Creating a deposit refund receipt template ensures a clear record of returned deposits. It is an important tool for both businesses and customers, providing transparency and accountability in financial transactions. A well-crafted receipt simplifies the refund process, minimizes disputes, and maintains professional standards.

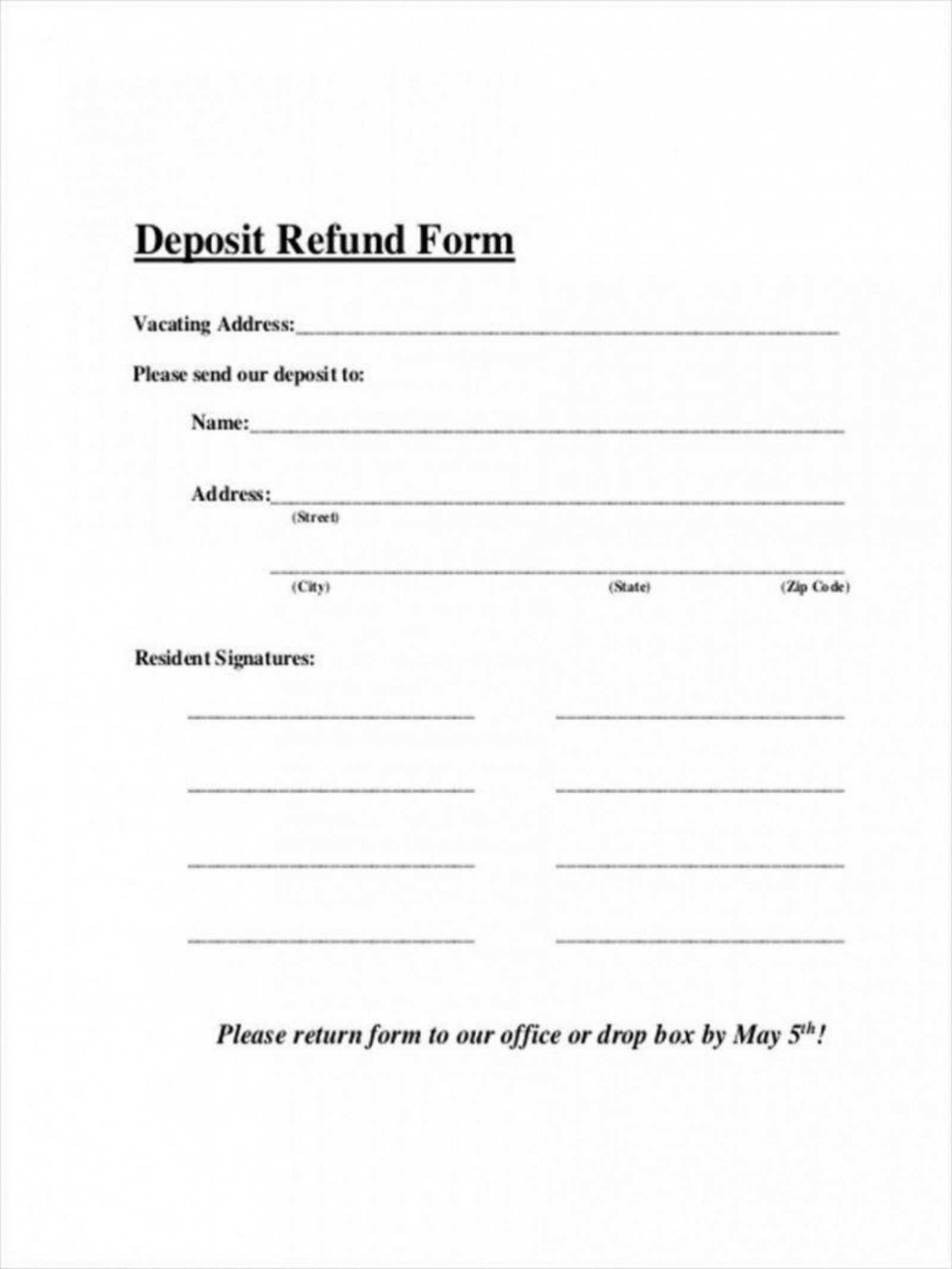

Start with including key details like the refund amount, date, and payment method. Clearly state the original deposit amount, the refund amount, and the reason for the refund if applicable. This helps avoid misunderstandings and provides a useful reference in case of future inquiries.

Make the receipt easy to understand by including your business name and contact information, as well as the customer’s details. If relevant, include transaction or invoice numbers. This adds a layer of organization and makes it easier for both parties to keep track of their financial exchanges.

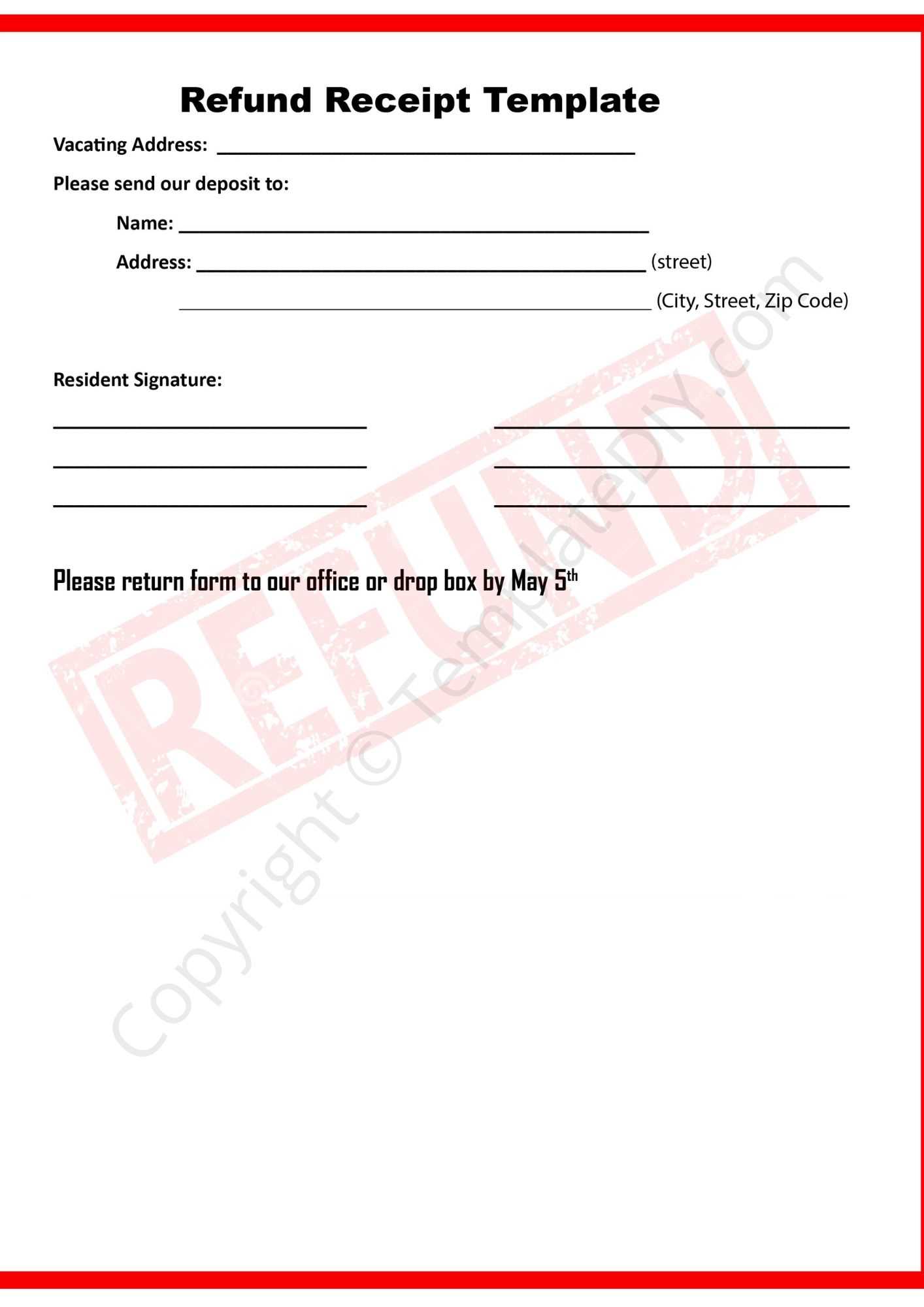

A simple yet effective template should be clear, concise, and professional, making the refund process smooth for both the customer and your business. Always ensure that the receipt is signed by the person responsible for issuing the refund, and provide the customer with a copy for their records.

Here is the revised version with minimal repetition:

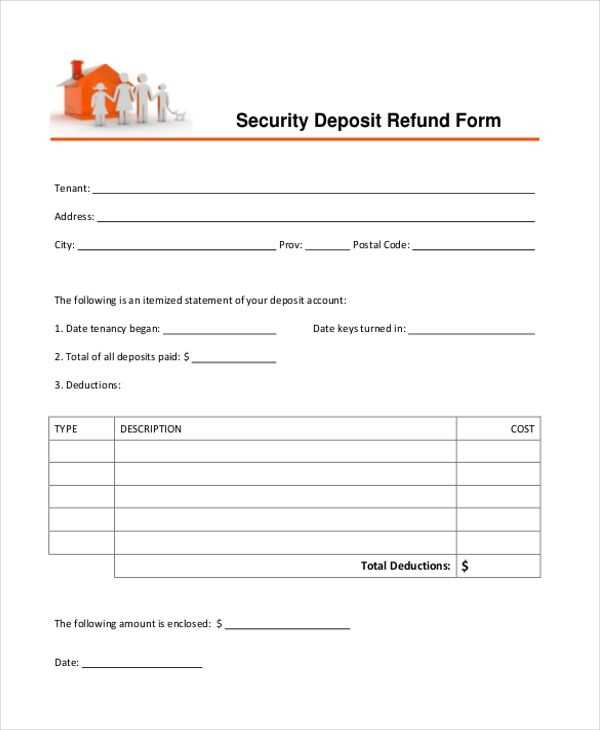

To create a simple and clear deposit refund receipt template, include the following key elements: the date, the refund amount, and the reason for the refund. Make sure to list the original deposit amount, any deductions, and specify the remaining balance refunded to the customer. This ensures clarity for both parties.

Essential Sections

The receipt should have clear headers such as “Refund Date,” “Original Deposit,” and “Refund Amount.” Provide the customer’s details, such as name and contact information, as well as your business or organization’s information. This creates a transparent document that both parties can reference later.

Tips for Clear Communication

Be concise and avoid unnecessary wording. Focus on numbers and details that matter. For example, specify the payment method used for the refund, whether by cash, credit, or another form. The receipt should allow the customer to easily understand the transaction details.

Ensure that all refunds are properly documented for both legal and bookkeeping purposes. This template can be adapted for various types of deposits, such as rental agreements, event bookings, or service fees. Tailor it to suit your specific needs while keeping the format simple and easy to read.

How to Create a Deposit Refund Receipt Template for Your Business

Design your deposit refund receipt template with clarity and precision. Begin by including the name of your business and its contact details. This ensures transparency and helps customers easily reach out if needed. List the customer’s full name, address, and contact information to identify the recipient of the refund.

Specify the date of the transaction, including the date the deposit was made and the date the refund is issued. Clearly state the original deposit amount and the refund amount, especially if there are any deductions or adjustments. Provide a brief description of the goods or services related to the deposit, along with any agreement or reference number to link the refund to a specific contract or transaction.

Include a section that explains any refund policies or terms, especially regarding conditions that may affect the refund amount or eligibility. It’s also recommended to note the method of refund (cash, cheque, bank transfer, etc.). Finally, have a signature line for both the business representative and the customer to acknowledge the refund.

Key Information to Include in a Deposit Refund Receipt for Legal Compliance

For legal compliance, ensure the receipt includes accurate and up-to-date business information, such as your registered business name and tax identification number. This establishes your legitimacy and protects you in case of disputes. If applicable, include any terms and conditions that comply with local regulations regarding deposit refunds. This could involve the timeframe within which refunds must be processed and the circumstances under which deposits may be forfeited or refunded in full.

Double-check the refund amount to ensure accuracy, particularly if the deposit was partially refundable. Clear documentation of the transaction ensures you’re covered from a legal standpoint. Additionally, ensure that you retain a copy of each receipt for your business records, as this may be needed for tax purposes or potential audits.

Common Mistakes When Creating a Deposit Refund Receipt and How to Avoid Them

Avoid ambiguity in the refund terms. Clearly state whether the refund is partial or full, and provide a breakdown if necessary. Not specifying whether the deposit is refundable or if there are any non-refundable portions can lead to confusion or disputes with customers.

Another mistake is omitting key details, such as the transaction reference number or the customer’s information. Always double-check for accuracy before issuing a refund receipt. Not including the reason for the refund can also lead to misunderstandings, so ensure the purpose of the refund is clearly noted.

Lastly, neglecting to include signatures or failing to keep proper records can create issues later. Make sure to have both parties sign the receipt and maintain accurate copies for your records to stay organized and legally protected.