Use a money receipt book template to streamline your financial transactions and ensure clarity in record-keeping. This simple yet effective tool helps businesses and individuals track payments, offering an organized way to document each financial exchange.

A well-designed receipt template includes essential details such as the payer’s name, amount paid, payment method, date of transaction, and a description of goods or services. By including these key elements, you can avoid confusion and provide transparency in every payment made or received.

Choose a template that suits your needs, whether for business or personal use. Customize it to match your specific requirements, ensuring it remains clear and easy to understand. A clean, professional format enhances the credibility of your transactions, making it easier to manage your finances over time.

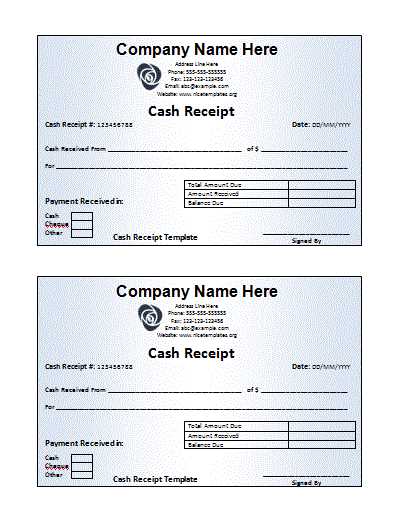

Money Receipt Book Template

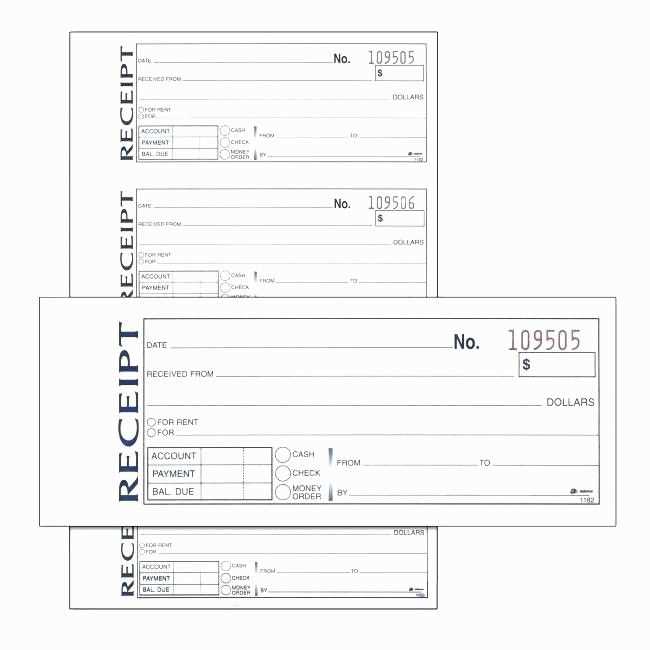

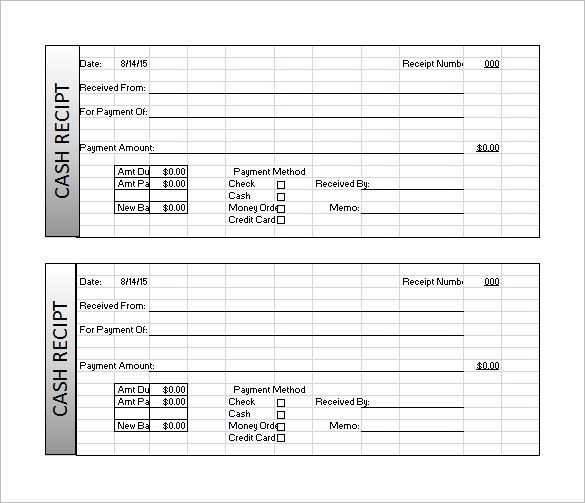

For a clear and organized money receipt book, ensure each receipt contains specific fields. Include the following: a receipt number, date, payer’s name, payment amount, payment method, and the purpose of the transaction. The receipt should also have a space for the issuer’s signature, confirming the transaction.

A clean layout is key. Use rows for each new entry and keep the formatting consistent throughout. A basic template might look like this: at the top, a header with “Receipt” and a unique number; underneath, sections for the payer’s details and the transaction breakdown. At the bottom, provide space for remarks, if necessary.

Maintain alignment and clear spacing. Avoid overcrowding the receipt with unnecessary text or designs. Simplicity makes it easier for both the issuer and the payer to quickly understand the details of the transaction.

To make your template adaptable, leave space for adding custom fields. This will help accommodate different types of payments or adjustments, such as tax or discount information.

When printing, choose quality paper that prevents smudging, and consider using carbon-copy forms for ease of record keeping. If using digital templates, opt for a format that is easy to modify and print, like Word or Excel, which also allows for quick updates as needed.

Choosing the Right Format for Your Money Receipt Book Template

Pick a money receipt book format that aligns with your needs. If you’re handling many transactions, go for a multi-part receipt with carbonless copy sheets. This way, you can keep a record without needing additional copies or separate documentation. For smaller volumes, a single-page format works just fine and is easier to manage.

Consider the Layout

The layout of your receipt should include space for key details: the payer’s information, amount received, date, payment method, and a brief description of the transaction. Organize these sections clearly to minimize errors. Grouping related information in logical sections (like payment info, itemized details) will help streamline your records.

Paper Quality and Size

Select paper that matches your use case. Thicker paper provides durability for long-term storage, while lighter paper can be more cost-effective for regular use. The standard receipt book size is 8.5×11 inches, but adjust the size to your preferred storage method. Ensure that the paper fits your filing system and provides enough space for clear writing.

Customizing the Template for Various Business Scenarios

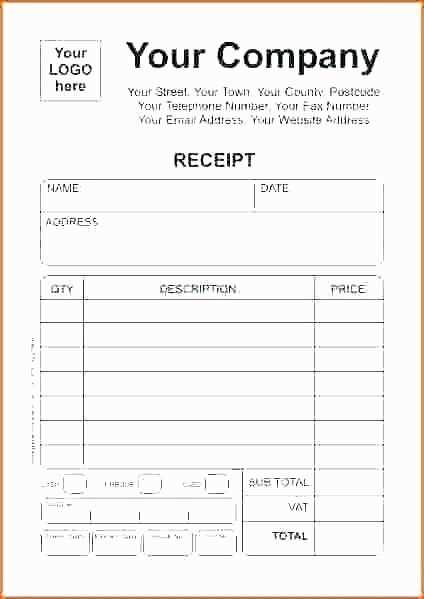

Adjust your money receipt book template to meet the specific needs of different business situations. The key lies in tailoring the fields, format, and design to reflect your brand’s identity and the nature of the transactions.

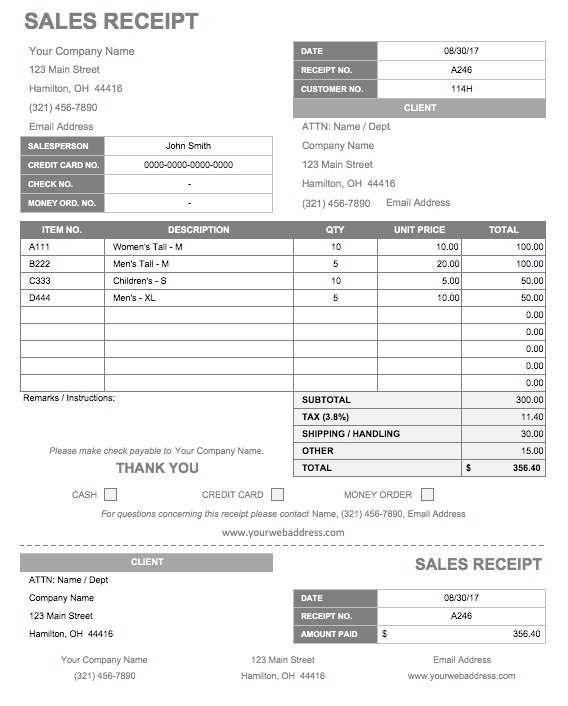

Retail Businesses

For retail businesses, include space for product details, quantities, and unit prices. This makes it easier for both the business and the customer to track purchased items. Add a section for discounts or taxes if necessary, and ensure that the receipt is clear and easy to read for fast transactions. Including a QR code linking to your store’s website or promotional page can enhance customer engagement.

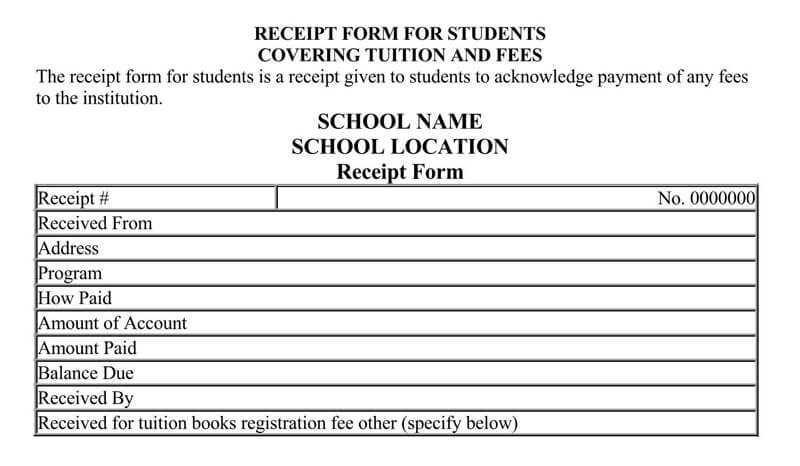

Freelancers and Service Providers

Freelancers should focus on service descriptions, hourly rates, and project milestones. Ensure there is room for detailed descriptions of the work completed, with corresponding rates, payment terms, and due dates. For transparency, leave space for both partial and full payments, and provide a section for tracking any deposits received in advance.

Incorporate your business logo and contact details at the top of the receipt for a professional look. If applicable, include a section for payment methods, such as bank transfer, credit card, or cash, to ensure all payment options are clearly outlined.

Customizable Fields for All Types of Businesses

The flexibility of a receipt template lies in its customizable fields. Depending on your business type, you may need to add or remove specific sections. For example, service-based businesses could benefit from adding a “service completion date,” while retail stores may prefer a “return policy” disclaimer. Regularly updating the template based on feedback or changing requirements will keep it functional and user-friendly for both customers and employees.

Ensuring Legal Compliance and Accuracy in Your Receipt Book

Start by including all mandatory details on each receipt. This includes the date of transaction, buyer and seller information, description of goods or services, amounts, and applicable taxes. Verify the accuracy of these details before issuing receipts to avoid future disputes.

Key Components of a Legally Compliant Receipt

- Transaction Date: Ensure the receipt reflects the correct date and time of the transaction.

- Item or Service Description: Provide clear and accurate descriptions for all items or services sold.

- Tax Information: Display the applicable taxes separately if required by law.

- Company Details: Include your business name, address, and tax identification number if applicable.

- Payment Method: Specify the method of payment, such as cash, credit card, or electronic transfer.

Maintaining Accuracy in Your Receipts

- Double-check Entries: Always verify all information before finalizing receipts to avoid errors.

- Use Numbered Receipts: Sequentially numbered receipts help keep a clear and traceable record of transactions.

- Maintain Consistent Formatting: Consistency in formatting ensures readability and professionalism.

- Record and Store Receipts: Keep copies of all receipts for at least the duration required by law, often several years.

Adhering to these practices helps protect both your business and customers by ensuring clarity, accuracy, and legal compliance.