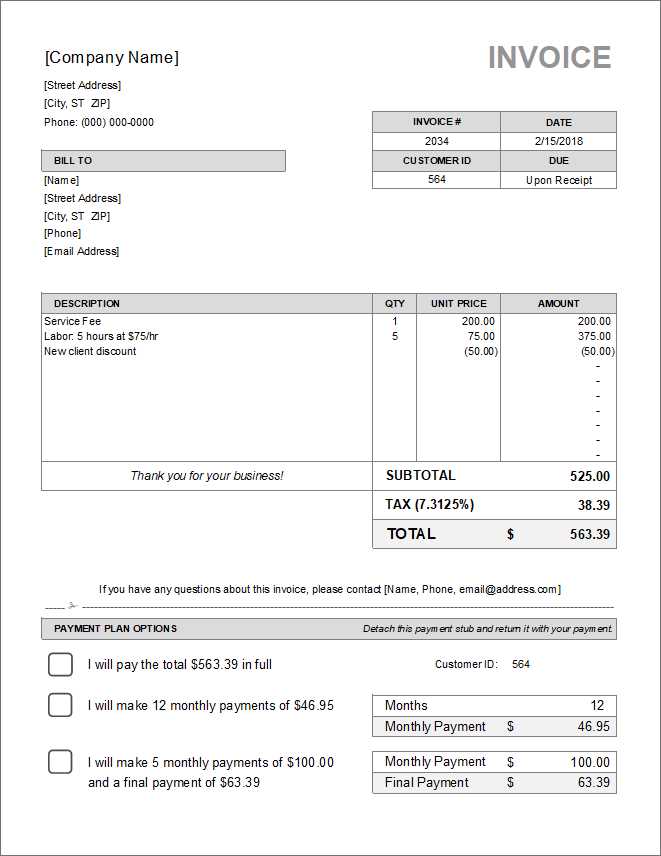

Send invoices with a clear due date to avoid payment delays. A template marked “Due Upon Receipt” sets immediate expectations, reducing the risk of late payments and cash flow issues. Clients understand they must process the invoice right away.

Include key details for clarity. Specify the issue date, payment instructions, and accepted methods. If applicable, mention late fees or discounts for early payments. A well-structured format minimizes confusion and speeds up processing.

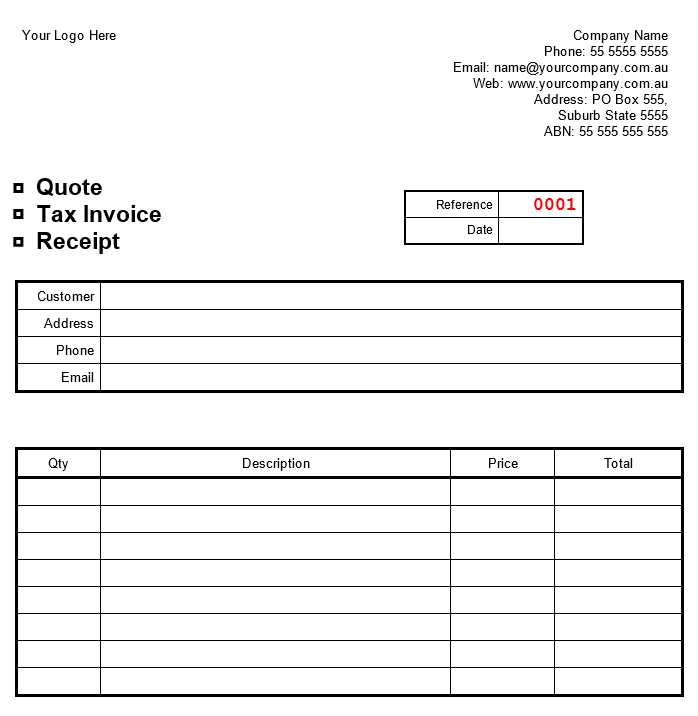

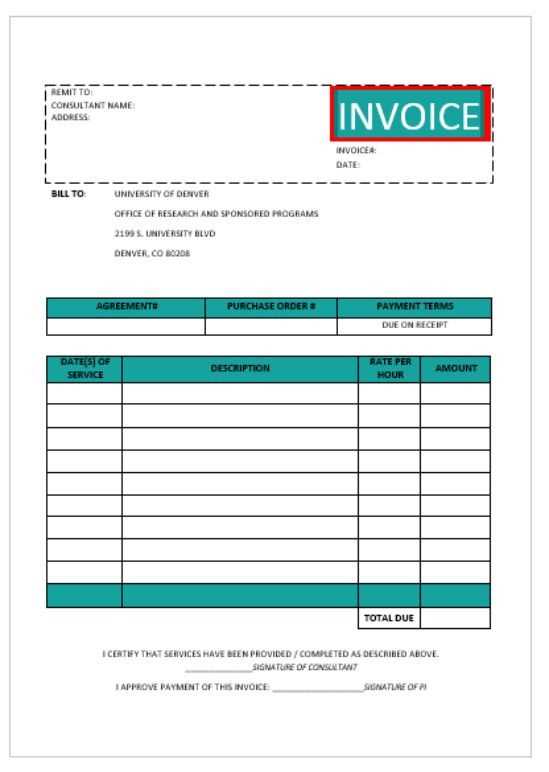

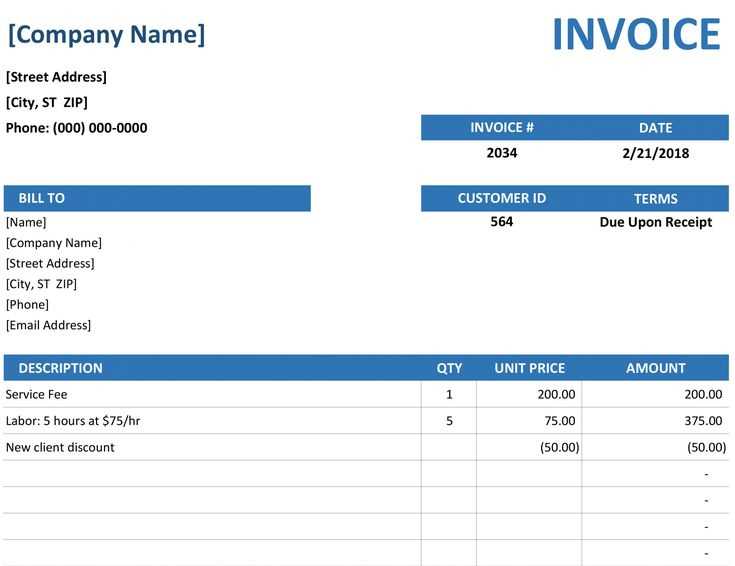

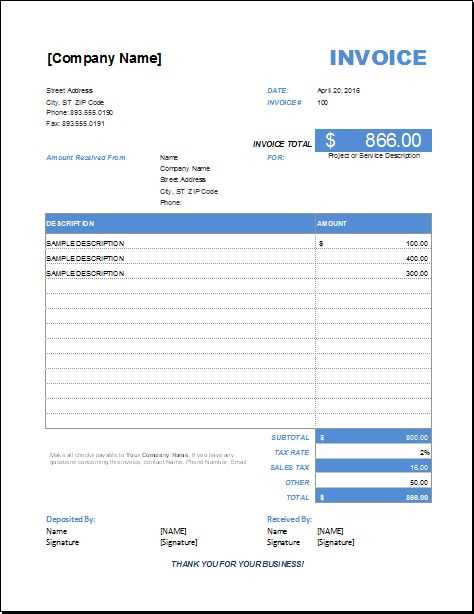

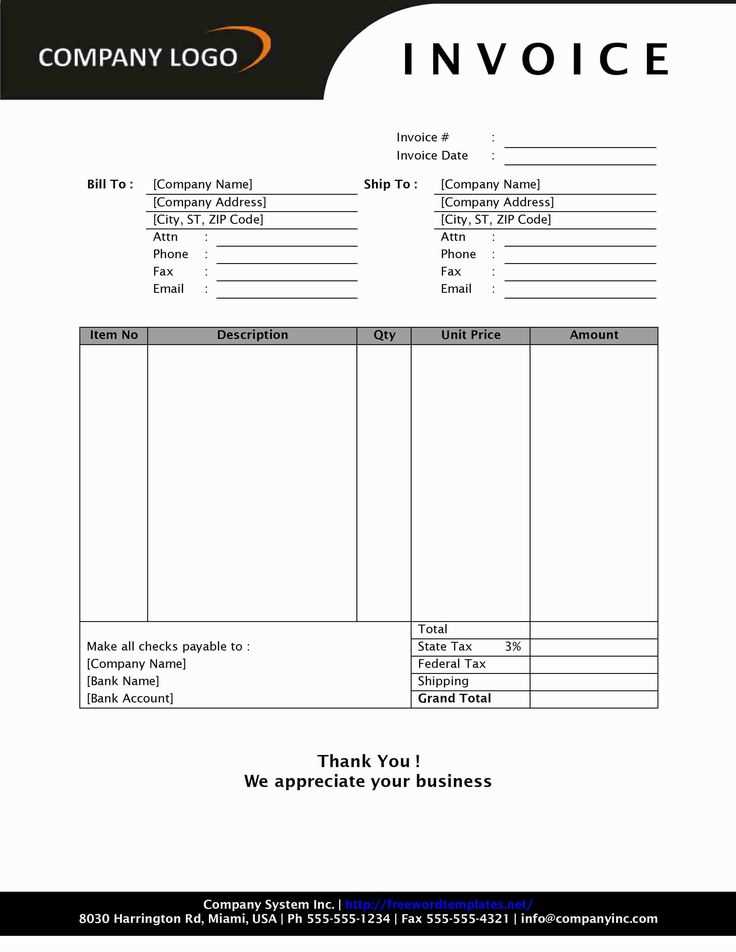

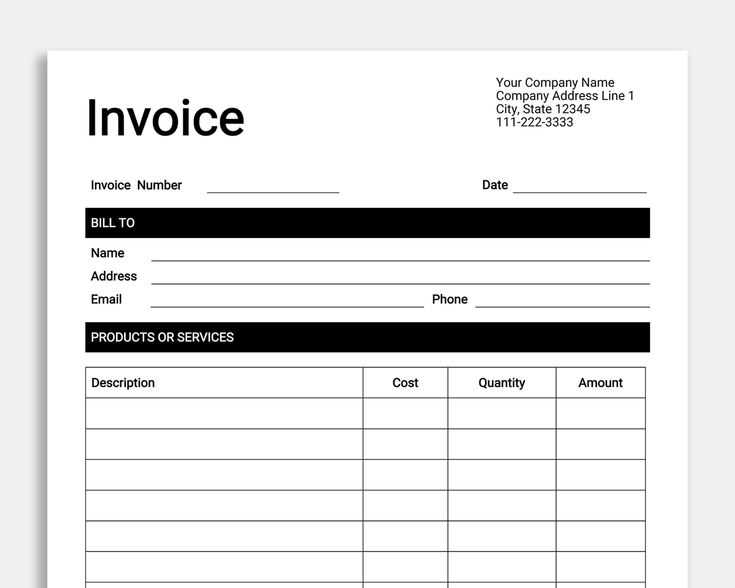

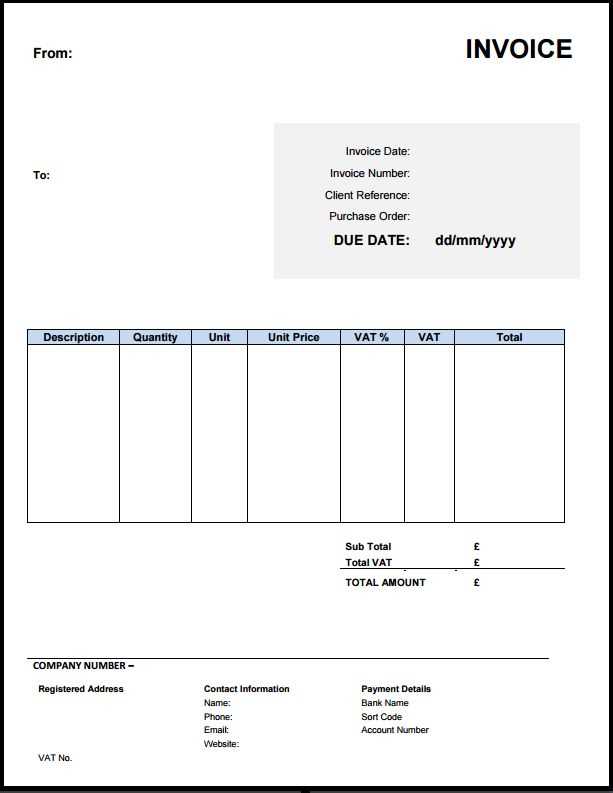

Choose a professional layout that highlights the most important information. Use bold headers, organized sections, and consistent formatting. Digital templates with automated calculations can further streamline the process.

Send invoices electronically to ensure faster delivery and tracking. Emailing a PDF or using invoicing software allows clients to access and process payments immediately. If needed, follow up with a reminder to confirm receipt and avoid unnecessary delays.

Invoice Template Due Upon Receipt

Use a clear, structured format to ensure immediate payment. Highlight the due date prominently and include precise terms to avoid confusion. Specify acceptable payment methods and provide direct links for online transactions.

| Invoice Number | Date | Due Date | Amount |

|---|---|---|---|

| #12345 | 02/11/2025 | Due Upon Receipt | $500.00 |

Attach a breakdown of charges to prevent disputes. Use itemized rows with descriptions, quantities, and unit prices. A late fee clause can deter delays. For recurring clients, consider automated reminders to reinforce prompt payments.

Key Elements to Include in the Template

Clearly display the business name and contact details at the top. This includes the company’s address, phone number, and email to ensure easy communication.

Specify the recipient’s information, including their name, company (if applicable), and address. Double-check these details to prevent processing delays.

Use a unique invoice number for tracking. A structured numbering system simplifies record-keeping and prevents duplicates.

State the invoice date and payment terms explicitly. “Due upon receipt” should be clearly mentioned to set immediate payment expectations.

List each item or service with a concise description, quantity, rate, and total cost. Clarity here reduces disputes and speeds up approval.

Show the subtotal, applicable taxes, and the final amount due in a distinct section. Highlighting the total ensures there’s no confusion.

Provide accepted payment methods and relevant details, such as bank account numbers or online payment links, to streamline transactions.

Include a short note expressing appreciation for the business relationship. A courteous closing reinforces professionalism and encourages prompt payment.

How to Format Payment Terms for Clarity

Use precise deadlines. Instead of vague phrases like “due soon,” specify exact terms, such as “Payment due upon receipt” or “Net 15.” Clear deadlines prevent misunderstandings and help ensure timely payments.

Highlight Late Fees

State penalties directly: “Invoices unpaid after 30 days incur a 5% late fee.” This encourages prompt payment and sets clear expectations.

Specify Payment Methods

List accepted options, such as bank transfers, credit cards, or digital payments. If certain methods are preferred, emphasize them: “ACH transfers are fee-free and processed within one business day.”

Keep it concise. Payment terms should be easy to understand at a glance. Use bullet points or bold text to highlight key details, making the invoice user-friendly.

Common Mistakes to Avoid in Immediate Payment Invoices

Send invoices with clear and direct payment terms to prevent confusion. Ambiguous wording or missing instructions can delay payments.

- Failing to Specify “Due Upon Receipt”

Without a clear payment deadline, clients may assume they have more time to pay. Ensure “Due Upon Receipt” is prominently displayed near the total amount.

- Omitting Late Payment Consequences

State potential fees or penalties for overdue payments. This discourages delays and reinforces urgency.

- Providing Incomplete Payment Details

Include all necessary payment methods, account numbers, and instructions. Missing information forces clients to follow up, slowing the process.

- Sending Invoices to the Wrong Contact

Verify that invoices are sent to the correct department or individual responsible for payments. Incorrect recipients cause unnecessary back-and-forth communication.

- Using Unreadable Formats

Ensure invoices are sent in a widely accepted format like PDF. Some accounting systems reject obscure file types, leading to processing delays.

- Not Following Up

If payment isn’t received within a reasonable timeframe, send a reminder. Many delays occur simply because the invoice was overlooked.