Creating a reliable online receipt book template helps simplify record-keeping and provides a streamlined way to track transactions. A well-organized template ensures that each receipt contains the necessary details, making it easier to review and manage purchases or payments. Use simple fields such as the transaction date, amount, payer information, and a brief description of the transaction to maintain clarity.

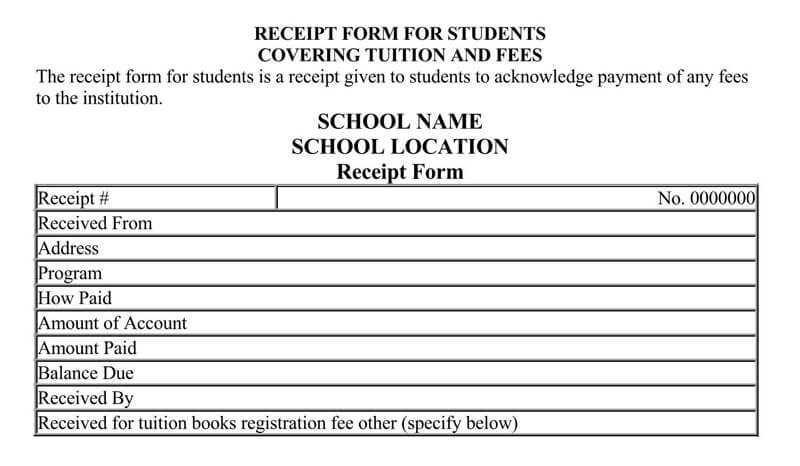

Include customizable options for different types of transactions, such as purchases, services, or donations. This allows flexibility in capturing a range of financial exchanges. Make sure the template accommodates all the key details relevant to your business or personal use, such as tax information, payment method, and invoice number for future reference.

Additionally, an online receipt book should be easy to update. Incorporate a date-stamped feature for automatic tracking of entries. This eliminates the need for manual input and ensures accurate chronological records. With the right online tools, you can automate the receipt generation process, saving time and reducing the risk of human error.

Choosing the Right Online Receipt Book Template for Your Business

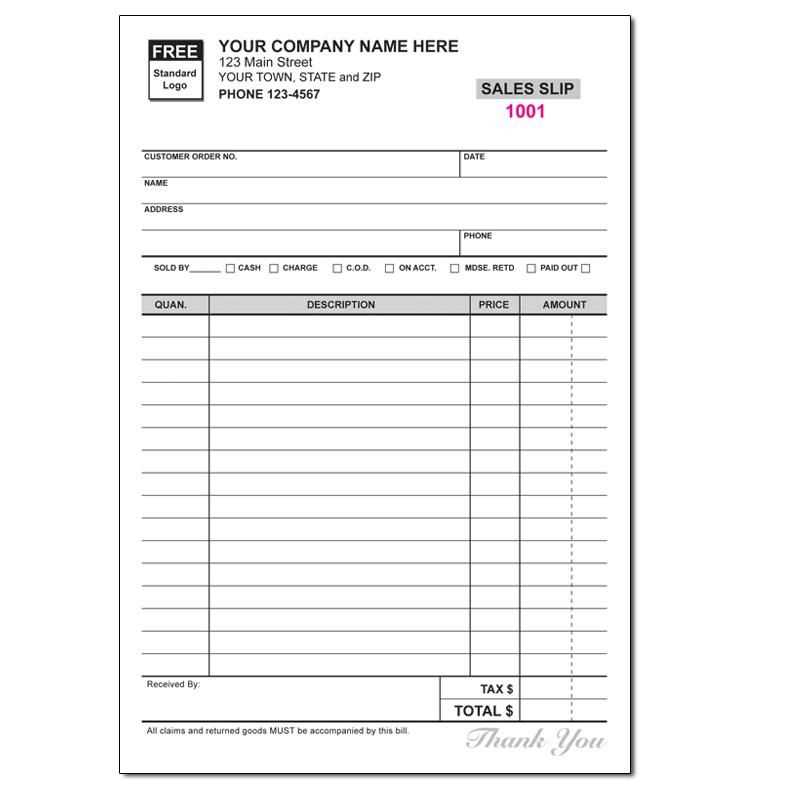

Choose a template that aligns with your business’s size and transaction volume. If you run a small business, a simple receipt template with space for basic details (like date, item description, and amount) will suffice. Larger businesses may need templates with more customization options, such as adding taxes, discounts, or multiple items in one receipt.

Consider templates that allow easy integration with your payment systems. Ensure the template is compatible with your POS system or accounting software to streamline your record-keeping process. Look for templates that allow you to store receipts electronically, making them easy to access and manage.

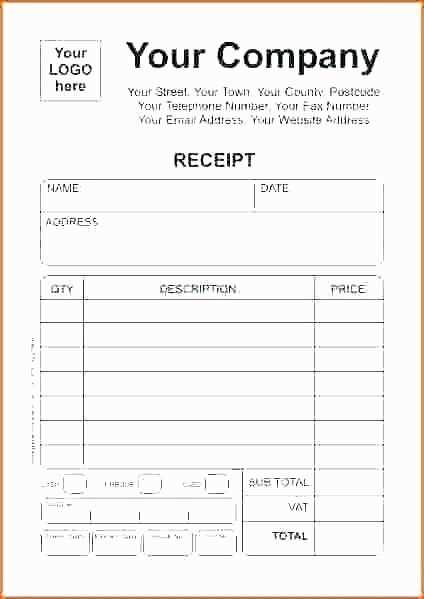

Customization is key. The receipt template should allow you to add your logo, business name, and contact details, giving it a professional appearance that builds trust with customers. You may also want a template that enables adding a unique receipt number or transaction ID for better tracking.

Check the template’s user interface. It should be straightforward to use, with clearly marked fields and a clean layout. A cluttered or confusing template will only slow you down and lead to mistakes. Choose a design that offers clarity and simplicity in presenting the transaction details.

Lastly, test the template’s flexibility. It should work well across various devices, from desktop computers to mobile phones. If you’re frequently on the go, consider a mobile-friendly template that allows you to issue receipts directly from your smartphone or tablet.

How to Customize Your Online Receipt Template for Different Payment Methods

Modify your receipt template to clearly reflect each payment method. For card payments, include details like the last four digits, transaction ID, and payment processor’s name. This ensures transparency and gives customers the reference they need.

For PayPal or other online wallets, list the transaction ID and the email address used for payment. It’s also helpful to include the payment gateway’s logo for quick identification.

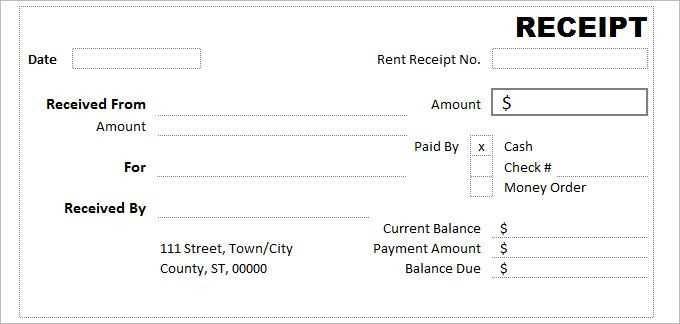

If using bank transfers, note the bank name, transfer reference, and payment date. This helps both you and the customer track the transaction easily.

When handling cash payments, indicate the exact amount received and the change given, if applicable. This reinforces trust and accuracy in your transactions.

Keep a consistent layout and use placeholders in your template to automatically fill in details based on the payment method selected. This approach saves time and ensures accuracy.

By tailoring the receipt for each payment method, you create a more professional experience while reducing confusion for customers.

Integrating Your Online Receipt Template with Accounting Software

Link your online receipt template directly to your accounting software to streamline financial tracking. Most accounting platforms, such as QuickBooks or Xero, offer integration options that allow automated receipt imports. Set up your receipt template to export data in a format compatible with your software, such as CSV or JSON. This reduces manual data entry and minimizes errors.

First, ensure your receipt template includes all necessary fields, such as transaction date, amount, tax, and payment method. These fields should match the data structure required by your accounting software. Use software-specific API integrations or built-in connectors to sync this data seamlessly. If your platform does not offer direct integrations, explore third-party tools like Zapier to create custom workflows between your receipt system and accounting software.

By automating this process, you not only save time but also improve the accuracy of your financial records. Reconciliation becomes quicker, and reporting is more reliable, providing you with clearer insights into your business’s financial health.