts contain the supplier’s name, unique invoice or receipt number, date of issuance, and a clear breakdown of charges. If your business is GST-registered, the receipt must also display the GST registration number and indicate the tax amount separately. Failing to include these details can result in compliance issues during audits.

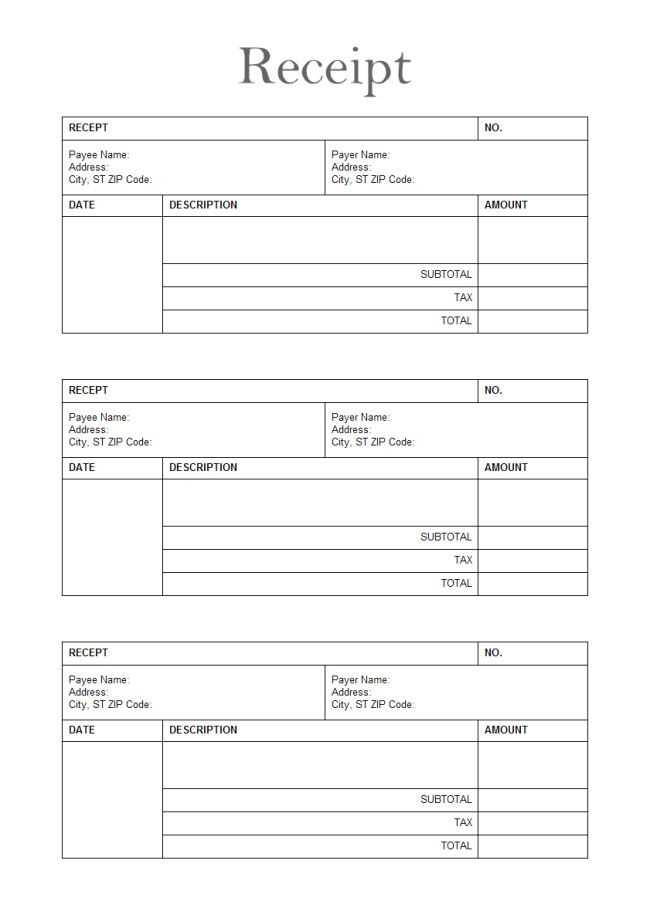

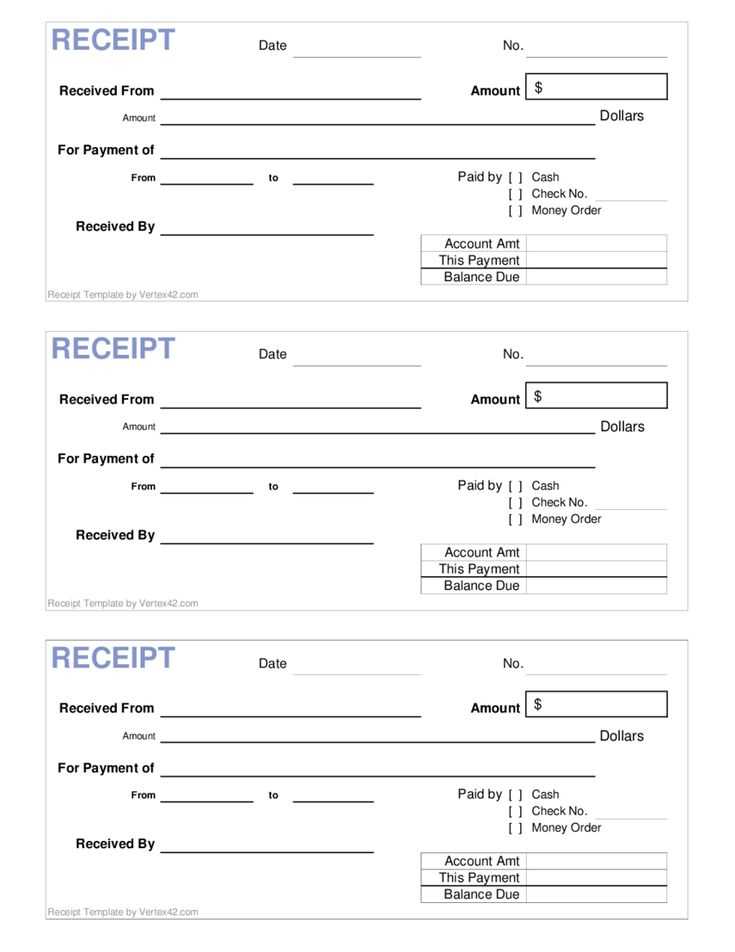

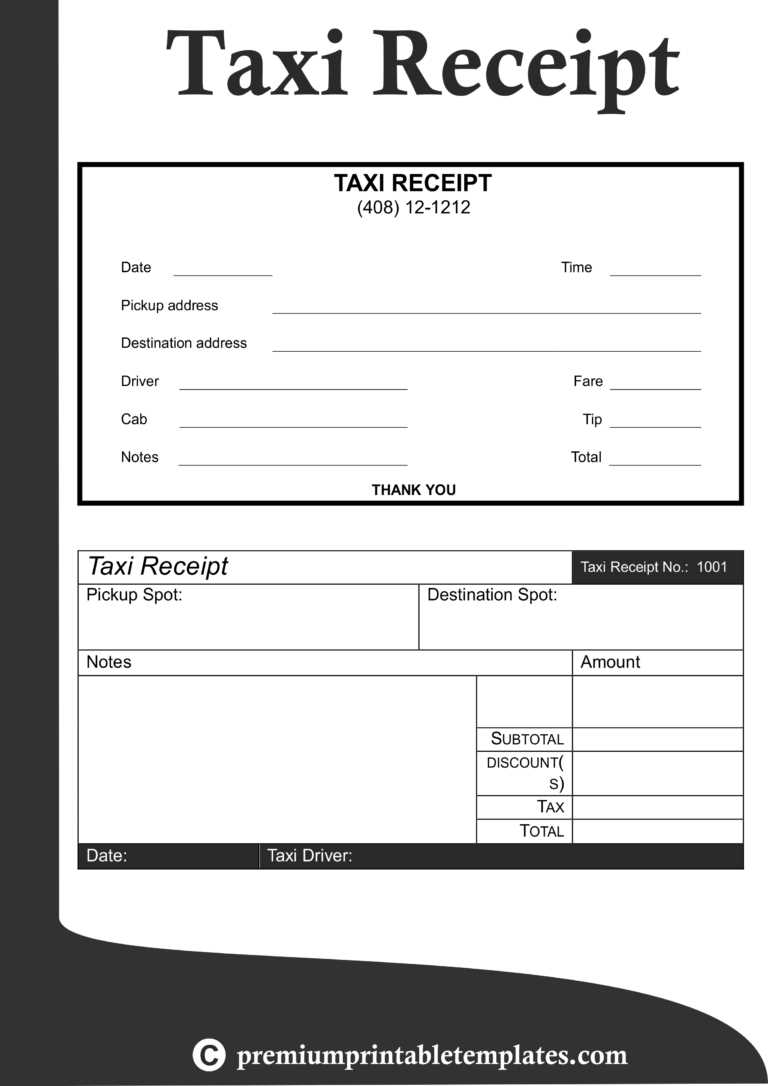

Clarity and professionalism in receipt design enhance customer trust. Using a structured layout with labeled sections prevents confusion and facilitates accounting. Digital and printed receipts should maintain consistent formatting, ensuring that transaction details remain readable and verifiable.

Businesses using receipt templates should align their format with regulatory requirements while maintaining a user-friendly layout. Automated tools can streamline the process by generating receipts with pre-filled data, reducing manual errors and improving efficiency.

Singapore Receipt Template: Key Aspects and Practical Considerations

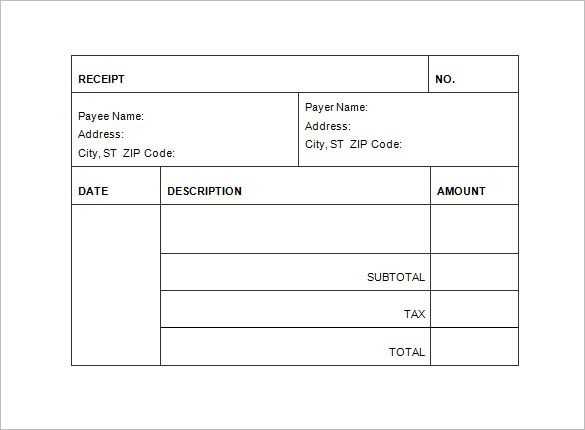

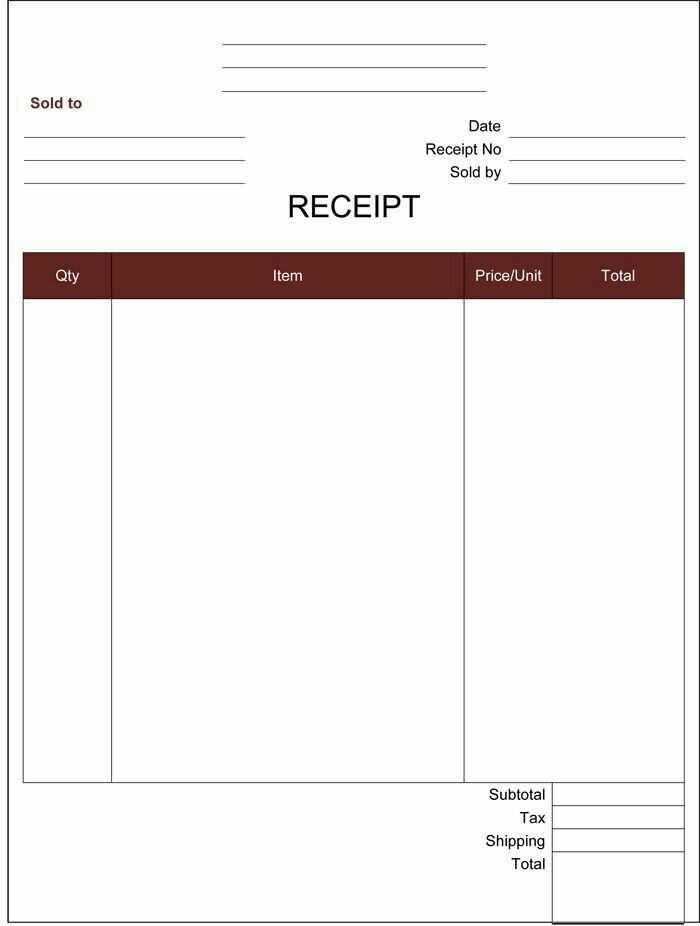

A proper receipt template in Singapore must comply with IRAS guidelines. Include the business name, registration number, date, and a unique receipt number to maintain accurate records. Clearly state the description of goods or services, quantity, unit price, and total amount in Singapore dollars.

For GST-registered businesses, the receipt should indicate GST separately, showing the subtotal, GST amount, and total payable. The GST registration number must also be present. If payment is received in cash, cheque, or electronic transfer, specify the method to avoid discrepancies.

Digital receipts should be securely stored and accessible for at least five years. Ensure consistency in formatting across all receipts to enhance clarity and streamline accounting. If issuing receipts electronically, use a structured format such as PDF or an automated system for better traceability.

Mandatory Information Required on a Singapore Receipt

A valid Singapore receipt must include specific details to comply with tax regulations and ensure clarity for both businesses and customers. Missing key elements can lead to disputes or compliance issues.

Business and Transaction Details

The receipt must display the business name, Unique Entity Number (UEN), and registered address. These details establish the seller’s identity and provide traceability. Additionally, include the transaction date and a unique receipt number to streamline record-keeping.

Itemized Breakdown and Taxes

Each receipt must list purchased items or services with clear descriptions and individual prices. If Goods and Services Tax (GST) applies, show the GST amount separately along with the seller’s GST registration number. The total payable amount should be prominently displayed.

For electronic receipts, ensure all required details are clearly visible in a structured format. Consistency in formatting and accuracy in data entry help maintain transparency and compliance.

Digital vs. Paper Receipts: Compliance and Formatting Standards

Singaporean businesses must ensure that both digital and paper receipts meet regulatory requirements set by the Inland Revenue Authority of Singapore (IRAS). Each receipt must include the company’s name, registration number, date, time, itemized breakdown, applicable taxes, and the final amount.

- Paper Receipts: Must be printed clearly with durable ink on high-quality thermal or standard paper. Fading receipts may not be accepted during audits, so businesses should advise customers to store copies properly.

- Digital Receipts: Must be in a non-editable format like PDF or an image file to prevent tampering. Electronic receipts must be stored securely for at least five years to comply with tax laws.

When formatting digital receipts, ensure compatibility across devices and operating systems. Standardizing font sizes, line spacing, and alignment improves readability. Use structured data formats like XML or JSON for integration with accounting software.

For customer convenience, businesses should offer multiple receipt delivery options, such as email, QR code downloads, or direct cloud storage access. This reduces paper waste while maintaining compliance.

Customization Options for Business Branding and Legal Requirements

Ensure your Singapore receipt template includes a professionally designed header with your company’s name, logo, and registered business number. A well-structured layout with consistent fonts and colors strengthens brand recognition.

Brand Identity Elements

Use high-resolution logos and a color scheme that matches your corporate branding. Custom footers with a tagline or website URL reinforce brand presence. Opt for a modern, readable font to maintain clarity.

Legal Compliance Features

Incorporate mandatory details such as the GST registration number (if applicable), a breakdown of taxable and non-taxable amounts, and clear payment terms. Ensure the format aligns with the requirements set by the Inland Revenue Authority of Singapore (IRAS).

For digital receipts, include a QR code linking to a verification page or additional terms. Always maintain proper record-keeping by storing electronic copies securely.