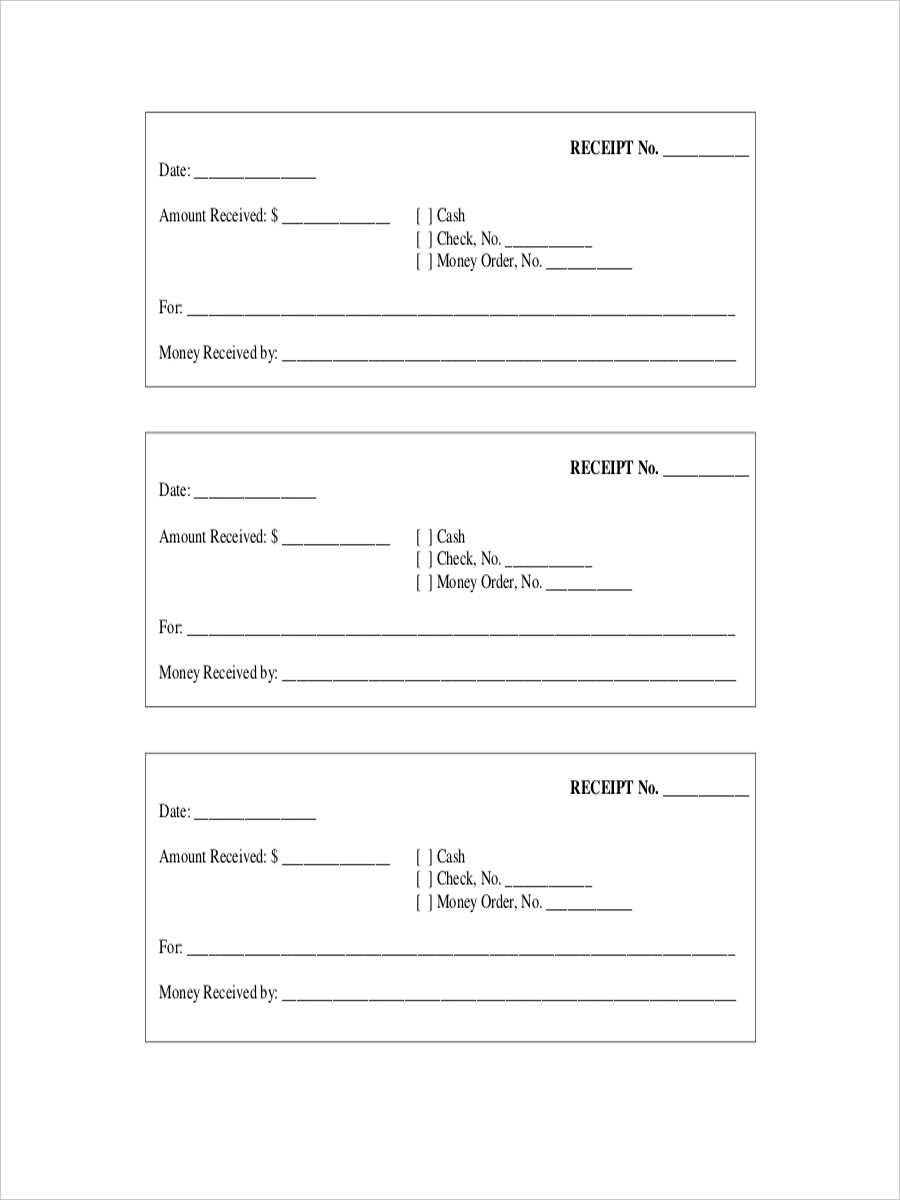

If you need a blank official receipt template, you’re in the right place. A receipt is an important document for both businesses and customers, confirming that a transaction has taken place. It’s vital to include the right information, such as the transaction amount, date, and the parties involved. Use a simple yet clear template to avoid confusion and ensure consistency across all your receipts.

First, make sure to include fields for the company name, address, and contact details at the top. Below that, there should be space for the transaction date and a unique receipt number for tracking. The amount received, payment method, and a description of the goods or services exchanged should follow. For added clarity, include a section for any taxes or additional fees applied.

Using a blank official receipt template saves time and ensures that all necessary details are captured correctly. This format is easy to adjust based on your business needs. With a well-organized receipt, both parties will have clear proof of the transaction, which is useful for record-keeping, returns, or accounting purposes.

Sure, here’s a refined version of your lines with minimized repetition:

To create a blank official receipt template, focus on clarity and structure. Include key details such as the date, transaction amount, and service provided. Use placeholder text like “[Customer Name]” and “[Amount]” to make customization easy. Ensure the layout is clean, with adequate spacing between sections for readability.

Limit the use of design elements to enhance usability. A simple, professional font such as Arial or Times New Roman ensures the document looks formal and is easy to read. Avoid unnecessary graphics or decorations that could detract from the purpose of the receipt.

Make sure the template includes a clearly labeled area for signatures if needed. This helps confirm the transaction’s legitimacy. Consider adding a footer with your company’s contact information for future reference.

Key components:

– Date of issue

– Transaction amount

– Service or goods description

– Customer information placeholder

– Signature area (optional)

– Footer with company contact

Keep the format consistent across all receipts to maintain professionalism. Regularly update the template if there are changes in legal requirements or company policies.

- Blank Official Receipt Template

To create a functional and professional blank official receipt template, follow these steps:

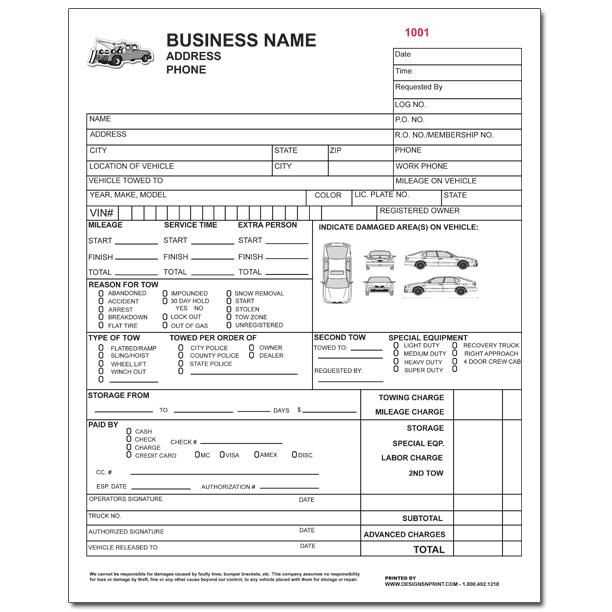

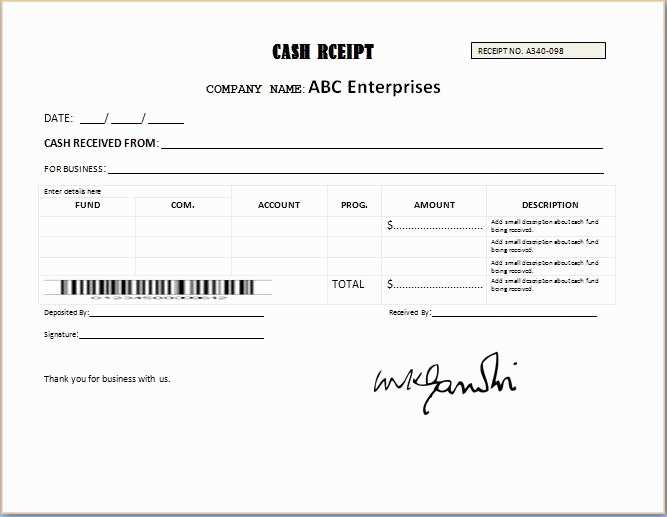

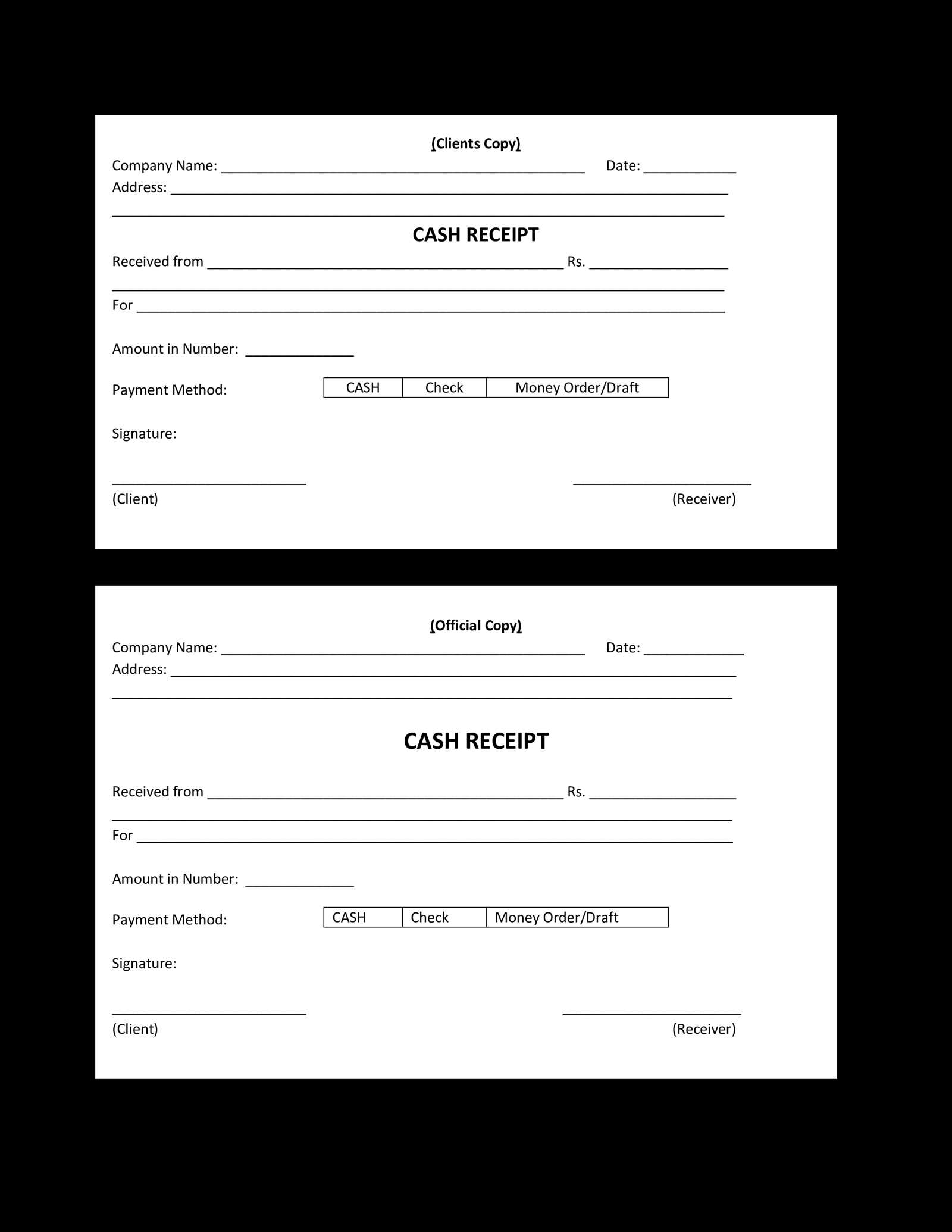

- Header: Include the company or individual’s name, logo, and contact details such as phone number or email address. This establishes credibility and provides easy contact options.

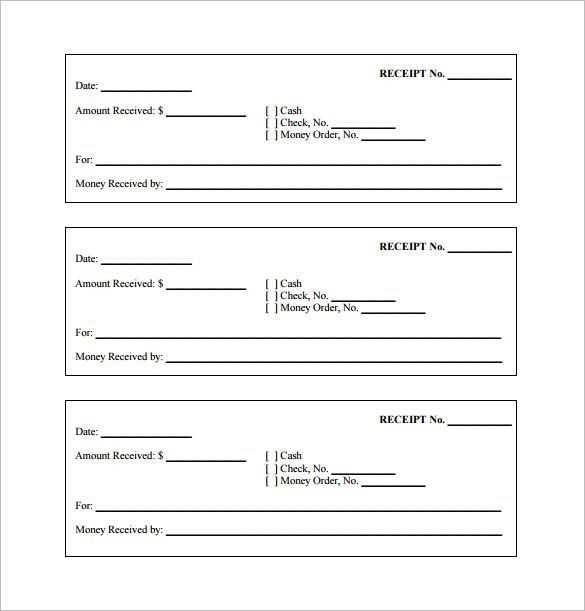

- Receipt Number: Generate a unique number for each receipt to maintain organized records. This can be sequential or based on a custom numbering system.

- Date of Issue: Clearly state the date when the payment was made. This is crucial for future reference and accounting purposes.

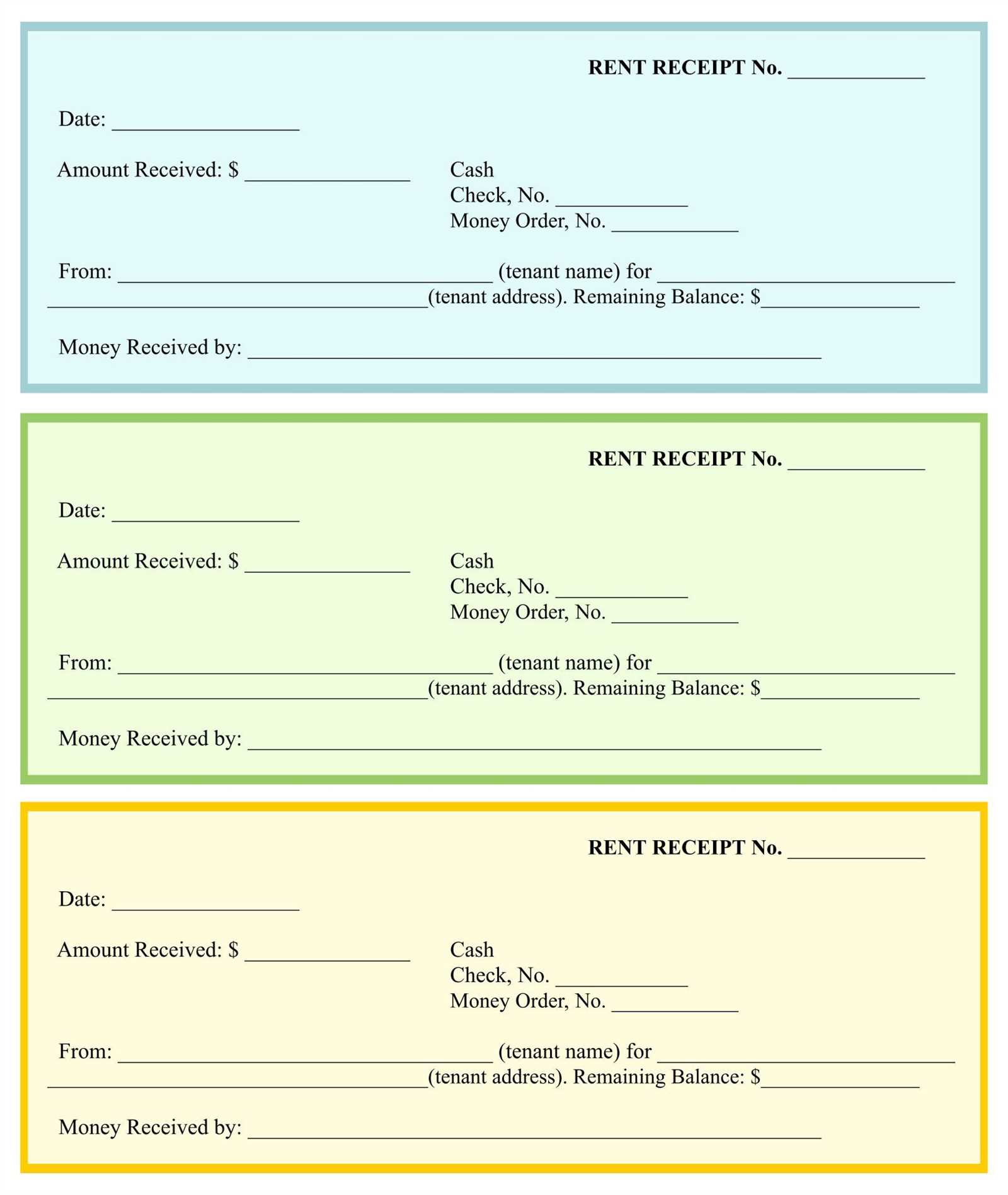

- Recipient Details: Include the name and contact information of the person or company receiving the payment. This section should also outline the payment method (e.g., cash, credit, bank transfer).

- Description of Goods or Services: Provide a brief, but precise, description of what was purchased or the services rendered. Itemizing each can enhance clarity.

- Amount Paid: Specify the total amount of money received, and break it down into subtotals, taxes, and discounts if applicable. Make sure this section is easy to read and accurate.

- Signature or Authorized Representative: Leave space for a signature of the person issuing the receipt or an authorized representative to confirm the transaction.

- Terms and Conditions: If applicable, include any relevant terms, such as refund policies or service guarantees.

This layout ensures all necessary information is provided in a clear and structured format, making the receipt both functional and professional.

Begin with a clean, simple layout. Include your business name, logo, and contact details at the top. Ensure the receipt has a unique identification number for easy tracking.

List the recipient’s details clearly, including their name and address. Then, provide a description of the transaction, such as the products or services provided, along with the amount paid.

Incorporate the payment method, whether it’s cash, card, or bank transfer. For transparency, include the date of the transaction and specify the tax rate or any discounts applied if relevant.

Finish by adding space for your signature and any other necessary notes. Double-check for accuracy, ensuring all fields are appropriately filled out.

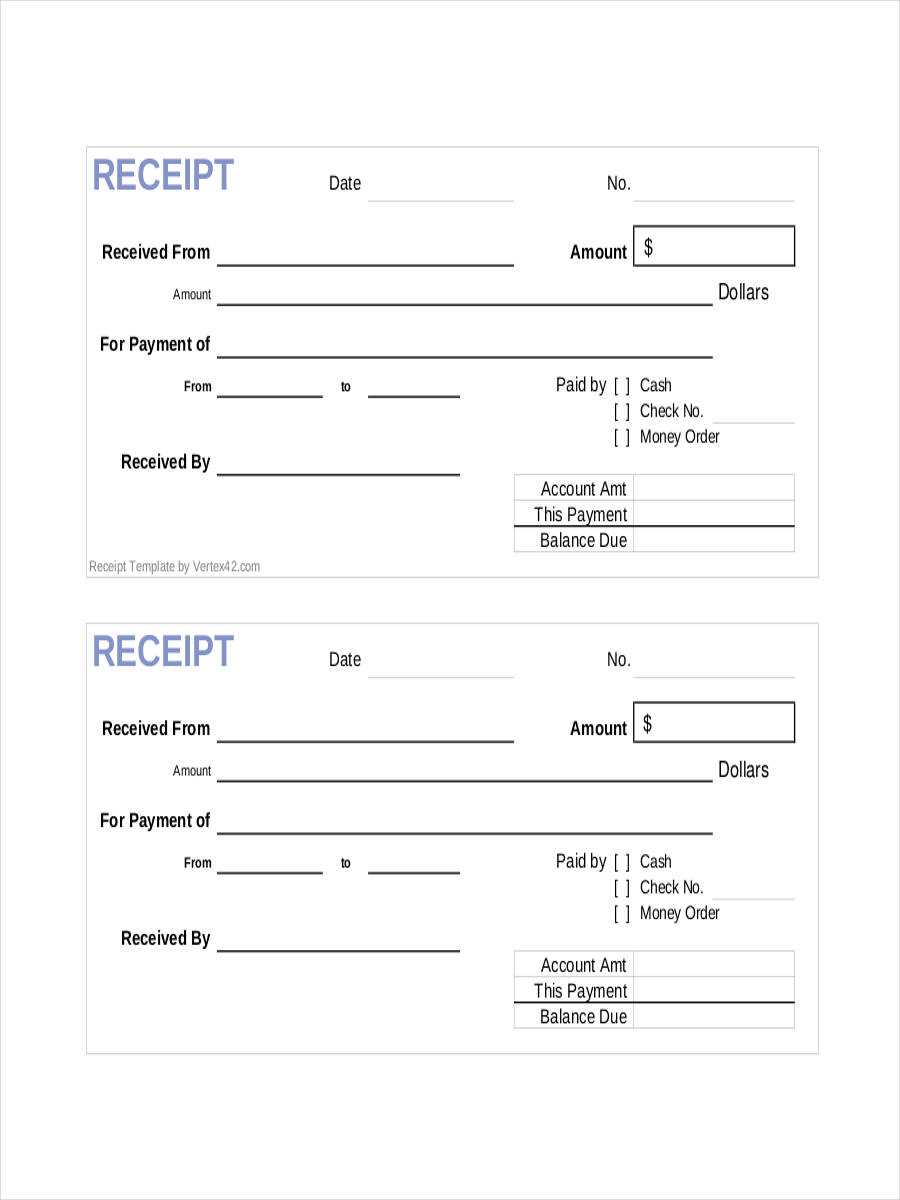

Ensure your official receipt template includes these key components for clarity and professionalism:

1. Business Information

Clearly display your business name, address, phone number, and email. This allows recipients to easily contact you if needed. Including a website or social media links may also be useful.

2. Receipt Number

Each receipt should have a unique identifier, such as a receipt number or code. This ensures proper tracking and reference for both you and the customer.

3. Date and Time

Include the date and time of the transaction. This helps maintain an accurate record of sales and can be crucial for bookkeeping and tax purposes.

4. Items or Services Provided

List the products or services sold, along with their quantity, unit price, and total price. Providing clear details on the transaction makes it easier for the customer to understand what they paid for.

5. Payment Method

Indicate the payment method used, such as cash, credit card, or online payment. This adds transparency and clarifies how the transaction was completed.

6. Total Amount

The total amount paid should be clearly stated, including taxes or any additional fees. A breakdown can be helpful if there are multiple charges.

7. Seller’s Signature

Including a space for the seller’s signature adds authenticity to the receipt and confirms that the transaction was completed.

Select a format that aligns with your business needs and customer expectations. A simple, clear design ensures all necessary details are easily readable. Avoid clutter; focus on the essentials like the company name, contact information, transaction date, amount, and a unique receipt number. Choose between digital or physical formats based on your customer preferences and the nature of the transaction. For online businesses, a PDF format is often the most convenient, while physical stores may prefer a pre-printed format with space for handwritten details.

Make sure the format is customizable. This allows you to add or remove sections as necessary, such as tax information or a return policy. For larger transactions, consider a more detailed template that accommodates additional information like payment methods or invoice numbers. Lastly, test the format across different devices or printing methods to ensure readability and compatibility.

Designing a receipt requires careful attention to detail to ensure clarity and accuracy. Here are some common errors to avoid:

- Missing Business Information – Always include essential business details such as name, address, phone number, and tax identification number. Without these, the receipt could be deemed invalid in case of an audit.

- Poorly Structured Layout – Avoid clutter. Ensure that each element (date, items, total cost) is clearly separated. A chaotic layout can confuse the customer.

- Incorrect or Incomplete Item Descriptions – Describe each purchased item clearly. Vague labels like “product 1” or “item A” make it hard for customers to verify their purchase details.

- Failure to Include Taxes – If applicable, display taxes separately and clearly. Not doing so can result in confusion or disputes.

- Illegible Fonts – Stick to readable fonts and avoid using tiny text. The receipt should be easy to read in all lighting conditions.

- Not Including Payment Method – Include the method of payment (cash, card, etc.) on the receipt. This is particularly useful for refunds and returns.

- Lack of a Unique Receipt Number – A unique receipt number helps track purchases, manage returns, and handle warranty claims effectively.

Additional Tips

- Ensure all totals are accurate – Double-check the final amount, including tax, discount, and additional charges.

- Consider the Design Consistency – Maintain a consistent style with your branding, including logos and color schemes, to keep your receipts professional and easy to identify.

Start by choosing a template that aligns with your business or personal needs. Focus on fields that are most relevant, like date, amount, and transaction details. Customize fonts and colors to match your branding without overwhelming the template’s purpose.

Adjusting Layouts

Ensure the layout is clean and organized. Use clear divisions between sections like customer details, item descriptions, and total amounts. This can be easily done by adjusting margins and spacing, which will make the document easier to read and more professional.

Adding Custom Fields

If your transactions require additional details, create custom fields. For example, you may need a specific tax rate or payment method section. Customize your template by inserting text boxes or tables in the desired spots to accommodate this information.

Keep your template simple yet informative–avoid cluttering it with unnecessary information that doesn’t add value to the document. This keeps the focus on the key details.

Store receipts in a secure, organized system. A locked file cabinet or a secure cloud storage service works well for this purpose. Ensure physical copies are placed in folders or labeled envelopes to prevent loss or damage.

Physical Receipt Storage

Keep receipts in a dry, cool environment to avoid deterioration. Use acid-free folders to prevent yellowing or curling. For receipts that need to be kept for extended periods, consider scanning them to preserve a digital backup.

Digital Receipt Storage

Upload scanned receipts to a secure, encrypted cloud storage platform. Organize them by categories, such as date, vendor, or expense type, to make retrieval easy. Protect your digital records with strong passwords and enable two-factor authentication for added security.

When distributing receipts, make sure the recipient understands how to handle and store them. For example, advise them to save copies in case the originals get damaged or lost. Always use secure channels, like encrypted emails or password-protected files, when sharing sensitive receipt information electronically.

To properly structure your blank official receipt template, it is important to prioritize clarity and simplicity. This ensures that all necessary information is easy to find and understand. Start by including basic sections such as the seller’s name, buyer’s name, and transaction date. These elements should be positioned at the top of the document for easy identification.

Next, create a table to list the purchased items or services. The table should include the following columns: description, quantity, unit price, and total amount. Ensure the table is neatly formatted for readability and consistent spacing.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Item 1 | 2 | $10.00 | $20.00 |

| Item 2 | 1 | $15.00 | $15.00 |

Conclude with the total amount due, including any applicable taxes or discounts. Provide space for the seller’s signature and any additional notes if necessary. By keeping the format clear and well-organized, your receipt will be easy to read and professional in appearance.