Need a donation receipt template? Get a professionally formatted file that ensures compliance with tax regulations and provides donors with clear documentation. A well-structured receipt helps organizations maintain transparency and streamline record-keeping.

Choose the right format based on your needs. Whether it’s a PDF for quick printing, a Word document for easy customization, or an Excel sheet for automated calculations, a pre-designed template saves time and reduces errors.

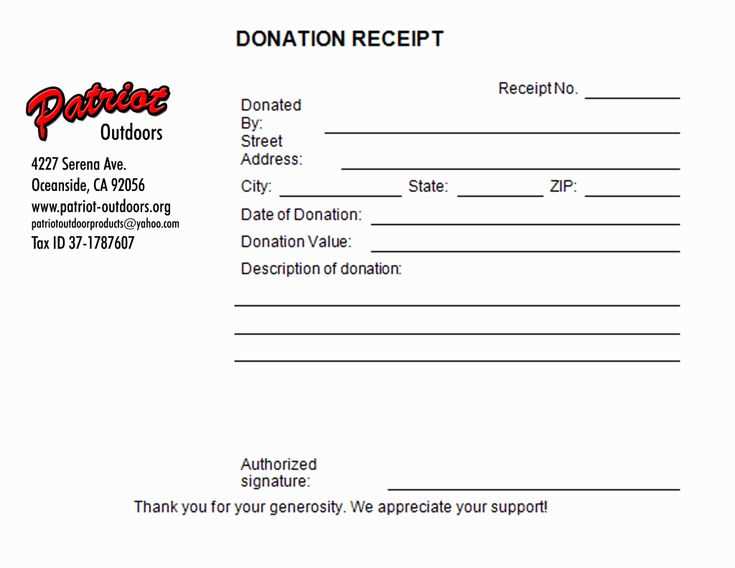

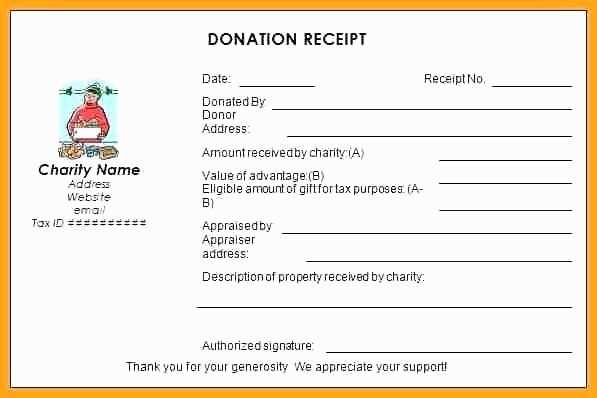

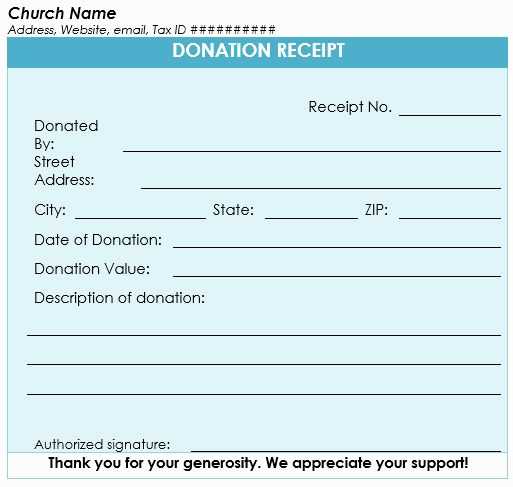

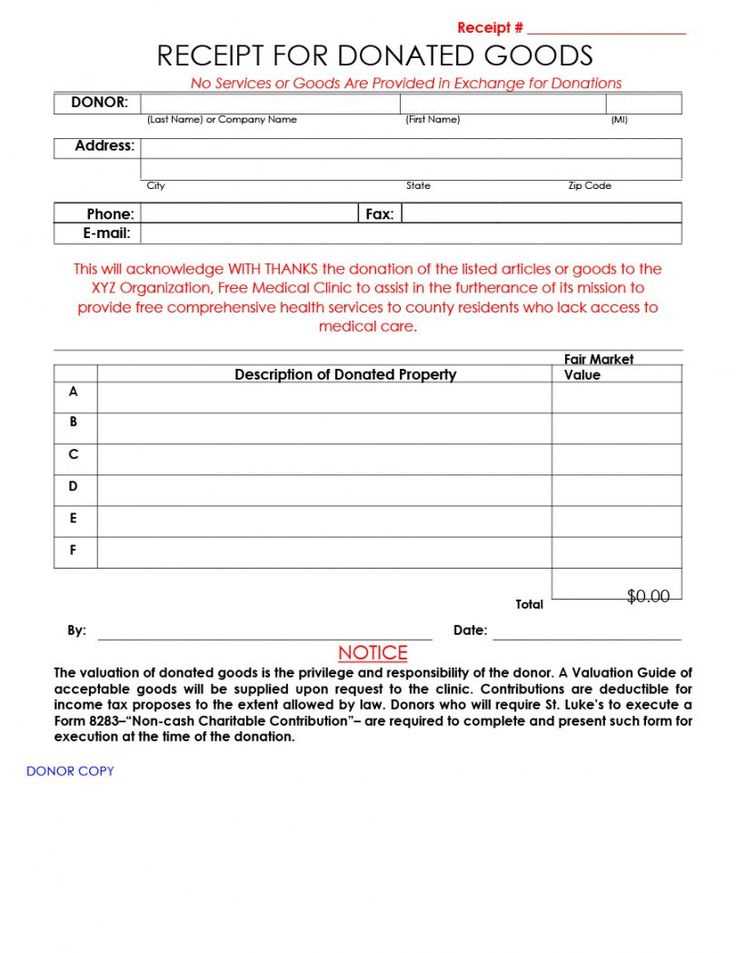

Each template includes essential details such as the donor’s name, contribution amount, date, and organization information. Some versions also feature automatic tax-deduction statements to meet legal requirements.

Download a template now and simplify the process of issuing donation receipts with minimal effort.

Donation Receipt Template Download

To create a donation receipt quickly, download a ready-made template. Customize the document to include the donor’s name, donation amount, and the organization’s details. Make sure the receipt is clearly structured to meet tax or legal requirements in your location.

Key Details to Include

Ensure your template has the following essential fields: donor’s full name, address, date of donation, and the exact amount donated. For tax purposes, it is also recommended to add the organization’s name, address, and EIN (Employer Identification Number), if applicable. Include a description of the donated items if it was not a cash contribution.

Why Use a Template?

Templates save time by eliminating the need to create a receipt from scratch for every donation. They provide a consistent format for donors and streamline your administrative process. Look for templates compatible with Word or PDF formats for ease of use and distribution.

Key Elements to Include in a Donation Receipt

Include the donor’s name and address. This helps ensure that the receipt is personalized and can be used for tax purposes. Clearly state the name of your organization, along with its tax-exempt status, if applicable. This provides legitimacy and reassurance to the donor.

Indicate the donation date. This helps the donor track their giving, especially for year-end tax filings. If the donation includes goods or services, describe them and their value. Be transparent about whether the donor received anything in return for their contribution.

Specify the donation amount, especially for monetary gifts. For non-cash donations, include a description of the items and their fair market value. Ensure that the donor understands whether they need to provide any additional documentation for non-cash gifts.

If applicable, include a statement confirming that no goods or services were provided in exchange for the donation. This is required for tax purposes when the donor is claiming a deduction.

Provide a clear and concise thank you note. Express gratitude for the donor’s contribution and emphasize the impact of their generosity. A personal touch can strengthen donor relations and encourage future contributions.

Best File Formats for Downloadable Donation Receipts

PDF is the most reliable format for donation receipts. It ensures that the document’s layout, fonts, and images remain intact regardless of the device or software used to open it. This format is widely accepted for formal records and is easy to save, share, and print.

Excel (XLS or XLSX) is another option, especially for organizations that need to manage multiple receipts in a structured way. It allows for easy data manipulation, but it may not be as professional-looking as a PDF.

Word documents (DOC or DOCX) offer flexibility for adding text and images, making them suitable for organizations that want to customize each receipt. However, they are less secure than PDFs and may lose formatting across different devices.

CSV files are useful for organizations that want to store donation data in a simple text format. This format isn’t ideal for sending receipts directly to donors but works well for internal record-keeping and later processing into more formal formats.

Where to Find Free and Customizable Receipt Templates

Many online platforms offer free and customizable receipt templates to help you generate professional-looking documents quickly. Here are some top places to check out:

- Google Docs – Offers a variety of free templates that can be easily customized and shared with recipients.

- Canva – Provides both free and paid receipt templates with a wide range of design options to suit different needs.

- Microsoft Word – Includes built-in receipt templates that you can personalize by changing fonts, colors, and other elements.

- Template.net – Features a collection of free templates that can be downloaded and tailored to fit your style.

- Jotform – Provides an online receipt generator with customizable options for a smooth, quick process.

- Zoho – Offers a free receipt template generator, allowing for easy editing and management of your receipts.

Each of these platforms ensures that you can customize the templates to match your branding or specific needs. Whether you are looking for something simple or a more stylish receipt, these sources have options to cater to your preferences.