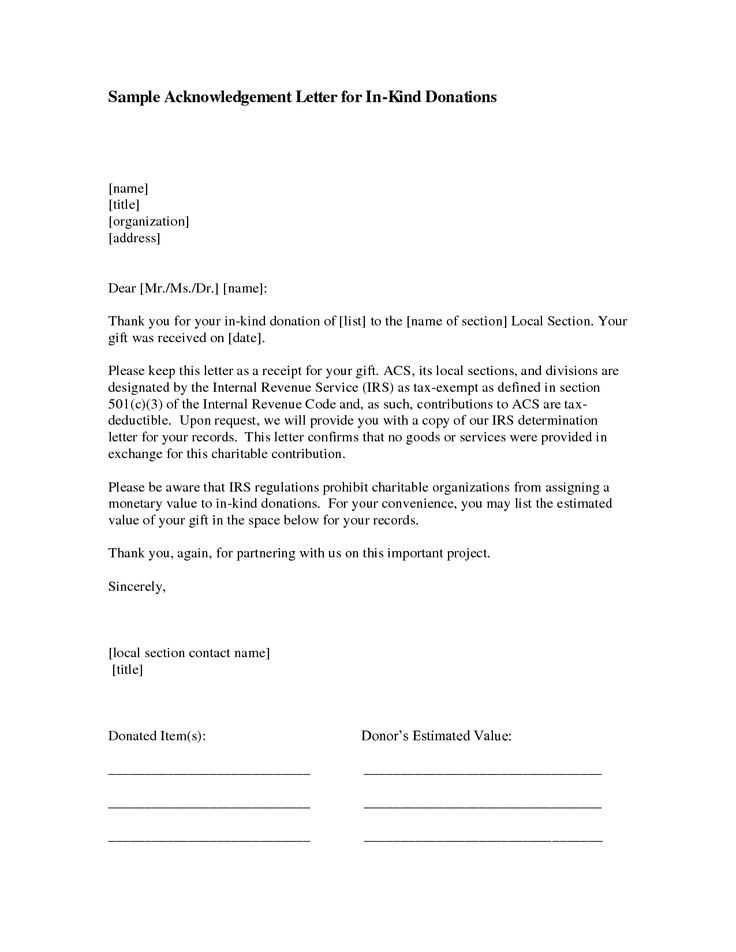

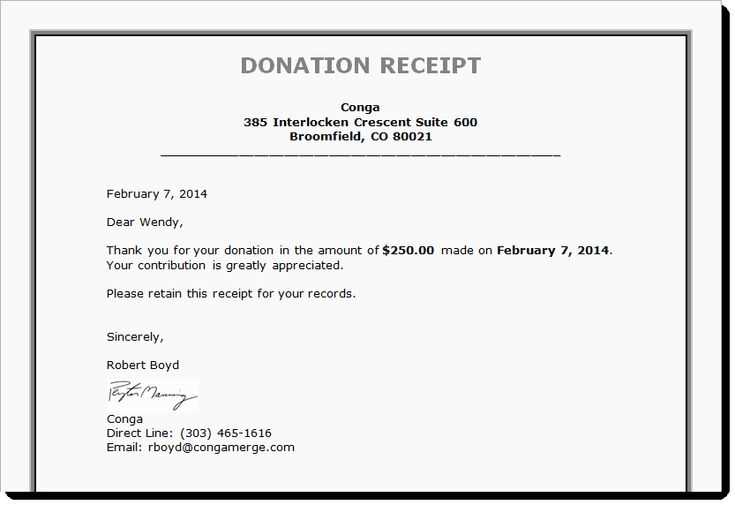

Every in-kind donation should be acknowledged with a well-structured receipt letter. This not only expresses gratitude but also provides essential documentation for tax purposes. The letter must include specific details about the donation, ensuring compliance with IRS guidelines and offering clarity to the donor.

Start with a warm thank-you message that clearly states the recipient organization’s name and the donor’s name. Then, describe the donated items or services in detail, avoiding any mention of monetary value, as donors are responsible for assigning the fair market value of their contributions.

Include the date of the donation, a statement confirming whether any goods or services were provided in return, and the organization’s tax-exempt status. For ease of record-keeping, provide the organization’s contact information and a signature from an authorized representative.

A well-crafted receipt letter not only fulfills legal requirements but also strengthens relationships with donors, encouraging future contributions. Consistency in formatting and wording helps maintain professionalism while ensuring that each donor receives a clear and concise acknowledgment.

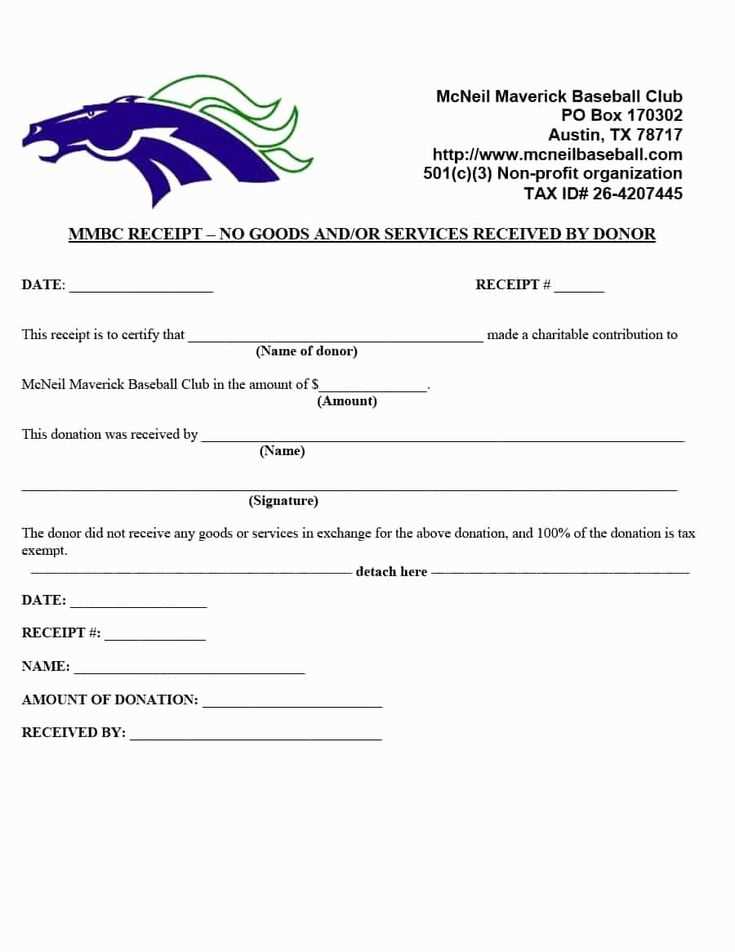

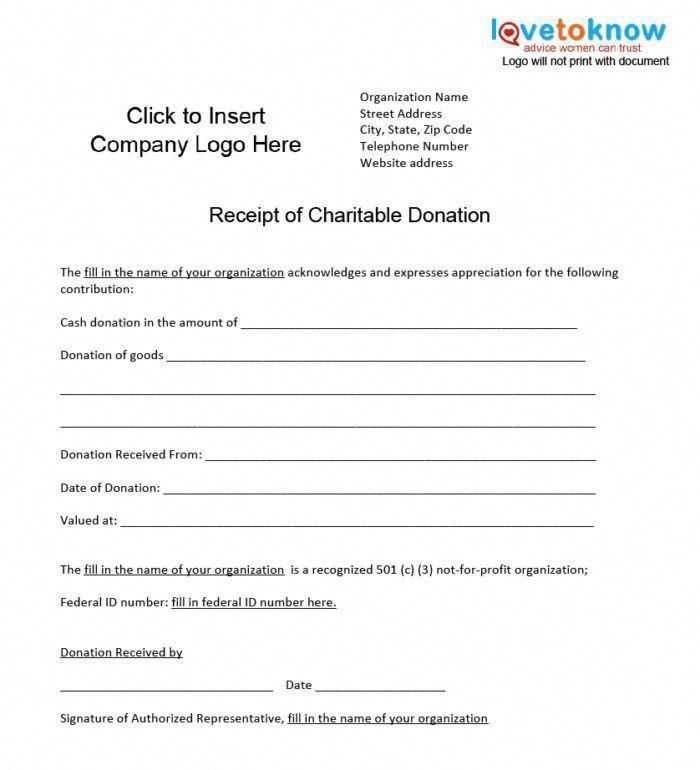

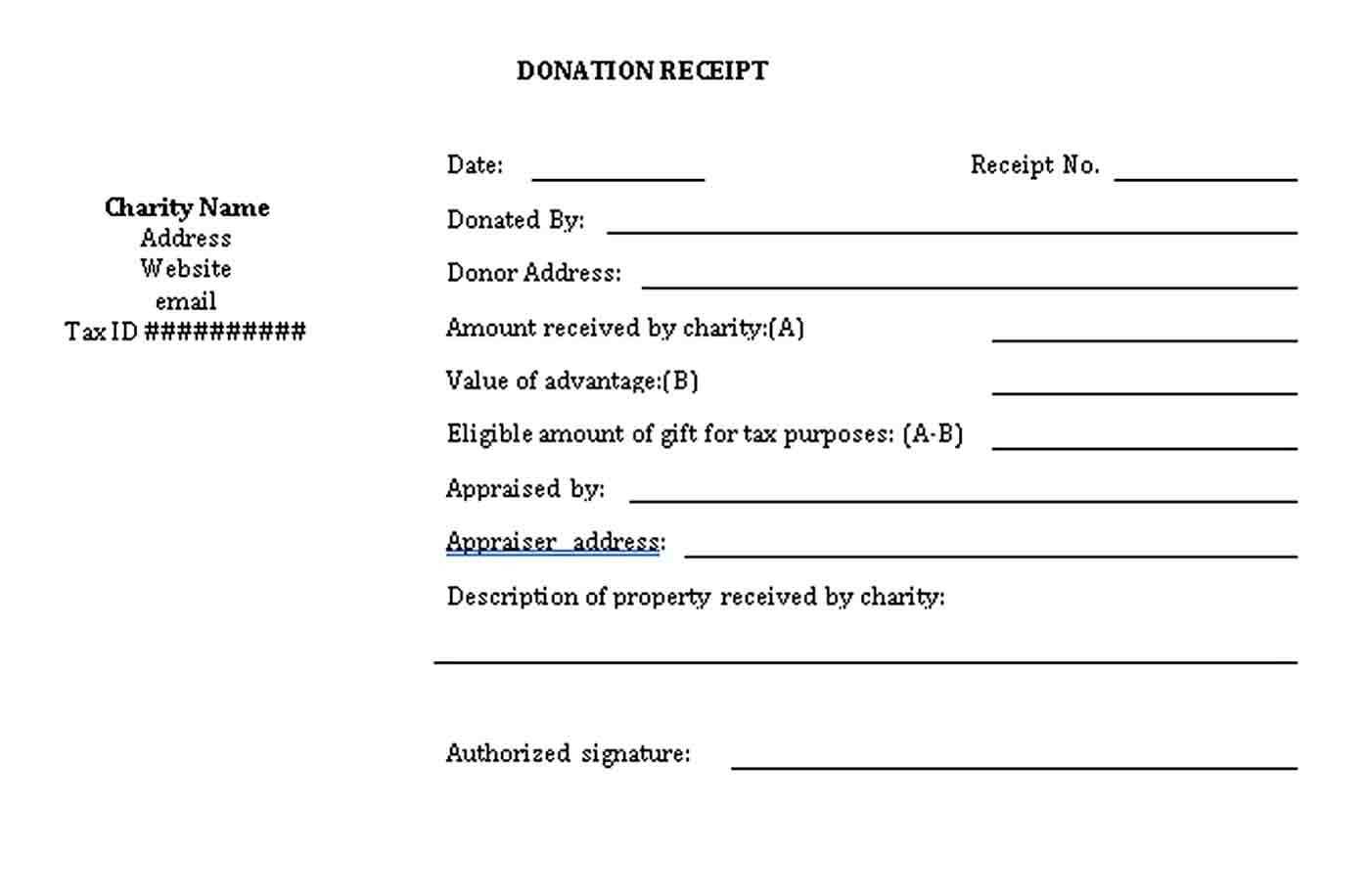

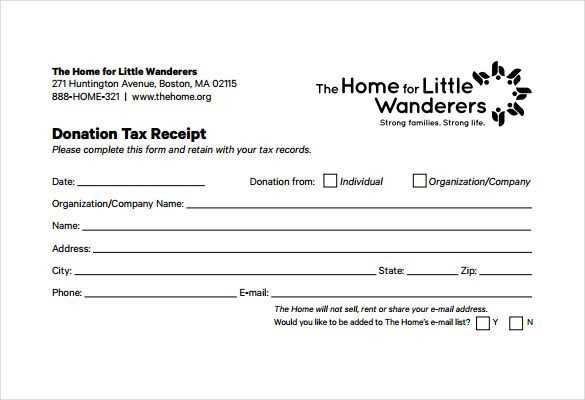

In-Kind Donation Receipt Letter Template

Provide a clear and professional acknowledgment of the donation by including the donor’s full name, contact details, and a detailed description of the contributed items. Specify the date of receipt and confirm that no goods or services were exchanged in return.

Use precise language to describe donated items, including quantity, condition, and estimated value if provided by the donor. Avoid assigning a monetary value yourself–this responsibility falls on the donor for tax purposes.

Ensure compliance with tax regulations by stating that your organization is a registered nonprofit and providing your tax identification number. Keep the letter concise, expressing gratitude while maintaining a formal and informative tone.

Sign the letter with an authorized representative’s name, title, and organization details. Retain a copy for your records and provide the donor with a physical or electronic version for their tax documentation.

Key Elements to Include in the Letter

Start with a clear statement of appreciation. Mention the donor by name and specify the donated items or services. A warm yet professional tone helps build lasting relationships.

Detailed Description of the Donation

Provide a precise description of the contributed goods or services. Avoid assigning a monetary value unless legally required. Instead, focus on the significance of the donation and how it will be used.

Tax Information and Legal Disclosures

Include a statement confirming that no goods or services were provided in exchange for the donation. If applicable, mention the organization’s tax-exempt status and provide any necessary IRS wording to ensure compliance.

Close with gratitude and a contact for any questions. A signature from an authorized representative adds credibility and a personal touch.

Formatting Guidelines for Clarity and Compliance

Use a clean and professional layout that enhances readability. Choose a standard font, such as Arial or Times New Roman, in a 12-point size. Align text to the left and maintain consistent spacing.

- Header: Include the organization’s name, address, and contact details at the top.

- Title: Clearly state “In-Kind Donation Receipt” to ensure transparency.

- Donor Information: List the full name or business name and address of the donor.

- Donation Details: Specify the donated items with descriptions, quantity, and estimated value.

- Statement of No Goods or Services: Confirm whether any goods or services were provided in exchange.

- Date: Record the date of donation to support accurate reporting.

- Signature: Include a signature or digital authorization for validation.

Use bold headers to differentiate sections, and keep paragraphs short. Avoid unnecessary jargon to ensure accessibility. Save the receipt as a PDF for easy sharing and secure record-keeping.

Common Mistakes and How to Avoid Them

Missing Key Details

A receipt must include the donor’s name, donation date, and description of the item or service. Omitting these details can make the receipt invalid for tax purposes. Double-check that all required information is present before sending.

Incorrect Valuation

Non-cash donations should not include a value assigned by the recipient. Instead, describe the item clearly and let the donor determine its worth for tax reporting. If needed, suggest professional appraisal for high-value items.

Tip: Keep copies of all receipts for record-keeping. This prevents issues if donors request verification later.