Creating a tax receipt for a child care center requires clear, accurate details to ensure parents can use the receipt for tax deductions. The key information should include the child care provider’s name, address, and tax ID number, as well as the total amount paid by the parent during the year. It’s vital to list specific dates of service and break down charges, such as tuition and additional fees, for transparency.

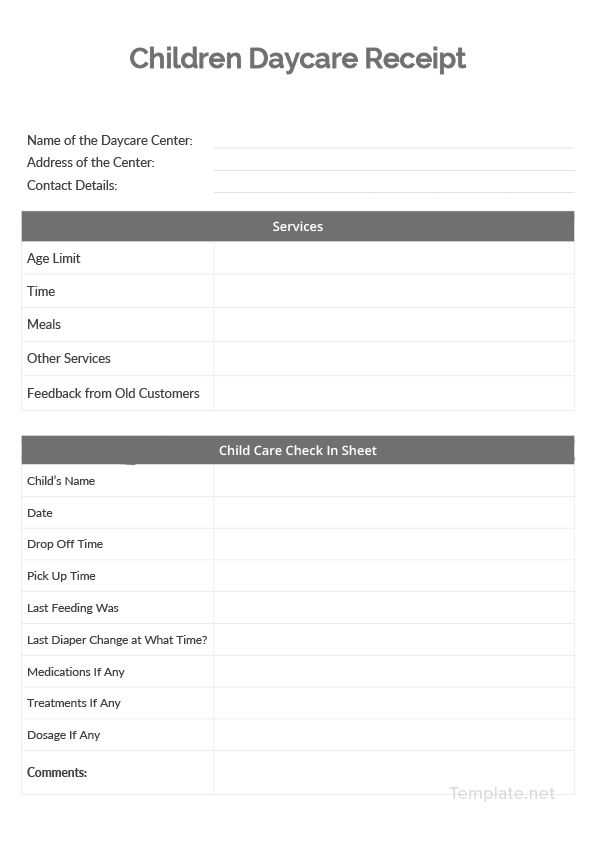

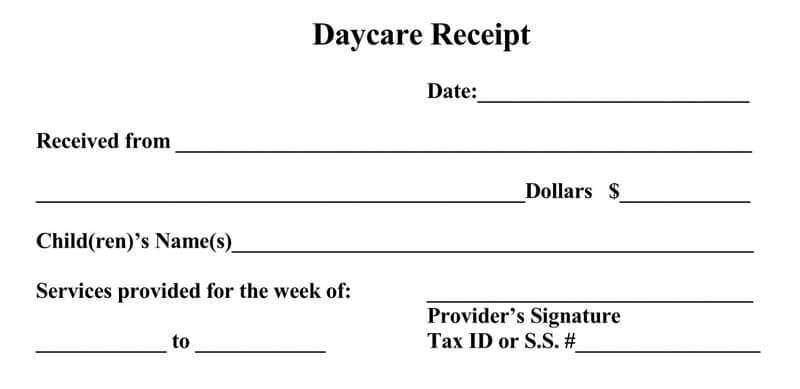

Use a simple template format that organizes this information logically. The receipt should be easy to read and provide all the necessary details for tax purposes. Include space for the parent’s name, the child’s name, and a clear statement that the payment was for child care services. A footer with a disclaimer about the receipt’s role in tax filings can also be beneficial.

Ensure that the template allows for easy customization, so parents can request updated receipts as needed. You may also want to include fields for specific programs or care services to clarify what is being deducted. Consistency in formatting makes the process smoother for both providers and families.

Child Care Center Tax Receipt Template

For a child care center tax receipt template, make sure to include the following key details:

- Child Care Center Name: Clearly state the full name of the facility.

- Tax Identification Number (TIN): Include the unique TIN to validate the receipt.

- Parent/Guardian Name: Include the name of the person paying for the child’s care.

- Service Description: Specify the type of care provided, such as full-time or part-time care.

- Payment Dates: List the specific dates the payments cover.

- Amount Paid: Clearly state the total amount paid for the period.

- Receipt Date: Indicate the date the payment was received.

- Signature: Include a signature or a printed name of the authorized individual from the child care center.

Each of these elements ensures transparency and allows parents or guardians to use the receipt for tax purposes. The document should be clear, organized, and easy to follow for both the care center and the individual receiving the care. For accurate tax deductions, a properly formatted receipt is key.

How to Create a Tax Receipt for Child Care Services

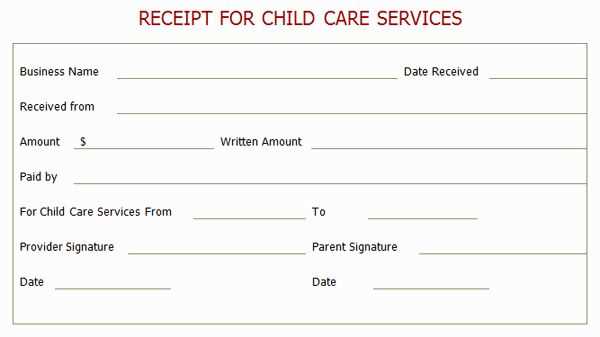

Include the full name and address of the child care provider at the top of the receipt. This helps clearly identify the service provider.

Next, add the recipient’s name, and specify the child(ren)’s names, ensuring the connection to the services provided is clear. This adds transparency to the transaction.

List the dates for which services were provided, including the start and end dates for the period covered by the receipt. Make sure these are accurate and consistent with your records.

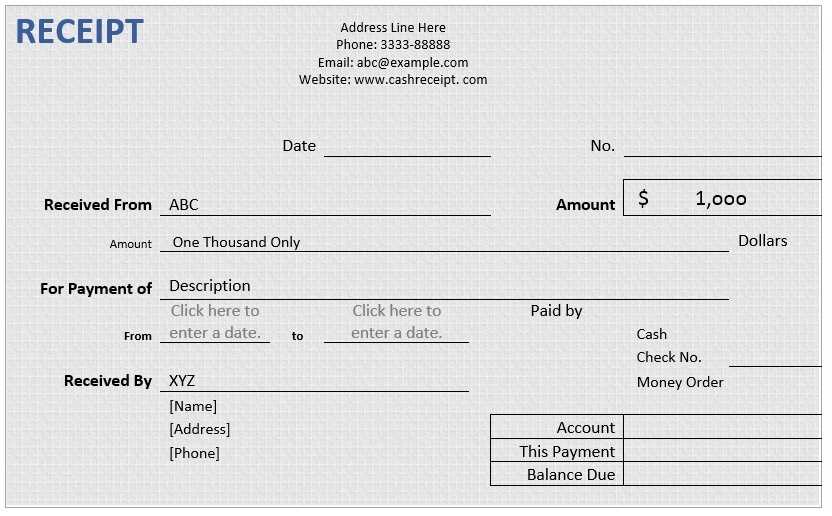

Detail the amount paid, breaking down any separate charges if applicable, such as daily rates, meal fees, or special services. Itemization prevents confusion.

Include the total payment amount, showing clearly any discounts or adjustments that were applied. This transparency helps avoid misunderstandings.

Specify the method of payment, whether it was cash, check, or another method. This helps maintain a clear financial record for both parties.

State your business’s tax identification number (TIN) or employer identification number (EIN), which is necessary for tax reporting. Without this, the receipt is incomplete for tax purposes.

Finally, sign the receipt, indicating that it was issued by the provider. This adds an official touch to the document and confirms its legitimacy.

Key Information to Include in a Child Care Tax Receipt

To ensure your tax receipt is accurate and useful, make sure it includes these critical details:

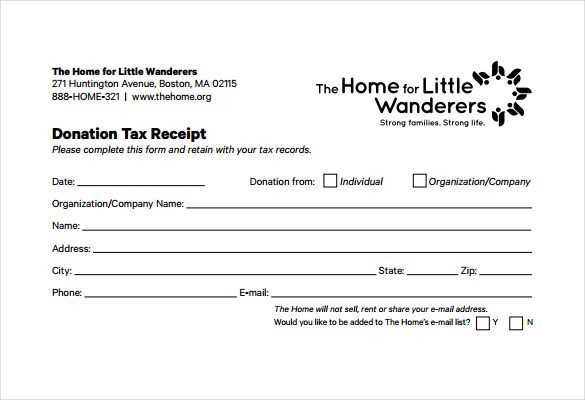

- Provider’s Name and Contact Information: Include the full name of the child care provider or facility, along with their contact details, such as address, phone number, and email address.

- Tax Identification Number (TIN): The provider’s TIN or Employer Identification Number (EIN) is required for tax reporting purposes.

- Child’s Name and Dates of Service: Clearly list the name of the child receiving care and the specific dates or months during which the services were provided.

- Amount Paid: Specify the total amount paid for child care services, broken down by month or week if applicable.

- Care Type: State whether the care was full-time, part-time, after-school, or any other relevant description of the service provided.

- Payment Method: Include how the payment was made, such as via check, cash, or credit card.

- Provider’s Signature: The receipt should be signed by the provider to confirm the payment and services rendered.

- Year of Service: Clearly indicate the tax year for which the receipt applies.

Make sure this information is clear and legible to avoid delays when filing taxes.

How to Format and Customize the Template for Different Clients

Begin by adjusting the header section to include the client’s name and contact details. This ensures the tax receipt is personalized and professional from the start. Replace the standard placeholders with client-specific information such as their business name, address, and registration number.

Customize Itemized Services

Modify the list of services or products provided, tailoring each item to the client’s offerings. Use clear descriptions of services provided, dates of care, and the rate charged for each. Be sure to categorize services if needed, such as “Child Care,” “Educational Support,” or “Meals.” This makes it easy for clients to track and understand the breakdown.

Adjust the Tax Information

Each client may have different tax structures depending on location and tax laws. Adjust the tax rate or include applicable tax deductions, ensuring the correct percentage is applied to the subtotal. If the client is exempt from certain taxes, make sure to note this and adjust the total amount accordingly.

Finally, customize the footer with a thank-you message or any special notes the client may require. You may also want to add payment methods or relevant refund policies, which will further align the template with the client’s needs.