Creating a receipt book template requires clear and structured design to ensure smooth and accurate record-keeping. Focus on including the necessary fields like transaction date, recipient name, item or service description, payment amount, and the method of payment. Having these details clearly marked on each page will simplify the process of issuing receipts and tracking transactions.

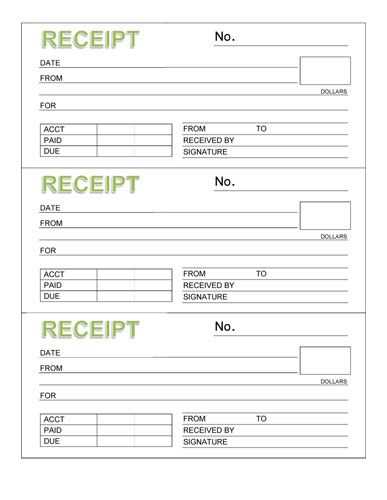

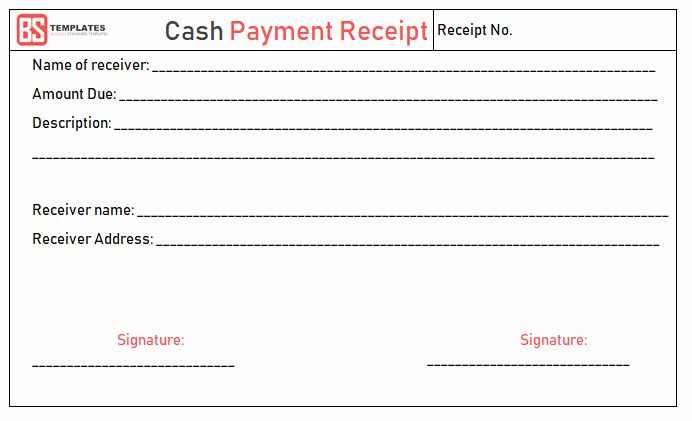

Start by incorporating a section for receipt numbers. This helps maintain an organized sequence of receipts for easier referencing and retrieval. It’s also wise to leave space for additional notes, such as transaction terms or specific instructions related to the payment. A designated area for signatures ensures verification of the transaction and adds credibility to each receipt issued.

Make sure the layout is clean and easy to follow. Each section should be distinct, ensuring users can quickly fill in the necessary details without confusion. If your receipt book is designed for both small businesses and personal use, consider using a flexible format that accommodates different needs while maintaining consistency in presentation.

Don’t forget to include a footer for business details, like contact information, website, or legal disclaimers. This adds a professional touch and can be important for customer reference. Design your template so that it is easily adaptable for future updates, like tax rate changes or service alterations, without needing a complete redesign.

Template of Receipt Book

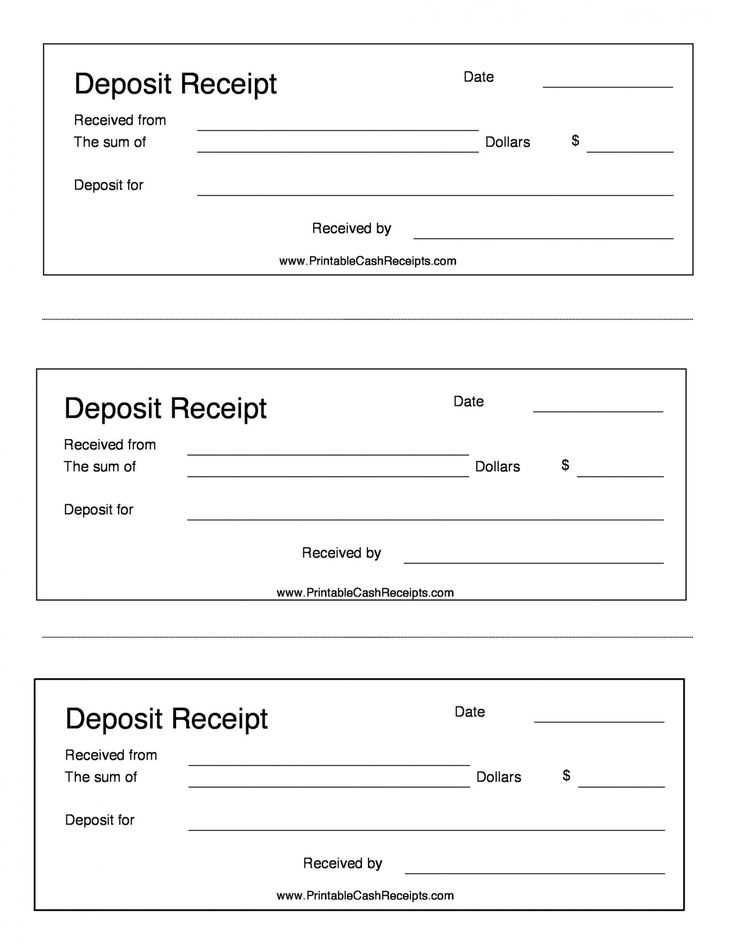

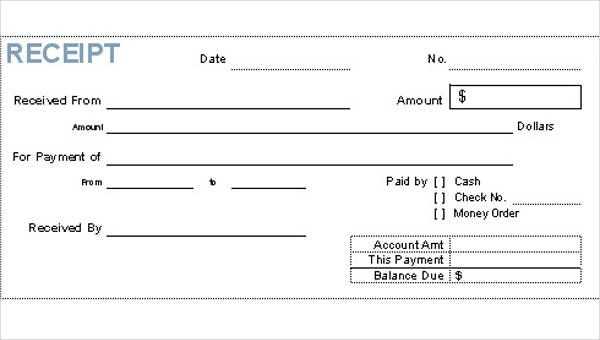

Ensure your receipt book template is clear and well-organized for smooth transactions. Each page should include sections for the receipt number, date, payer’s name, amount paid, payment method, and a brief description of the transaction. It’s important to leave space for signatures or other authorizations if needed.

For better record-keeping, add a carbon copy or duplicate section for easy tracking. The layout should allow for legible handwriting and a consistent format, making it easy to cross-reference information. If using a digital template, ensure fields are easy to fill and print neatly.

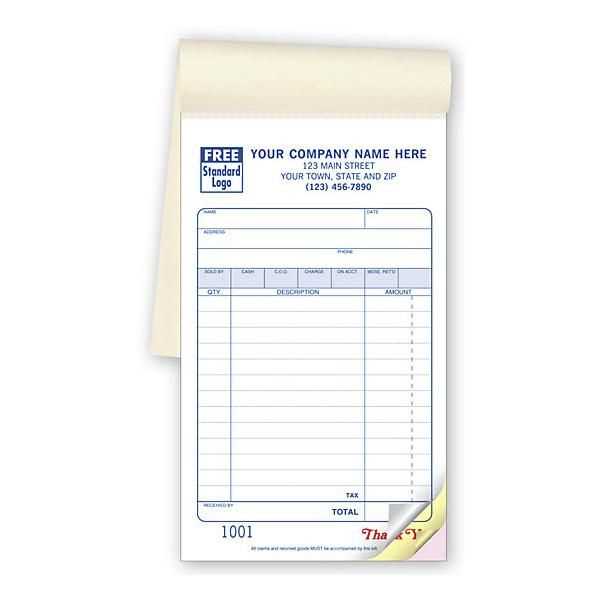

Consider including a place for your business name and contact details, helping with branding while maintaining a professional appearance. Customize the design to match your business’s needs, keeping it simple but functional to avoid clutter.

Choosing the Right Format for Your Receipt Book

Select a format based on the volume and purpose of your transactions. If your business deals with high-volume transactions, a compact size, like A5 or A6, will be convenient. For businesses requiring more details, opt for larger sizes like A4 to accommodate additional fields for information.

Size and Layout

The size of the receipt book dictates how much information you can include on each receipt. Small sizes are perfect for quick transactions, while larger ones allow for customization with more detailed fields, such as multiple items, taxes, or discounts. Consider how much space you need for writing or printing, and choose a size that accommodates all necessary details without crowding.

Number of Copies

Decide how many copies are needed for each transaction. A common format is a three-part receipt book–one for the customer, one for your records, and one for administrative use. Choose the format with sufficient copies to avoid the need for extra documentation. If your transactions require legal verification, opt for more copies to ensure compliance.

| Size | Use Case |

|---|---|

| A5 | Quick transactions, small businesses |

| A4 | Detailed transactions, large orders |

| Custom | Highly specific needs, branding opportunities |

Choosing the format should match both the practicality and branding of your business. The right choice enhances the clarity and organization of your receipts, making both recording and referencing simpler.

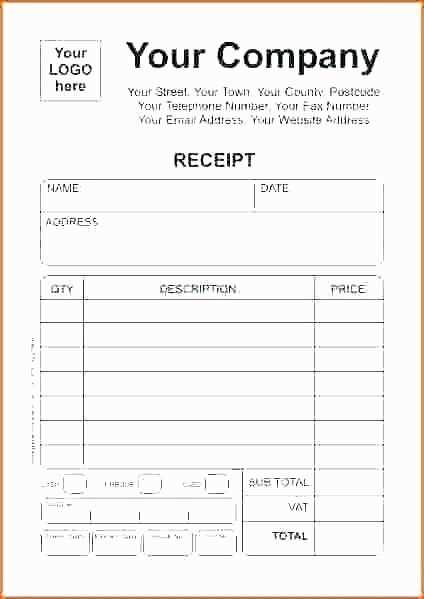

Designing Layout and Key Information Sections

Begin with a clean, organized structure. Place the receipt title at the top for immediate clarity. This could be “Receipt” or “Invoice,” depending on the context. Ensure the font size for the title stands out but doesn’t dominate the space.

The next section should include your company or organization details. This can include the name, address, contact information, and any relevant identification numbers. Position this information in a header section aligned to the left or center, depending on your style. Make sure the text is legible without overcrowding the area.

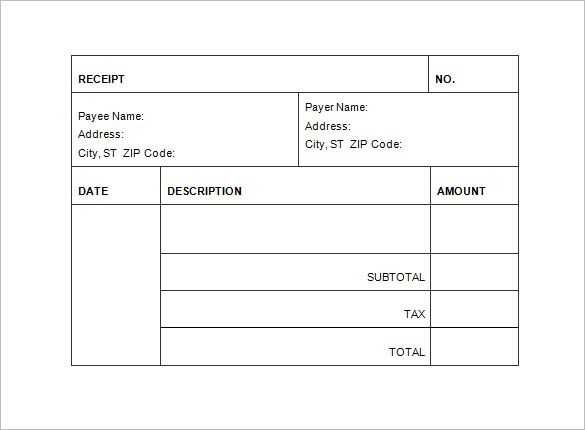

Right below, include the recipient’s details. Clearly label this section with “To” or “Recipient” to maintain consistency. Provide space for their name, address, and any other necessary information. Use enough space so the recipient’s details are distinguishable but not too far from the business information.

In the body, include the itemized list of purchased goods or services. Use a table with clearly defined rows and columns for quantity, description, unit price, and total cost. This should be the most prominent section in terms of layout, as it provides the main content of the receipt. Keep the text concise and avoid excessive formatting to maintain readability.

Follow the item list with a total section, which should stand out to immediately communicate the final amount due. Include a “Total” or “Amount Due” label in bold to distinguish it from other sections. Optionally, add space for tax calculations or discounts if applicable.

Finally, include a footer with payment details or return policy information. Keep it minimal but informative, ensuring the font size doesn’t overwhelm the layout. You may also add a thank you note, which adds a personal touch but does not interfere with the overall structure.

Customizing Fields for Different Transaction Types

Adjust the fields based on the type of transaction you’re processing. For example, in sales receipts, you might want to include product details, discounts, and taxes. For refunds, fields for the original purchase date and reason for return become more relevant. Tailoring your template to fit each transaction type ensures smooth data entry and improves accuracy.

Sales Receipts

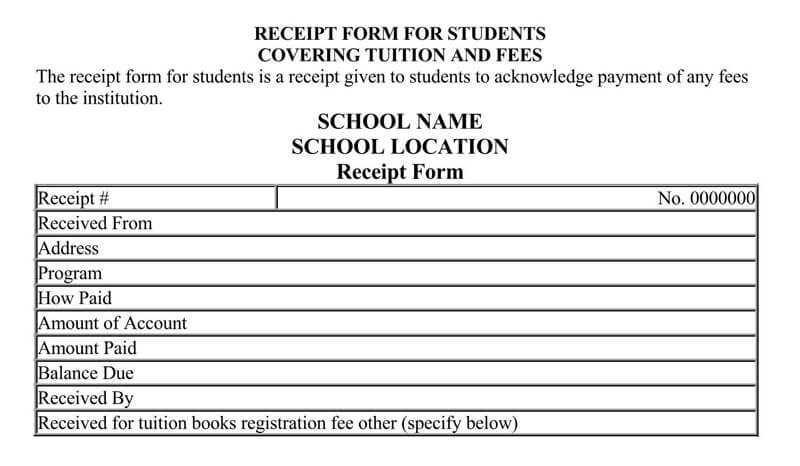

Sales receipts should capture the buyer’s details, items purchased, and applicable taxes. Fields for payment method, transaction ID, and any applied discounts will provide a clear picture of the sale. Always include space for the receipt date and a unique reference number for tracking purposes.

Refund and Exchange Receipts

Refunds require additional fields like the original purchase date and reason for the return. Include a field for the amount refunded and the condition of the item if relevant. For exchanges, add a section to record the new item and any price differences to ensure proper documentation of the transaction.

Incorporating Legal and Tax Information on Receipts

Ensure that receipts include the necessary legal and tax information to comply with local regulations and support transparent business practices. This may include the following details:

- Business Registration Number: Display the official registration number of your business. This verifies your business’s legitimacy and allows customers to trace its legal status.

- Tax Identification Number (TIN): Include the TIN to indicate the business’s tax registration with the local tax authority. This number helps customers confirm that transactions are properly reported to tax authorities.

- VAT (Value Added Tax) Details: If applicable, show the VAT rate and the amount charged for taxable items. Break this down separately if multiple items are subject to different rates.

- Tax-Exempt Status: If your business or certain sales are exempt from taxes, clearly state this exemption and any corresponding regulation.

Additional Tax Information

Include any other specific tax information that is required by local legislation. For instance, some jurisdictions require businesses to itemize and explain specific deductions or tax breaks directly on receipts. This helps maintain transparency in transactions and reduces the risk of errors or disputes.

Consumer Rights and Legal Notices

Incorporating consumer rights information, such as return policies and warranties, can also be beneficial. These should be clearly outlined, especially if they impact how the receipt may be used for refunds or exchanges. Make sure the wording is concise and accessible to avoid confusion.

Ensuring Proper Numbering and Tracking System

Assign a unique sequential number to each receipt to guarantee smooth tracking. Numbering should be consistent, and you must ensure that there are no gaps or duplicates in the sequence. This can be achieved by using automatic numbering systems in receipt books or software that can generate these numbers for you. Make sure each book of receipts is clearly identified with a distinct starting number to avoid confusion across multiple books.

Implementing a Backup System

Track each receipt number manually or digitally to avoid losing track of any issued receipts. Use a record-keeping method where each number is logged along with the date and the transaction details. This allows for easy verification in case of disputes or discrepancies. For extra security, keep a backup copy of the numbering system in a separate location to prevent data loss.

Maintaining Audit Trails

Review your receipt logs periodically to ensure that no numbers have been skipped or duplicated. This audit helps catch any errors early and ensures full accountability. Having a system in place for periodic checks strengthens the credibility and reliability of your receipt book system.

Printing and Binding Options for Receipt Books

For receipt books, opt for high-quality, durable paper that can withstand repeated handling. Most commonly, carbonless copy paper is used for printing, which ensures that one copy transfers cleanly to the next page. Choose between 2-part or 3-part paper depending on how many copies you need. Ensure the ink used is smudge-resistant for better longevity.

When printing, select a method that suits the volume and type of receipts. Offset printing offers sharp, clear text and is ideal for large print runs. For smaller batches, digital printing can be more cost-effective and faster. Both methods can produce professional-looking results, but offset printing tends to be more economical for high-volume production.

For binding, consider stapling, spiral binding, or stitched binding. Stapling is the simplest and cheapest, while spiral binding provides durability and allows easy access to all pages. Stitched binding is a more formal approach and works well for higher-end receipt books. Always ensure the binding method secures the pages firmly, so they don’t shift or tear during use.

Consider the size of the receipt book when deciding on binding. For compact books, a simple stapled spine may be sufficient, but larger receipt books may require more secure binding methods like spiral or stitched options. Each binding type offers varying degrees of flexibility and durability, so choose based on your intended use.