A well-structured receipts and payments account template saves time and ensures accurate financial tracking. Whether managing a small business, nonprofit, or personal finances, a clear record of cash flow helps maintain transparency and control over income and expenses.

The core of this template includes receipts (all incoming funds) and payments (all outgoing transactions). Common receipt entries cover sales revenue, donations, or loans, while payments include rent, salaries, and utility bills. Keeping these records up to date simplifies financial analysis and decision-making.

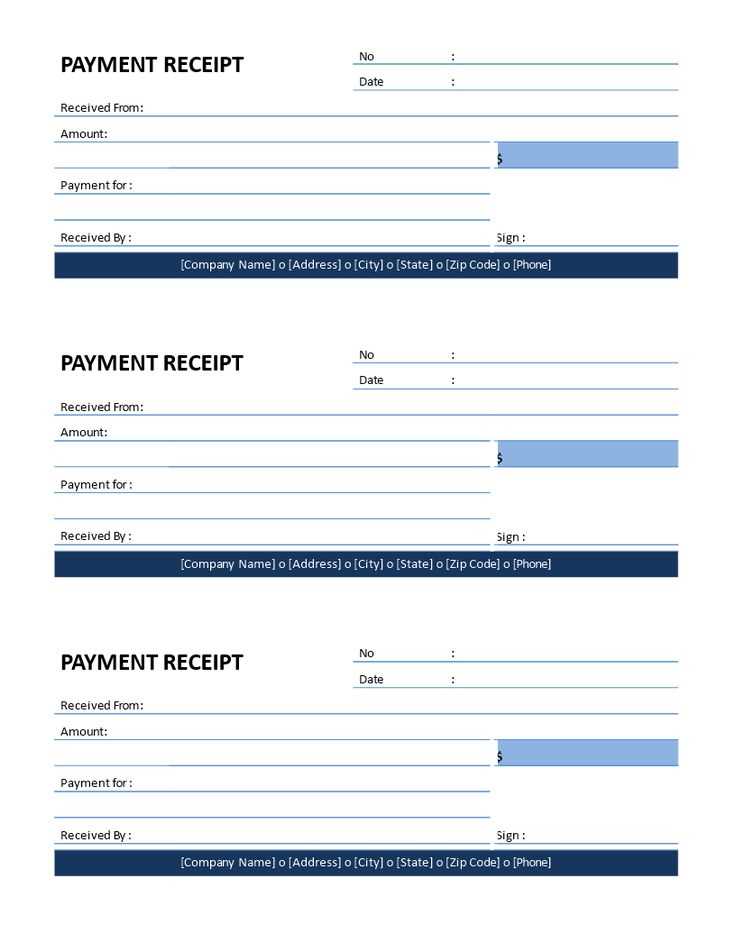

Using a structured format eliminates guesswork. A typical template consists of four key columns: date, description, amount received, and amount paid. Some templates also include a running balance to track available funds in real time. Spreadsheet tools like Excel or Google Sheets allow easy customization, adding automated calculations and filters for better clarity.

For accuracy, update the account regularly and ensure each entry has supporting documentation, such as invoices or receipts. Categorizing transactions further improves organization, making it easier to identify trends and optimize budgeting.

Download or create a receipts and payments account template tailored to specific needs, and enjoy a streamlined approach to financial management.

Here’s the corrected version without unnecessary repetitions:

To streamline your receipts and payments accounts template, focus on clarity and simplicity. Use precise headings and categories that reflect the transaction types. Avoid excessive details that do not add value to the financial overview. For example, group similar expenses and incomes under specific sections instead of repeating general categories multiple times. This will make your document more readable and easier to follow.

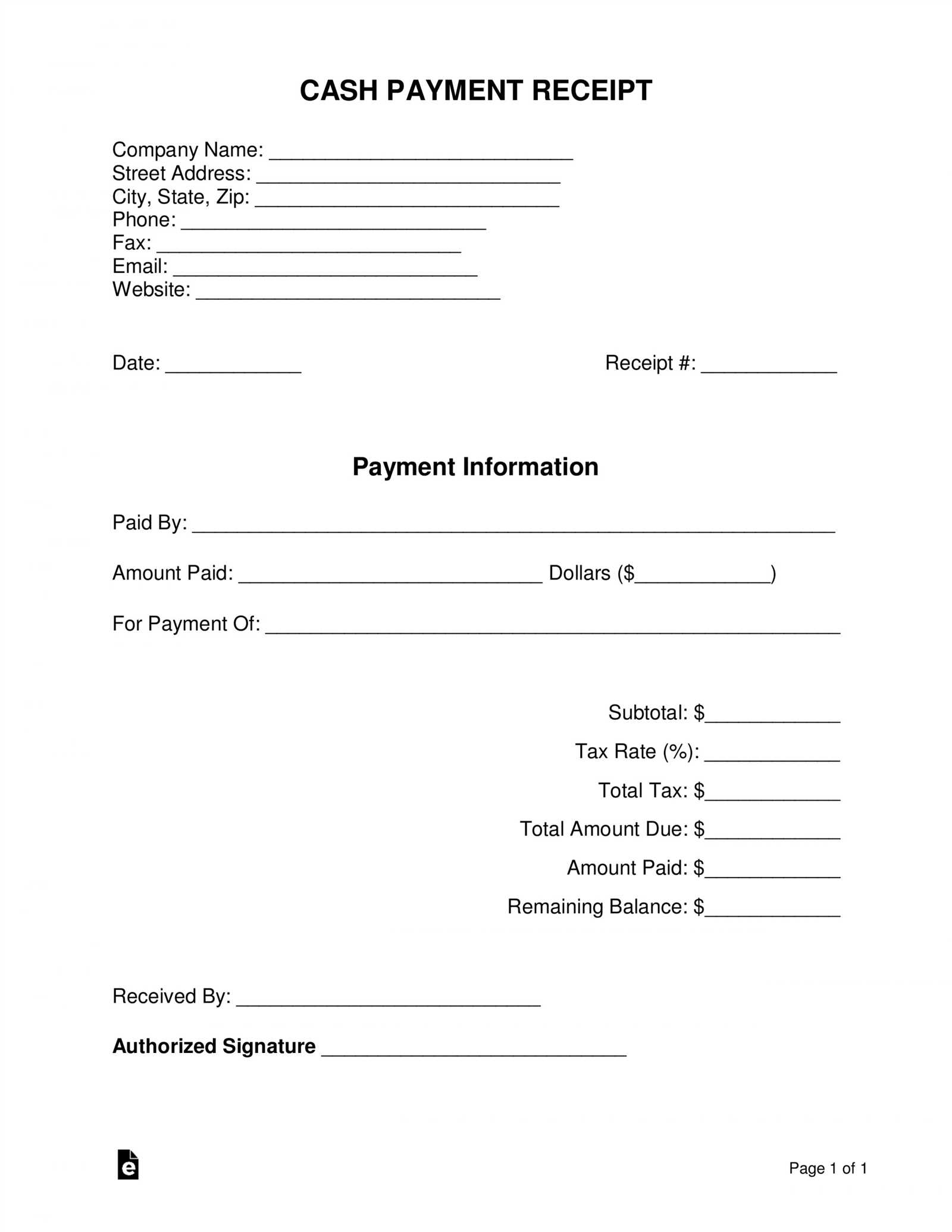

Ensure that each entry is clearly identified with relevant information, such as dates, amounts, and descriptions. It’s also helpful to add reference numbers for easy tracking. This approach minimizes confusion and ensures that all entries are properly organized.

| Date | Description | Amount | Category |

|---|---|---|---|

| 2025-02-10 | Payment for office supplies | $150 | Expenses |

| 2025-02-11 | Refund from vendor | $50 | Income |

By following this streamlined structure, you can avoid unnecessary clutter and ensure all data is presented in an organized manner. Always focus on what’s most relevant to the reader.

- Receipts and Payments Accounts Template

The Receipts and Payments Account template provides a clear structure for recording financial transactions, showing both income and expenditure for a specific period. It helps track cash inflows and outflows, providing transparency and organization for financial statements.

Template Structure

- Receipts: List all cash inflows including sales, donations, and any other income sources.

- Payments: Record all outflows such as expenses, bills, wages, and any other disbursements.

- Net Cash Flow: Calculate the difference between total receipts and total payments. This gives an overview of cash movement within the period.

- Closing Balance: Provide the final cash balance after all receipts and payments have been accounted for.

Key Guidelines

- Ensure that all receipts and payments are recorded in chronological order.

- Use separate columns for receipts and payments for clarity.

- Regularly update the account to reflect any new transactions.

- Cross-check the entries periodically for accuracy, especially when preparing reports.

A receipts and payments account includes specific elements that offer transparency and clarity in financial tracking. Below are the key components to include:

- Receipts: This section records all incoming cash, including sales revenue, loans, donations, or any other sources of income.

- Payments: It lists all outgoing expenses, such as purchases, operating costs, taxes, or loan repayments.

- Opening Balance: The balance carried over from the previous period. This is crucial for understanding the starting point of your financial position.

- Closing Balance: The remaining amount after all receipts and payments have been recorded. It shows the end-point financial status for the period.

- Date Range: The specific period the account covers, which helps provide context to the financial data.

- Descriptions: A brief explanation for each transaction. This ensures clarity about the purpose of each receipt or payment.

By organizing your receipts and payments account with these elements, you maintain clear financial documentation for reporting, analysis, and future planning.

To create a receipt and payments template in Excel, begin by organizing your columns for clarity and ease of use. Label the first column “Date” to record transaction dates, followed by “Description” for transaction details. Add columns for “Receipts” and “Payments” to track incoming and outgoing funds separately. For balance tracking, create a column titled “Balance” to automatically update based on the amounts entered in the previous two columns.

Formulas for Automatic Calculations

To ensure your template works efficiently, use simple Excel formulas. In the “Balance” column, input a formula that adds the receipt and subtracts the payment for each row. The formula will look something like this: =SUM(Receipts – Payments). Copy this formula down the entire column so that each row automatically updates based on new entries.

Formatting for Readability

Make the template visually clear by using Excel’s formatting options. Highlight the header row with bold text and a light background color for easy identification. Use number formatting for monetary values to maintain consistency, ensuring all amounts are displayed with the correct currency symbols. Additionally, apply conditional formatting to highlight any negative balances, making them stand out for immediate attention.

Double-checking the account’s starting and ending balance is crucial. Many errors arise from discrepancies in these numbers, which can affect the accuracy of the entire record. Before proceeding, ensure you have the correct figures in place. Review past reports for consistency and verify that all entries align with prior balances.

Inaccurate Categorization

Incorrectly categorizing receipts and payments is a frequent mistake. Proper classification prevents confusion and ensures clarity in financial statements. Payments for services should be grouped under expenses, while income from sales must be recorded as revenue. Incorrect categorization can distort financial data and lead to errors in subsequent financial analyses.

Skipping Documentation Verification

Neglecting to verify receipts and supporting documentation can cause errors. Each entry should have a corresponding receipt or invoice for cross-referencing. Without this step, entries may lack verification, and mistakes in the accounting process can easily go unnoticed.

To ensure accuracy in receipts and payments accounts, always structure your data clearly. Begin with a simple layout that includes two main categories: “Receipts” and “Payments”. Each category should have a corresponding column for date, description, and amount. Keeping your records organized will prevent errors and save time during audits or reports.

Receipts Category

For the receipts section, list all incoming funds. Make sure to include a brief description and the exact date of each transaction. You can categorize receipts by type, such as sales revenue, loan income, or refunds, for better clarity. This method aids in understanding cash flow at any point in time.

Payments Category

Under payments, list all outgoings like supplier payments, rent, salaries, or utility bills. Categorizing payments by type helps track where funds are being spent and assists in budgeting. Be sure to document every payment with supporting details, such as invoice numbers or payment method.