Double entry bookkeeping relies on a balanced method of recording transactions, ensuring that every financial action has an equal and opposite effect. A receipt voucher template plays a key role in this process by providing a structured document that confirms and details transactions for both sides of the equation. When applying this template, one side represents the inflow of funds, and the other records the corresponding credit entry.

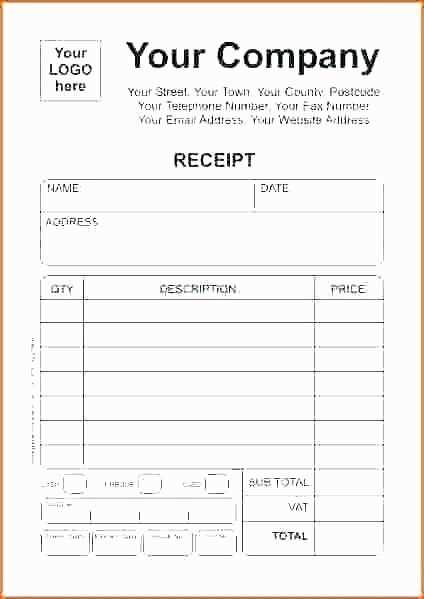

By using a well-designed template, businesses can ensure that each transaction is documented accurately and in compliance with accounting standards. The template should include the date, amount received, account details, and a brief description of the transaction. This format ensures consistency and minimizes the risk of errors when transferring information to the general ledger.

For best results, update your voucher templates regularly and tailor them to suit the specific needs of your accounting system. Consistent use of this tool will streamline your bookkeeping process, improve accuracy, and provide a reliable audit trail for financial reporting.

Here’s the improved version without repetition:

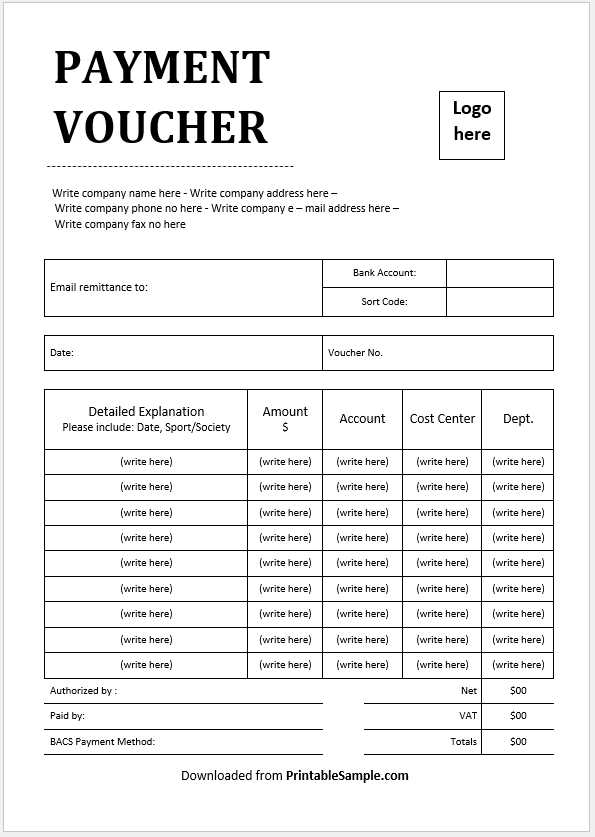

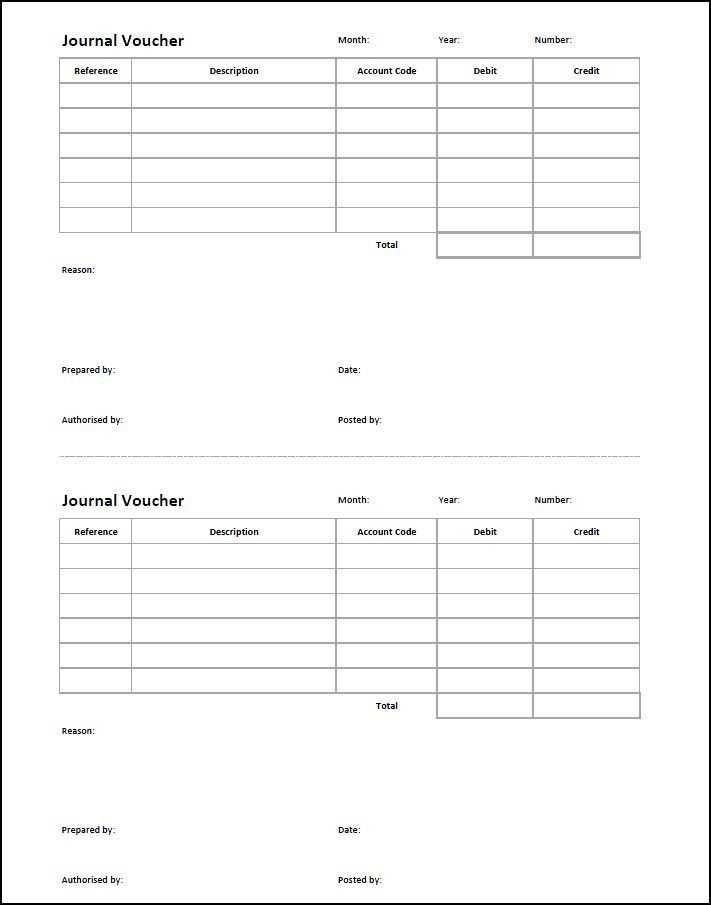

Begin by clearly specifying the transaction date and a unique voucher number. This ensures easy tracking and referencing. Clearly define the accounts involved, listing both debit and credit entries, each with corresponding amounts. Ensure the amounts are balanced, with total debits equaling total credits. Include brief descriptions for each entry to clarify the nature of the transaction, such as “payment received” or “goods purchased.” Keep the format consistent, aligning each entry neatly in rows to avoid confusion. Regularly check for accuracy and completeness to maintain smooth bookkeeping.

- Receipt Voucher Template in Double Entry Bookkeeping

To create a receipt voucher template in double entry bookkeeping, ensure that the template reflects the basic principles of this accounting system. Each transaction must involve at least two accounts: a debit and a credit. The amount for each must be equal to maintain balance.

The template should include fields such as the date, voucher number, amount received, payer’s details, and the specific accounts affected. For example, if a business receives cash from a customer, the cash account is debited, and the revenue account is credited.

Make sure the format clearly separates debit and credit entries, with the total of the debits matching the total of the credits. You can use two sections in your template: one for debits and another for credits. This simple structure helps to track each part of the transaction clearly.

Incorporating reference numbers for both accounts and the transaction helps in tracking and reconciling the entries later. Lastly, ensure that the voucher contains space for any additional notes or explanations related to the transaction, offering clarity for future review.

To create a receipt voucher template that supports double entry bookkeeping, clearly define both the debit and credit entries. Start by ensuring that every transaction involves a debit and a corresponding credit, maintaining the balance in your records. Each entry should be distinct, with clear labels for the account names and amounts.

First, allocate a section for the transaction details, including the date, receipt number, and reference details. The debit side should list the account to which money is being received, while the credit side shows the account from which money is being transferred.

Use a consistent format to organize the amount for both debit and credit, ensuring that the total debits match the total credits for each transaction. This guarantees accuracy and supports the principle of double entry bookkeeping. Consider adding columns for descriptions to clarify the nature of each transaction.

Include space for signatures and approval stamps to validate the voucher. This adds a layer of authenticity and ensures proper documentation for audit purposes. Keep the template simple, but comprehensive, allowing for quick identification of discrepancies or errors.

Finally, store all receipts in a well-organized system, cross-referencing each voucher with its corresponding journal entry. This will facilitate easy tracking of financial records and ensure all entries are accurately recorded.

Tracking Cash Inflows: Ensuring Proper Debit and Credit Entries

Accurately tracking cash inflows requires careful attention to both debit and credit entries. A receipt voucher template plays a key role in documenting incoming payments, ensuring that each cash transaction is recorded correctly. Here’s how to ensure accurate bookkeeping:

Start by recognizing that cash inflows should always be recorded as debits in the cash account, reflecting an increase in cash. On the other side of the entry, identify the source of the funds, such as a revenue account, and record it as a credit. This ensures that the accounting equation remains balanced.

Each transaction should be entered into a double-entry system, with one debit and one credit entry. For example, if a customer pays an invoice, the cash account is debited, and the revenue account is credited. This shows that cash has increased, while revenue has also increased, maintaining the integrity of the accounting records.

| Date | Description | Debit | Credit |

|---|---|---|---|

| 02/09/2025 | Payment from Client A | $500 | Revenue Account |

| 02/09/2025 | Payment from Client B | $300 | Revenue Account |

Consistency in the entry process is key to maintaining accuracy. Review your transactions regularly to verify that all cash inflows have been properly recorded. By ensuring accurate debit and credit entries, you prevent errors and keep your financial statements reliable.

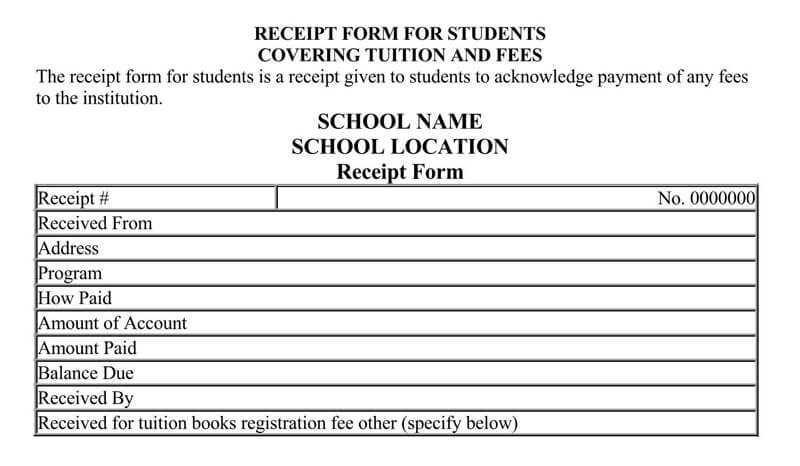

Record customer payments immediately as receipt vouchers to maintain accurate financial records. This step ensures that payments are correctly logged in your accounts, reflecting both the cash inflow and the corresponding revenue or outstanding receivable reduction.

Step 1: Verify Payment Details

Before recording, confirm the payment details–amount, payment method (cash, check, credit card, etc.), and the date of receipt. Cross-check the payment against the sales invoice or contract to ensure accuracy.

Step 2: Record the Receipt Voucher

Create a receipt voucher in your accounting system. This voucher should reflect the customer’s name, payment method, amount received, and any applicable transaction fees. Record the debit entry to your cash or bank account and the corresponding credit entry to either revenue or accounts receivable, depending on the transaction.

- Debit: Bank/Cash account (for the received amount)

- Credit: Accounts Receivable or Revenue (based on the nature of the transaction)

For partial payments, ensure that the accounts receivable balance is adjusted accordingly. If the payment is for a new sale, credit the revenue account or the relevant sales account.

Step 3: Documentation and Filing

Attach the payment receipt or a copy of the transaction document to the voucher. Maintain organized records for future reference or audit purposes. Proper filing ensures that all financial information is traceable and available when needed.

Linking bank transactions to your double-entry bookkeeping system is a straightforward process. Every bank entry–whether it’s a deposit, withdrawal, or transfer–must be recorded with two corresponding entries to maintain the balance. Here’s how you can integrate these transactions seamlessly:

1. Record Deposits

- When a deposit is made, credit the bank account to reflect the increase in cash.

- Simultaneously, debit the appropriate account, such as revenue or accounts receivable, depending on the nature of the deposit.

2. Record Withdrawals

- For withdrawals, debit the bank account to show a decrease in cash.

- Credit the relevant expense or liability account, such as accounts payable or expenses, to match the transaction.

For transfers between bank accounts, the process involves debiting one account and crediting another with the same amount. This ensures that both accounts reflect the correct balance.

By following these steps, you maintain accurate financial records that align with the principles of double-entry accounting, keeping both your books and your bank statements in sync.

Double-check the date on each receipt voucher. Incorrect dating can lead to errors in financial reporting and disrupt your accounting periods. Always ensure the date matches the actual transaction date, not when the entry is made.

Ensure the correct account classification for every transaction. Misclassifying an expense or income item under the wrong account can distort financial statements and complicate audits. Verify each entry against the correct ledger account category.

Be meticulous with the amounts. Verify that all numerical data is accurate, especially when dealing with partial payments or multiple items on a single receipt. A small mistake can add up over time and cause discrepancies in financial balances.

Don’t overlook the description fields. Make sure every voucher entry has a clear, detailed explanation of the transaction. This helps when reviewing receipts in the future and ensures clarity for auditors or colleagues.

Regularly reconcile your receipt vouchers with bank statements or payment receipts. This process will highlight discrepancies early, allowing you to address issues before they affect the financial statements.

Be cautious of duplicates. Ensure each voucher is entered only once. Duplicate entries not only inflate financial figures but also lead to inaccurate reports and errors during audits.

Always include relevant documentation with each voucher entry. This could include invoices, contracts, or receipts, which help verify the transaction if questioned later. Missing documentation may cause problems during audits.

Automating receipt vouchers in accounting software reduces the risk of human error and speeds up transaction recording. By setting up automatic invoice matching, the system can directly link receipts with the appropriate accounts. This ensures accurate allocation of funds without manual intervention. Automation allows the software to instantly record credit and debit entries based on predefined templates, reducing errors in data entry.

Additionally, implementing automated rules for categorizing receipts improves consistency. These rules can be based on vendor details, payment method, or transaction type. With such a system, accountants can focus more on analysis, rather than data entry. It also improves auditing, as all transactions are properly logged and can be easily traced back to their original source.

By integrating receipt vouchers with other modules, such as accounts payable or accounts receivable, automation ensures seamless workflows. This integration allows for quick reconciliation and gives users a clear view of outstanding balances. In the long run, automating receipt voucher processes can save time and enhance the overall accuracy of financial reports.

Receipt Voucher Template Double Entry Bookkeeping

Design your receipt voucher template with clear debit and credit entries to align with double-entry bookkeeping principles. A simple template should include the following columns: date, description of the transaction, debit, credit, and balance. Ensure every entry has a corresponding opposite entry in the ledger. For example, when receiving a payment, the debit entry increases your cash account, while the credit entry reduces the accounts receivable balance.

Label each entry to track its source, whether it’s a payment or a refund, and categorize it appropriately. Maintain a running balance column to ensure accuracy, and always verify that total debits match total credits. This provides a straightforward way to track financial transactions, ensuring transparency and accountability in your accounting process.

Always include unique reference numbers for each transaction to easily identify and audit entries. This practice reduces errors and simplifies cross-checking with bank statements or invoices. By integrating these principles, your receipt voucher template will support the integrity of your double-entry bookkeeping system.