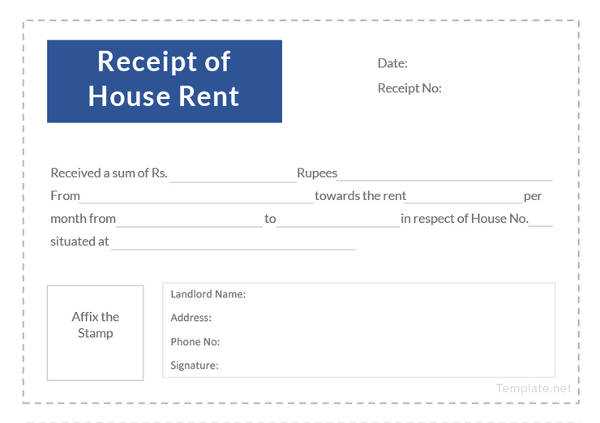

For tenants and landlords in India, a properly structured rent receipt is necessary for financial documentation and tax benefits. A monthly rent receipt serves as proof of payment, ensuring transparency in rental transactions and providing tax deductions for tenants under House Rent Allowance (HRA).

A standard rent receipt includes key details such as the tenant’s name, landlord’s name, rental amount, payment date, and property address. It should also feature the landlord’s PAN if the annual rent exceeds ₹1,00,000, as per Indian tax regulations.

For convenience, a well-structured template simplifies the process, reducing errors and ensuring compliance with legal requirements. Digital or printed formats are both acceptable, but a signed copy is preferable for authenticity.

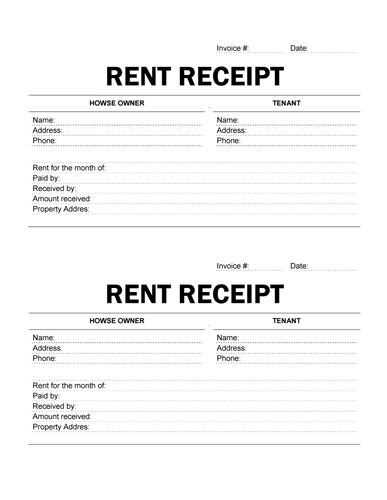

Using a pre-designed format not only saves time but also ensures that all necessary elements are included. Whether for personal record-keeping or official use, a structured template helps streamline rental transactions efficiently.

Here is the revised version with reduced word repetition:

For a well-structured rent receipt template, ensure you include the tenant’s name, address, rent amount, and payment date. Clearly mention the rent period covered by the payment, specifying the start and end dates. This helps avoid confusion and provides transparency for both parties.

Key Elements in a Rent Receipt Template

A concise template should contain the following:

| Field | Description |

|---|---|

| Tenant’s Name | Full name of the individual paying rent. |

| Property Address | Location of the rented property. |

| Rent Amount | Exact payment made by the tenant. |

| Payment Date | The date when the rent was paid. |

| Rent Period | Time span covered by the rent payment (e.g., January 2025). |

| Landlord’s Name | Name of the person receiving rent. |

| Signature | Signature of the landlord or authorized representative. |

Formatting Tips

Use a clear, professional font to ensure readability. Keep the template simple, but ensure all necessary fields are included. Avoid overloading the document with excessive information. Stick to the essentials for easy reference.

- Monthly Lease Payment Slip Format India

For creating a monthly lease payment slip in India, include the following elements to ensure clarity and legal validity:

Required Information

- Tenant Name: Clearly mention the tenant’s full name as per the agreement.

- Landlord Name: Include the landlord’s full name or property owner’s details.

- Lease Property Address: Specify the rental property’s address to avoid confusion.

- Payment Amount: State the exact rent amount for the month. Mention if any additional charges like maintenance or utilities are included.

- Payment Date: Indicate the date on which the payment was made.

- Mode of Payment: Specify whether the payment was made by cheque, bank transfer, cash, or any other method.

- Lease Period: Mention the duration of the lease for clarity.

- Receipt Number: Include a unique receipt number for reference in future communications.

Formatting Tips

Ensure the slip is formatted professionally. Use clear headings and bullet points for easy reading. A clean, straightforward layout will help prevent disputes or confusion. If using a digital format, include all details in a PDF or Word document for easy sharing and record-keeping.

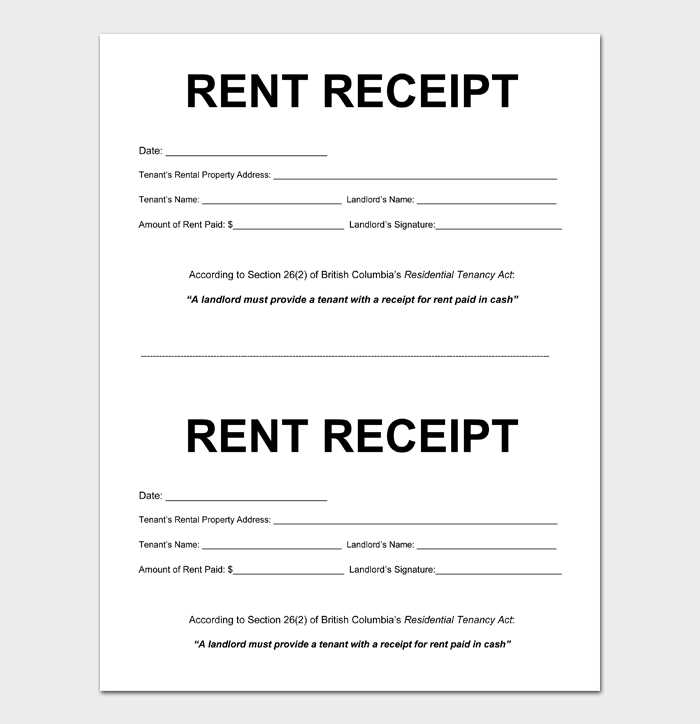

In India, rental receipts are vital for both landlords and tenants to maintain transparency and avoid disputes. A rental receipt serves as proof of payment, and its legal validity depends on accurate details. Ensure that the receipt includes the full name and address of both parties, the property address, the rent amount, and the payment date. It’s also advisable to mention the period for which the payment covers (e.g., monthly, quarterly).

Inclusion of GST Information

When applicable, it is necessary to mention Goods and Services Tax (GST) in the receipt. For rent exceeding ₹20,000 per month, GST registration is mandatory for landlords. Ensure that the GSTIN is clearly stated in the receipt if this applies. Without this, the receipt may not be valid for tax purposes.

Importance of Signature

For added legitimacy, both the tenant and the landlord should sign the receipt. This signature confirms that both parties agree on the details mentioned. Without a signature, the receipt may not be recognized in legal or tax-related matters. Electronic signatures are also acceptable in some cases, but it’s important to check the specific legal requirements in your area.

Ensure that your receipt reflects all necessary details. Include the rent amount, due date, and the payment method. If you allow partial payments or late fees, clearly mention these terms in the receipt format. Adjust the fields to match your lease agreement, such as security deposits or advance payments. Add sections for tenant information like name and address, and also the landlord’s contact details for clarity. Customize the receipt by including a section for remarks or additional notes, which can be helpful in case of disputes. Finally, ensure the receipt is easy to read and doesn’t contain unnecessary information that could confuse either party.

Ensure all tenant and landlord details are clearly mentioned, including full names, addresses, and contact information. Missing or incorrect details can lead to confusion or disputes later on.

Incorrect Rent Amount or Payment Terms

Double-check the rent amount and payment schedule. Any discrepancies in the agreed-upon amount or payment dates can cause issues between the parties. Clearly state the rent amount, the due date, and the method of payment.

Failure to Specify Duration of Lease

Clearly mention the start and end dates of the lease agreement. Failing to define the duration can lead to misunderstandings about the lease period, especially in the case of renewing or terminating the contract.

Do not forget to outline the consequences of late payments or missed payments. These terms should be explicitly stated in the agreement to avoid conflicts down the line.

Ensure clarity in the structure of your rent receipt by organizing it systematically. Start with the tenant’s name, followed by the property address. Clearly state the rent amount, the period it covers, and the payment date. Include payment methods such as cash, cheque, or bank transfer for transparency. Always mention the landlord’s details for verification purposes, including contact information.

- Tenant’s Name

- Property Address

- Rent Amount

- Payment Period

- Payment Date

- Payment Method

- Landlord’s Contact Information

For added accuracy, include the due date for the next rent payment and any late fee policies if applicable. If the rent receipt is for partial payments, note the balance remaining. Always provide a receipt number to track payments efficiently.

- Next Rent Due Date

- Late Fee Information

- Partial Payment and Balance

- Receipt Number

Use a clear, readable font and include spaces for signatures from both parties, if necessary. Consider creating a template for regular use, ensuring it’s up to date with local laws and tax requirements.