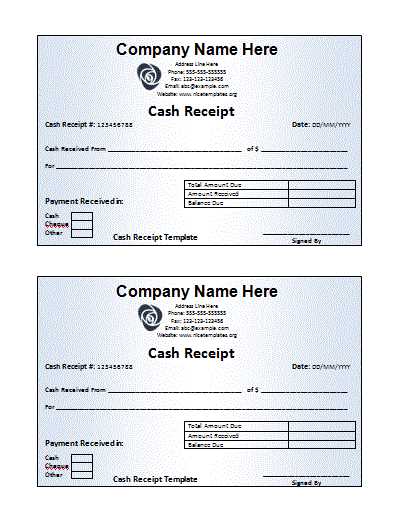

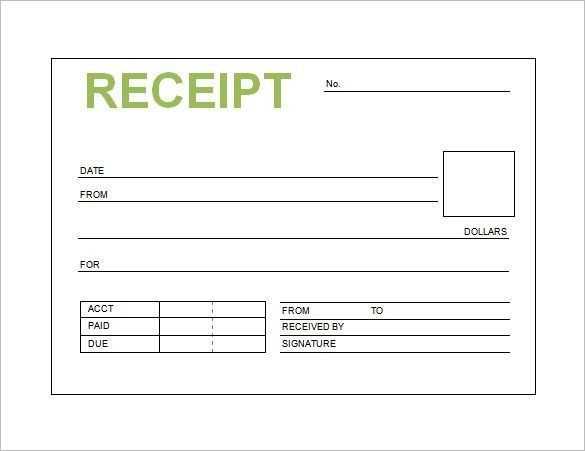

For streamlined receipt management, opt for software that offers customizable templates with clear formatting options. A well-structured design ensures that all necessary details–such as date, amount, and payment method–are recorded accurately. Look for solutions that support multiple formats, including PDF, Excel, and Word, to match your workflow.

Automation is key to reducing errors and saving time. Features like auto-fill fields, sequential numbering, and cloud synchronization simplify the process of creating and storing receipts. Some programs also integrate with accounting software, ensuring seamless financial tracking.

Security should not be overlooked. Choose a tool that offers data encryption and backup options to protect sensitive information. Cloud-based platforms with role-based access provide an added layer of control, preventing unauthorized modifications.

For businesses that require frequent adjustments, a solution with drag-and-drop editing and reusable templates makes customization effortless. If mobility is a priority, opt for software with mobile compatibility to generate receipts on the go.

Finding the right receipt booklet template software means balancing functionality, ease of use, and security. Evaluate available options based on these criteria to ensure a smooth and reliable experience.

Receipt Booklet Template Software

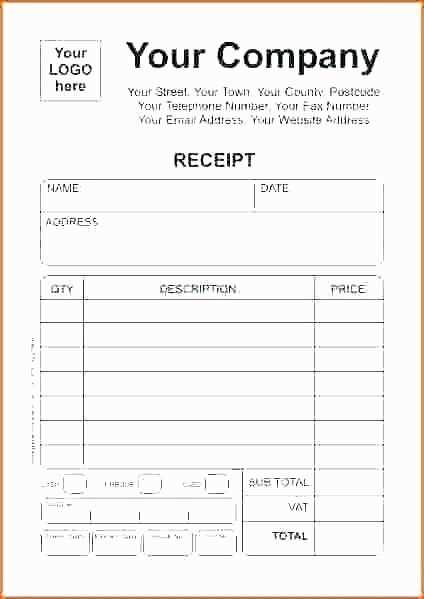

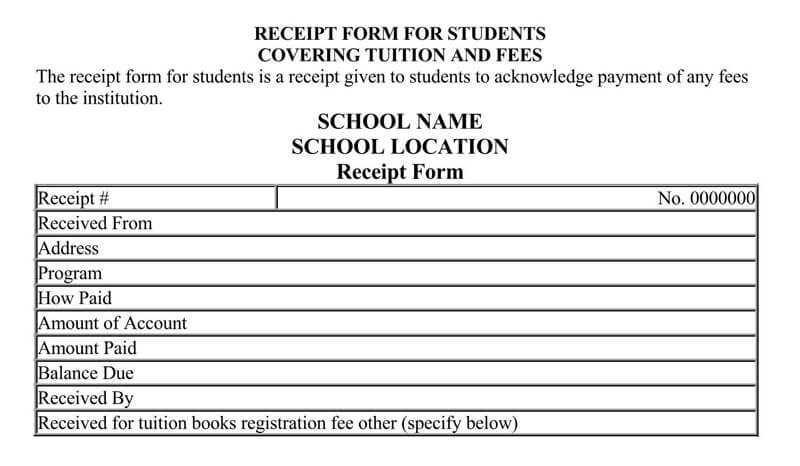

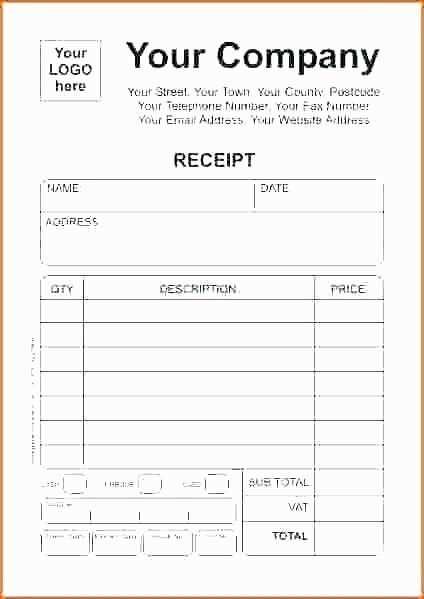

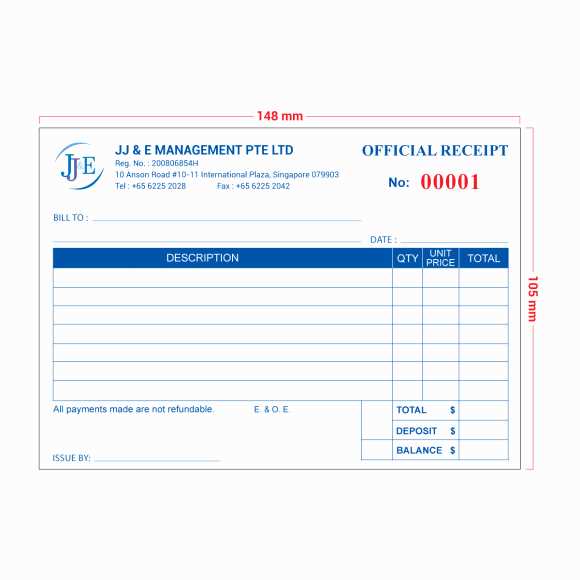

Choose software with customizable fields to ensure flexibility in receipt design. Look for options that allow you to edit company details, tax rates, itemized sections, and numbering formats.

Automation and Data Export

Save time with auto-calculation features for totals, taxes, and discounts. Ensure compatibility with CSV or PDF exports to simplify record-keeping and sharing.

Print and Digital Formats

Opt for software that supports both printed and digital receipts. Cloud synchronization can help store and access records across multiple devices.

Before finalizing your choice, test the template options for clarity and compliance with local financial regulations.

Customization Options for Business Branding

Choose fonts that reflect your brand’s personality. A sleek sans-serif works well for modern businesses, while a classic serif adds a touch of tradition. Keep font choices minimal–two complementary styles ensure readability without clutter.

Incorporate your logo seamlessly. Position it in a consistent spot on every receipt, such as the top-left corner or as a watermark. Opt for high-resolution images to maintain clarity in both digital and printed formats.

Select a color scheme that matches your brand identity. Subtle accents, like colored headers or dividers, enhance visual appeal without overwhelming the layout. Ensure colors print well in grayscale for versatility.

Adjust layout elements to fit your branding needs. Custom headers, footers, and section dividers provide a polished look. Adding a tagline or mission statement reinforces brand recognition with every transaction.

Include contact details and social media handles. A dedicated section with a website link or QR code encourages repeat business. Personalized thank-you messages create a professional yet welcoming touch.

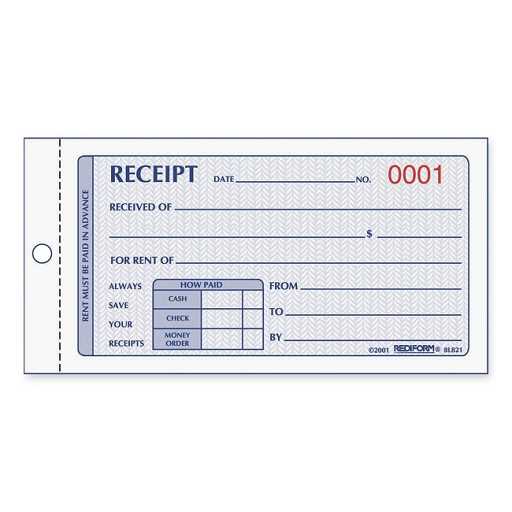

Key Features for Automated Receipt Numbering

Sequential assignment eliminates manual errors and ensures consistency across all receipts. The software automatically increments numbers based on a predefined format, preventing duplicates and skipped entries.

Customizable prefixes and suffixes help categorize receipts by department, date, or location. Users can define specific patterns, such as INV-2025-001, aligning with internal tracking systems.

Timestamp integration links each receipt to a precise date and time, reinforcing transaction authenticity. This feature simplifies audits and enhances record-keeping accuracy.

Multi-user synchronization prevents conflicts in collaborative environments. When multiple users generate receipts, the system updates numbering in real time, avoiding duplicate assignments.

Export-ready formats ensure compatibility with accounting software. Automatic numbering integrates seamlessly with spreadsheets, databases, and financial platforms, streamlining reconciliation processes.

Error detection flags missing or duplicate numbers, reducing discrepancies. The system alerts users to gaps in sequences, maintaining data integrity without manual oversight.

Export and Print Settings for Professional Output

Set the resolution to at least 300 DPI to ensure sharp text and clear graphics. Lower resolutions may cause blurriness, especially in small font sizes or detailed logos.

Choosing the Right File Format

Export in PDF for consistent formatting across different devices and printers. Use the PDF/X-1a standard to preserve colors and fonts, avoiding unexpected changes during printing. If vector elements are involved, ensure they remain scalable by enabling vector preservation in the export settings.

Optimizing Color and Margins

Use CMYK color mode for print accuracy, as RGB may result in unexpected shifts. Set bleed margins to at least 3mm (0.125 inches) to prevent white edges if the document requires trimming. Check printer specifications for margin requirements to avoid cut-off content.

Enable embedding of fonts to maintain layout integrity, especially when sharing files with others. If using spot colors, verify that they are properly defined in the software to match the intended shades during printing.

Compatibility with Accounting and POS Systems

Ensure that the receipt booklet template software supports common data formats like CSV, XML, or JSON for seamless integration with accounting platforms and POS systems. Direct export to QuickBooks, Xero, or Sage simplifies financial tracking, reducing manual data entry errors.

- Automated Data Sync: Look for software that syncs with cloud-based accounting tools to update transactions in real time.

- POS System Integration: Verify compatibility with POS solutions like Square, Shopify, or Clover to streamline payment processing.

- API Support: If custom integration is needed, an open API allows developers to connect the software with existing workflows.

- Multi-Currency Handling: Essential for businesses operating internationally, ensuring accurate financial reporting.

- Tax Compliance: Features like automated tax calculations and VAT/GST support simplify regulatory compliance.

Check whether the software offers automated reconciliation, matching receipts with bank transactions. This reduces discrepancies and speeds up bookkeeping. A built-in audit log helps track changes, ensuring financial accuracy.

Security Measures for Preventing Unauthorized Edits

Enable user authentication to control access. Require strong passwords and implement multi-factor authentication (MFA) to verify user identity.

Use role-based permissions to limit editing rights. Assign specific access levels based on responsibilities to prevent unintended modifications.

Activate change tracking to monitor edits. Log user actions with timestamps and details of modifications.

Encrypt stored and transmitted data to protect against tampering. Implement end-to-end encryption to ensure only authorized users can view or modify content.

Automate regular backups to preserve original records. Store copies in secure, offsite locations for quick restoration if unauthorized edits occur.

| Security Measure | Implementation |

|---|---|

| User Authentication | Require strong passwords and MFA |

| Role-Based Permissions | Restrict access based on user roles |

| Change Tracking | Log edits with timestamps and user details |

| Data Encryption | Secure stored and transmitted data |

| Regular Backups | Automate and store securely |

Audit user activity periodically to detect anomalies. Set up alerts for suspicious actions and review logs frequently.

Restrict access to editing tools on shared devices. Require users to sign in individually to prevent unauthorized use.

Apply digital signatures to verify document integrity. Ensure changes are trackable and authorized.

Cloud Storage and Multi-Device Access Capabilities

Use cloud storage integration to back up and access receipt data seamlessly from multiple devices. Ensure that your receipt booklet software supports synchronization across different platforms. This guarantees that the same receipt information is available on your smartphone, tablet, or computer, anytime and anywhere.

Key Features

- Real-Time Syncing: Ensure real-time updates for all devices, making changes or additions on one device instantly visible on others.

- Cross-Platform Compatibility: Choose software that works smoothly across various devices and operating systems, such as iOS, Android, Windows, and macOS.

- Offline Access: Even when you’re not connected to the internet, having offline access to stored receipts allows you to continue working without interruptions.

- Secure Backups: Cloud storage guarantees automatic backups of your receipts, reducing the risk of data loss due to device malfunctions or theft.

Best Practices

- Set up automatic syncing to ensure that new receipts or updates are stored in the cloud without needing manual uploads.

- Check that cloud storage offers strong encryption and security measures to protect your sensitive data.

- Test the multi-device access functionality across different devices to ensure smooth operations and consistency in data display.