Automating charity receipt generation simplifies record-keeping for both donors and organizations. With a pre-designed template, you can instantly generate receipts that contain all necessary information, such as donation amount, date, and donor details, without any manual input. This automation saves time and ensures consistency across all receipts issued.

The automated process reduces human error, which can happen when receipts are created manually. A template also makes it easy to track donations and organize records for tax purposes, making compliance smoother. By utilizing an automated receipt system, charities can focus more on their cause rather than administrative tasks.

Setting up an automated charity receipt template involves choosing software or an online tool that allows for customization. Ensure the template includes fields for all required information such as donor name, donation amount, and date. This way, each donation is accurately documented and easily accessible in the future. The simplicity and reliability of an automated system will improve your organization’s efficiency.

Charity Receipt Template Automated

Automating charity receipt generation can save time and reduce errors. By using a template, you can streamline the process of issuing receipts while ensuring they meet legal requirements. Here’s how to automate charity receipts with precision:

Key Information for Automated Receipts

- Donor’s name and address

- Charity’s name, address, and tax identification number

- Donation date

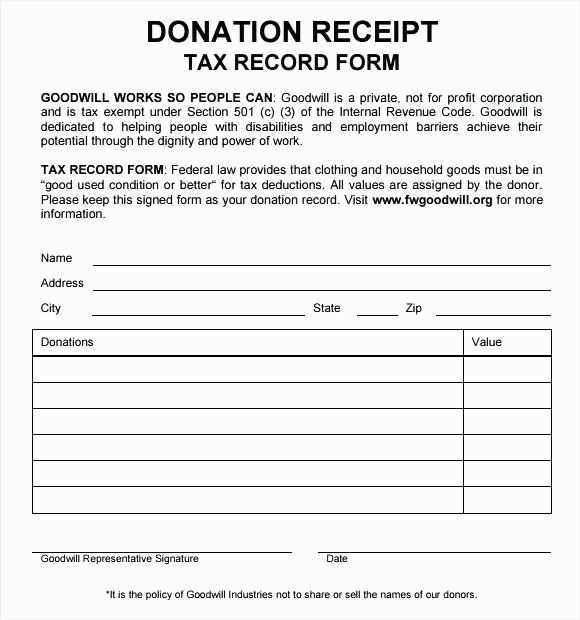

- Donation amount (if cash, specify total amount; if property, describe items)

- Statement confirming whether goods or services were provided in exchange for the donation

Steps to Automate the Process

- Choose a reliable automation tool or platform that integrates with your charity’s donation system.

- Design a template with the required fields mentioned above, leaving spaces for dynamic data to be populated automatically.

- Set up an integration to pull donor data from your donation management system.

- Customize the output format of receipts (PDF or email format) to meet your preferences.

- Enable automatic email delivery or printing of receipts for timely acknowledgment of donations.

Automating charity receipts ensures accuracy, minimizes administrative work, and enhances the donor experience with fast, professional acknowledgment.

Setting Up Automated Charity Receipt Generation

Use a reliable software solution to automate receipt generation. Choose a platform that integrates with your donation system and supports custom templates for receipts. Ensure the platform complies with local tax laws, including the required donor information and donation details.

Configure your system to generate receipts automatically upon donation processing. Most platforms allow you to set up automatic triggers for sending receipts, ensuring donors receive them without manual intervention. Double-check that all required fields are included, such as donor name, donation amount, and date.

Customize the receipt template to include your charity’s logo, contact details, and tax-exempt status. A professional-looking receipt increases credibility and helps maintain trust with donors. You can adjust the layout and content to align with your branding.

Set up email notifications for donors after their donation is processed. Include a link to the receipt or attach a PDF file for easy access. This streamlines the process and ensures that your donors receive timely documentation for tax purposes.

Regularly test the automation system to catch any issues early. Monitor receipt generation to ensure it functions correctly, particularly during peak donation periods. Maintain an archive of receipts for internal use and compliance with accounting standards.

Customizing Templates for Compliance and Branding

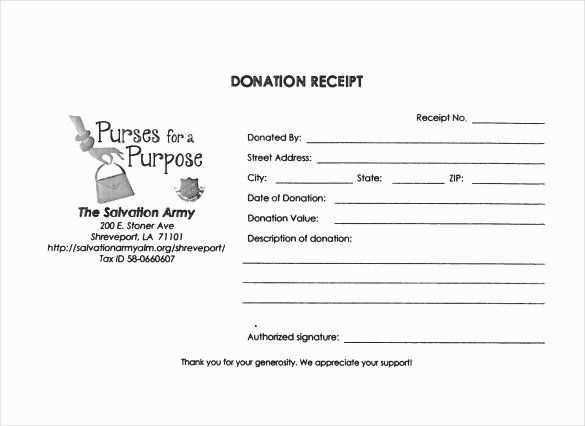

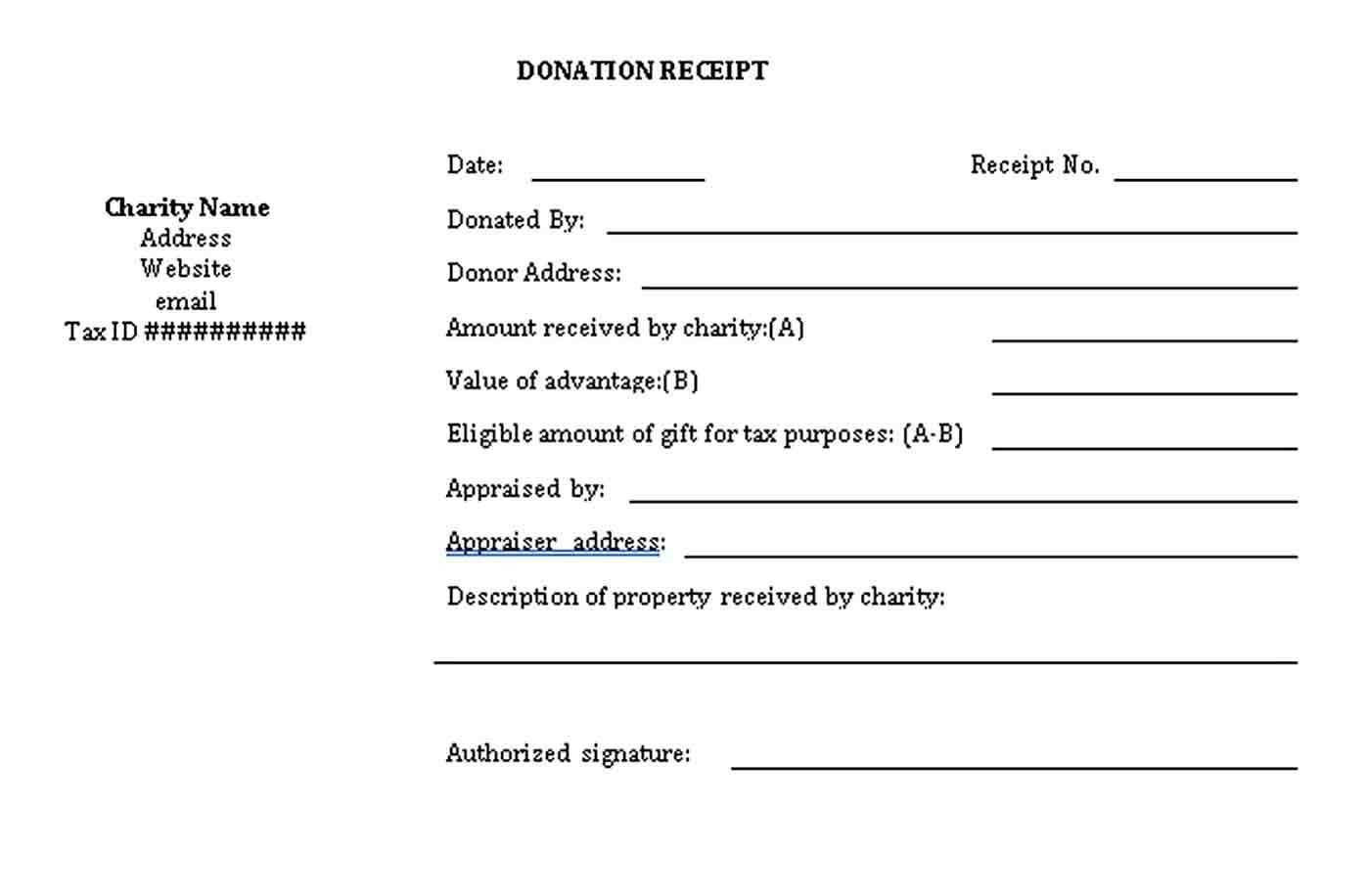

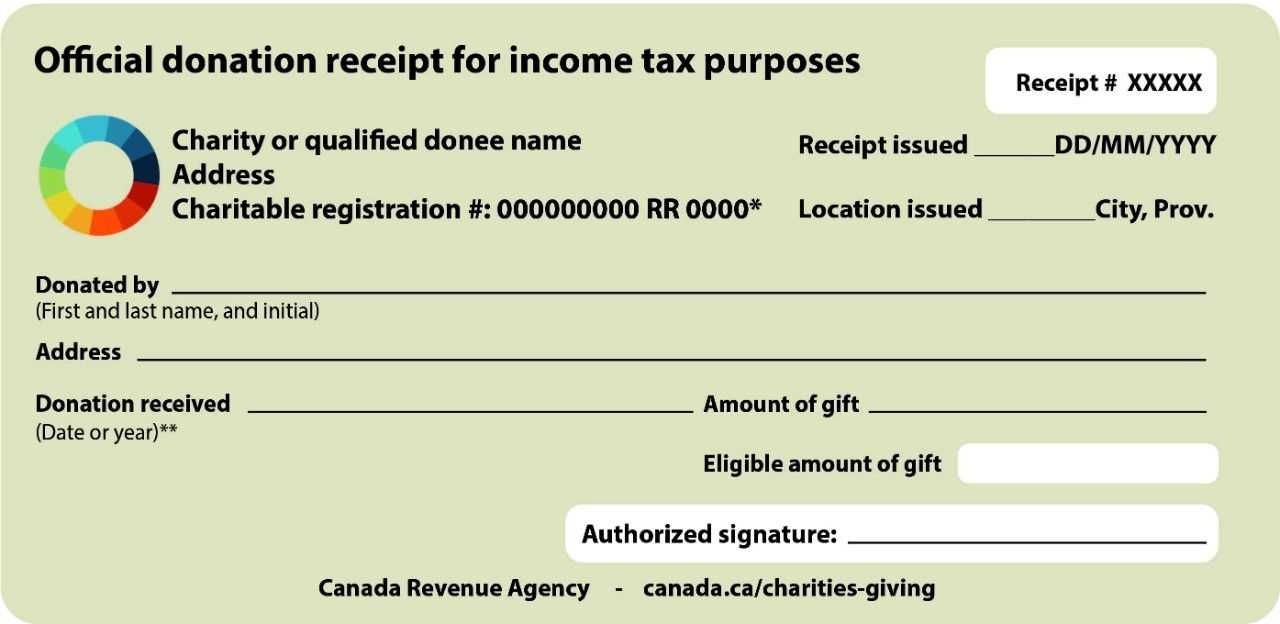

Ensure your charity receipt templates meet both compliance standards and your organization’s branding by focusing on key elements that align with legal requirements and visual identity. Adapt the template to include mandatory fields such as the donor’s full name, donation amount, date, and a statement of the charity’s tax-exempt status. Be specific about the charity’s registration number and provide any other details required by local laws or tax authorities.

Tailoring for Legal Requirements

Each region has specific laws dictating what must appear on a donation receipt. Verify that your template is designed to include all necessary disclaimers or tax-related information. Depending on jurisdiction, you may need to list whether the donation was tax-deductible, the value of goods or services provided in exchange, and the organization’s charitable status. Double-check these details annually to ensure compliance with any changes in tax legislation.

Branding and Design Adjustments

To align with your charity’s brand, customize your template with the organization’s logo, color scheme, and fonts. Consistency in design helps strengthen brand recognition and adds professionalism. Adjust the layout to prioritize clarity, ensuring that all required fields are easily readable. Use colors and design elements that reflect your charity’s mission while avoiding overcrowding the document with excessive visuals or text.

Managing Donor Data for Streamlined Receipt Distribution

Organize donor information in a centralized database. A well-structured system allows quick access to donor profiles, ensuring receipts are sent without delay. Categorize data fields to capture key details such as donation amounts, dates, and donor preferences for receipt delivery (email or postal mail). This setup reduces the risk of errors and improves processing speed.

Automate Data Entry and Updates

Integrate your donor management system with automated data capture tools. This minimizes manual entry, which often leads to mistakes or delays. Use forms on your website to collect donor details directly into your system, automatically updating profiles and ensuring real-time accuracy.

Segment Donor Lists for Targeted Distribution

Segment your donor data based on donation frequency, amount, or engagement. This segmentation allows you to send tailored receipts efficiently and track specific donor preferences. For example, high-value donors may prefer personalized receipts, while one-time contributors may receive more generic confirmations.

Make use of advanced filtering options to send receipts in bulk while retaining a personalized touch. Automation ensures that each donor receives the correct acknowledgment promptly.

By combining well-organized data and automation, receipt distribution becomes seamless and hassle-free. Keeping your donor data up to date not only enhances accuracy but also strengthens relationships with your supporters.