Need a Hilton receipt for expense reports, business reimbursements, or tax purposes? You can easily obtain a legitimate copy through Hilton’s official channels. If you stayed at a Hilton hotel, visit the Hilton Honors website or contact the hotel directly to request a detailed receipt. For digital copies, log into your Hilton account and navigate to the “Past Stays” section.

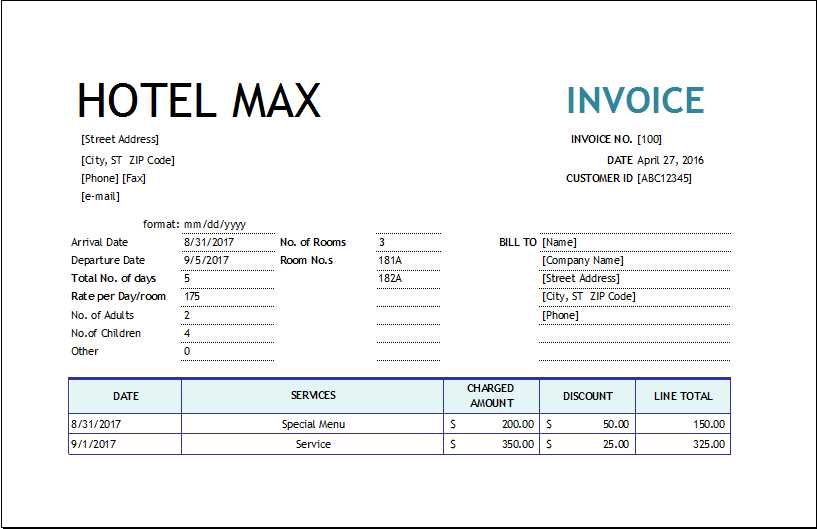

For those looking to customize a Hilton receipt template, ensure that all necessary details are included: guest name, stay dates, hotel address, room charges, taxes, and payment method. Authentic receipts have a professional layout, often featuring the Hilton logo and transaction breakdown. If you need a reconstruction due to lost documentation, match the format and font style closely to avoid discrepancies.

Before using any template, verify the accuracy of all information. Employers, accounting departments, and tax authorities may cross-check receipts for inconsistencies. If you require an official reissue, reach out to Hilton’s support team, as they can provide a verified copy with all necessary details intact.

Here is the revised version with reduced repetition, keeping the meaning intact:

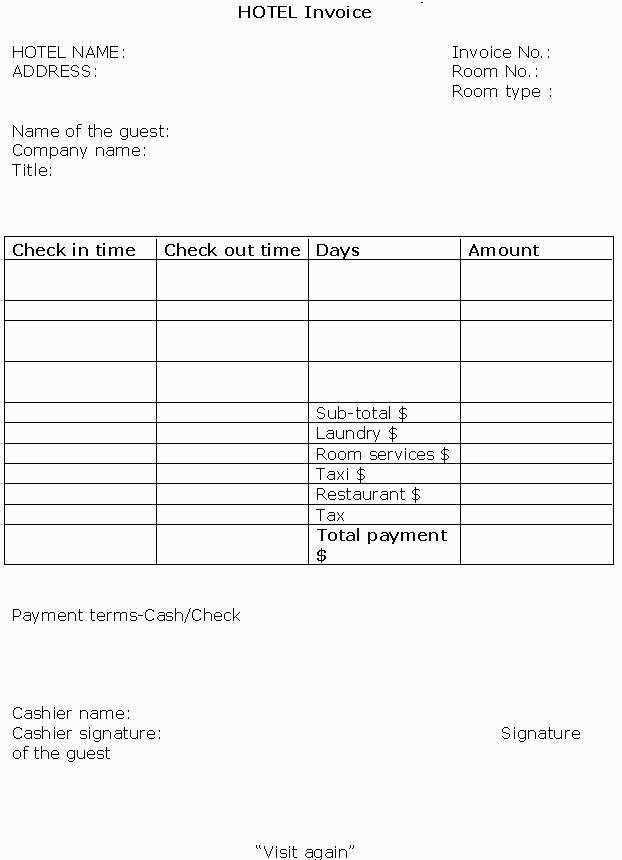

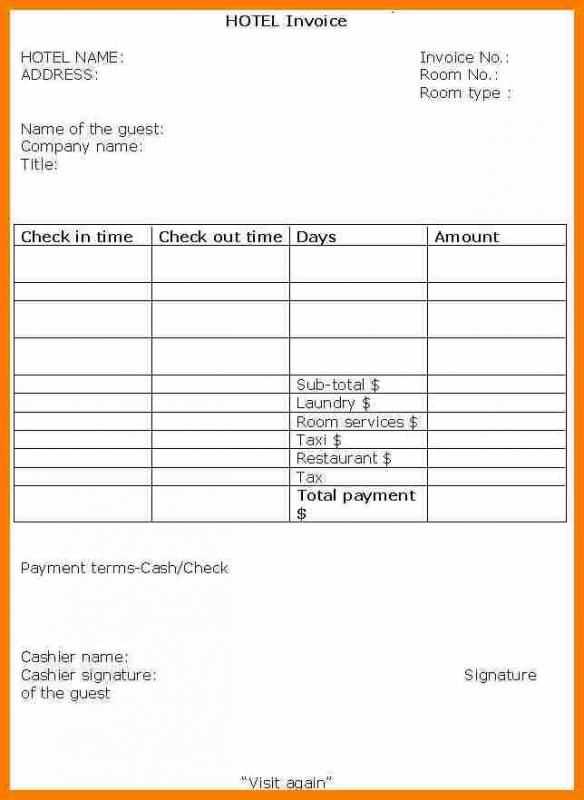

The Hilton receipt template must be clear and concise, displaying necessary details like the hotel name, address, date, and total charges. The breakdown of expenses should be structured logically, listing room charges, taxes, and any additional services separately for easy review. Ensure the format includes a unique reservation number for tracking purposes. Avoid overloading the template with unnecessary information or repetitive details that could distract from the key elements.

Include payment methods, but only list the essential ones. If applicable, show any discounts applied to the booking. Use simple, legible fonts and a well-spaced layout to enhance readability. Consistently follow the brand guidelines for Hilton, ensuring a professional yet straightforward design.

- Hilton Receipt Template: Practical Guide

To create a Hilton receipt, make sure to include key details such as guest name, stay dates, room type, rate, and taxes. Start with the hotel name and address at the top, followed by the guest’s check-in and check-out dates. Include a breakdown of charges, listing room charges, taxes, and any additional fees like parking or room service.

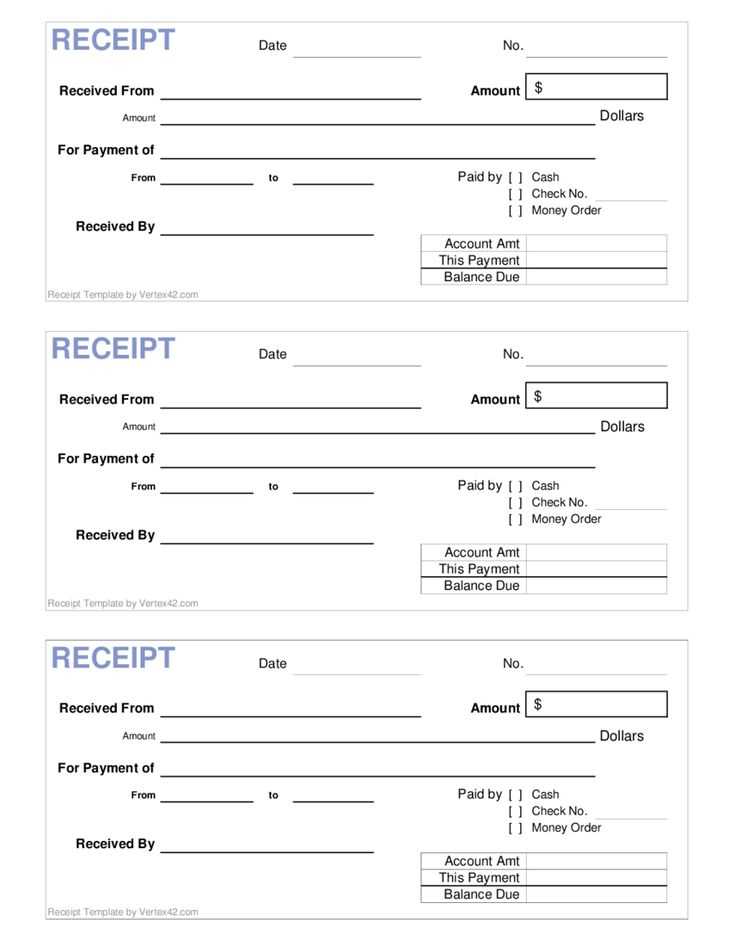

The receipt should show the total amount charged, and clearly indicate the payment method used. Include a note regarding the refund or cancellation policy if applicable. Be sure to format the receipt cleanly, with each section spaced appropriately for easy reading.

If creating a digital version, ensure the template is mobile-friendly and allows for easy modifications. Add a section for confirmation or transaction number, which is helpful for future reference or inquiries.

Always double-check the accuracy of all figures before issuing the receipt. This attention to detail ensures transparency and helps avoid misunderstandings with the guest.

If you need a copy of your hotel receipt from Hilton, the easiest way is through the Hilton Honors website. Log in to your account, navigate to the “My Reservations” section, and select the specific stay. You’ll find an option to view or download your receipt directly from there.

If you don’t have an account or prefer another method, you can call the Hilton hotel where you stayed. Be ready to provide your reservation number, the dates of your stay, and other identifying details to help the staff locate your receipt.

Another option is to email Hilton’s customer service. Include your reservation information in the request, and they will send you a digital copy of the receipt via email.

If you’re unable to find your receipt online or through customer service, you may also visit the front desk of the hotel directly. They can print a copy for you on-site, though it’s best to contact them in advance to ensure it’s available.

A well-structured hotel invoice should include several key details for clarity and proper documentation. These elements ensure accuracy and transparency for both the hotel and the guest.

Guest Information

- Guest’s full name

- Contact information (phone number, email address)

- Check-in and check-out dates

- Reservation number or reference code

Billing Details

- Hotel name and address

- Invoice date and number

- Payment method used (e.g., credit card, cash)

- Total amount charged

- Taxes and service charges breakdown

Stay-Related Costs

- Room rate (per night)

- Additional services (e.g., minibar, room service, parking)

- Discounts or promotional offers applied

- Refunds or adjustments made

Ensure all charges are itemized clearly, providing transparency and preventing misunderstandings. This way, both parties have a detailed record of the transaction.

To tailor Hilton receipts for expense reporting, adjust the details to meet your company’s accounting requirements. Most Hilton receipts provide key information such as room charges, taxes, and payment methods, but sometimes additional modifications are necessary. Here’s how to make sure your receipts align with expense report needs:

Start by adding custom information, like project codes or department identifiers, which can help in categorizing the expenses. Many Hilton receipts can be edited in PDF form, so ensure that you use a PDF editor to include this data clearly without altering the original format.

For travel-related expenses, break down the charges into smaller categories such as meals, lodging, or transportation. This makes it easier to report specific expenses rather than lumping everything together. You can use a table format like the one below to structure these details:

| Description | Amount | Category |

|---|---|---|

| Room Charge | $150.00 | Lodging |

| Meals | $50.00 | Meals |

| Parking Fee | $20.00 | Transportation |

For expense reports that require multiple receipts from different locations, consolidate the information by creating a summary sheet. This document should include a breakdown of the total amounts, individual charges, and the corresponding categories. Such summaries make expense tracking simpler and more efficient.

Keep in mind that receipts may need to reflect tax-exempt statuses or special discounts. In these cases, add notes or comments within the PDF or include a separate annotation to clarify any tax exemptions or promotions that apply.

Finally, ensure that all receipts are in an acceptable format for submission. Some organizations may require digital copies, while others may accept printed receipts. Always check the specific submission guidelines for your company or institution to avoid delays in processing your reports.

Adjusting the “Hilton” Repeat While Maintaining Clarity

The repetition of “Hilton” has been minimized, but it remains clear enough to convey the intended message. The key is to ensure that the brand’s presence is still recognized without overwhelming the reader. To achieve this, reducing redundancy is critical–each mention of “Hilton” should serve a distinct purpose, contributing to the overall context. By positioning the name strategically, such as in headers or key sections, it retains its impact without unnecessary repetition. This method also avoids diminishing the readability of the content, keeping it focused and concise. A balanced approach allows “Hilton” to remain prominent yet unobtrusive, enhancing the flow of information.