A well-structured service receipt should clearly outline the transaction, including any deposit made. Whether you run a repair shop, a consulting business, or a rental service, providing a detailed receipt ensures transparency and avoids disputes. A properly formatted document includes key details such as payment breakdowns, service descriptions, and client information.

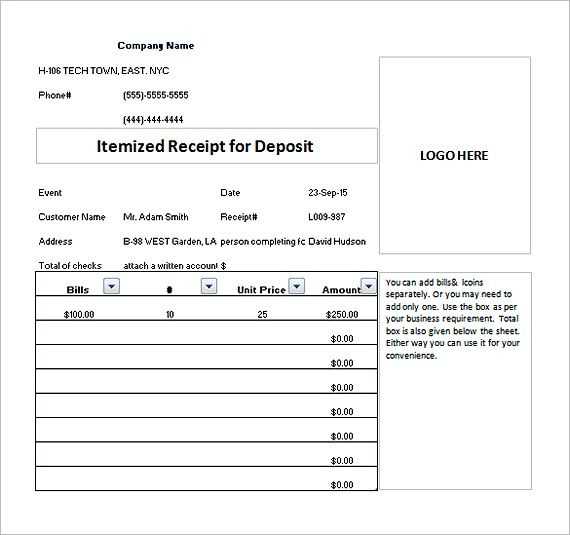

To create a reliable receipt, include the business name, customer details, date of service, and a unique receipt number. Specify the total amount, the deposit paid, and the outstanding balance. This structure helps clients track payments while protecting your business from misunderstandings.

For added clarity, include a payment method section indicating whether the deposit was made via cash, card, or bank transfer. If applicable, add terms regarding refunds or deposit adjustments. A professional layout not only enhances credibility but also simplifies record-keeping for both parties.

Service Receipt Template with Deposit Section

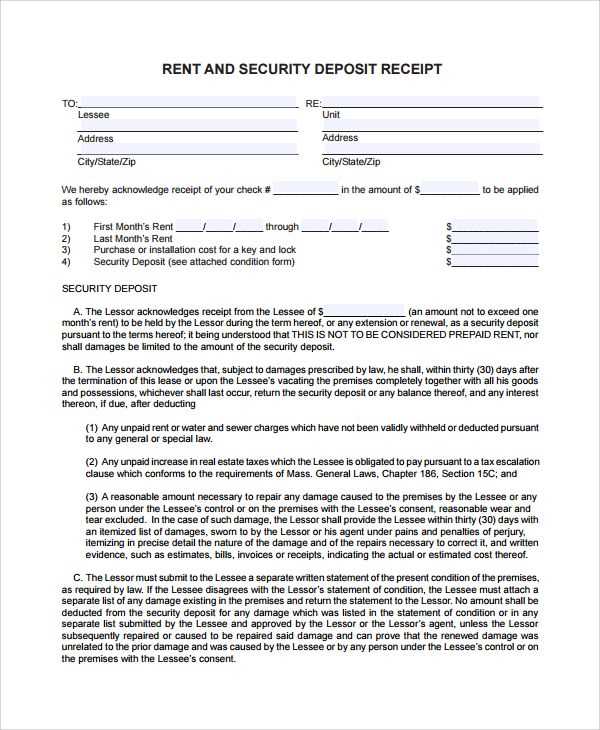

Ensure your service receipt includes a clearly defined deposit section to avoid payment disputes and maintain transparency. Specify the deposit amount, payment method, and date received. If the deposit is refundable or applied toward the final balance, state these conditions explicitly.

Key Details to Include

List the total service cost, the deposit percentage or fixed amount, and the remaining balance. Provide a breakdown of charges and applicable taxes. If installment payments are allowed, outline the schedule clearly.

Formatting for Clarity

Use bold or underlined text for critical details like due dates and deposit terms. A dedicated section at the top of the receipt ensures visibility. Including a signature line for both parties strengthens agreement acknowledgment.

Providing a digital or printed copy to the customer ensures record-keeping and minimizes disputes. Keep your template structured and adaptable to different services for efficiency.

Key Elements to Include in a Service Receipt

Include the business name, address, and contact details at the top. This ensures clarity and helps with record-keeping. Use a legible font and align the information properly.

Client and Service Details

List the client’s name, contact information, and a unique receipt number. Specify the service provided with a brief description, including date, time, and location if applicable.

Payment Breakdown and Deposit

Clearly outline the total cost, taxes, and any discounts. If a deposit was made, indicate the amount, payment method, and remaining balance. A separate section for deposit details prevents confusion.

Conclude with a payment confirmation statement, including the date of full settlement. Adding a signature or digital acknowledgment enhances credibility.

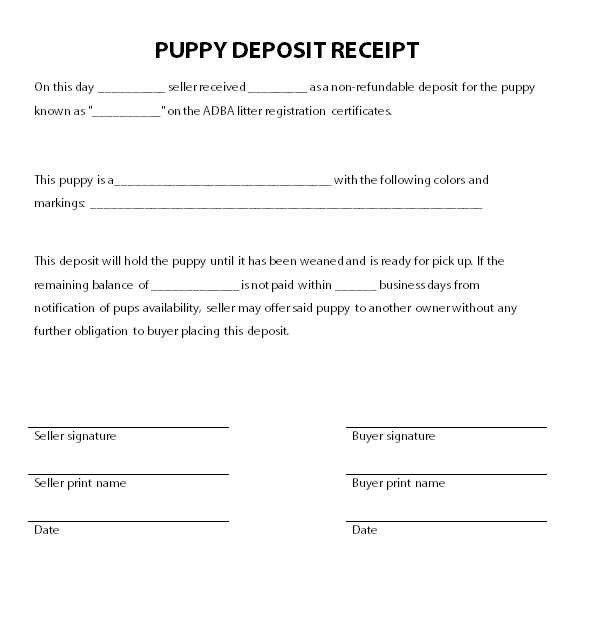

How to Structure the Deposit Section Clearly

Specify the deposit amount upfront. Display the exact sum in bold or a separate row to ensure it stands out. If percentages apply, include both the percentage and the corresponding amount in currency.

Clarify payment methods. List accepted options such as cash, credit card, or bank transfer. If restrictions exist, mention them explicitly to prevent misunderstandings.

State refund conditions. Define whether the deposit is refundable or non-refundable. If partial refunds apply, outline the conditions and any associated fees.

Include payment deadlines. Specify due dates to avoid delays. If late fees apply, mention the amount and how they accumulate.

Provide confirmation details. Include a unique transaction ID or receipt number. This helps both parties track the deposit and ensures transparency.

Customizing the Template for Different Services

Adjust the template to reflect the specifics of your service by modifying key sections. Ensure clarity in descriptions and include relevant details for transparency.

- Deposit Structure: Define whether the deposit is a percentage, a fixed amount, or a refundable security. Adjust the wording to match your policies.

- Service Breakdown: List all included services, avoiding vague descriptions. If applicable, specify hourly rates, package deals, or tiered pricing.

- Cancellation Terms: If deposits are non-refundable after a certain period, state the deadline clearly. For flexibility, mention rescheduling options.

- Payment Methods: Highlight accepted options such as bank transfers, credit cards, or digital wallets. If a specific method is required for deposits, make it clear.

- Industry-Specific Fields: Add relevant fields like license numbers for contractors, VINs for auto services, or appointment times for consulting.

Test the updated template by generating a sample receipt. Ensure all required details are included, formatting is consistent, and legal disclaimers are present if needed.