Use a receipt book template to simplify the process of tracking payments and transactions. A well-organized template ensures consistency and accuracy in documenting each exchange. Choose a design that suits your business style, whether for personal use, small businesses, or professional services.

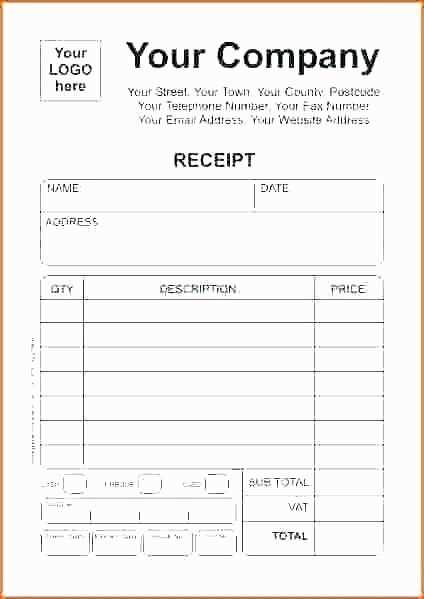

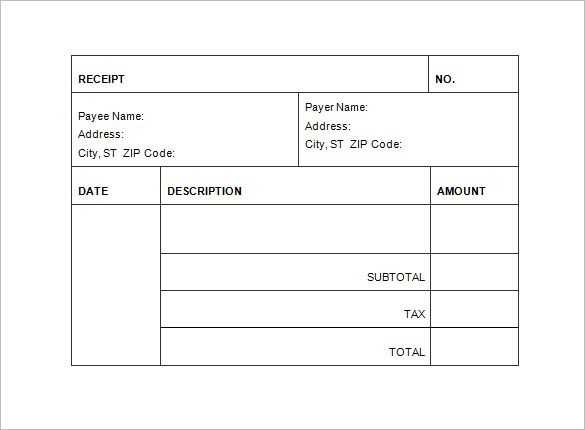

Look for templates that include clear fields for date, amount, item description, and payment method. A simple structure helps maintain legibility and makes it easier to review records later. Customizable fields are a bonus, allowing you to adjust the template for your specific needs, such as adding tax or discount columns.

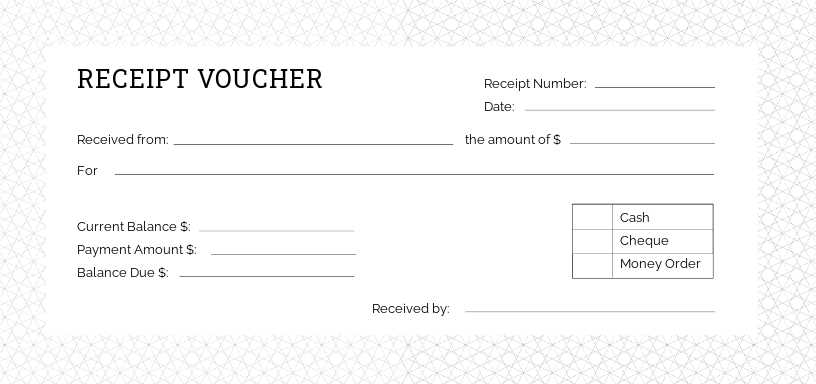

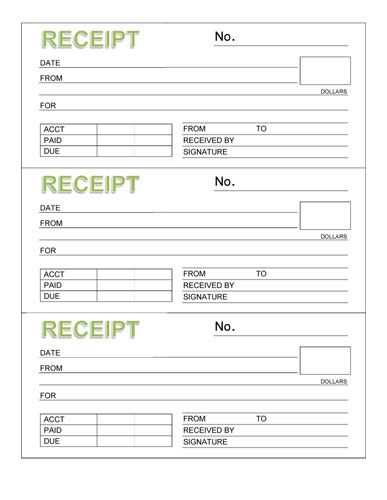

Consider using a template that allows for duplicate copies. This way, you can keep a record for both your customer and your business. Templates come in various formats, from printable PDF versions to editable Word or Excel files. Select the one that fits your workflow best and helps streamline daily operations.

Here’s the corrected version with reduced repetitions:

Focus on a clean and simple layout. When creating a receipt book template, make sure to include the necessary fields without redundancy. Keep the information clear and concise. A well-structured receipt includes details like the transaction date, amount, payer’s information, and a unique receipt number.

Key Sections to Include:

| Field | Description |

|---|---|

| Receipt Number | A unique identifier for each transaction. |

| Date | The date the transaction occurred. |

| Payer Details | Name and contact details of the person paying. |

| Amount | The total value of the transaction. |

| Description | A brief summary of the goods or services exchanged. |

Ensure you leave space for signatures or acknowledgments if necessary. This ensures clarity and minimizes confusion in future reference. Additionally, avoid unnecessary repetition in the header section. A simple title like “Receipt” is sufficient.

- Receipt Book Templates

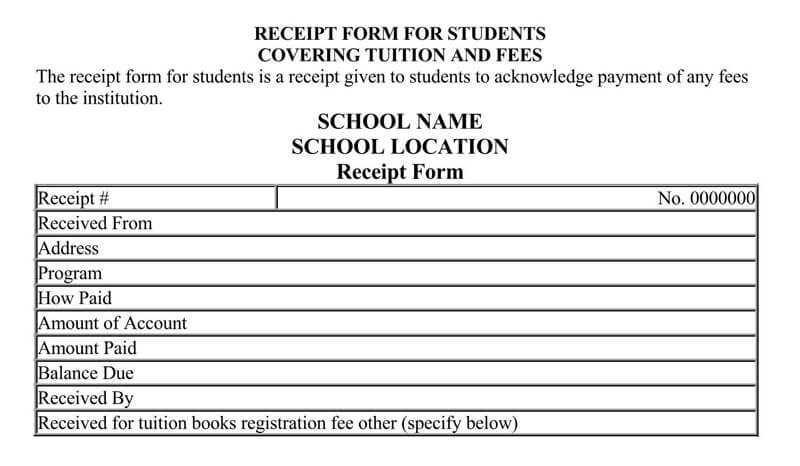

When selecting a receipt book template, opt for one that suits your business size and the nature of your transactions. A simple format with sections for item details, amounts, and dates is a practical choice for small businesses. If you need more detailed records, look for templates with space for tax information, client signatures, or additional terms and conditions.

Choosing the Right Format

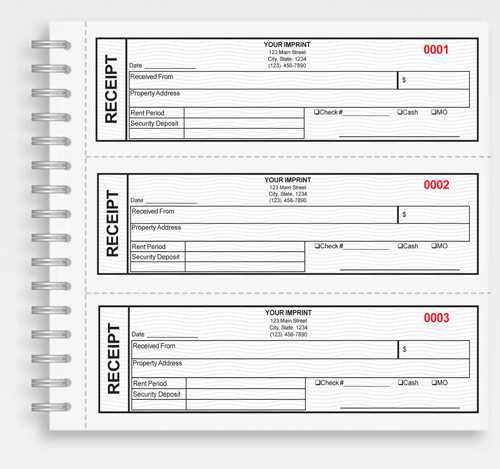

For businesses with frequent, high-volume transactions, consider a template that accommodates multiple copies of each receipt for easier record-keeping. Duplicate and triplicate templates are common for this purpose, allowing one copy for the customer and another for your records. Digital templates can also simplify storage and retrieval, especially when integrated into accounting systems.

Customizing the Template

Ensure your template includes branding elements like your logo and business name. This adds a professional touch and helps customers identify your business quickly. Additionally, include fields for payment methods (cash, credit, debit) and any relevant customer information for later reference.

Choose a receipt book template that fits your business needs. For businesses dealing with products, look for templates with space for item descriptions, quantities, and prices. Service-based businesses should prioritize templates that allow for detailed service descriptions, time tracking, and rates.

Customization Options

Pick a template that offers customization. You should be able to add your business name, logo, and contact information. This makes your receipts look professional and helps reinforce your brand identity with every transaction.

Ensure Key Details are Included

Make sure the template includes all the necessary fields for taxes, payment methods, and invoice numbers. This helps with bookkeeping and ensures your receipts are compliant with local regulations.

Test Before Committing

Before finalizing your choice, test how the template prints or saves in digital format. The layout should be clean and organized, ensuring that customers can easily read and understand the details of the transaction.

Adjust your receipt book template to meet tax and accounting standards by including specific fields required by local regulations. For instance, ensure it has clear sections for itemized details like sales tax, total amount before tax, and the final total. Add a field for your business tax ID number, which may be needed for record-keeping and tax filing. Include a space for both the date of the transaction and the payment method, as this is often required for accurate accounting records.

Next, use a numbering system for each receipt to ensure they are uniquely identifiable. This will help with tracking and organization during audits. Make sure the template includes a breakdown of taxable and non-taxable items, if applicable. For businesses that offer discounts, provide an area to list them separately from the total amount to make tax calculations easier.

Consider adding an area for additional notes, where specific tax-exempt information or deductions can be documented. Depending on the nature of your business, you might need to customize the template further to meet specific industry regulations or business needs, like adding fields for inventory tracking or specific codes related to different types of sales.

Finally, double-check the layout and structure to ensure the template is clear, concise, and provides all necessary information for both the customer and your accounting team. Regularly review your template against the latest tax guidelines to ensure ongoing compliance.

Start by choosing a layout that fits your needs. Use a word processor like Microsoft Word, Google Docs, or design tools like Canva to create your template. Set the dimensions according to the size of the receipts you want, commonly 3 x 5 inches or 4 x 6 inches.

Designing the Template

Place essential fields such as “Date,” “Amount,” “Description,” and “Signature” in a logical order. Ensure there’s enough space for each section, and leave room for any additional information you might need. Use bold and underlined text for headings to make them stand out. Try to keep the font readable and professional, typically using a font size of 12 to 14 points.

Adding Custom Elements

If you want to personalize your receipt book, consider adding your logo, business name, or contact information. Keep the design simple, so it’s easy to read and professional. You can also add any legal disclaimers or terms that may apply to your transactions.

After designing, save the file in a printable format, such as PDF. Check the document layout by printing a test page to ensure the spacing and text alignment are correct. Once satisfied, print multiple copies or save it for future use.

Receipt Book Templates

To make your receipt book both organized and functional, use a clear structure in the template. The template should include the following key elements:

- Receipt Number – Ensure each receipt has a unique identifier for easy tracking.

- Date – Include space for the date of transaction to maintain proper records.

- Payee Information – Include the name and contact details of the person making the payment.

- Payment Details – Provide space for a description of the goods or services purchased and the payment method used.

- Total Amount – Clearly state the amount paid, including taxes if applicable.

Design Tips for Receipt Templates

- Keep it Simple – Avoid cluttering the template with unnecessary information.

- Readable Fonts – Use legible fonts to ensure the receipt is easy to read.

- Space for Notes – Add an area for additional comments or notes for flexibility.

Creating Digital Templates

- Use Standard Software – Programs like Word or Excel are perfect for designing receipt templates.

- Save as a Template – Save your receipt design as a template for quick future use.

- Printable Option – Ensure the template is formatted for easy printing when needed.