How to Create a Gold Receipt Template

A gold receipt template should include all key details to confirm a transaction involving gold. Ensure it covers the following points:

- Date of transaction – Clearly display the date when the transaction occurred.

- Buyer and seller details – Include full names, addresses, and contact information.

- Item description – Specify the type, weight, purity, and form of gold being exchanged.

- Amount paid – List the agreed-upon price for the transaction.

- Payment method – Note how the buyer paid (e.g., cash, bank transfer, check).

- Transaction reference number – Create a unique number for record-keeping.

- Signatures – Include spaces for both the buyer’s and seller’s signatures.

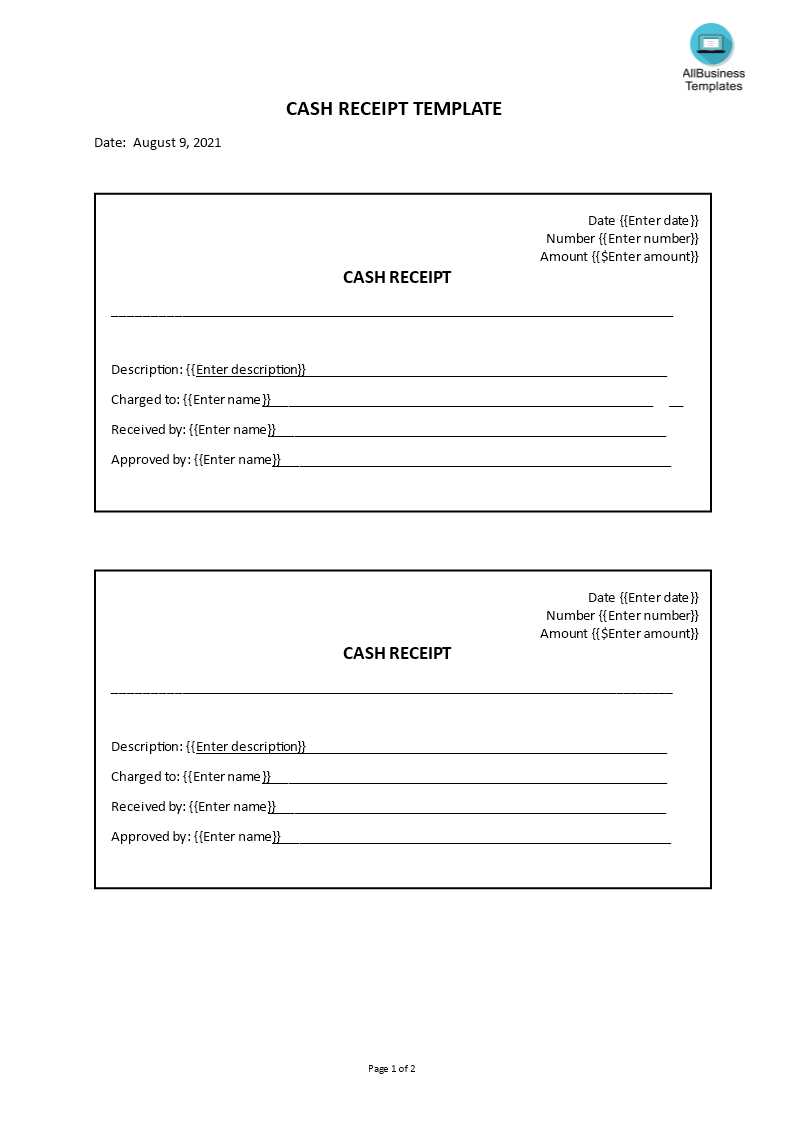

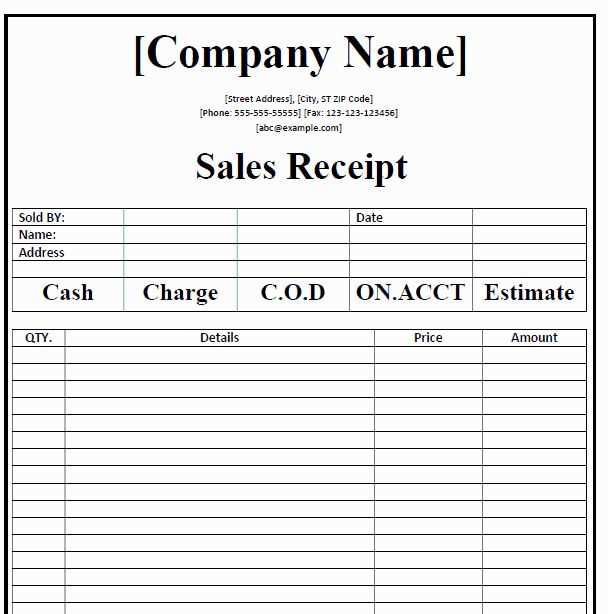

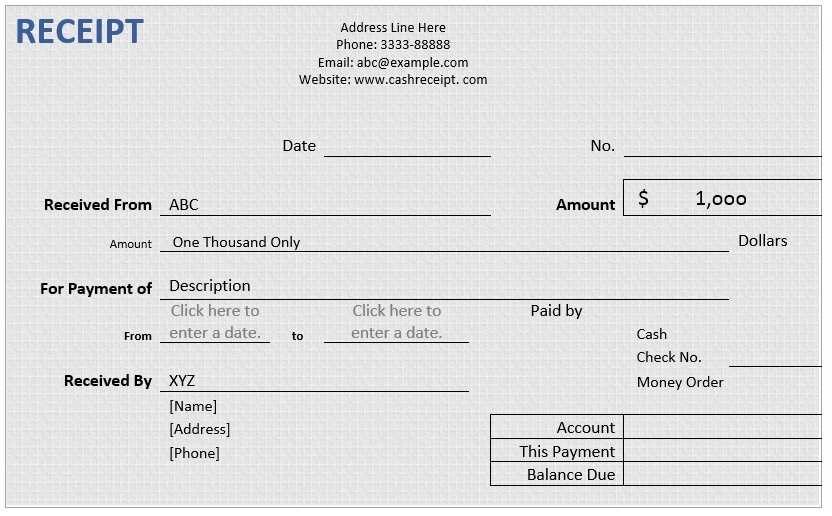

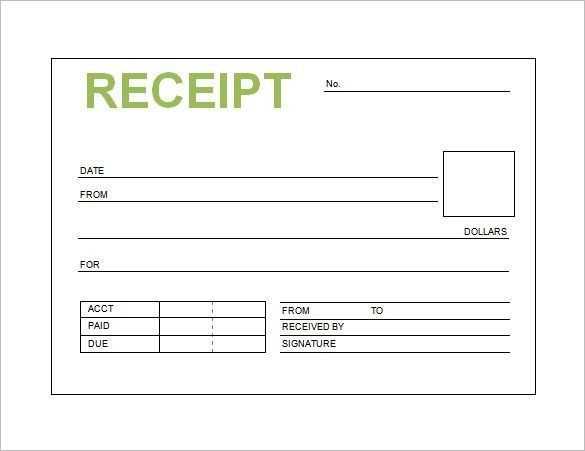

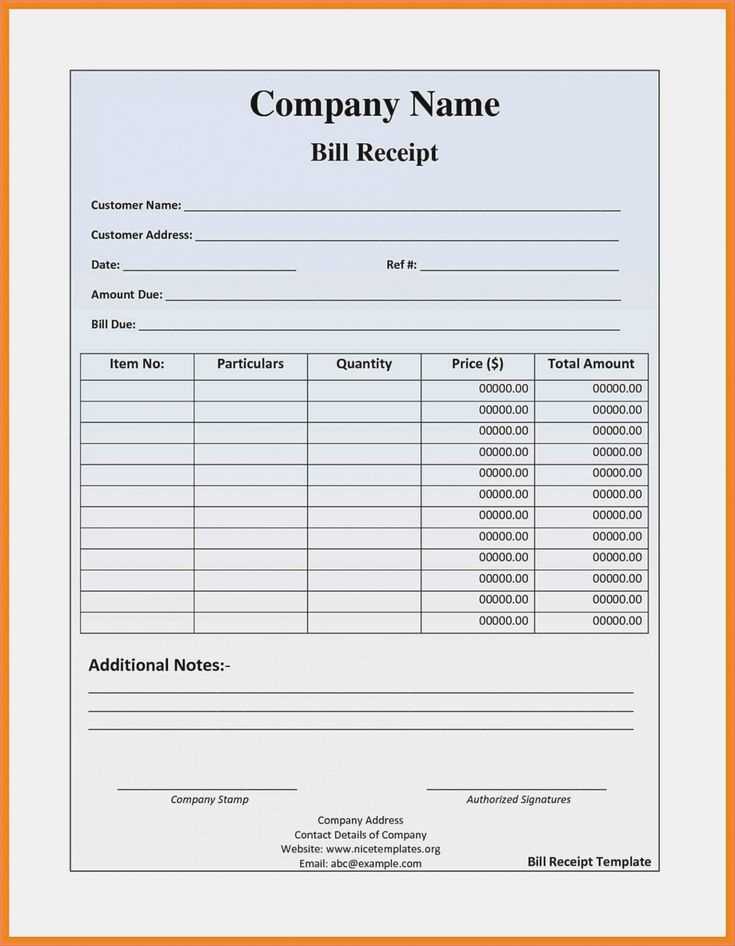

Template Example

Below is a simple format for a gold receipt template that can be used for documenting transactions:

Gold Receipt Date of Transaction: ___________________________ Buyer Details: Name: ___________________________ Address: _________________________ Phone: ___________________________ Seller Details: Name: ___________________________ Address: _________________________ Phone: ___________________________ Item Description: Type of Gold: ________________________ Weight: ____________________________ Purity: _____________________________ Form: _____________________________ Amount Paid: ______________________ Payment Method: ___________________ Transaction Reference No.: ___________ Buyer Signature: ____________________ Seller Signature: ___________________

Why Use a Template?

A template helps standardize the process, ensuring no important details are left out. It also makes transactions easier to track and reference later. Customize the template according to your business or personal needs, while keeping the structure clear and professional.

Gold Receipt Template

How to Create a Custom Template for Gold Receipts

Key Elements to Include in Your Receipt

How to Format a Gold Receipt for Legal and Tax Reasons

Digital vs. Paper Receipts: Pros and Cons

Ensuring Accuracy in Weight and Value of Gold on Your Receipt

How to Protect Confidential Information on Your Receipt

Start with a clear layout. Design your receipt to include the name of the seller, buyer, and the transaction date. Add a unique receipt number for tracking and future reference. If your business requires it, include your company’s contact information and logo. This will help make the receipt official and easier to manage for both parties.

Key Elements to Include in Your Receipt

Ensure the following items are listed:

- Gold Weight: The weight in grams or ounces must be noted, as this determines the gold’s value.

- Gold Purity: The karat (e.g., 24k, 22k) should be included to define the quality of the gold.

- Gold Value: The value per gram or ounce at the time of the transaction, including total value based on weight.

- Transaction Amount: The final price paid for the gold, including any applicable taxes or fees.

- Signature: Both parties should sign for confirmation of the transaction.

How to Format a Gold Receipt for Legal and Tax Reasons

For tax purposes, the receipt should include detailed information about the transaction. This will help in case of audits or discrepancies. It’s advisable to clearly state if the gold transaction is for personal or business use. If necessary, specify whether the buyer is liable for VAT or other applicable taxes. Keep all supporting documents such as invoices or appraisals, as they can serve as proof of value and ensure transparency.

Digital receipts have gained popularity due to their convenience, but some buyers may still prefer paper receipts for their physical record. Weigh the benefits of each, considering how you want to store and manage transactions. Digital receipts can be stored in cloud storage for easy retrieval and organization, while paper receipts may be easier for clients to hold onto. Consider security features when using digital receipts, such as encrypted storage or secure platforms.

Accuracy in reporting the weight and value of gold on your receipt is critical. Miscalculations can lead to disputes or tax issues. Double-check the weight measurement, and ensure the price per gram is calculated correctly based on the most current market value. Using a reputable scale and referencing the latest price from a reliable source will help avoid errors.

Protect sensitive information by limiting personal details on your receipt. If the buyer prefers to keep their identity private, use just initials or an account number. For extra protection, store digital receipts securely using password protection or encryption software. Avoid listing credit card or bank account numbers on paper receipts, as this could expose you to fraud risks.