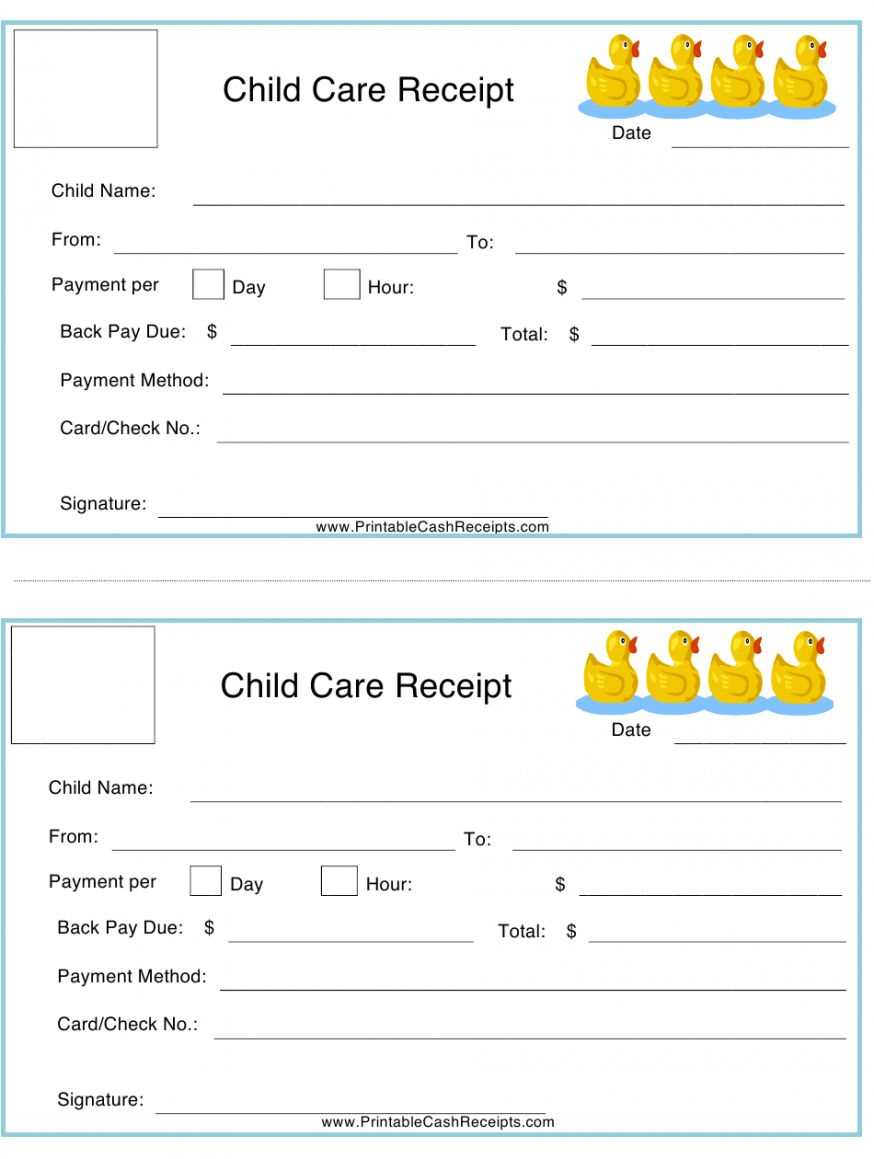

Ensure that you keep accurate records of your dependent care expenses. A well-structured reimbursement receipt is necessary to simplify the process and avoid delays. The template should include specific details such as the provider’s name, service dates, and amount paid.

Include the provider’s contact information, including the name, address, and phone number. This verifies the authenticity of the expense. Make sure to specify the dates during which the dependent care services were provided. This ensures the reimbursement request aligns with the covered period for tax benefits.

Clearly list the total amount paid, breaking down any charges for multiple services, if applicable. This allows for accurate accounting and helps avoid confusion when submitting your claim. Double-check that all fields are filled out correctly to prevent processing delays.

Here is the revised version of your lines:

Ensure accurate information: Double-check all entries, including the date of service, the care provider’s details, and the amounts paid. Mistakes here can delay processing or lead to rejections.

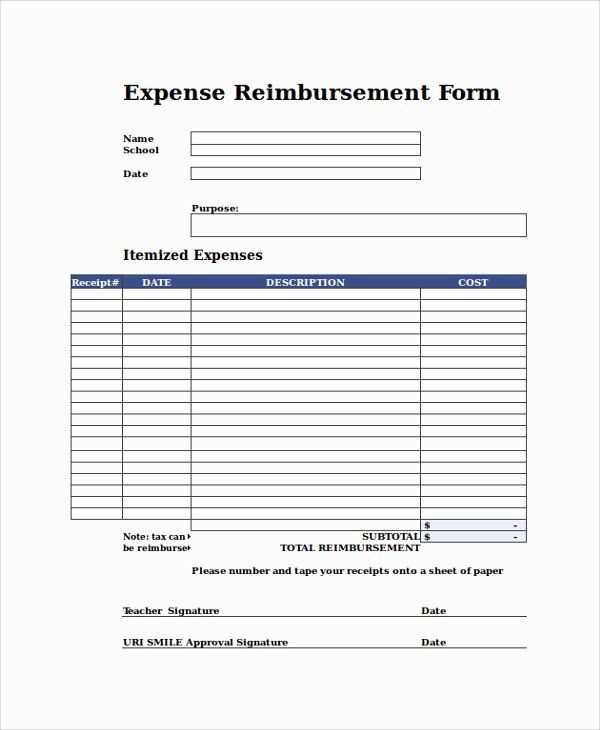

Clear breakdown of services: List each dependent care service separately. Include specific dates and charges for each service to avoid confusion. This clarity ensures quicker review and approval.

Verify receipts: Attach legible, itemized receipts to the reimbursement form. These should clearly indicate the amount paid, the date of the service, and the type of care provided.

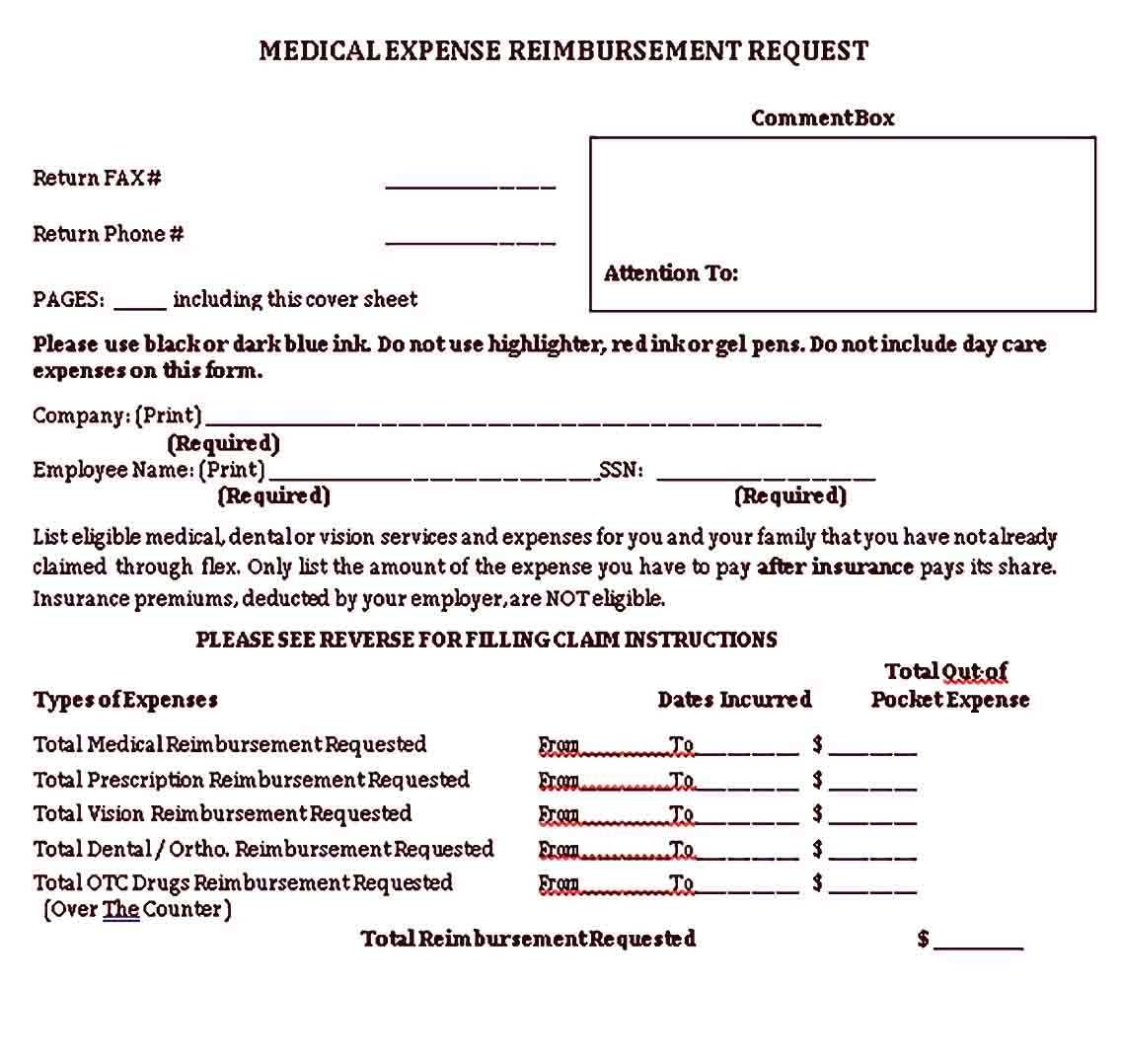

Understand eligible expenses: Review your employer’s policy on eligible dependent care expenses. Only submit claims for services covered under your plan to ensure approval.

Review reimbursement limits: Familiarize yourself with the maximum allowable reimbursement amount under your plan. Exceeding this limit may result in partial reimbursements or denials.

- Dependent Care Reimbursement Receipt Template

To request reimbursement for dependent care expenses, it’s important to have a well-organized and complete receipt. The template should include key details like the provider’s name, service dates, the amount charged, and any applicable tax information. A structured receipt helps ensure that your submission is clear and processed without delays.

Key Information to Include

- Provider Name: Clearly state the full name of the dependent care provider.

- Provider Contact Information: Include the phone number and address for verification purposes.

- Service Dates: Specify the exact dates on which the services were provided.

- Amount Charged: Clearly list the amount billed for each service or session.

- Tax Information: If applicable, include any taxes applied to the service fees.

Template Example

Below is a simple template structure:

Provider Name: [Provider's Full Name] Provider Contact: [Phone Number, Address] Service Dates: [Start Date] to [End Date] Total Amount: [Amount Charged] Tax: [Applicable Tax Information]

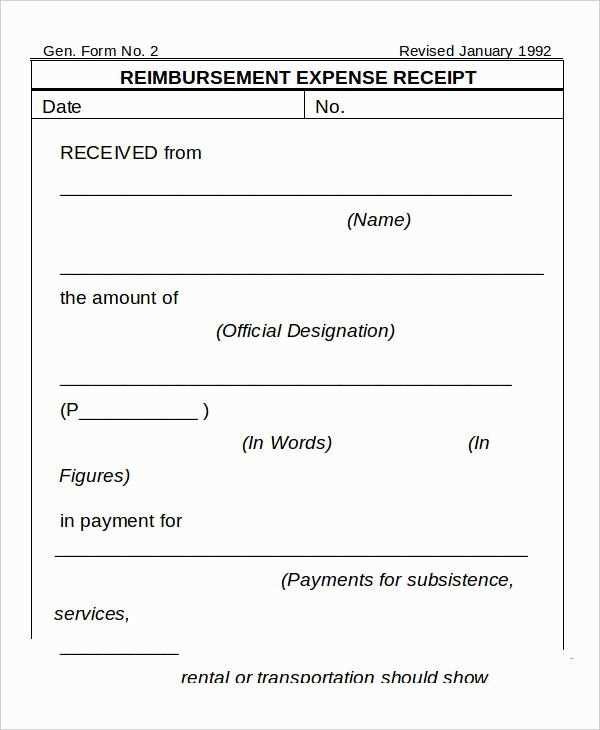

To create a reimbursement receipt for dependent care, start by clearly stating the service provided. Include the provider’s name, address, and contact details. Next, list the care recipient’s name and the specific dates services were rendered. Provide a detailed description of the care, such as the number of hours and type of service offered. Clearly indicate the total amount paid for the service, including any applicable taxes.

Ensure the receipt is signed by the care provider to confirm the accuracy of the information. A method of payment (e.g., check, cash, or credit card) should also be documented, along with the payment date. If applicable, include an invoice number or transaction ID for reference.

Final Tip: Double-check that all the details are accurate, as an incomplete or unclear receipt can delay reimbursement processing. Keep a copy of the receipt for your records and submit the original to your employer or dependent care plan administrator as required.

Include the caregiver’s full name, address, and contact details. The name of the care provider should be clear and match any official records. Provide the service recipient’s name and relationship to the caregiver for verification.

Details of Services Provided

Clearly list the type of care provided (e.g., daycare, elderly care, special needs assistance), along with dates and hours of service. Specify the hourly rate or total cost for each service to ensure transparency.

Payment Information

State the total amount paid and include the payment method used, whether by check, credit card, or other means. Record the payment date and, if applicable, any partial payments or balance due.

Don’t forget to include the signature of the caregiver or their representative, along with the date, confirming the accuracy of the information provided.

To claim reimbursement for dependent care expenses, ensure that your receipts meet the required guidelines. The receipt must clearly specify the name and address of the care provider, the dates of service, and the amount paid for each service. You must also include the provider’s tax identification number or Social Security number.

Key Details to Include in Your Receipt

Your receipt should not only contain the basic information but also be itemized. The description of services should be specific–listing dates and exact charges. If the care involves multiple dependents, make sure to break down the costs per dependent. If possible, request a formal receipt from the provider rather than using a handwritten note.

Submitting Your Claim

When submitting your claim, attach the itemized receipts along with any required forms. Double-check that all the information on the receipt aligns with the form’s requirements. Keep a copy of everything for your records in case there are any questions or discrepancies later.

Ensure all receipts are legible and clearly show the date of service. A blurry or unclear receipt could lead to delays or rejection.

Always include the name of the dependent receiving care. Missing this detail can cause confusion and may result in your submission being incomplete.

Check for any duplicate submissions. Submitting the same receipt more than once can cause unnecessary complications. Track your submissions to avoid errors.

Verify that the expenses are eligible. Non-eligible items, such as transportation or non-care-related items, should not be included. Double-check the list of approved expenses before submitting.

Ensure that the amount submitted matches the total listed on the receipt. Discrepancies between the receipt amount and the claim can lead to disqualification.

Be mindful of deadlines. Late submissions are typically not accepted, so make sure to submit all required documentation well within the allowed time frame.

Double-check that all forms are completed correctly. Missing or incomplete fields on forms can delay processing or cause rejection.

Ensuring Compliance with IRS Regulations for Dependent Care

To ensure compliance with IRS regulations for dependent care reimbursement, follow these key steps:

- Review IRS Publication 503 to understand the guidelines for qualifying expenses and eligible dependents.

- Keep accurate records of all dependent care expenses, including receipts, dates, and the care provider’s information.

- Ensure that the care provider is not a relative or household member to avoid conflicts with IRS rules.

- Submit receipts promptly and verify that they contain required details such as the provider’s name, address, and tax ID number.

- Ensure the care is provided for children under the age of 13 or other qualifying dependents as per IRS definitions.

- Track all reimbursements and adjust your records to avoid exceeding the annual reimbursement limits set by the IRS.

By following these steps, you can ensure your dependent care reimbursement claims are in full compliance with IRS regulations and avoid unnecessary complications during tax filing season.

Begin by ensuring your receipt meets the requirements for reimbursement. It should clearly list the service or product, the amount, the date, and the name of the provider. Without this information, the submission may be delayed or rejected.

Next, gather any additional documentation that might be required, such as a statement from the care provider or supporting invoices. This ensures that all necessary information is included in one submission.

After gathering your documents, log into your reimbursement portal or email platform, depending on your employer’s submission process. Follow the provided guidelines closely to avoid mistakes. Some platforms will allow you to upload scanned copies or photos of your receipt, while others may ask for PDF versions.

Fill in any required fields on the submission form. This may include your employee ID, the service dates, and the care provider’s contact details. Double-check that all information is correct before submission to prevent any delays in processing.

Once submitted, keep a copy of all documents and a confirmation email or receipt. If there are any issues, this documentation will be useful when following up.

| Step | Action |

|---|---|

| 1 | Ensure receipt includes all necessary details (amount, date, provider). |

| 2 | Gather any additional supporting documents (e.g., care provider statement). |

| 3 | Log into the reimbursement portal and follow submission guidelines. |

| 4 | Double-check the information on the submission form before sending. |

| 5 | Save copies of all documents and confirmation for future reference. |

To properly submit a dependent care reimbursement request, include the necessary documentation in the form of a clear receipt. Ensure the receipt lists the following information:

- Provider’s Name and Address: Include the full name and address of the care provider offering the service.

- Dates of Service: Specify the exact dates on which dependent care services were provided.

- Amount Paid: The total amount charged for the services rendered must be clearly stated.

- Description of Services: Detail the care services provided, such as babysitting, daycare, or eldercare.

- Provider’s Tax Identification Number (TIN): Include the TIN or Social Security number of the care provider for verification purposes.

For an efficient claim process, make sure to retain copies of the receipts and ensure all the information is accurate before submitting to avoid delays. Additionally, some reimbursement programs may require a signed statement from the provider, so confirm the necessary documentation before submission.