Creating a Clear and Organized Template

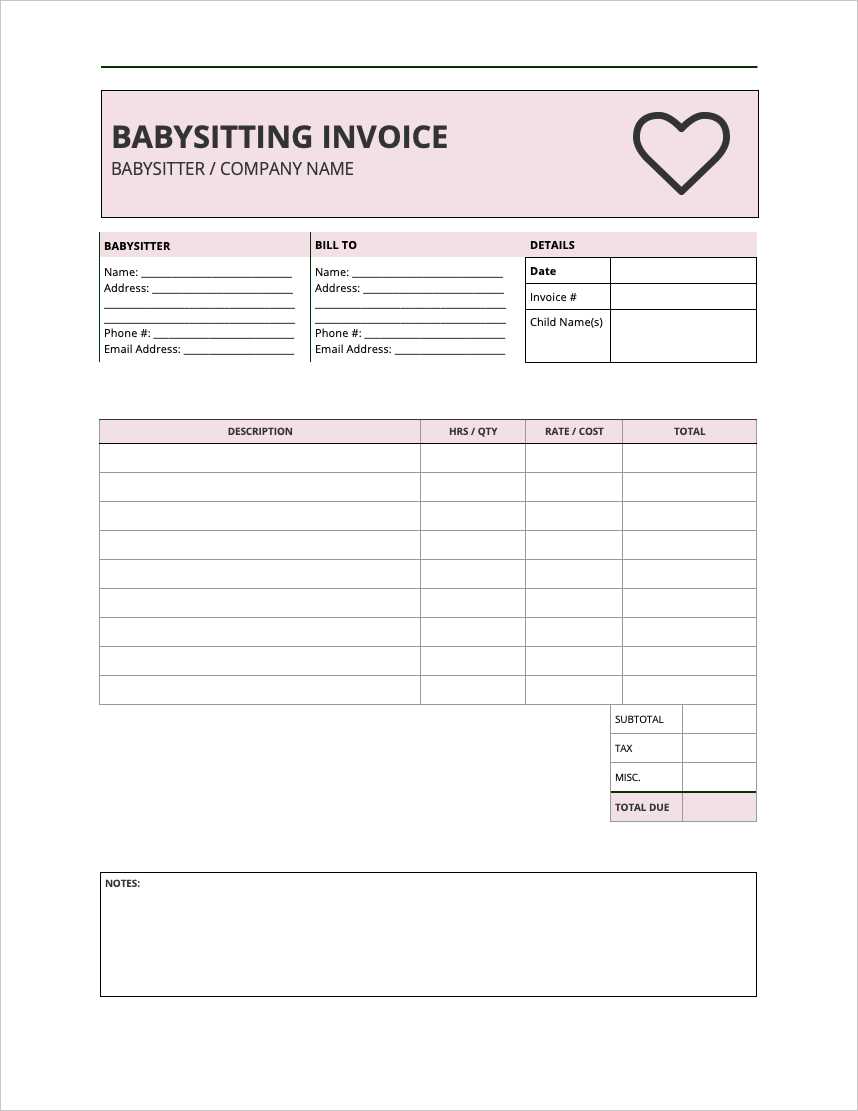

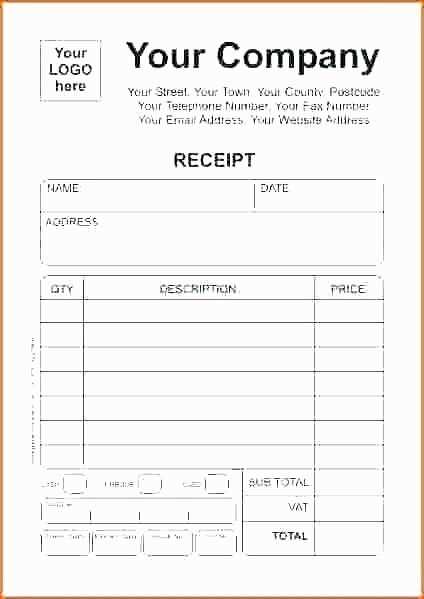

For tracking child care expenses, a well-structured receipt template is a practical tool. Use a simple layout to ensure key details are easy to capture and read. Include the following sections:

- Provider’s Name and Contact Information – Include the child care provider’s full name, address, and phone number.

- Recipient’s Information – Add the parent’s name and contact details.

- Date of Service – Record the exact date(s) child care was provided.

- Amount Paid – Clearly state the amount paid for the service.

- Payment Method – Specify whether the payment was made by cash, check, or another method.

- Description of Services – Detail the type of care provided, such as hours of care or activities involved.

- Provider’s Signature – Have the provider sign the receipt to validate it.

Why Use This Template?

Using a template simplifies the record-keeping process for child care expenses. It ensures that all necessary information is captured in a consistent and professional manner. This helps with financial management and provides clear documentation for tax purposes. You can easily adjust the template based on specific needs and requirements.

Template Example

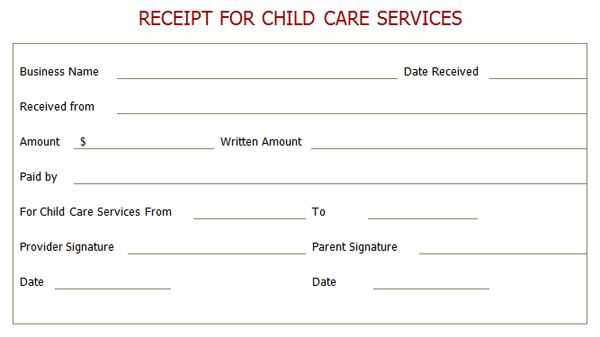

Here’s a basic layout for your receipt:

Child Care Receipt Provider Name: ________________________________ Provider Address: _______________________________ Phone Number: _________________________________ Parent Name: _________________________________ Parent Address: _______________________________ Phone Number: _________________________________ Date of Service: _______________________________ Amount Paid: _________________________________ Payment Method: _______________________________ Description of Services: _________________________ Provider Signature: ____________________________

Modify the sections as needed to match your specific situation. A neat and concise receipt will help keep your records clear and accurate.

Child Care Receipts Template

To create a simple receipt template for child care, start by including the essential details: provider’s name, contact information, date of service, child’s name, hours worked, and the total amount paid. These elements ensure clarity and compliance with most tax requirements.

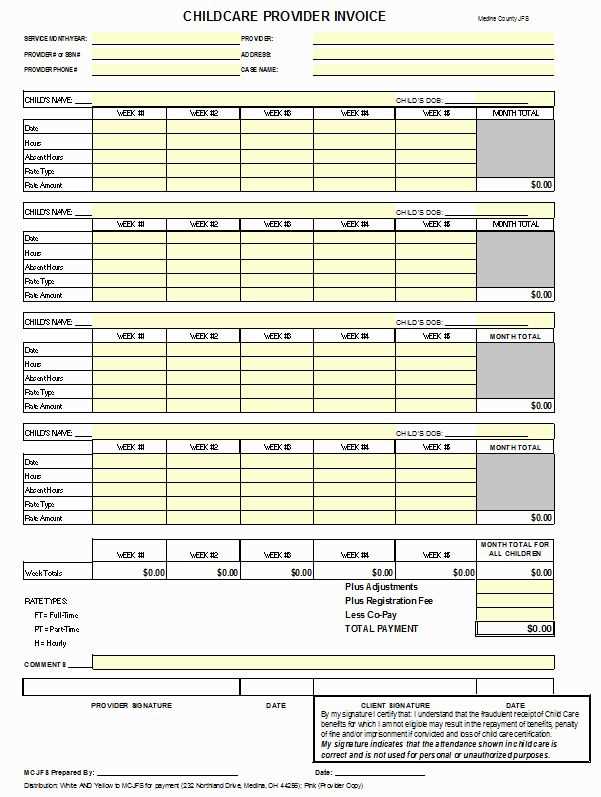

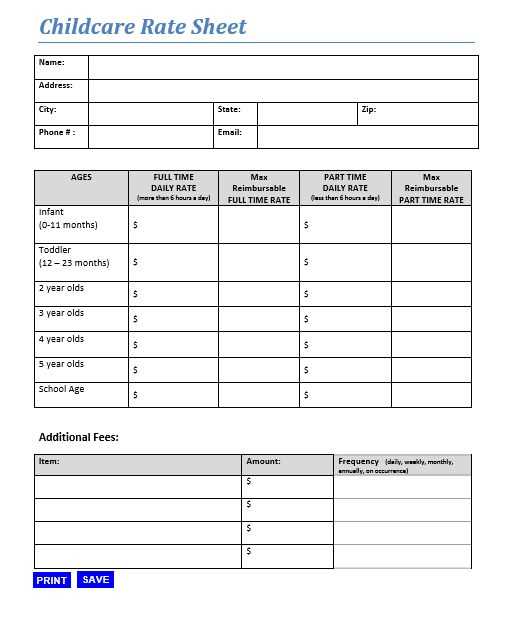

Customizing Your Template for Various Child Care Services

Adjust your template based on the type of child care provided. If you’re offering after-school care, note the pickup and drop-off times. For full-time daycare, add the days of the week and specific hours worked. This customization ensures the receipt meets the needs of different child care situations while maintaining consistency.

Using Receipts for Child Care in Tax Deductions and Record-Keeping

Keep your receipts organized to track child care expenses for tax deductions. Taxpayers can often claim child care costs, so having accurate and detailed receipts is crucial. Store all receipts in a folder or digital file for easy access during tax season, and ensure they include the provider’s information for verification purposes.