If you’re looking to create a quick and easy check receipt, a free template can save you time and effort. These templates provide a ready-made format, allowing you to simply fill in the necessary details such as the payer’s name, amount, and date. With minimal effort, you can have a professional receipt at your fingertips.

Most free check receipt templates are customizable, meaning you can adjust the design to suit your needs. Whether you’re managing personal transactions or handling business payments, a template lets you focus on the details that matter, without worrying about formatting. It’s a straightforward tool for anyone who needs a reliable record of payments.

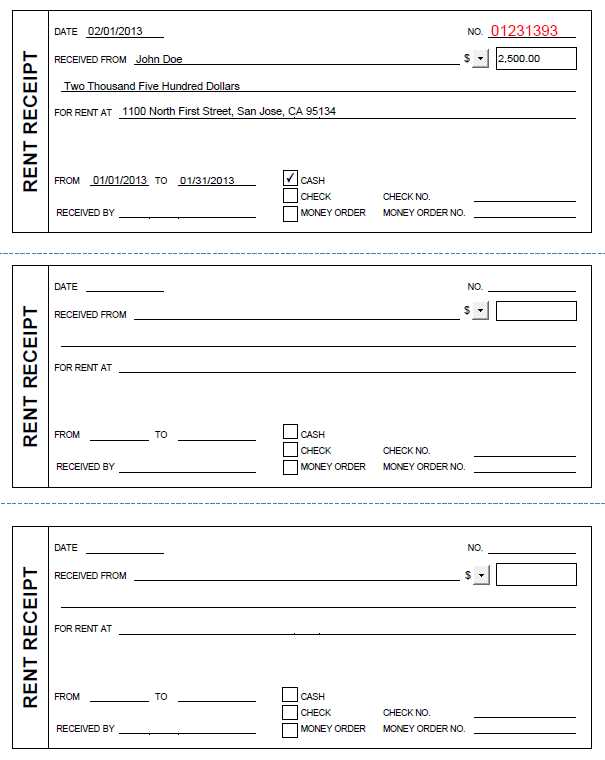

Finding the right template is easy, and many options are available in various formats such as Word, PDF, and Excel. You can even print out hard copies for offline use, making them convenient for different scenarios. Whether it’s for rent, loans, or other types of payments, a well-designed receipt template offers clarity and organization.

Here’s the revised version where each word repeats no more than 2-3 times:

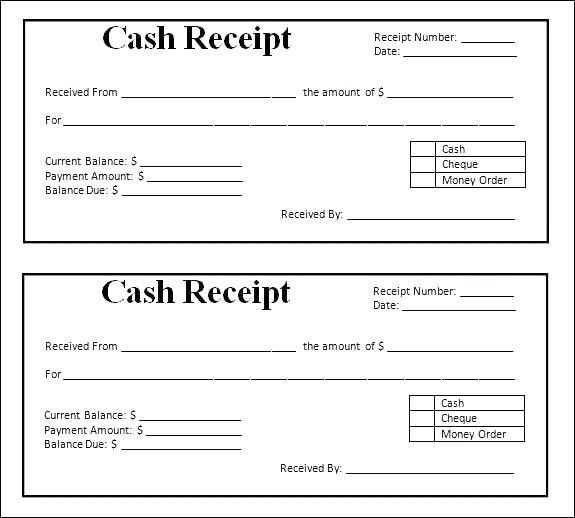

Use a simple template that includes key information. Include the name of the payer, amount, date, and items purchased. For clarity, make sure the total amount is clearly visible. Place your company or personal information at the top, followed by the receipt details.

Keep it short–avoid lengthy descriptions. If you offer multiple payment methods, list them briefly. If the payment method affects the price, highlight this in a separate section to keep things organized.

Make sure to include a unique receipt number for easy tracking. It’s also useful to include your contact details for any questions. Ensure the receipt looks professional by using a clear, legible font.

In case of refunds or exchanges, have a designated spot for these notes. This will help avoid confusion later. Keep your template flexible enough to adjust to different needs, but always include the basic details for clarity.

Free Check Receipt Template

If you’re looking for a simple and clear way to document check payments, using a free check receipt template is the best solution. Here’s how you can create one that’s both functional and straightforward.

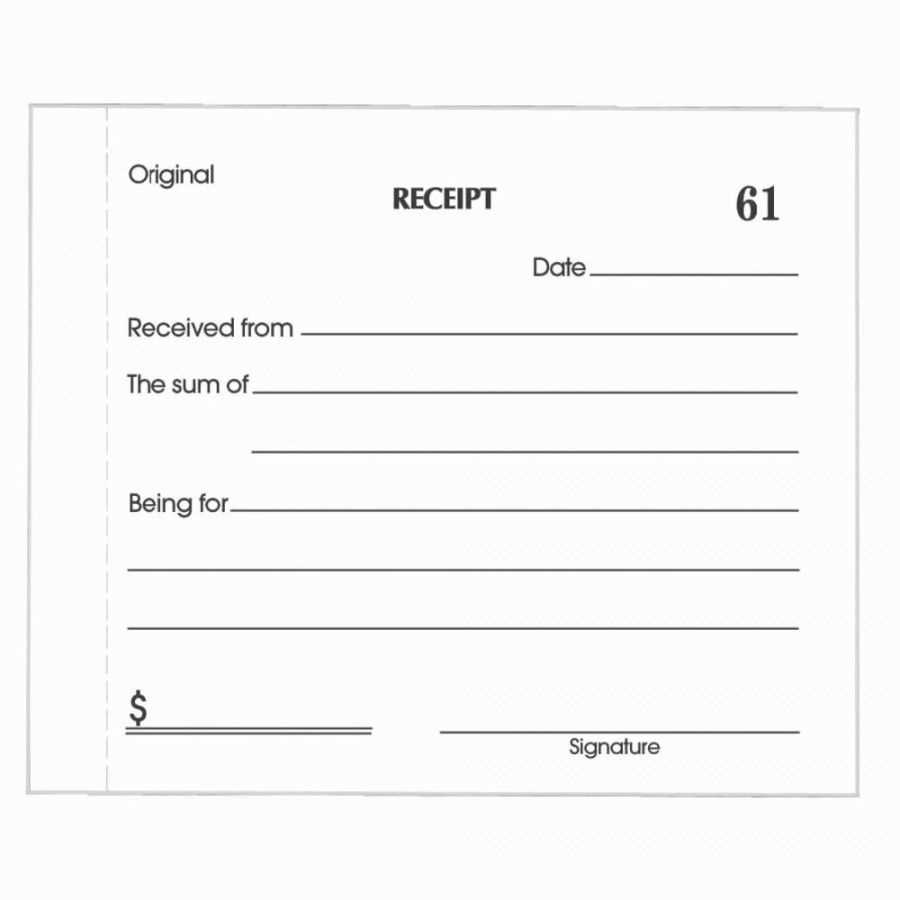

- Date of Transaction: Always start by including the date when the check was issued. This provides a clear reference point for both the payer and the recipient.

- Payee Information: Include the name of the person or business receiving the check. This ensures the recipient can easily track payments and identify their receipts later.

- Check Number: List the check number for accurate tracking. This helps with future follow-ups or bank inquiries.

- Amount Paid: Clearly write the amount the check is for, both in numbers and words, to prevent any confusion.

- Signature: Have a space for the payer’s signature to validate the receipt. This confirms the transaction took place.

- Purpose of Payment: Briefly note the reason for the payment. This adds context to the receipt, especially if it’s for a specific service or product.

- Additional Notes: Leave space for any other relevant information that may be needed for record-keeping or clarification.

Using a free template ensures you can customize the details while saving time. It also guarantees that you cover all necessary information for a valid transaction receipt.

Focus on personalizing your receipt template with your business details first. Add your company name, logo, address, phone number, and website at the top of the template. This ensures your receipts reflect your brand’s identity and provide customers with key contact information.

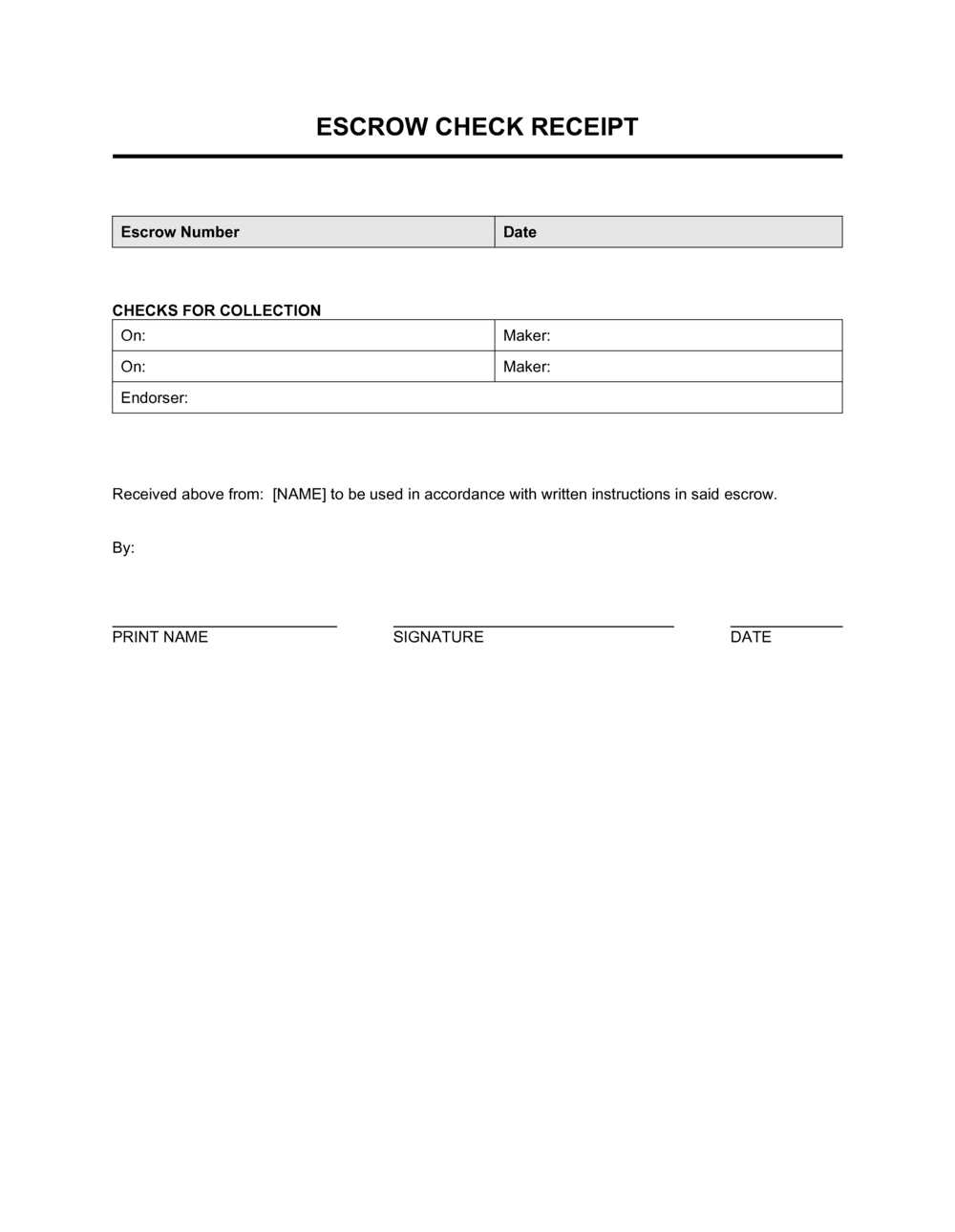

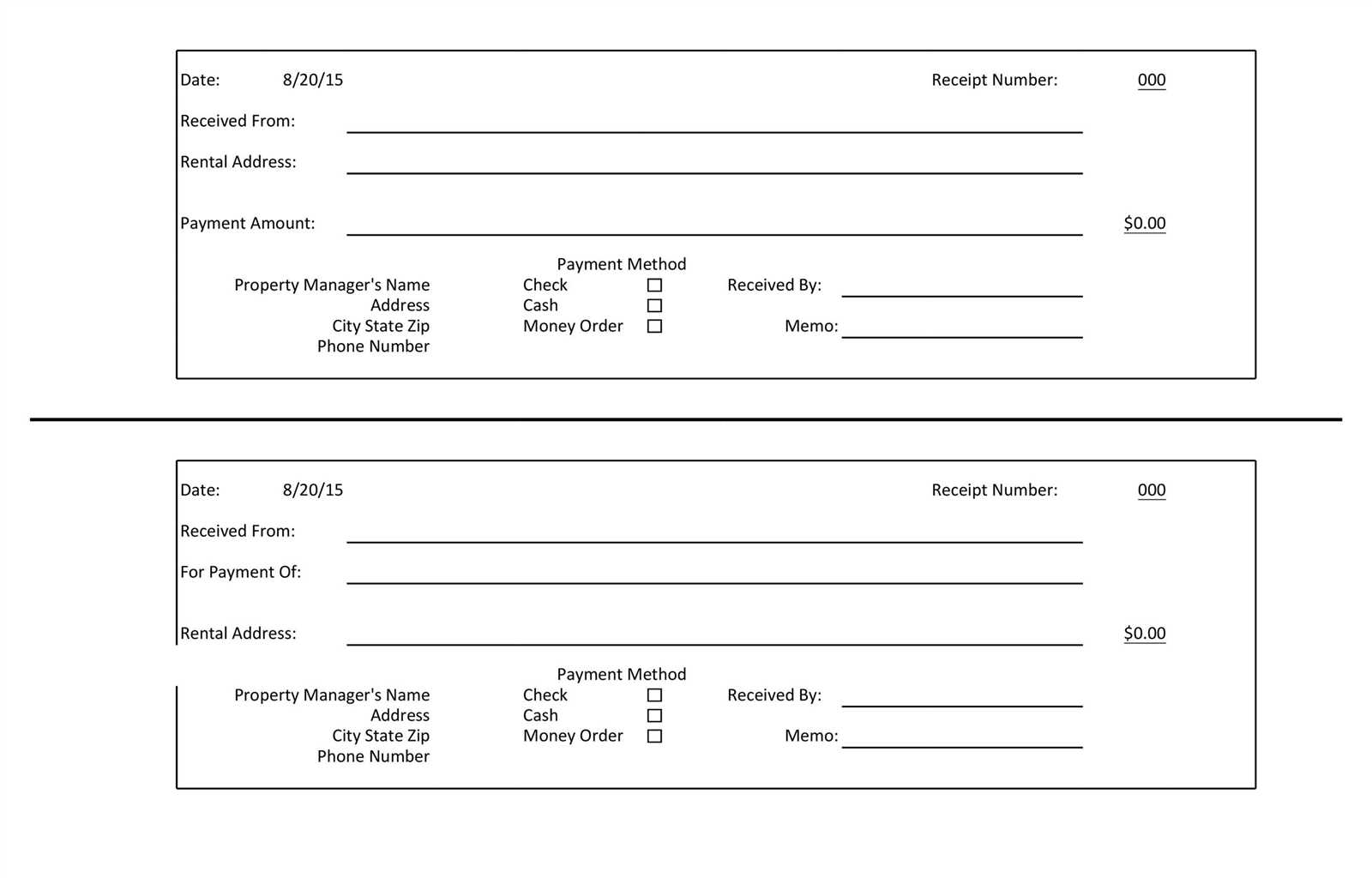

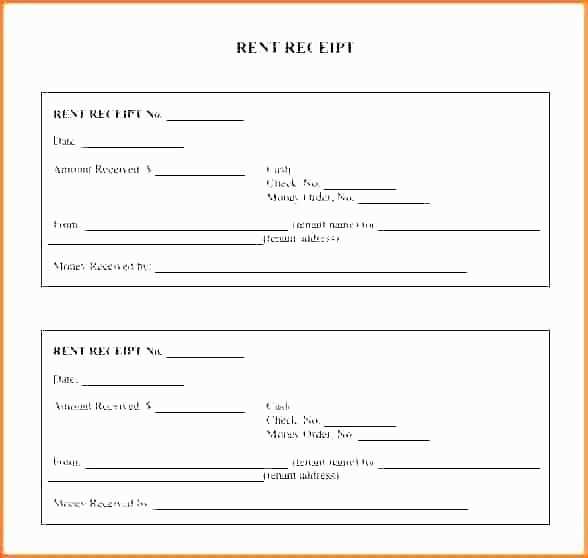

Next, modify the layout to include fields relevant to your transactions. Include sections for the date, transaction number, itemized list of products or services, quantities, prices, taxes, and totals. You can also integrate a payment method field to track whether a transaction was made via cash, credit card, or other methods.

Consider adjusting fonts and colors to match your business’s aesthetic, creating a more cohesive brand experience. Ensure readability by using clear, easy-to-read fonts and appropriate font sizes. Keep the color scheme simple–use colors that align with your logo, but avoid overwhelming the receipt with too many hues.

Make space for custom notes or terms and conditions at the bottom of the receipt. This section can be used for return policies, discounts, or personalized messages for repeat customers. These little touches can make a receipt feel more personal and professional.

Finally, ensure that your receipt template is compliant with local laws. Include any necessary tax information, business registration numbers, or disclaimers that may be required in your area.

One of the best places to find trustworthy check receipt templates is through dedicated online template platforms like Canva or Template.net. Both offer a wide selection of customizable templates that cater to various needs. Canva, for example, provides easy-to-use drag-and-drop tools for creating personalized check receipts without requiring graphic design experience.

If you’re looking for simplicity, sites like Vertex42 and Office Templates provide downloadable Microsoft Word or Excel check receipt templates. These templates are straightforward and ready to use, ensuring a hassle-free experience for those who prefer offline editing.

For those in need of more tailored options, consider browsing niche websites like Invoiced or 123FormBuilder. These platforms focus on invoice and receipt generation, offering templates that can be adjusted for check receipts with professional design elements.

Additionally, some accounting software, such as QuickBooks and FreshBooks, offer check receipt templates that integrate with their broader invoicing systems. These can be an excellent choice for businesses that require a seamless connection between receipt generation and financial record-keeping.

Whether you’re searching for free or premium templates, these platforms provide various options that can meet different business or personal needs.

Double-check the date and time of each transaction. An incorrect timestamp can lead to discrepancies in your records. Ensure that the template has a clear field for this information, and update it right away after each transaction.

Include all relevant details for every purchase, such as the item description, quantity, unit price, and total cost. This ensures your records match the original transaction and can be easily cross-referenced later.

Use consistent terminology across receipts. If you’re using abbreviations, make sure they’re standardized to avoid confusion. Clear, recognizable language will make it easier to review records and prevent misinterpretations.

Regularly back up your receipts, whether digitally or physically. Storing them securely ensures that you can retrieve any transaction data you need at any point. Consider setting up an organized folder system or cloud storage for easy access.

Pay attention to tax details. Including accurate tax amounts on each receipt will prevent future errors in your financial reports. If your template doesn’t have a field for taxes, add one to keep everything aligned with local tax rules.

Ensure the template includes a section for payment method. This will make it easier to track how each transaction was processed, which is especially helpful for reconciling accounts later.

Always print or save a copy of the receipt right after issuing it. This eliminates the risk of losing any crucial information before it can be recorded accurately.

If you’re looking to create a check receipt template, focus on simplicity and accuracy. Make sure the template includes all necessary fields like the check number, date, payer and payee details, payment amount, and a description of the transaction.

Use a clear structure: Start with a title like “Check Receipt” at the top. Then, provide space for the payer’s name, address, and contact details. Include a section for the check number, issue date, and payment amount in both numerical and written form. End with a space for any notes or additional information regarding the payment.

For better readability: Divide the sections into clear rows or columns. This will help both parties easily find the relevant information. Use lines or boxes to separate each field and keep the design straightforward.

Don’t forget legal details: Depending on your location, you may need to include specific wording regarding the acceptance or legal implications of the check. Ensure that the terms are clearly stated to avoid any confusion later.

Keep your check receipt template in a digital format, such as a Word document or PDF, so it can be easily updated and printed as needed. Templates like these save time and maintain consistency across transactions.