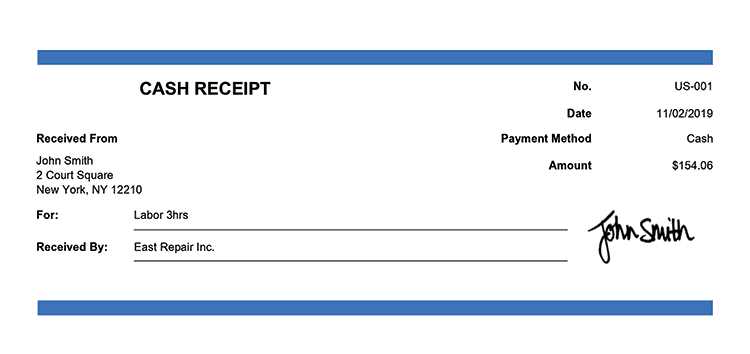

A well-structured cash receipt template helps restaurants maintain accurate financial records and provide customers with clear payment documentation. Whether you run a small café or a large dining establishment, a properly formatted receipt ensures transparency and professionalism in every transaction.

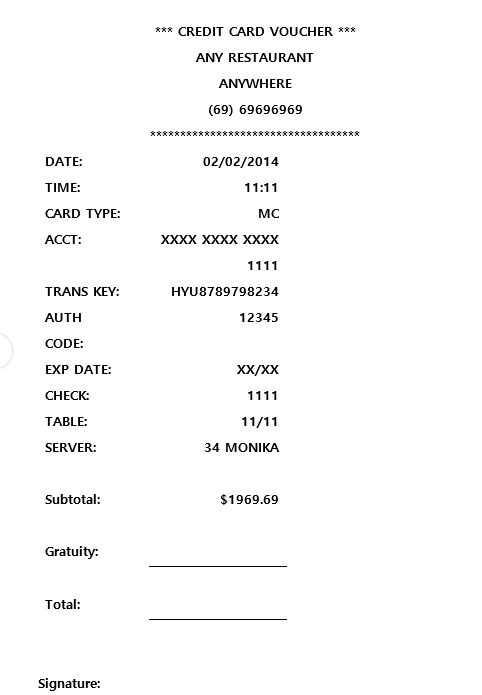

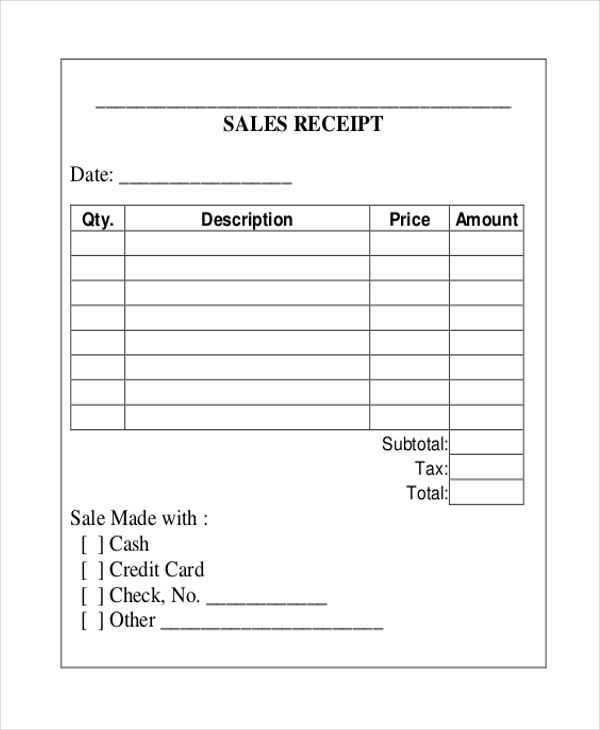

A standard restaurant cash receipt should include essential details such as the restaurant name, date, receipt number, itemized charges, tax, gratuity, total amount, and payment method. Clearly presenting this information helps prevent disputes and simplifies bookkeeping. Additionally, adding a section for special notes or promotions can enhance customer engagement.

Choosing between digital and printed receipts depends on business needs. Digital receipts reduce paper waste and integrate easily with accounting software, while printed receipts remain a preferred option for customers who require a physical copy. Whichever format you choose, consistency in layout and information ensures smooth financial management.

Using a customizable template saves time and maintains consistency. Many restaurants opt for pre-designed templates in formats like PDF, Excel, or Word, which can be easily tailored to match branding elements. Selecting a format that aligns with your restaurant’s workflow ensures efficiency in daily operations.

The structured receipt format ensures clarity, covering essential details and improving customer experience. Let me know if you need further refinements!

Restaurant Cash Receipt Template

A well-structured restaurant cash receipt should include key details for clarity and record-keeping. Ensure the template includes the restaurant name, address, and contact details at the top. Below, add the receipt number and date of transaction for tracking purposes.

List purchased items with a clear description, quantity, and price. Display subtotal, tax, and total amount separately for transparency. If applicable, include a field for gratuity.

Indicate the payment method (cash, card, or other) and add a space for the server’s name. If offering refunds or exchanges, a brief return policy section is useful.

For branding, consider adding a logo and a short thank-you message to encourage repeat business.

Your HTML section on key elements of a cash receipt is ready. Let me know if you need any adjustments!

Choose a template that matches your restaurant’s branding. Look for a design that aligns with your color scheme, logo placement, and layout preferences.

Modify Key Details

- Business Name & Logo: Replace placeholder text with your restaurant’s name and upload a high-quality logo.

- Contact Information: Ensure the phone number, email, and address are correct.

- Tax & Currency: Adjust tax rates and currency symbols to match local regulations.

Personalize Item Listings

- Menu Items: Update descriptions to reflect your actual dishes and prices.

- Discounts & Promotions: Highlight special offers or loyalty program details.

Save your customized template in an easily editable format like PDF or Word for future updates. Print a sample to check alignment and readability before finalizing.

Ensure that restaurant receipts meet local legal requirements for record-keeping and tax purposes. They should clearly show the date, items purchased, amounts, and applicable taxes. The receipt also needs to list your business’s name, address, and tax ID number for verification during audits or tax filings.

Consider using a standard format for your receipts to comply with accounting regulations. This makes it easier to track sales and reduces the likelihood of errors during financial reporting. Different jurisdictions may have specific rules on receipt storage duration and accessibility, so familiarize yourself with these to avoid potential penalties.

Maintain consistency in how you issue and store receipts. Digitizing receipts can help manage records more efficiently, but ensure that digital records are legally acceptable in your jurisdiction. If receipts are printed, use durable paper and ink that can withstand long-term storage for reference purposes.

| Receipt Information | Legal Requirement |

|---|---|

| Date of transaction | Must be clearly stated for tax reporting purposes |

| Itemized list of purchased goods/services | Required for transparency and tax calculation |

| Total amount including tax | Necessary for accurate financial reporting and tax filings |

| Business name and address | Required for identification in case of disputes or audits |

| Tax Identification Number | Needed for tax compliance and audits |

Consult with an accountant to ensure your receipts are structured correctly and comply with the local tax laws. Any discrepancies or missing information can result in complications during audits, so being proactive is key.

For a clear, well-organized restaurant cash receipt template, structure the document with all essential details that reflect the transaction accurately. Include the date and time of the purchase, the name of the restaurant, and the items purchased with their corresponding prices. Ensure each item is clearly labeled with a description to avoid confusion. Don’t forget to list applicable taxes and tips separately to maintain transparency. At the bottom, place a total amount due section, including payment method details (credit card, cash, etc.) for proper record-keeping. Keep the format simple and readable to ensure ease of use for both staff and customers.