To create a legally compliant Australian receipt template, ensure it includes the required details such as the business name, ABN, date of transaction, item descriptions, and total amount. If GST applies, clearly state the tax component. Missing any of these details may lead to compliance issues.

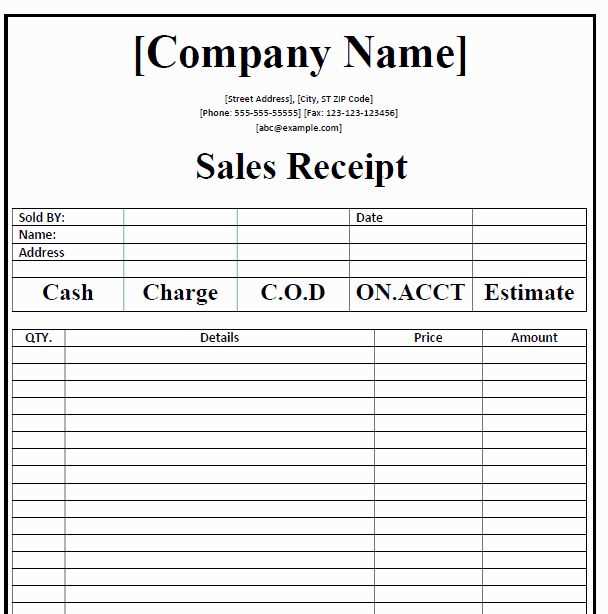

A standard receipt must include the phrase “Tax Invoice” if the business is registered for GST. This distinction is crucial for customers claiming tax deductions. Additionally, the receipt should specify whether the amount includes or excludes GST to prevent confusion.

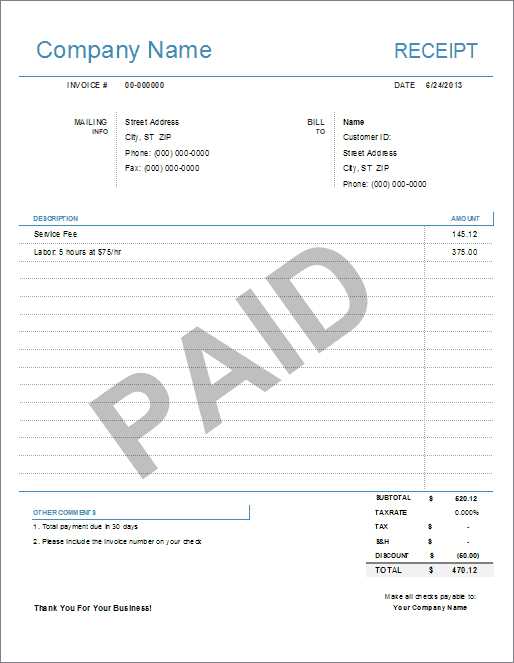

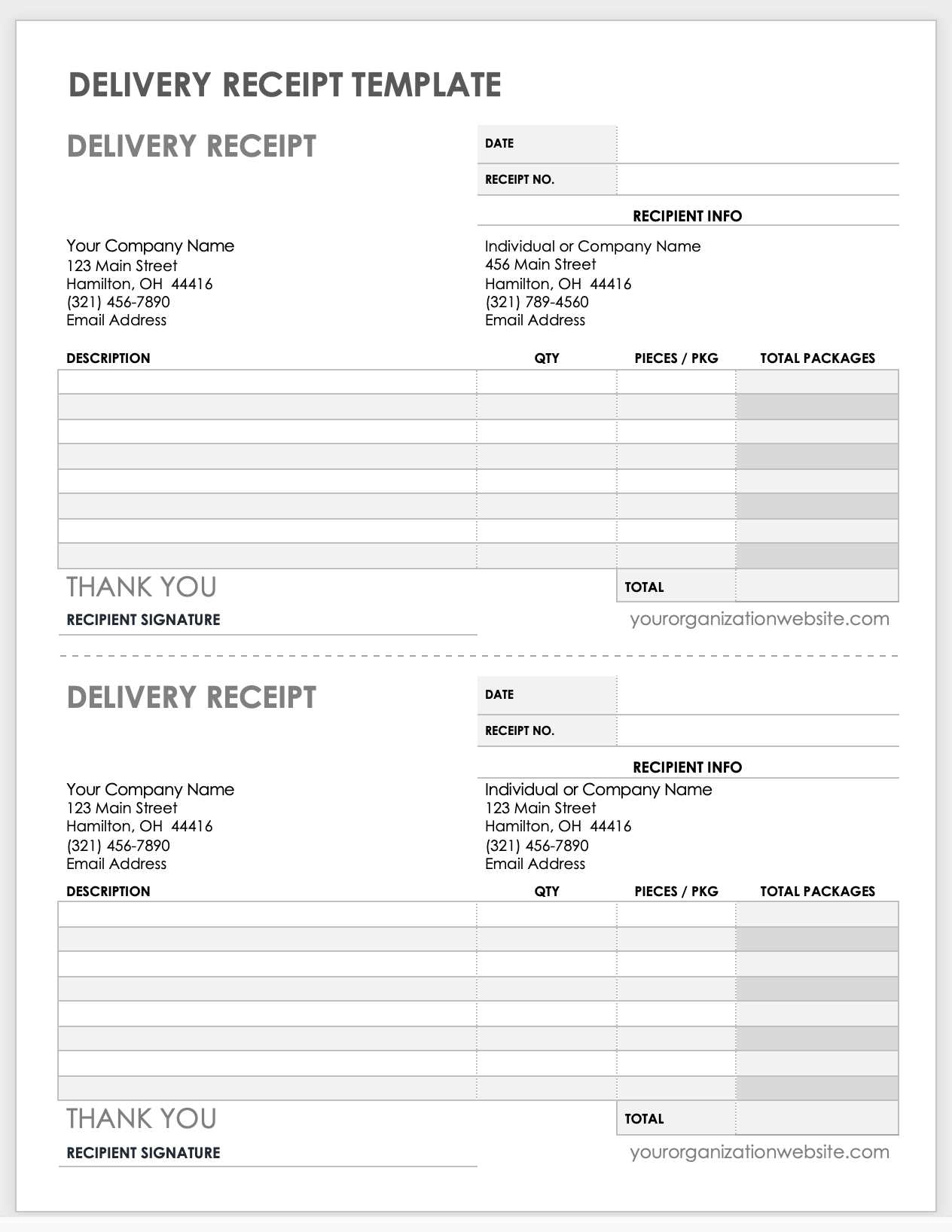

For digital and printed receipts, keep formatting simple and legible. Use a structured layout with clear headings and itemized details. If using templates, ensure they align with the Australian Taxation Office (ATO) guidelines. A well-designed receipt enhances transparency and professionalism while meeting legal obligations.

Australian Receipt Template

Include ABN for Legitimacy. Every Australian receipt must display the business’s Australian Business Number (ABN). Without it, the document may not be valid for tax purposes.

List GST Separately. If your business is registered for GST, show the total price with tax included and provide a separate line stating the GST amount. For non-GST transactions, include a note like “No GST applicable”.

Provide a Clear Breakdown. Itemize each product or service with individual prices, quantity, and total cost. This improves transparency and prevents disputes.

State Payment Method. Indicate whether the transaction was completed via cash, credit card, bank transfer, or another method. This detail helps in record-keeping.

Ensure Readability. Use a clear font and logical layout. Key details like date, receipt number, and business contact information should be easy to find at a glance.

Key Elements Required in an Australian Receipt

Every valid Australian receipt must include essential details to comply with tax and consumer laws. Missing any key information can lead to disputes or compliance issues.

- Business Name and ABN: Clearly display the registered business name and Australian Business Number (ABN). If the business does not have an ABN, the receipt must state that withholding tax may apply.

- Date of Transaction: Specify the exact date the purchase was made to ensure accurate record-keeping.

- Itemized List of Goods or Services: Provide a breakdown of each item or service, including a brief description, quantity, and price.

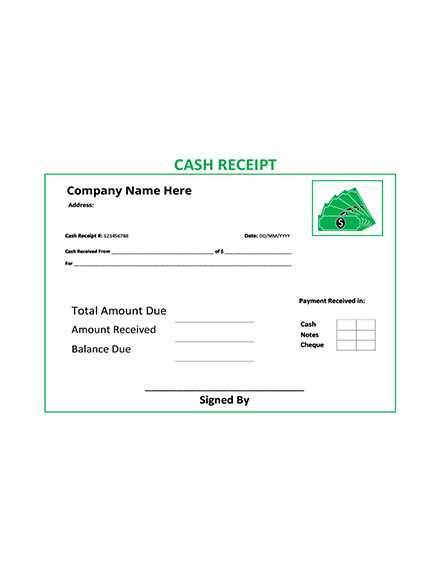

- Total Amount: Indicate the full amount paid, including GST if applicable.

- GST Information: If the business is registered for GST, the receipt must show the GST amount separately or include a statement that the total price includes GST.

- Payment Method: Mention whether the transaction was completed via cash, card, bank transfer, or another method.

- Customer Details (if applicable): Some receipts, especially for high-value transactions, may require the buyer’s name or contact details.

- Invoice Number or Receipt Number: Assign a unique identifier for easy tracking and reference.

For receipts over $82.50 (including GST), businesses must issue a tax invoice upon request. Ensuring all required elements are included prevents issues with tax claims and improves transparency.

Formatting Guidelines for Business and Tax Compliance

Include the business name exactly as registered, ensuring it matches tax records. Display the Australian Business Number (ABN) clearly to meet legal requirements.

Use a structured layout with distinct sections for item descriptions, quantities, prices, and totals. Align numerical values consistently to improve readability.

Specify the date of the transaction in DD/MM/YYYY format. If applicable, indicate the due date for payments to avoid confusion.

For tax compliance, separate the Goods and Services Tax (GST) amount. If the business is GST-registered, include “Tax Invoice” at the top and specify the GST component for each taxable item.

Ensure that payment details, such as accepted methods and reference numbers, are easy to find. Provide the customer’s name or ABN when required for business-to-business transactions.

Maintain a professional appearance with a legible font and adequate spacing. Avoid unnecessary elements that could distract from essential details.

Common Mistakes When Creating an Australian Receipt

Missing Required Details

Omitting essential information can make a receipt invalid. Always include the business name, ABN (Australian Business Number), date of issue, a clear description of goods or services, and the total amount, including GST if applicable.

Incorrect GST Calculation

GST must be calculated at 10% of the total price. If the receipt includes GST, ensure it is labeled as “Tax Invoice” and clearly states the GST amount. If GST does not apply, specify “GST Free.”

Unclear Pricing Breakdown

Customers should easily understand the cost breakdown. List item prices separately, showing the subtotal, GST (if applicable), and the final amount. Avoid rounding errors that could cause discrepancies.

Improper Formatting

A cluttered or poorly structured receipt can lead to confusion. Use consistent spacing, readable fonts, and clearly distinguish between item descriptions, prices, and tax details.

Omitting Payment Details

Receipts should specify the payment method, such as cash, card, or bank transfer. For card payments, the last four digits of the card number can be included, but avoid storing full details for security reasons.

Failing to Issue Receipts When Required

Businesses must provide a receipt for purchases over $75 if requested. Keeping digital or paper copies for record-keeping also helps with tax compliance and dispute resolution.