Need a reliable way to issue receipts? A well-structured blank official receipt template saves time and ensures consistency in financial records. Whether you’re managing a small business, a nonprofit, or freelance transactions, a ready-to-use template simplifies documentation while maintaining a professional appearance.

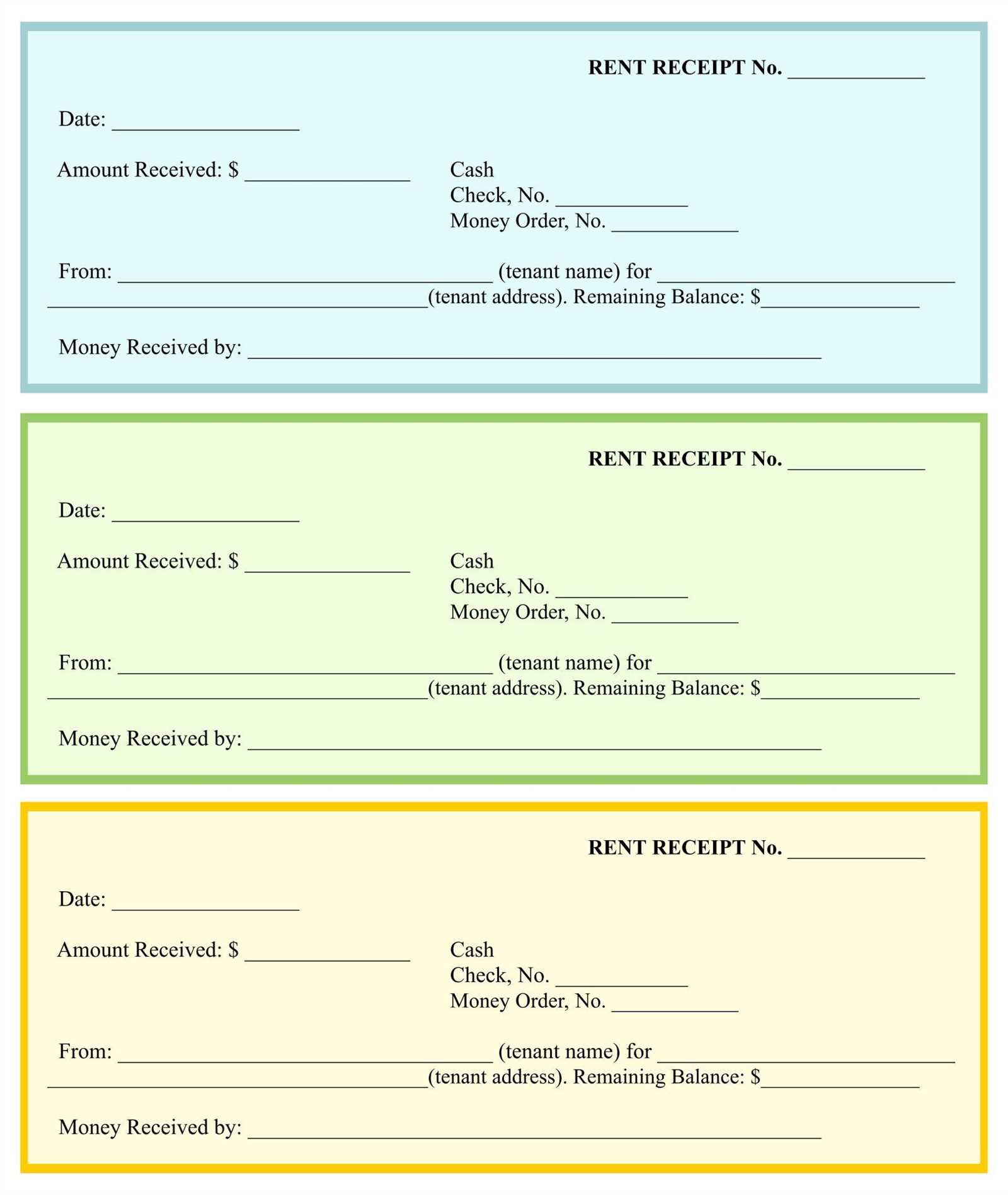

Standard templates include fields for the payer’s name, date, amount, payment method, and issuer details. Many also feature space for additional notes or legal disclaimers. Customizing a template to match branding, tax requirements, or industry-specific needs improves clarity and compliance.

Digital and printable templates come in multiple formats, including PDF, Word, and Excel. Editable PDFs allow for quick entry and printing, while Excel formulas help automate calculations. Cloud-based templates integrate with accounting software, reducing manual input errors.

Before selecting a template, check local tax laws and accounting regulations. Some jurisdictions require specific details like tax identification numbers or official stamps. Ensuring compliance from the start prevents legal issues and maintains financial accuracy.

Here’s the revised version without unnecessary repetitions:

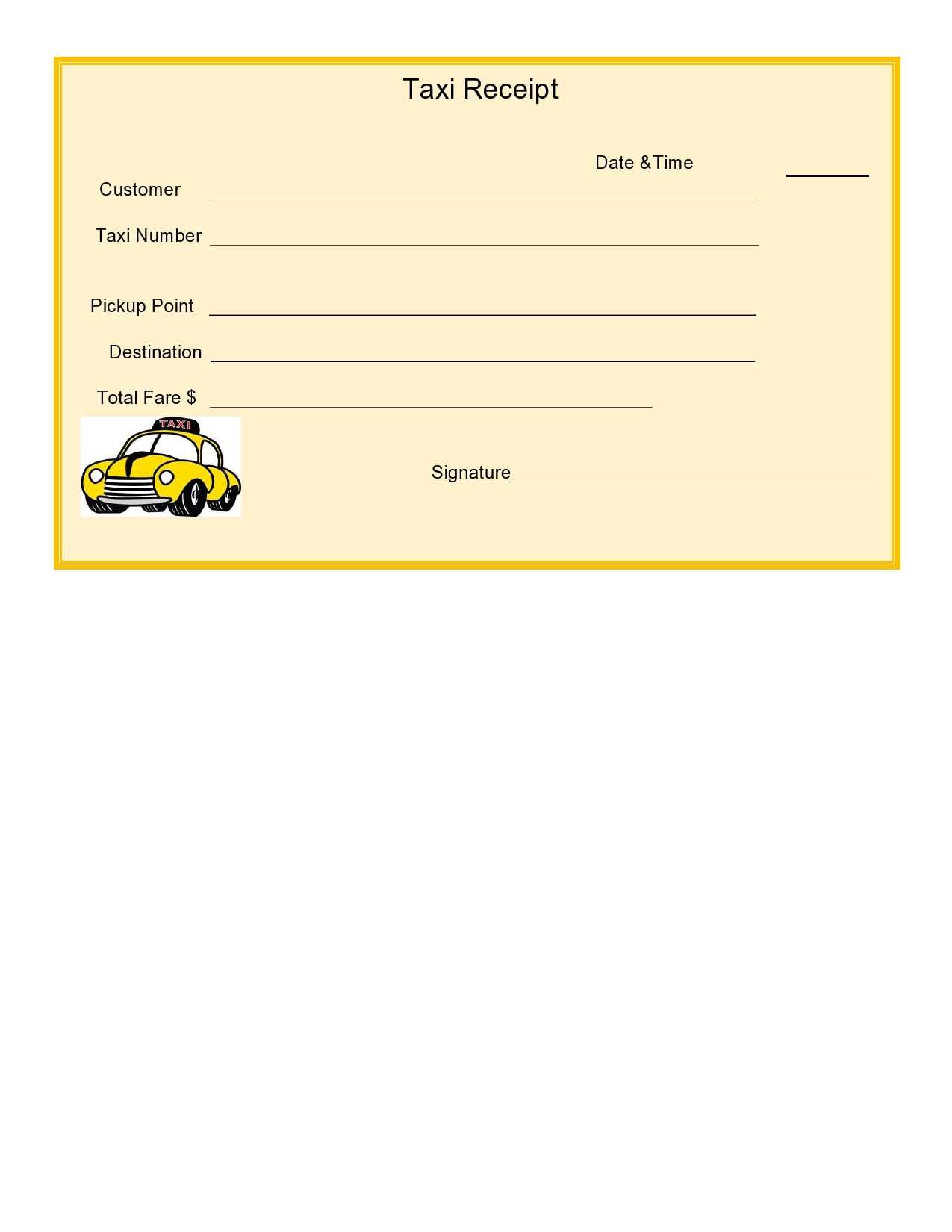

Start by organizing your receipt template to ensure clarity. Focus on the key sections that customers need: business name, contact details, transaction details, and a breakdown of services or products sold. Avoid clutter by using clear, simple lines and sections. Place the receipt number in a prominent location for easy reference, followed by the date and time of the transaction.

Template Structure

The first section should include your business’s name, logo, and contact details, followed by the receipt number and date. Ensure these details are separated for easy scanning. Next, list the items or services purchased with a brief description and price next to each. End with the total amount, payment method, and a space for signatures or additional notes, if necessary. This structure keeps everything clear and easy to follow for both parties involved.

Formatting Tips

Ensure your template is not crowded. Use ample spacing to differentiate sections. Bold important information like totals or payment methods. Using a consistent font throughout the template helps maintain readability and ensures a professional appearance.

- Blank Official Receipt Templates: A Practical Guide

Choose a reliable template that meets your business or personal needs. When selecting a blank receipt template, ensure it includes essential details like the date, transaction amount, payer information, and purpose of the payment.

Key Features to Include

- Business Name and Address: Clearly display the name of the issuing entity and its contact details.

- Payer Information: Include the name and contact details of the individual or organization making the payment.

- Date and Amount: Make sure the receipt specifies the transaction date and the total amount received.

- Payment Method: Indicate whether the payment was made via cash, card, or another method.

- Receipt Number: A unique identifier for each receipt ensures proper record-keeping.

- Purpose of Payment: A brief description of what the payment is for helps both parties track transactions.

Customizing the Template

After selecting the template, tailor it to suit your specific needs. You can adjust the layout, add or remove fields, and ensure your branding (like logos or colors) is consistent with your business identity. Many templates come in formats compatible with word processors and spreadsheet software, making customization easy and quick.

By using a blank official receipt template, you simplify the process of documenting payments, keeping records clear and professional for both parties involved.

When designing a blank official receipt template, focus on clarity and completeness. Each receipt should contain specific details for easy reference and legal purposes.

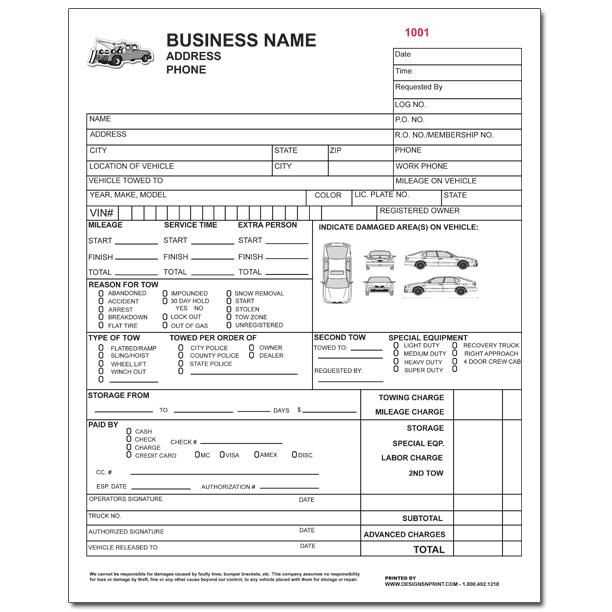

1. Business Information

Include the name, address, phone number, and email of the business or entity issuing the receipt. This ensures the recipient knows who issued the document and how to contact them if needed.

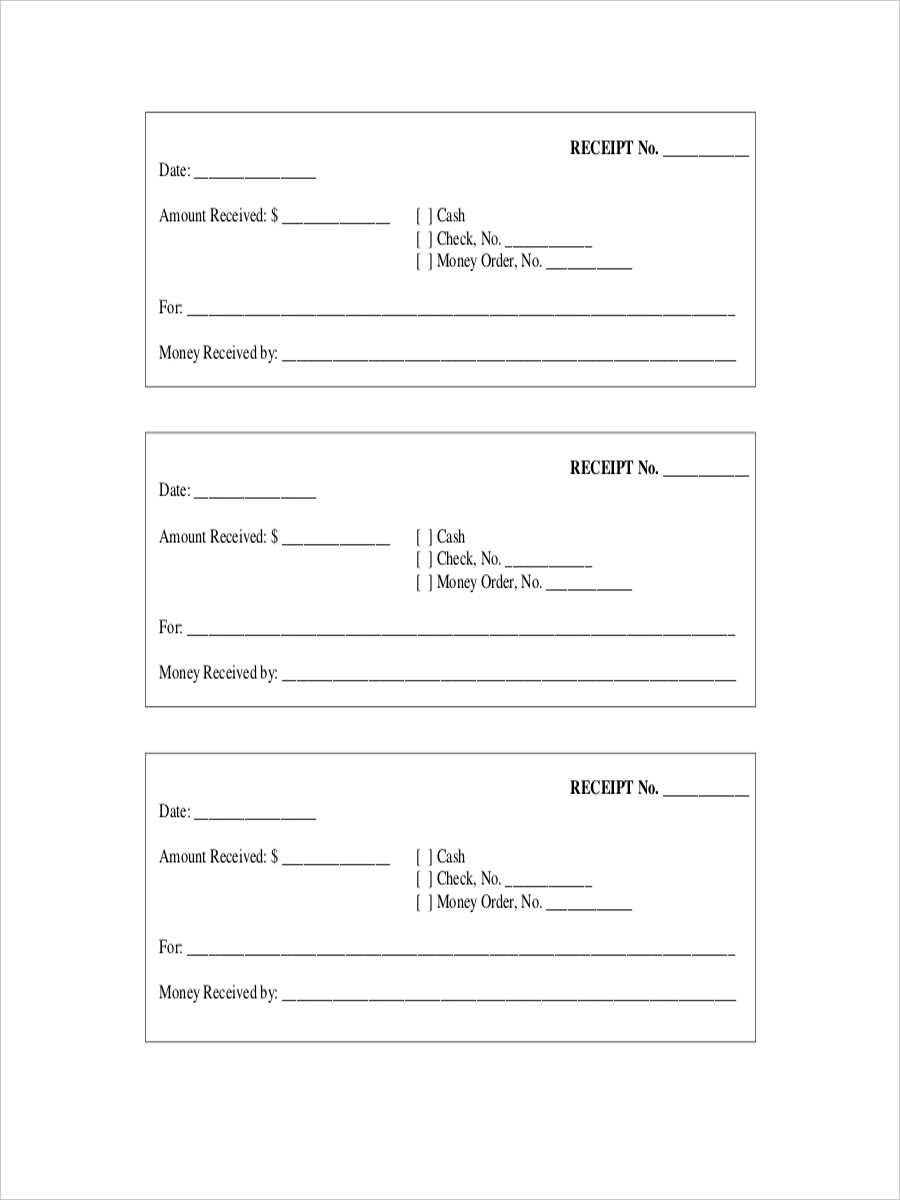

2. Receipt Number and Date

Assign a unique receipt number and include the date of transaction. This helps track the receipt and aids in organizing financial records. The format for dates should follow a consistent style (e.g., MM/DD/YYYY).

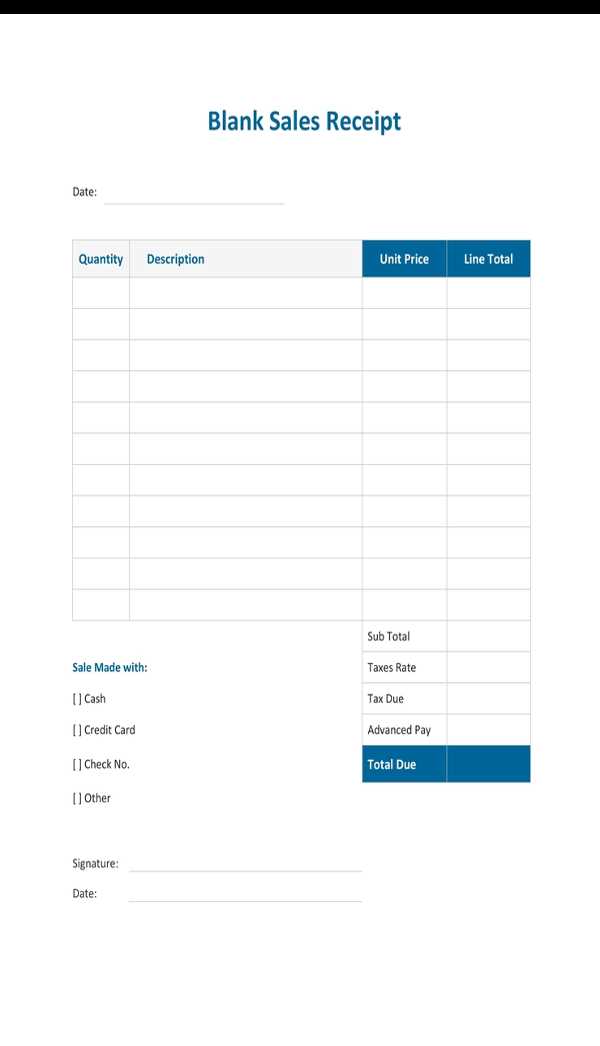

3. Transaction Details

Specify the products or services provided, along with their individual prices. If applicable, include the quantity, unit price, and any taxes or discounts applied. These details give clarity on the payment made.

4. Total Amount

The total amount paid should be clearly stated. This should be the sum of all items, taxes, and discounts. Ensure the total is prominently displayed, reducing confusion.

5. Payment Method

Indicate how the payment was made–whether through cash, credit card, bank transfer, or another method. This serves as proof of the transaction type and protects both parties in case of disputes.

| Element | Details |

|---|---|

| Business Information | Company name, address, phone number, email |

| Receipt Number and Date | Unique number, transaction date |

| Transaction Details | Products/services, price per item, quantity, taxes, discounts |

| Total Amount | Complete amount, including taxes and discounts |

| Payment Method | Cash, credit card, bank transfer, etc. |

Receipts come in various formats and layouts depending on the type of transaction and industry. Below are common options to consider when designing your receipt template.

- Basic Text Format: A simple receipt layout featuring essential details such as the business name, date, transaction amount, and payment method. This format is ideal for small businesses or informal transactions.

- Itemized Format: This layout breaks down each item or service purchased, showing prices individually. It’s useful for businesses that sell multiple products or services in one transaction, such as retail stores or restaurants.

- Tax Breakdown Format: Receipts in this format clearly display tax amounts separate from the total price. It’s commonly used in businesses where tax calculations are essential, such as in e-commerce or any regulated industry.

- Detailed Format: This format includes extra information, such as the buyer’s name, address, and payment terms. It’s suited for businesses requiring more detailed transaction records, like contractors or service-based industries.

- QR Code Format: Some receipts feature a QR code for easy access to the transaction record online. This format is becoming more popular for digital receipts, especially in tech-driven industries or for eco-conscious businesses.

Choosing the right layout ensures clarity and professionalism, making it easier for customers to understand their transactions.

Before using any receipt templates, ensure they align with your jurisdiction’s tax laws. Templates must meet specific legal requirements, especially when it comes to record-keeping for tax purposes. Always check if the template includes necessary details such as the business name, contact information, and tax identification number, which are mandatory in many regions.

Using pre-made templates can save time, but you should also verify their compliance with local regulations. For instance, the format of the receipt might vary based on where you are located. In some places, you might need to include VAT or other tax-related information on the receipt. Double-check that these fields are either automatically included in the template or are easy to add.

Next, consider copyright laws. While using a free template may seem like an easy solution, be aware of the potential copyright claims. Some templates, especially from online sources, could be copyrighted. Before modifying or redistributing a template, ensure that it’s either free to use commercially or that you have obtained the appropriate permissions.

Finally, if you are using the template for business purposes, ensure that it contains enough detail to avoid legal disputes. If the template is too vague or lacks necessary information, you may face challenges when validating transactions or in case of an audit. Keep your receipts clear, accurate, and aligned with business practices that are recognized legally.

| Legal Aspect | Requirement |

|---|---|

| Tax Information | Ensure your template includes necessary tax numbers and business details |

| Copyright | Verify the template’s license to avoid potential copyright issues |

| Clarity and Detail | Make sure the template is clear and includes all necessary transaction details |

For printed receipts, PDF is the preferred file format. It preserves formatting across different devices and printers, ensuring that the layout remains consistent. Additionally, PDFs are widely supported and can be easily printed without compromising quality.

When preparing receipts for digital use, especially for emailing or uploading online, JPEG and PNG are solid choices. Both formats offer high-quality images with manageable file sizes. PNG is ideal for receipts with logos or transparent backgrounds, while JPEG works well for high-resolution images where file size might be a concern.

If you need a scalable design, SVG (Scalable Vector Graphics) is an excellent option. Unlike raster formats, SVG files can be resized without any loss of quality, making them suitable for both web and print. SVG is commonly used for logos and icons but can also work for receipt designs where resolution flexibility is important.

For those who require receipts in editable formats, consider using DOCX or XLSX. These formats are compatible with text processing and spreadsheet software, making them easy to customize for specific transactions or customer details.

Tailor your receipt template to meet the specific requirements of your business. Start by adjusting the design to align with your brand. This includes using your company logo, color scheme, and a consistent font style that matches your other marketing materials. This small touch not only enhances your professional appearance but also strengthens brand recognition.

Modify Fields to Fit Your Products or Services

Include fields that reflect your product or service offering. For retail businesses, add sections for items, quantities, unit prices, and taxes. Service-based businesses might want to emphasize hourly rates, services rendered, and any applicable discounts. Customize the template to showcase what matters most for your operations, ensuring the receipt provides all necessary details in a concise manner.

Incorporate Legal and Compliance Elements

Depending on your location and industry, legal or compliance information may be required. Add tax identification numbers, business registration details, or any specific disclaimers that may be necessary. Including these elements helps ensure your receipts are not only useful but also legally sound and compliant with local regulations.

Lastly, offer your customers an easy-to-read format. Whether you go for a digital or paper receipt, clarity is key. Include clear, legible text and appropriate spacing, making it easy for customers to find important information like the total amount, payment method, and any return policies.

For high-quality and customizable receipt templates, explore online platforms that specialize in document design. Websites like Template.net and Jotform offer free and paid options that cater to various business needs, from basic receipts to more complex invoice formats. These templates are downloadable and easy to edit in standard word processing or spreadsheet software.

1. Online Template Libraries

Online libraries are often the best source for reliable receipt templates. Microsoft Office Templates and Google Docs provide an extensive selection of professional-grade receipt templates. These templates are designed for quick customization, and you can adjust the layout to fit your business requirements.

2. Accounting and Invoicing Software

If you already use accounting software, take advantage of its built-in receipt template feature. Platforms like QuickBooks and Zoho Invoice include receipt templates that can be personalized with your business logo, client information, and payment details. This integration can save time and ensure consistency across all your documents.

Always verify that any template you use is compatible with your preferred software and meets your region’s tax and legal requirements. This ensures that your receipts comply with business standards and help you stay organized.

Now the text sounds natural and free of redundant repetitions.

- Focus on clarity by using simple, direct sentences. Avoid unnecessary phrases that don’t add value.

- Eliminate overused expressions or formalities. Keep the tone straightforward and accessible.

- Use active voice to make the writing more engaging and easier to follow.

- Be specific with your language to prevent ambiguity and ensure understanding.

- Review your content to identify and remove any redundancies that do not contribute to the message.

By following these guidelines, your text will flow more smoothly, without sounding overly formal or repetitive.