A cash receipts ledger template is a practical tool that simplifies tracking incoming cash flows for businesses. It allows you to record payments received, categorize them, and monitor the financial health of your operations. This template helps ensure that all cash transactions are captured accurately and systematically.

By using a cash receipts ledger template, you can easily track each payment’s source, amount, and the corresponding account. The template can be customized to fit specific business needs, whether you’re managing daily cash receipts or handling larger transactions over longer periods. It also provides a straightforward way to reconcile your cash balance and generate accurate financial statements.

Incorporating this template into your routine can save time and reduce errors, making it an invaluable asset for financial record-keeping. Whether you’re a small business owner or managing a larger organization, a cash receipts ledger template ensures all cash inflows are documented with precision and consistency.

Here’s the corrected version:

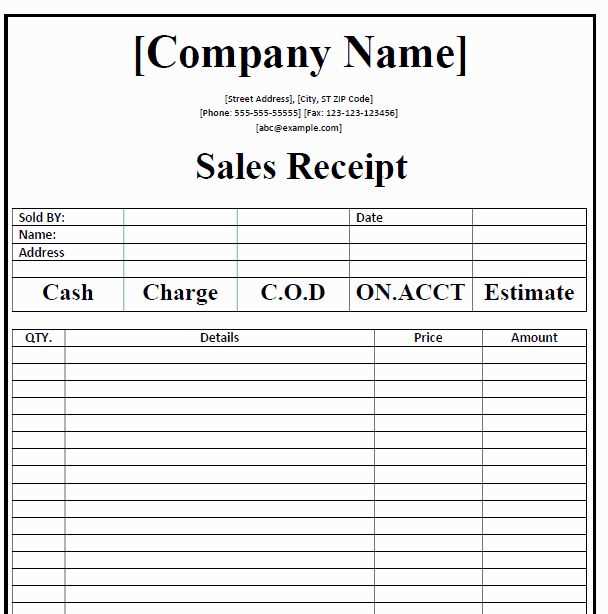

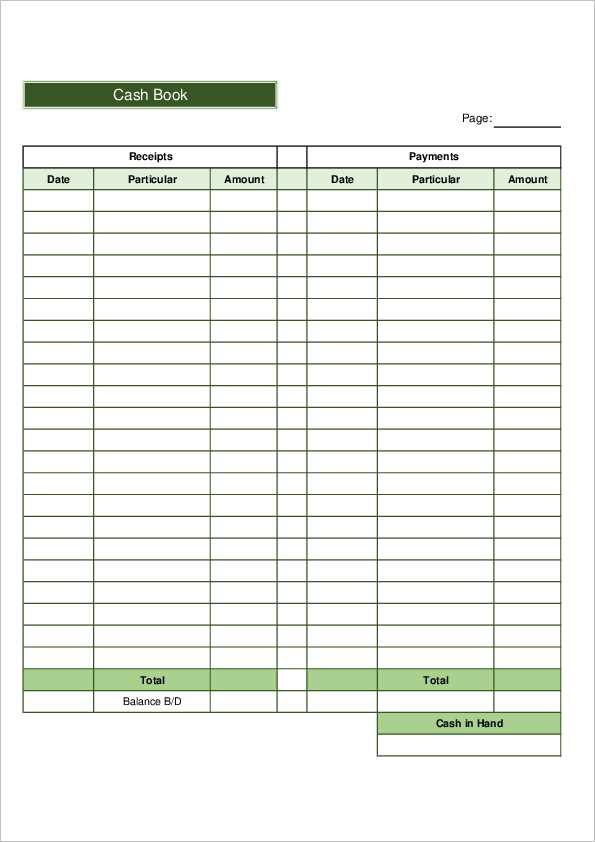

To set up a Cash Receipts Ledger template, focus on structuring it clearly. Begin by creating columns for the date, receipt number, customer name, payment amount, payment method, and account to which the payment is applied. This provides an organized layout for easy tracking. Ensure the template includes a total section at the bottom to automatically calculate the total payments received for the period. This simplifies financial reviews and ensures accuracy. Avoid cluttering the template with unnecessary fields to keep it clean and functional.

For a smooth operation, update the template regularly to reflect new transactions, and make sure you save backups of the document to avoid data loss. For added convenience, you may consider integrating the ledger with accounting software to streamline data entry. Always verify that the total cash receipts match your bank deposits to ensure consistency across records.

- Cash Receipts Ledger Template

A well-structured cash receipts ledger template helps you track cash inflows efficiently. It provides a clear view of incoming funds, ensuring accurate financial records. Include the following key columns in your template:

| Date | Receipt Number | Source | Amount Received | Payment Method | Account | Remarks |

|---|---|---|---|---|---|---|

| 02/04/2025 | 001 | Customer A | $500 | Cash | Sales Revenue | Payment for invoice #123 |

| 02/04/2025 | 002 | Customer B | $750 | Check | Sales Revenue | Payment for invoice #124 |

In this format, each entry records the date, receipt number, source of payment, amount, payment method, and relevant account. Use clear categories and ensure all receipts are recorded immediately after the transaction to maintain accuracy.

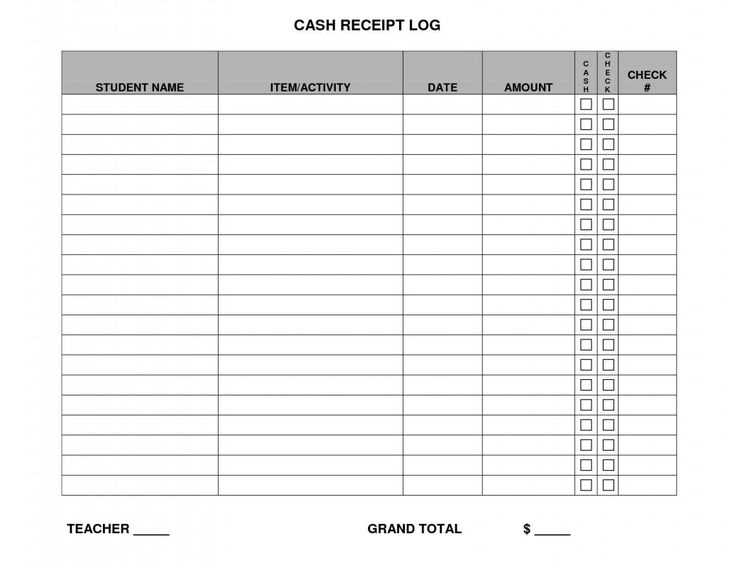

To create a cash receipts ledger in Excel, begin by setting up columns to capture key transaction details. Start with columns for “Date,” “Receipt Number,” “Customer Name,” “Amount,” and “Payment Method.” These columns provide an organized format for tracking cash receipts.

Input data regularly as transactions occur, ensuring each receipt is entered in chronological order. For accurate record-keeping, use Excel’s built-in data validation features to limit input errors, such as dropdown menus for payment methods (e.g., cash, check, credit card).

Use Excel formulas to calculate totals automatically. For instance, sum up all “Amount” entries with the SUM function at the bottom of the column to see the total cash receipts for any given period. Additionally, you can create filters on columns to quickly sort through transactions by customer or date.

Include a column for notes if you need to track additional information for specific receipts. This can be useful for any follow-up actions or remarks regarding particular payments.

Finally, save and back up your spreadsheet regularly to ensure you don’t lose any important financial data. You can also explore Excel’s charting tools to visualize trends in cash receipts over time, helping with financial analysis and reporting.

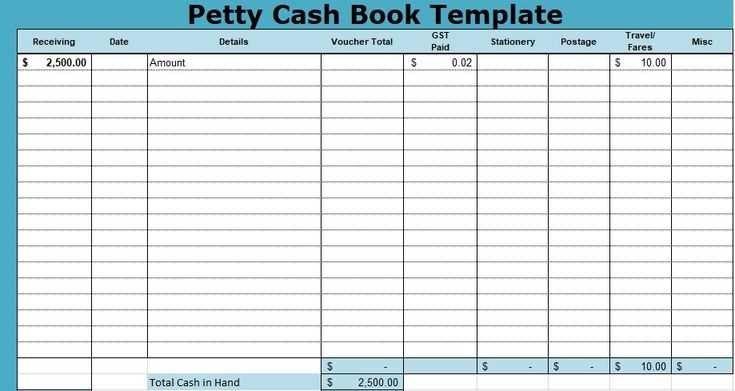

Adjust the ledger template to reflect the specific needs of your business by focusing on key elements that ensure smooth tracking and reporting. Modify categories such as payment methods, invoice numbers, and customer details to match your operational structure.

Adjusting Categories and Fields

- Include relevant columns for transaction details, such as payment type (cash, check, card), transaction date, and amount.

- Customize customer information fields for easy tracking of recurring clients and associated invoices.

- Ensure the ledger accommodates tax-related columns if your business requires separate tax calculations.

Setting Up Regularly Used Templates

- Create a template for different transaction types such as sales, refunds, or deposits.

- Use predefined categories to avoid repetitive data entry and improve consistency across records.

By customizing these features, you can streamline the process of recording transactions and ensure your ledger aligns with specific business workflows.

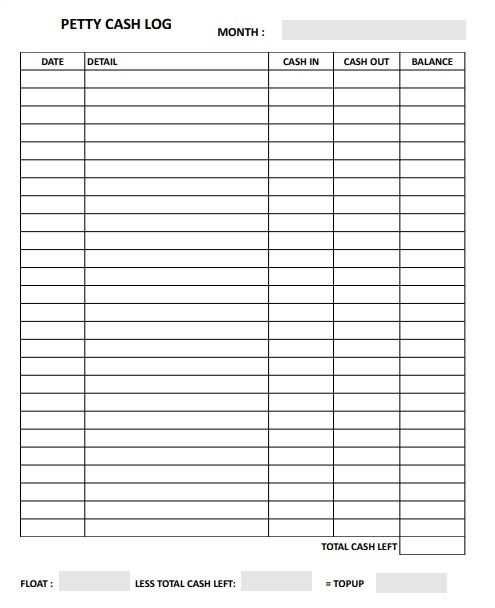

Track incoming and outgoing cash by organizing transactions in clear categories. Use the ledger’s columns for dates, descriptions, amounts, and payment methods to simplify this process. Regularly update each entry, noting any irregularities, to prevent discrepancies.

- Record all transactions promptly: Enter cash inflows and outflows as soon as they occur. This reduces the risk of missing critical details.

- Classify entries by category: Group transactions such as sales, payments, or refunds. This helps identify trends and provides a better view of financial health.

- Monitor balances: Frequently check the current balance to ensure the cash flow aligns with expected patterns.

- Review regularly: At the end of each week or month, analyze the ledger for any large variations. Make adjustments as needed.

- Use totals and subtotals: Keep track of the sums for each category to get a snapshot of financial standing at any given time.

By following these practices, the template becomes a powerful tool for managing cash flow and supporting informed decision-making.

To integrate payment methods into the cash receipts ledger, begin by clearly categorizing the different payment types. For example, include fields for cash, credit card, checks, bank transfers, and any digital payments like PayPal or cryptocurrency. This ensures transparency and streamlines accounting processes.

Each payment method should have its own entry field. For credit card transactions, record details such as the transaction date, amount, and the last four digits of the card number for reference. Bank transfers should be tracked by transaction ID, date, and amount transferred. This will help reconcile payments easily.

Link payment details to individual receipts. Each ledger entry should have a reference to the associated receipt, making it easy to match payments with sales. This linkage also allows for quick identification in case of payment disputes or refunds.

Always include the payment status in your ledger. This could range from “pending” to “cleared” or “reversed.” Keeping track of payment statuses will help avoid confusion and prevent errors when reconciling the ledger with bank statements or other financial reports.

For businesses with recurring payments, such as subscription models, include a column to track payment cycles and due dates. This will help ensure that payments are made on time and will allow for easier follow-up with customers in case of late payments.

Track each receipt as soon as it’s issued. Use a clear, consistent format to record the date, receipt number, source, and amount. Make sure all entries are accurate and organized to avoid confusion during reconciliation. A template with pre-set categories can speed up this process and reduce human error.

Organizing Daily Entries

Group receipts by type (cash, checks, electronic transfers, etc.) and assign them to corresponding accounts. This ensures all sources are accounted for and aligns with your general ledger. Record all details for each transaction, including the payment method and any relevant notes, to maintain a comprehensive log.

Daily Reconciliation

At the end of each day, compare your receipts to the bank statements. This will help you identify discrepancies early and resolve them before they grow into bigger issues. Create a daily report summarizing the total receipts, and double-check that all amounts are correctly entered into your accounting software or spreadsheet.

Double-check each entry before finalizing it. Verify that amounts, dates, and categories align with the supporting documents. Implement automated formulas or checks within the ledger to flag discrepancies, ensuring no errors slip through unnoticed.

Standardize data entry formats. Establish clear guidelines for entering information, such as consistent date formats or rounding practices, to reduce confusion and errors. Consistency improves accuracy and saves time during reviews.

Cross-check totals with external records. Regularly compare ledger totals to bank statements or sales receipts. This step provides an extra layer of verification and helps spot issues early.

Limit access to the ledger to authorized personnel only. Restricting editing privileges ensures that no one can unintentionally alter important information, maintaining data integrity and minimizing human error.

Regularly back up your ledger data. This practice protects against data loss due to unforeseen issues and provides a way to restore previous versions if needed, keeping the ledger accurate over time.

Creating an Accurate Cash Receipts Ledger

A well-structured cash receipts ledger ensures clear tracking of all incoming payments. To start, include these key components in the template: the date of receipt, the payer’s name, payment amount, method of payment, and a reference number or description for tracking purposes. Ensure the layout is user-friendly and allows easy access to all critical details. This minimizes confusion and provides a clear audit trail for future reference.

Key Sections in the Ledger

- Date of Receipt: This should be a mandatory field to clearly define when the transaction occurred.

- Payer Information: Include the name or company from whom the payment was received for reference and transparency.

- Payment Amount: Clearly list the amount to prevent any ambiguity in records.

- Payment Method: Specify whether the payment was via cash, check, or electronic transfer.

- Reference Number: A unique identifier for each receipt simplifies future searches or audits.

Formatting Tips

Ensure consistency in formatting, especially for dates and amounts. For example, use the same date format (MM/DD/YYYY) throughout. Additionally, align monetary values to the right for better readability. This simple design will improve tracking and minimize errors when updating or reviewing the ledger.