A well-structured personal sale receipt protects both the buyer and the seller in any private transaction. Whether selling a used car, furniture, or electronics, providing a clear and detailed receipt helps avoid disputes and ensures a record of the agreement.

Include the date of sale, names and contact information of both parties, and a detailed description of the item. Specify the amount paid, payment method, and any relevant terms, such as “sold as-is” or warranty details. A simple statement confirming the transfer of ownership adds further clarity.

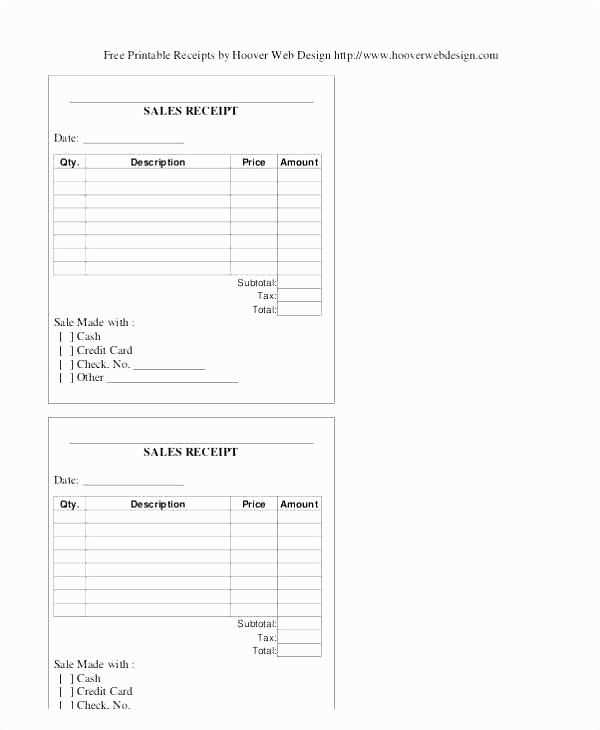

Handwritten or digital, a personal sale receipt should be easy to read and kept for future reference. Using a pre-made template ensures all necessary details are included, making the process smooth and hassle-free.

Here’s a version without unnecessary repetition but retaining the meaning:

A concise personal sale receipt should clearly list the transaction details while being easy to read. Keep the format simple, starting with the seller’s and buyer’s names, followed by the date and unique receipt number. Then, detail the items sold, including the description, quantity, and price. Finally, include the total amount paid along with payment method and any taxes applied. Ensure all fields are clearly labeled for quick reference.

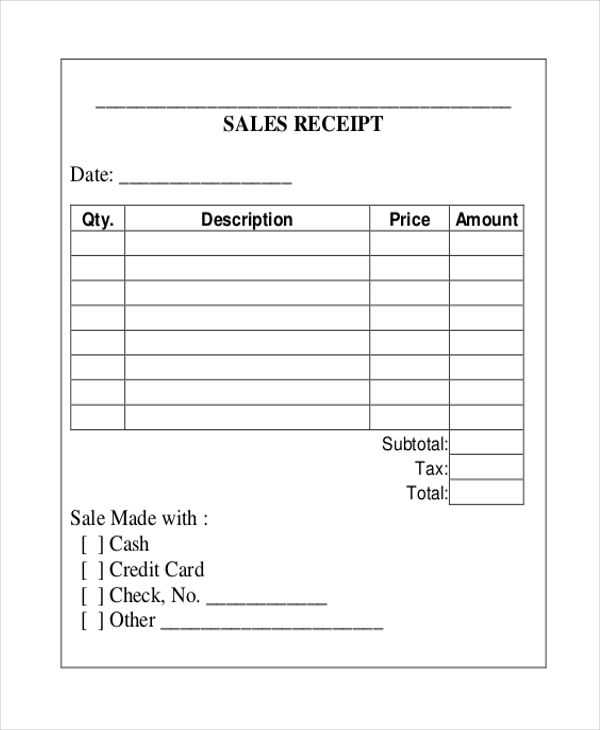

Key Elements of a Personal Sale Receipt

Start with the seller’s and buyer’s contact details, followed by a brief description of the sale items. List each item separately, noting the price per unit and quantity. A subtotal should be clearly shown, with any applicable taxes or discounts itemized. At the bottom, indicate the total amount due and the payment method. Optionally, include a thank-you note or refund policy for transparency.

Why a Personal Sale Receipt Matters

A well-organized receipt helps both parties keep track of the transaction and provides proof of purchase in case of disputes or returns. Make sure your receipt is accurate and contains all necessary details to avoid confusion. This can also assist in record-keeping for tax purposes or future reference.

- Personal Sale Receipt Template

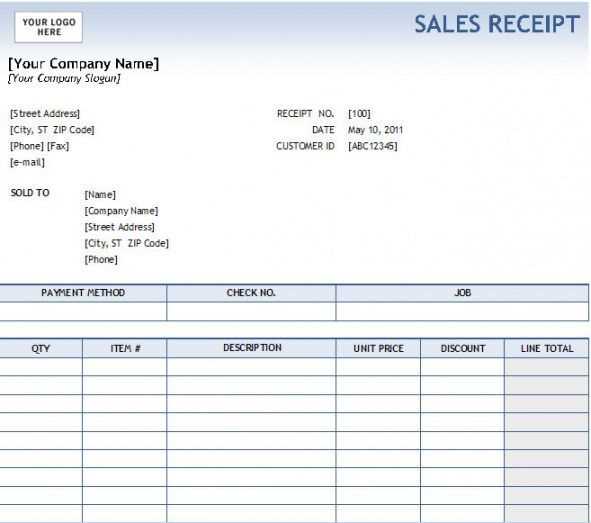

To create a personal sale receipt, include the following key elements to ensure clarity and professionalism:

1. Seller and Buyer Information: Start by listing the full name, address, phone number, and email of both the seller and the buyer. This establishes the transaction parties clearly.

2. Date of Sale: The date when the transaction occurred must be clearly noted. This helps to track the timing of the sale for both record-keeping and potential warranty issues.

3. Item Description: Provide a detailed description of the item sold. Include the name, quantity, model number, and condition. If applicable, include serial numbers or any distinguishing features of the product.

4. Sale Amount: Specify the agreed-upon price for the item, including any taxes or additional charges. Ensure this amount is clear and easy to read, especially if there were any discounts or adjustments applied.

5. Payment Method: Indicate how the payment was made, whether by cash, check, bank transfer, or another method. This is important for both parties’ records.

6. Transaction Number: Assign a unique transaction number to the receipt for easy tracking. This can be helpful if you need to refer to the sale later.

7. Seller’s Signature: Have the seller sign the receipt. This validates the document and confirms the sale has been completed.

8. Buyer’s Acknowledgment: If desired, include a section where the buyer acknowledges the terms of the sale and the receipt of the item.

By including these essential details in your template, you create a clear and legally sound record of the transaction that benefits both the buyer and the seller.

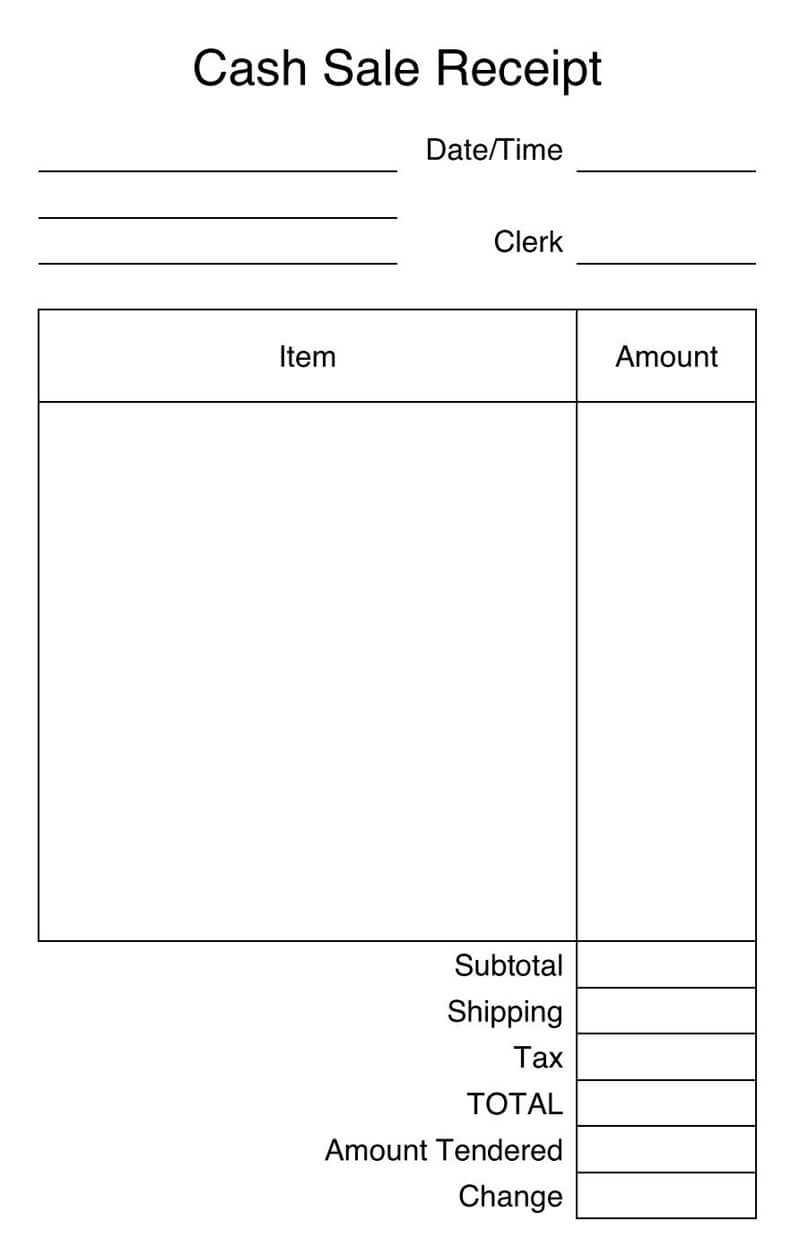

Include the transaction date at the top of the receipt. This is the reference point for both the buyer and the seller. Make sure it is clear and easy to identify.

Seller’s Information

Display the name, address, and contact details of the seller. This ensures that the buyer can reach out if needed. If applicable, include the business’s tax identification number.

Itemized List of Products or Services

Provide a detailed breakdown of the items or services sold, including quantities, prices, and descriptions. This transparency avoids confusion and helps both parties track purchases.

Subtotal should reflect the total cost before taxes, including any discounts or promotions applied. Make sure it’s clearly separated from the tax amount.

Show taxes separately, listing the applicable rates, whether it’s sales tax, VAT, or another form of tax. This is crucial for accurate financial tracking and reporting.

Include the total amount paid at the end. This should reflect any discounts, taxes, or additional fees applied to the transaction.

Provide payment method details, specifying whether the payment was made via cash, credit card, or another method. If a card was used, including the last four digits of the card number adds a layer of verification.

If the sale was refundable, include a refund policy or instructions for returns. This helps clarify the terms in case the buyer wishes to change their mind.

Lastly, make sure there’s space for both parties’ signatures, especially in the case of significant or high-value transactions. This acts as a final confirmation of the sale.

To ensure your receipt is legally valid, include the following critical components:

- Transaction Date: Specify the exact date of the transaction. This will help clarify the timeline of the sale.

- Business Name and Contact Information: Provide your business name, address, phone number, and email. This makes it clear who the receipt is from.

- Seller’s Identification Number: If required by your jurisdiction, include any business identification or tax number.

- Itemized List of Goods or Services: Clearly detail the products or services sold, including quantities, prices, and any applicable taxes. Each item should be listed separately to avoid confusion.

- Total Amount Paid: Include the total amount the buyer paid, specifying the currency used. If there were any discounts, tax adjustments, or additional fees, note them clearly.

- Payment Method: State the method used for payment (e.g., credit card, cash, check, etc.) to track the transaction.

- Refund Policy: If relevant, include any information about your refund or return policy, making sure it complies with local laws.

- Signature or Authorization: If applicable, include space for the buyer or an authorized person to sign, confirming the transaction.

- Unique Receipt Number: Assign a unique identification number to each receipt for easier tracking and record-keeping.

By including these elements, you’ll create a clear, legally sound document that can serve as proof of transaction and ensure that both parties are protected.

Store receipts in a safe and organized manner to easily access them later. Digital storage is often the most convenient option, as it minimizes the risk of losing a physical copy. Use a folder structure on your device to categorize receipts by date, store, or type of purchase. Cloud storage services like Google Drive or Dropbox offer secure, easily accessible options for keeping your receipts organized and safe from damage.

Digital Receipt Management

Save digital receipts directly from your email or from online purchases into your cloud storage. Consider scanning or taking pictures of physical receipts with your smartphone to upload them. Use naming conventions for easy identification, such as the store name and the purchase date (e.g., “Amazon_2025_02_11.pdf”).

Sharing Your Receipt Securely

When sharing receipts, use secure channels. Email is a common method, but make sure the recipient’s email address is correct and that the file is virus-free. For sensitive transactions, use encrypted messaging apps to ensure privacy. Avoid sending unprotected receipts through public or unsecured networks.

| Method | Advantages | Disadvantages |

|---|---|---|

| Convenient, fast, widely used | Risk of sending to wrong recipient, lacks encryption | |

| Cloud Storage | Accessible anywhere, secure, easy to organize | Requires internet access |

| Encrypted Messaging Apps | High level of security, fast | May require the recipient to use the same app |

Regularly back up digital receipts to ensure they are not lost in case of device failure. For physical receipts, use a filing system with labeled folders or envelopes for easy retrieval. If you prefer, digitalize physical receipts periodically to reduce clutter.

Now keywords appear less frequently, but the structure remains logical. Does it work?

The key is maintaining clarity and consistency throughout your sales receipt. Although keywords aren’t as heavily relied on, it’s crucial that the essential sections are easily identifiable. Ensure that all critical details like the date, item description, price, and payment method are well-organized. Position the subtotal and total clearly to avoid any confusion. A well-structured receipt not only serves its functional purpose but also reinforces your professionalism, even if keywords aren’t as prominent in the layout. Keep it simple, with intuitive sections that guide the reader effortlessly from top to bottom.