If you’re handling transactions, a clear and straightforward cash receipt template will make your life easier. It ensures that both you and your customer have a record of the transaction, which can be helpful for future reference or accounting purposes. A simple receipt includes basic details: the amount received, the payment method, the date, and the purpose of the payment. These elements help avoid misunderstandings and provide a clear summary of the transaction.

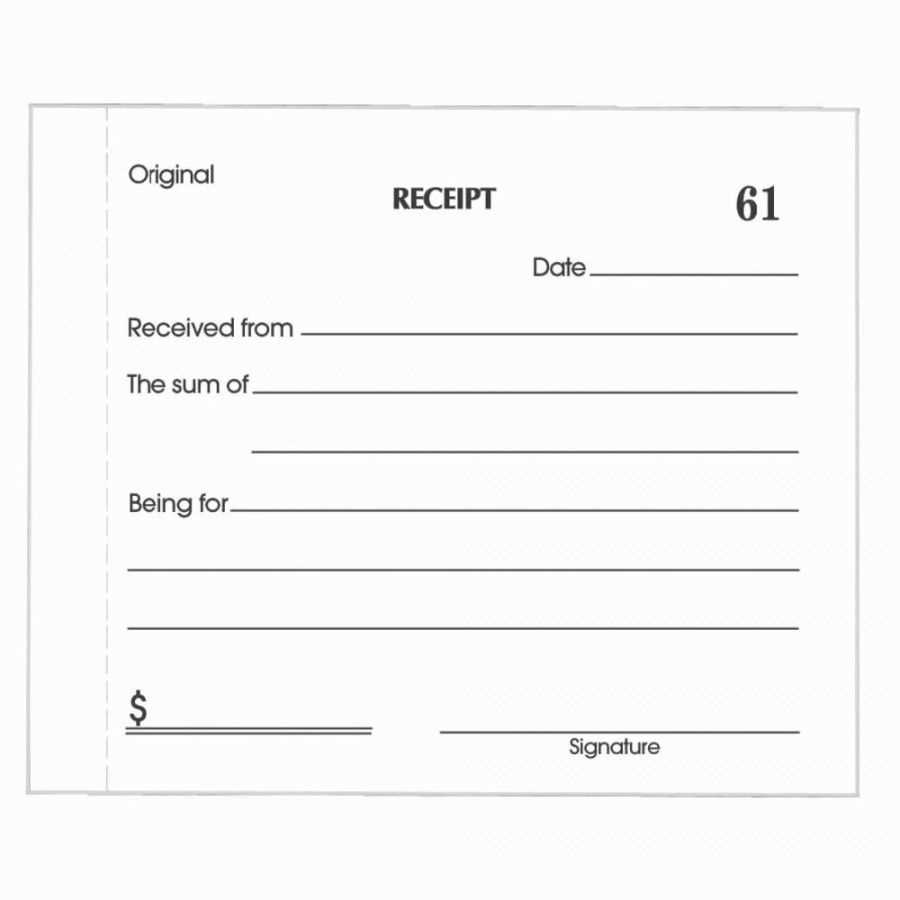

Creating your own template doesn’t have to be complicated. Start with a header that clearly states “Receipt” and include the business name and contact information. Below that, list the transaction details: date, amount, and payer’s name. Add a brief description of the service or product exchanged. Make sure to include a section for the signature of the person issuing the receipt. This can add an extra layer of verification.

Using a simple template will save time and help maintain organized records for both personal and business transactions. Whether you need it for occasional payments or as a routine tool in your business, this receipt format keeps things transparent and easy to follow.

Here’s the corrected version:

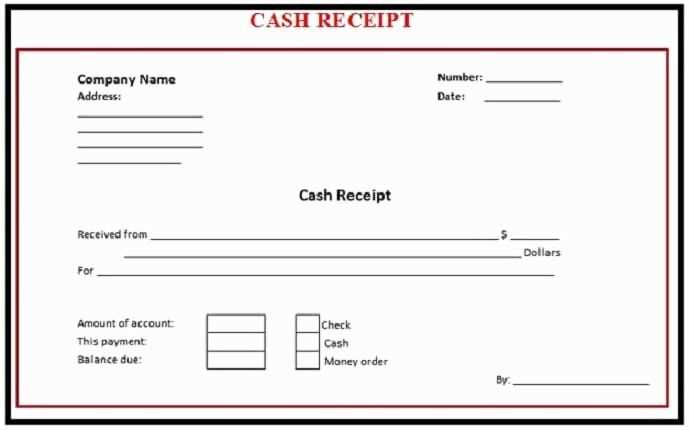

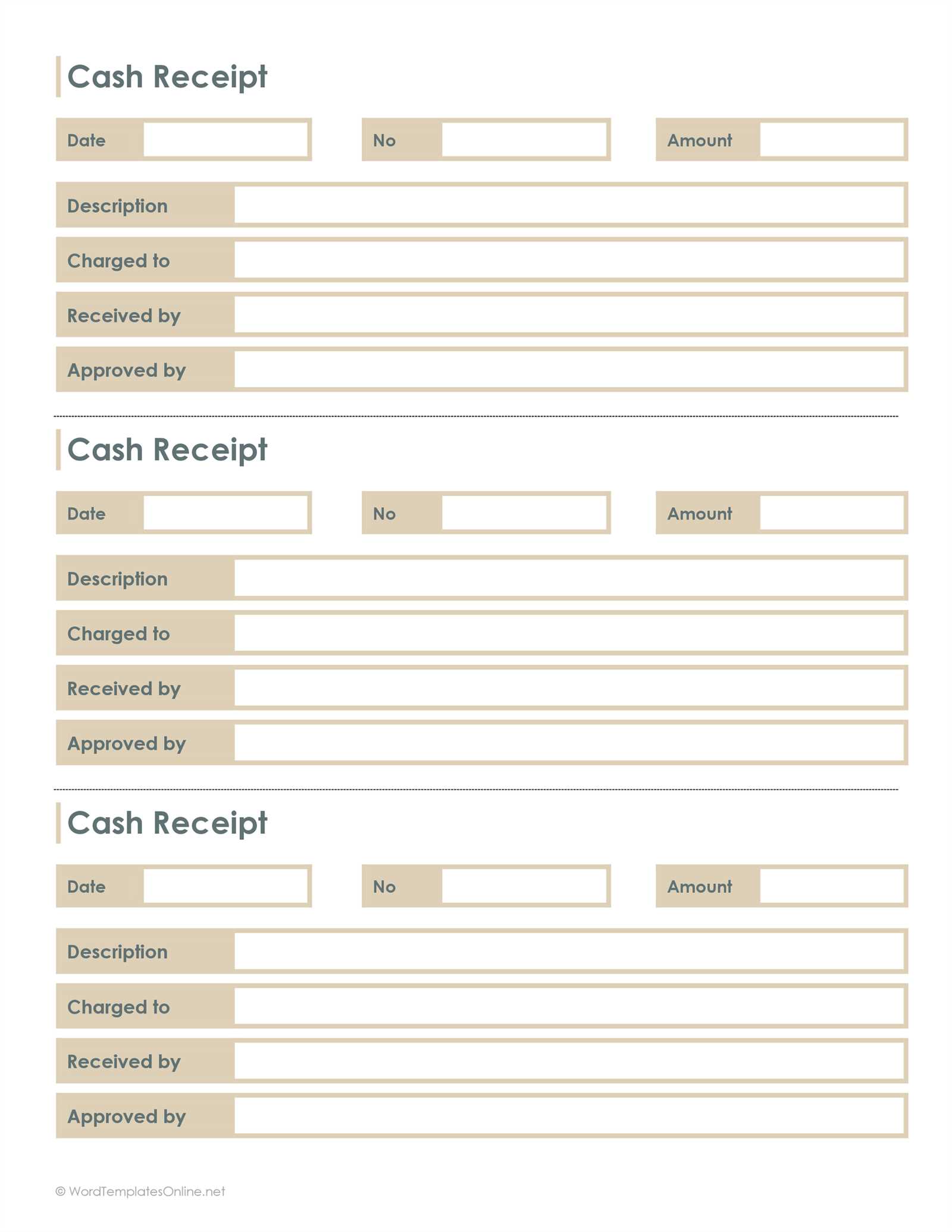

For a clear and easy-to-use cash receipt template, ensure it includes the following key details: receipt number, date, payer’s name, amount paid, and purpose of payment. Keep the layout simple, with enough space for each entry. Use a clean and legible font for easy reading. Here’s a structure that works well:

Receipt Template Structure:

| Receipt Number | Date | Payer Name | Amount Paid | Purpose |

|---|---|---|---|---|

| 001 | 02/11/2025 | John Doe | $100 | Consultation Fee |

| 002 | 02/11/2025 | Jane Smith | $150 | Service Payment |

Each section should be clearly labeled. It’s helpful to add a signature line at the bottom for both parties to confirm the transaction. This ensures transparency and protects both the payer and the recipient.

- Simple Cash Receipt Template

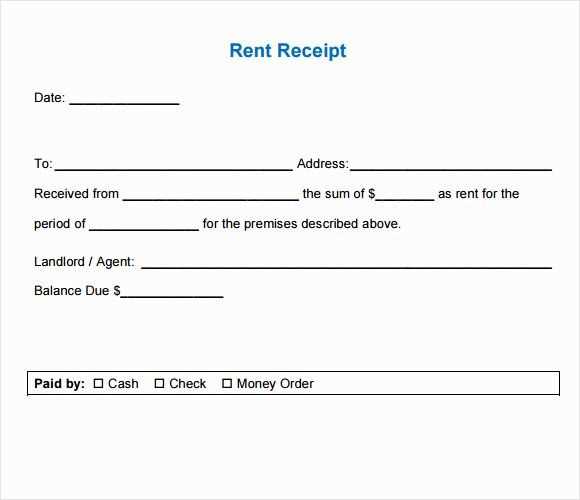

When creating a simple cash receipt, include these key elements: the payer’s name, the date of the transaction, the amount received, and the method of payment. Keep it clear and concise, with enough detail to avoid confusion.

Basic Structure

Start with the name of your business or organization, followed by the receipt number for tracking purposes. Below, provide the payer’s full name and the amount they paid. Make sure the amount is written both numerically and in words to prevent errors. Lastly, include a brief description of what the payment was for.

Receipt Information

Ensure the receipt has the date of payment, along with the payment method (cash, check, or other). This information is vital for accurate financial record-keeping. Include a section for the signature of the person issuing the receipt to verify its authenticity.

Open Excel and create a new workbook. Start by adjusting the cell sizes to make sure your receipt fits well on a standard page. Use a combination of rows and columns to define sections for your receipt information, such as the company name, customer details, items purchased, and total price.

Define the Header Section

In the first few rows, create a space for your company name, address, and contact information. Center the text for a clean, professional look. Below this, add the date and receipt number fields so that each receipt is properly labeled and easy to track.

List Items and Pricing

For the items section, use columns to list the product names, quantities, unit prices, and total prices. Create formulas to automatically calculate the totals for each item. To do this, use the formula =B2*C2 in the total price column (assuming the quantity is in column B and the unit price is in column C). Ensure there’s a column for discounts or taxes, if applicable.

At the bottom of the items list, calculate the grand total by summing all the total prices. Use the formula =SUM(D2:D10) (adjust the range to your data). Add a row for payment method and any other details you want to include.

Finally, make sure to format the receipt neatly using borders and shading to separate the different sections, improving readability. Save the template for future use by saving it as an Excel template file (.xltx), so you can easily create new receipts whenever necessary.

A simple cash receipt should clearly outline the transaction details to ensure transparency and accuracy. These key elements should always be included:

1. Transaction Date

Record the exact date of the transaction. This ensures that both parties have a reference point for when the payment was made.

2. Amount Paid

Clearly state the amount paid, including the currency. This helps avoid confusion and provides a straightforward record of the transaction.

3. Payer and Payee Details

Include the names of the payer and the payee. If necessary, add addresses or contact details to ensure the transaction can be traced back to the correct individuals.

4. Description of Goods or Services

Briefly describe what the payment is for, whether it’s for a product or service. This provides context and ensures both parties understand the purpose of the transaction.

5. Payment Method

Indicate how the payment was made, whether in cash, via check, or by another method. This ensures both parties agree on the transaction’s form.

6. Signatures

Both parties should sign the receipt. This confirms agreement to the transaction details and adds an additional layer of security.

Including these elements in a cash receipt guarantees that the transaction is documented thoroughly and can be referenced if needed later on.

Customize your receipt template to match your business needs and ensure consistency across all transactions. Here’s how you can adjust the key elements:

- Logo and Branding: Add your business logo and select a color scheme that aligns with your brand identity. This reinforces your brand and makes your receipts look professional.

- Business Details: Include your business name, address, contact number, and website. Make sure these are clearly visible to allow customers to easily reach out if needed.

- Date and Time: Make sure each receipt displays the date and time of the transaction. This helps with both record-keeping and customer reference.

- Itemized List: Include a detailed breakdown of the items purchased, along with quantities and prices. This is essential for transparency and customer trust.

- Tax Information: Add tax rates and amounts to ensure customers are aware of the taxes applied to their purchase. You can adjust this depending on your location and business regulations.

- Discounts and Offers: If applicable, clearly list any discounts or promotional offers. This highlights special deals and can drive customer satisfaction.

- Payment Method: Indicate the payment method used, whether it’s cash, card, or another option. This will make your records more accurate.

- Transaction ID: Adding a unique transaction number or order ID can be helpful for both customers and for your own record-keeping.

- Return and Exchange Policy: Briefly mention your return or exchange policy. Customers will appreciate the transparency and clarity.

Adjust these elements as needed based on your business type, the information you need to track, and the customer experience you want to create. A well-tailored receipt helps build trust and maintain organized records.

For a simple and clear cash receipt, ensure you include the following essential components: date of transaction, payer’s details, the amount paid, and the purpose of the payment. Start by listing the transaction date, followed by the full name or business name of the payer. Include the amount received, specifying the currency used, and make sure to mention any applicable taxes or discounts. Finally, provide a brief description of what the payment is for–whether it’s for goods, services, or other reasons.

How to Structure the Receipt

Arrange the details in a structured format. Begin with the payer’s information at the top, followed by a line break and the amount paid. Below that, specify any tax or discount adjustments. This ensures clarity and keeps the transaction transparent. Make sure the receipt is easy to read, with clear spacing between sections.

Adding Optional Details

If necessary, you can add a receipt number for tracking purposes. This will help both you and the payer reference the transaction in the future. A space for signatures can also be included if required by the nature of the transaction.