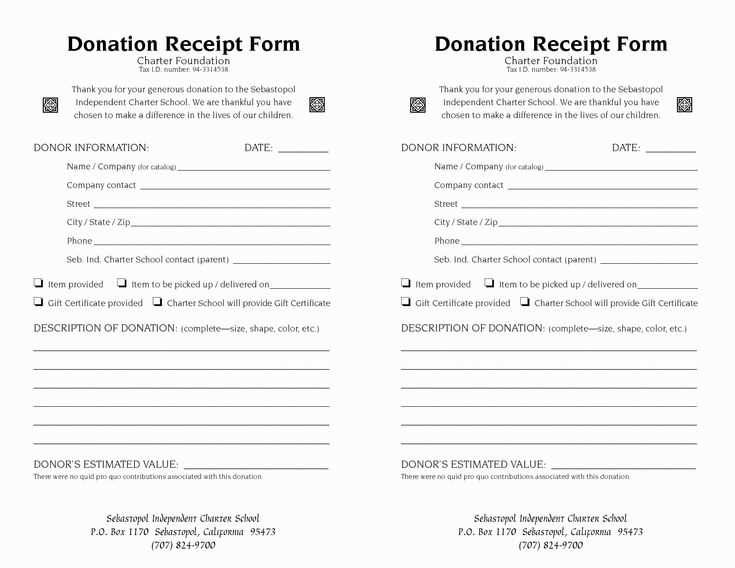

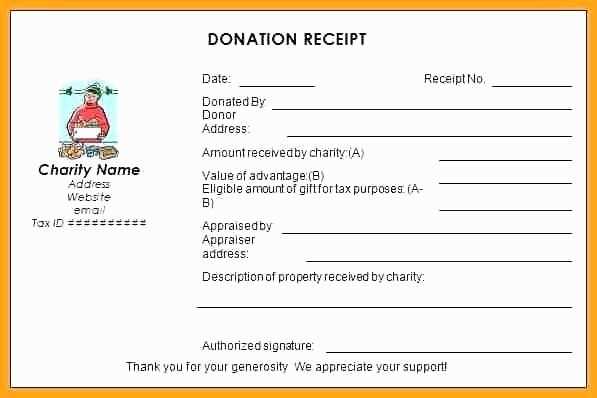

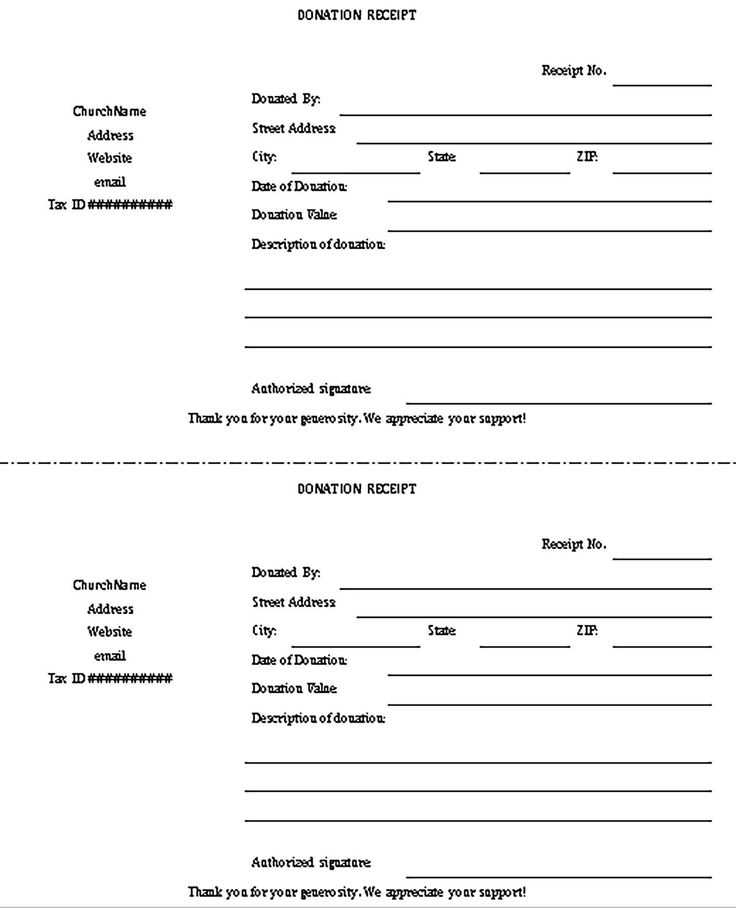

A well-structured donation receipt template ensures compliance with tax regulations while streamlining your organization’s record-keeping process. Start by including the donor’s full name and contact information at the top of the receipt. This not only personalizes the document but also helps both parties maintain accurate records.

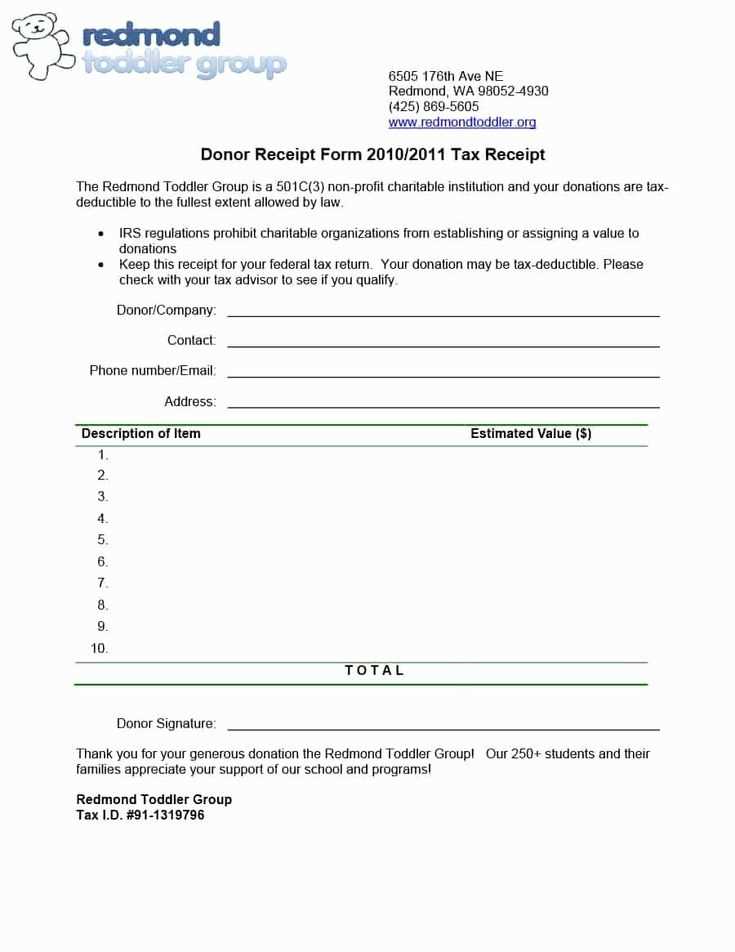

Next, detail the items donated, specifying descriptions, quantities, and condition. Avoid assigning a monetary value unless required by law; instead, emphasize that the donor is responsible for estimating the fair market value of their contributions. For example, “10 gently used hardcover books” provides clarity without overstepping legal boundaries.

Include your organization’s full name, address, and tax identification number to confirm its non-profit status. This step is critical for ensuring that donors can claim tax deductions for their contributions. Additionally, specify whether or not the donor received any goods or services in exchange for their donation, as this impacts the receipt’s validity for tax purposes.

Finally, close with a thank-you message expressing appreciation for the donor’s generosity. Keep the tone sincere and concise, reinforcing the impact of their support on your organization’s mission. A thoughtful receipt fosters stronger connections and encourages future contributions.

Here’s how to rephrase sentences while avoiding word repetition and preserving their meaning:

Focus on synonyms and alternative expressions to maintain clarity and variety in your writing. Below is a simple guide to help rephrase effectively:

| Original Sentence | Rephrased Sentence |

|---|---|

| We appreciate your generous contribution to our nonprofit organization. | Thank you for your kind support of our charitable efforts. |

| Please fill out the donation receipt form to document your gift. | Kindly complete the receipt form to record your contribution. |

| Your donation helps us provide essential services to those in need. | Your gift enables us to deliver vital assistance to people requiring support. |

When rephrasing, consider breaking longer sentences into shorter ones for better readability or changing sentence structure entirely. Experiment with verb forms or transitions to keep the tone engaging while preserving meaning.

- Non-Profit Item Donation Receipt Form

A well-structured donation receipt form ensures compliance with tax regulations and provides transparency for donors. Include fields for donor’s name, contact information, and date of donation. Clearly specify the description of donated items, their quantity, and estimated fair market value.

Non-profits should add a statement confirming whether any goods or services were provided in exchange for the donation. If applicable, include the value of such benefits. To strengthen legitimacy, provide the organization’s name, address, and tax identification number.

Consider a signature field for both the donor and an authorized representative. Digitizing the form with fillable PDFs or online submissions can streamline the process and ensure accurate records.

Include the following elements in your donation receipt template to ensure clarity, transparency, and compliance with tax regulations:

1. Donor and Organization Information

- Donor’s Full Name and Address: Clearly state the donor’s name and mailing address to personalize the receipt and ensure accuracy.

- Organization Name and Address: Provide the legal name and contact information of your nonprofit organization.

- Tax Identification Number: Include your organization’s EIN to confirm tax-exempt status.

2. Donation Details

- Date of Donation: Record the exact date the donation was received.

- Description of Donation: For non-cash items, provide a detailed description (e.g., “one dining table in good condition”). Avoid assigning a monetary value; this is the donor’s responsibility.

- Cash Amount: Specify the exact amount donated, if applicable.

3. Acknowledgment Statement

Include a clear statement acknowledging whether the donor received goods or services in return for the contribution:

- If no goods or services were provided: “No goods or services were exchanged for this donation.”

- If goods or services were provided: Describe them and include their fair market value (e.g., “Dinner valued at $50 was provided”).

4. Legal and Practical Additions

- Signature: Add a space for a signature or an official stamp to authenticate the receipt.

- Receipt ID: Include a unique receipt number for record-keeping and tracking.

- Thank-You Message: Express gratitude to reinforce the donor’s support and foster future contributions.

By covering these elements, you create a professional and compliant donation receipt that serves both your organization and the donor effectively.

Ensure that donation receipts meet IRS requirements by including the organization’s full legal name, tax-exempt status, and EIN (Employer Identification Number). Clearly state whether any goods or services were provided in exchange for the donation. If so, include a description and a good-faith estimate of their value.

For contributions over $250, donors must receive a written acknowledgment containing the donation amount and a statement specifying whether the donor received anything in return. Without this, donors may lose the ability to claim deductions.

Nonprofits must retain copies of all receipts and related documentation for at least three years to comply with audit requirements. For property donations, ensure the receipt describes the item, its condition, and any appraised value if available. Donations exceeding $5,000 often require a formal appraisal, so communicate this clearly to donors.

Adhering to these guidelines not only protects donors but also ensures your organization remains compliant with federal and state regulations.

Focus on simplicity and readability. Choose a clear, legible font that is easy to read both in print and on a screen. Opt for standard fonts like Arial or Helvetica in appropriate sizes, with headings slightly larger than the body text to create a hierarchy.

Use a clean layout with sufficient white space around the text. This makes the receipt less cluttered and helps guide the reader’s eyes to important details. Separate different sections of the receipt clearly, such as donor information, item descriptions, and values.

Highlight key information like the donor’s name, donation date, and item description using bold or a slightly larger font. Avoid excessive use of colors or underlining, as they can distract from the core details.

Make sure the receipt includes a concise description of the donated items, including quantity, condition, and any specific notes. Ensure that the donation value is clearly presented, especially if it differs from the market price.

Keep instructions simple. Add any necessary tax information, instructions for the donor, and your nonprofit’s contact details in a clear, easy-to-find spot. Avoid cluttering the design with excessive verbiage or complex terms.

Test the readability of your receipt on various devices and printed formats. It should maintain clarity and functionality in both digital and physical formats to meet the needs of all donors.

If you have suggestions or need a different approach, let me know!

If you’re looking for adjustments or a tailored approach, don’t hesitate to share your thoughts. Your feedback helps make the process more suitable for your needs. Whether it’s adjusting the wording, adding specific sections, or changing the format, we’re flexible and ready to accommodate. Feel free to specify any details you’d like to see or modify in the receipt template, and we’ll adjust accordingly.

Suggestions for Customizing the Template:

- Donation Details: Include additional fields like donor’s contact information or preferred acknowledgment method.

- Template Style: If you’d like the design to reflect your organization’s brand, we can update fonts, colors, and logos.

- Frequency of Receipts: Let us know if you need different versions for one-time or recurring donations.

Your input will ensure the final receipt aligns with your preferences and requirements. Just provide a bit more detail, and we’ll take it from there!