A well-structured remittance receipt template ensures clear documentation of payments, whether for business or personal transactions. It should include key details such as the payer and payee information, transaction date, payment amount, and reference numbers. Providing this document helps maintain financial transparency and serves as proof of payment.

To create a reliable template, include these elements:

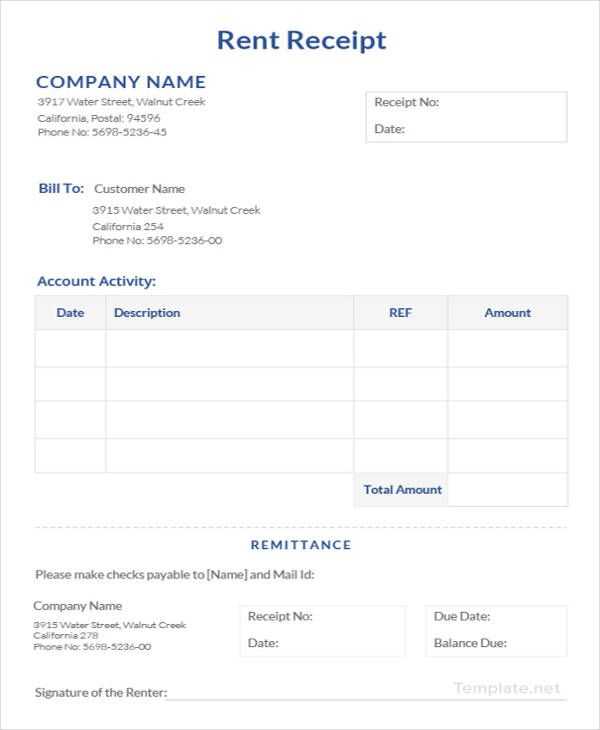

- Header: Clearly state “Remittance Receipt” at the top.

- Payer & Payee Details: Full names, addresses, and contact details.

- Transaction Information: Amount, currency, payment method, and date.

- Reference Number: A unique identifier for easy tracking.

- Notes or Purpose: Optional but useful for specifying the reason for the transaction.

- Authorized Signature: Digital or handwritten for verification.

Using a standardized format reduces errors and ensures compliance with record-keeping requirements. Whether you’re a freelancer, small business owner, or financial administrator, a structured receipt template simplifies transaction management.

Here’s the corrected version with unnecessary repetitions removed:

When creating a remittance receipt template, focus on clarity and simplicity. Start by including the sender’s and recipient’s names, the transaction amount, and the date. Ensure that each section is clearly labeled without redundancy. For example, avoid repeating “payment” or “transfer” multiple times throughout the template. Use concise wording like “Transaction Amount” instead of “Total Payment Amount” and “Date of Payment” instead of over-explaining the date’s context. This helps maintain readability and professionalism.

Key Sections to Include

1. Sender’s Information: Name, address, and contact details.

2. Recipient’s Information: Name, address, and contact details.

3. Transaction Information: Amount, currency, date, and any reference number.

Tips for Clear Formatting

Avoid cluttering the receipt with excessive details. If a reference number or transaction ID is available, include it once and make sure the field is prominent. Organize information logically so the recipient can quickly understand the details without scanning through repetitive sections. Keep your font legible and align your text neatly to improve the document’s readability.

- Remittance Receipt Template

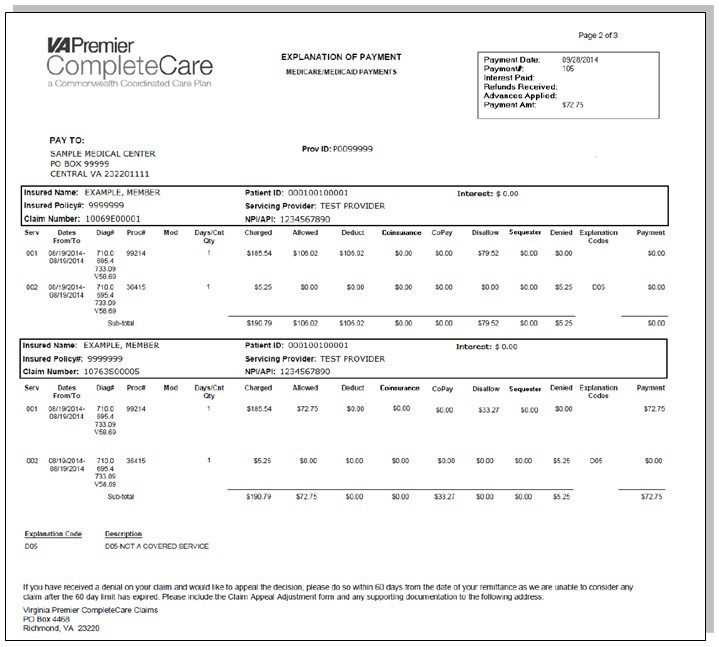

A remittance receipt template should clearly outline the payment details to avoid confusion. Make sure to include the payer’s name, the recipient’s name, the payment amount, and the date of the transaction. Add a reference number or invoice number to track payments efficiently.

The template should also contain a section for the payment method, whether it’s a bank transfer, check, or online payment. This provides clarity on how the transaction was processed. If relevant, include any additional fees or adjustments related to the payment.

Finally, provide space for both the payer and the recipient to sign, confirming the transaction. This adds a layer of authenticity to the document and serves as proof of the exchange. Keeping the template concise yet complete ensures that all necessary information is included without overwhelming the reader.

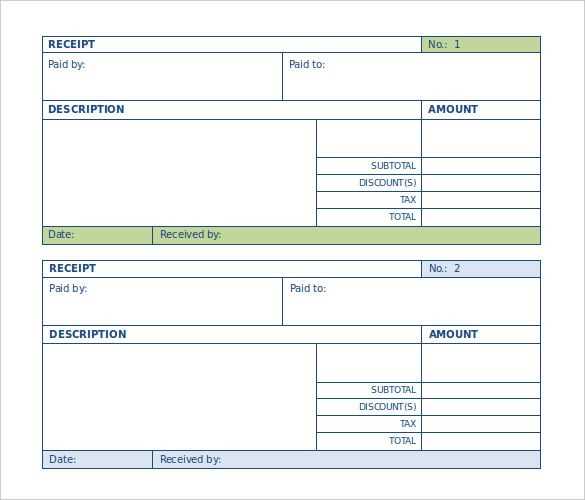

Ensure each receipt template includes the sender’s and recipient’s full details. Include names, addresses, phone numbers, and email addresses where applicable. This guarantees that all parties involved can be contacted easily if needed.

Transaction Details

Include the transaction date and the method of payment. Be clear about whether the payment was made via bank transfer, cash, or another method. This gives a transparent record of the transaction for both parties.

Amount and Currency

Specify the exact amount received and the currency used. If multiple currencies are involved, show both amounts and clarify which currency is being used. This ensures there’s no confusion about the value of the transaction.

Include a unique receipt or transaction number for tracking purposes. This number should be easily distinguishable and unique to each transaction, allowing easy reference for future inquiries.

For clarity, describe the purpose or nature of the payment. Include information about what the payment was for, such as a product, service, or deposit. This will reduce potential disputes over what the payment covered.

Lastly, ensure the receipt template includes a space for any additional notes. This section can accommodate additional information such as terms and conditions, or any relevant reminders specific to the transaction.

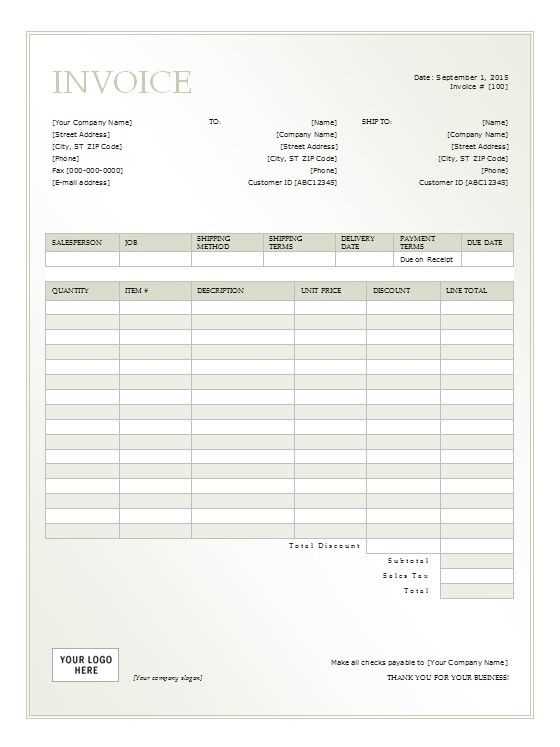

Customize your remittance receipt to reflect the specific requirements of various payment methods. This enhances clarity and professionalism in transactions.

1. Adjust Payment Details

- Include relevant transaction information, such as transaction ID, payment processor name, and method (e.g., wire transfer, PayPal, credit card).

- For cryptocurrency, add wallet addresses and transaction hashes.

2. Modify Layout for Visual Appeal

- Use icons representing each payment method for instant recognition.

- Ensure the layout is consistent but flexible to accommodate different information sizes.

By tailoring the receipt format for each payment method, you ensure recipients easily understand their transactions. This approach promotes transparency and trust.

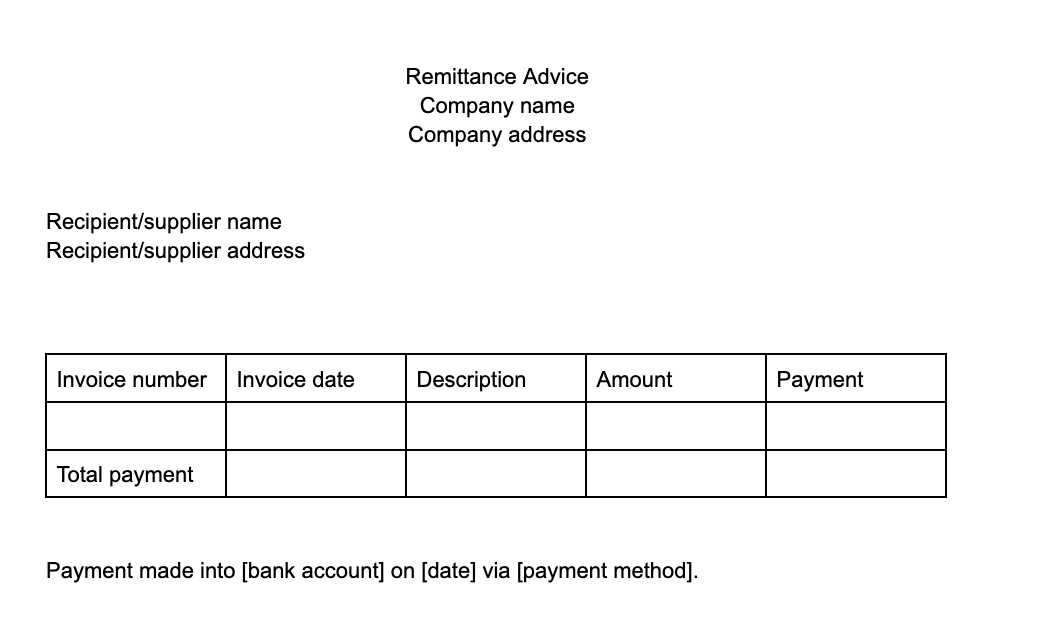

Ensure that receipts are clearly itemized, detailing each transaction’s components. This clarity aids in compliance with tax regulations and simplifies record-keeping for both personal and business accounts. Accurate documentation helps avoid discrepancies during audits.

Maintain a consistent format for receipts to facilitate easier tracking and organization. Include essential information such as the date, amount, payer’s information, and purpose of the transaction. This standardization assists accountants in processing financial records swiftly.

Be aware of the specific legal requirements governing receipts in your jurisdiction. Different countries may have varying laws regarding what constitutes a valid receipt. Familiarize yourself with these regulations to ensure that your receipts meet all necessary legal standards.

Utilize digital receipt storage solutions for efficient organization. This approach not only saves physical space but also enhances accessibility. Digital records can be quickly retrieved when needed, making it simpler to provide documentation during tax filings or audits.

Consider consulting with a tax professional or accountant to ensure your receipt practices align with current laws and accounting standards. Their expertise can provide insights tailored to your specific financial situation, ensuring compliance and optimal record management.

| Receipt Element | Description |

|---|---|

| Date | The date when the transaction occurred. |

| Amount | Total cost of the transaction, including any applicable taxes. |

| Payer Information | Name and contact details of the individual or business making the payment. |

| Purpose | Brief description of what the payment is for. |

Regularly review your receipt management process to identify areas for improvement. Streamlining this system can enhance overall financial clarity and efficiency.

Include a clear header on your remittance receipt to identify it easily. Start with the title “Remittance Receipt” prominently displayed at the top. This ensures recipients recognize the document immediately.

Provide the sender’s details, such as full name, address, and contact information. This information establishes the origin of the funds and builds trust.

Next, outline the recipient’s information, including name and address. This section confirms who will receive the funds and prevents any confusion.

Clearly indicate the transaction date. This helps both parties track the payment and is vital for accounting purposes.

Detail the amount sent, including the currency. This avoids misunderstandings and allows for easy verification of the transaction.

Consider adding a unique transaction reference number. This feature aids in tracking and provides a point of reference for any inquiries.

Lastly, ensure the document has a professional layout with ample space between sections for clarity. A well-organized receipt reflects professionalism and care.