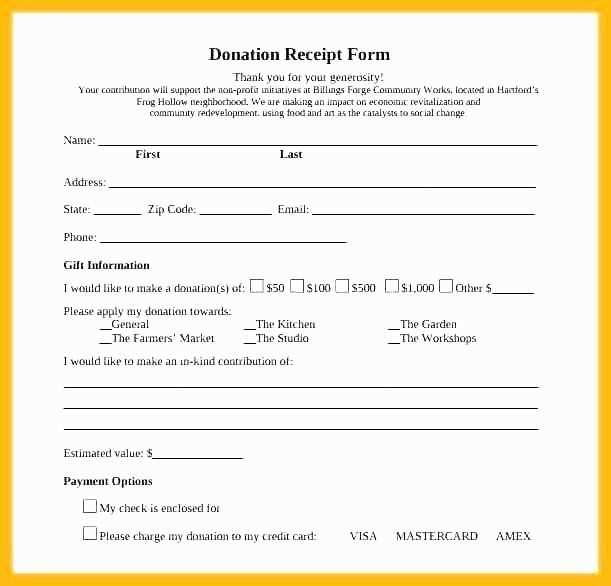

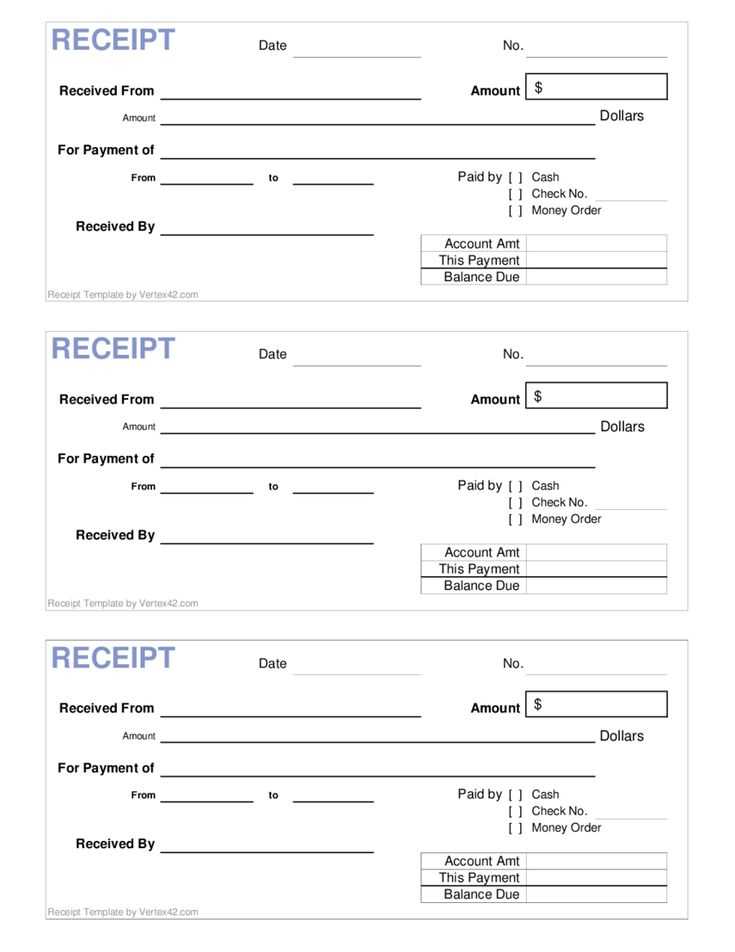

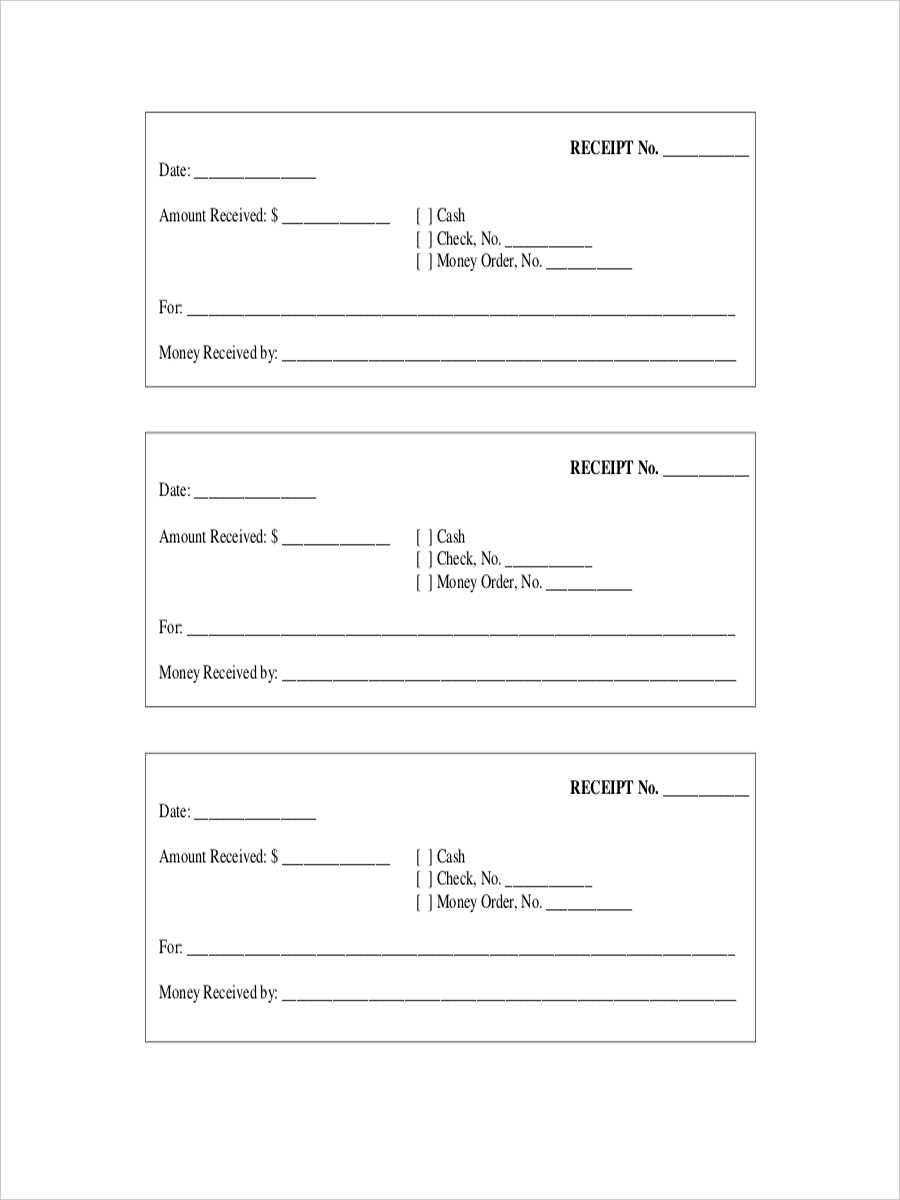

Use a well-structured receipt template to clearly communicate the details of your transaction. It should include all key elements such as the seller’s information, buyer’s information, itemized list of purchased goods or services, payment methods, and the total amount. Providing clear, organized receipts helps maintain professional relationships and ensures transparency in financial dealings.

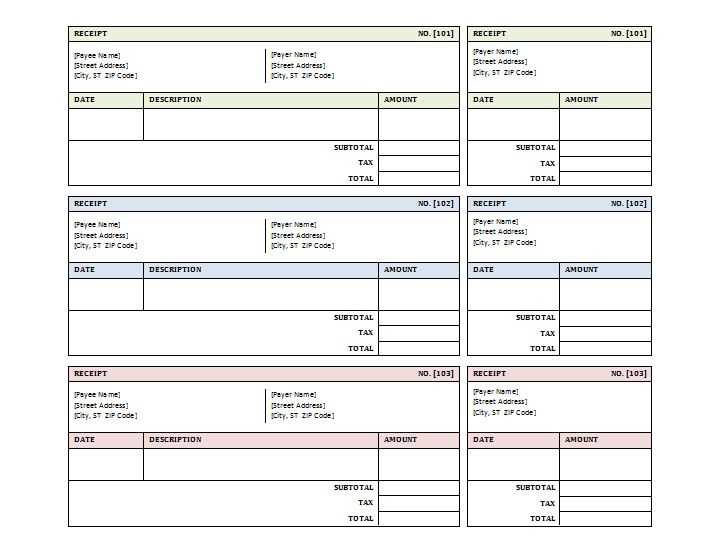

Incorporate a transaction ID or invoice number for better tracking. These identifiers streamline record-keeping and help resolve potential disputes or inquiries. Additionally, include the date of the transaction to keep your documentation accurate and up-to-date.

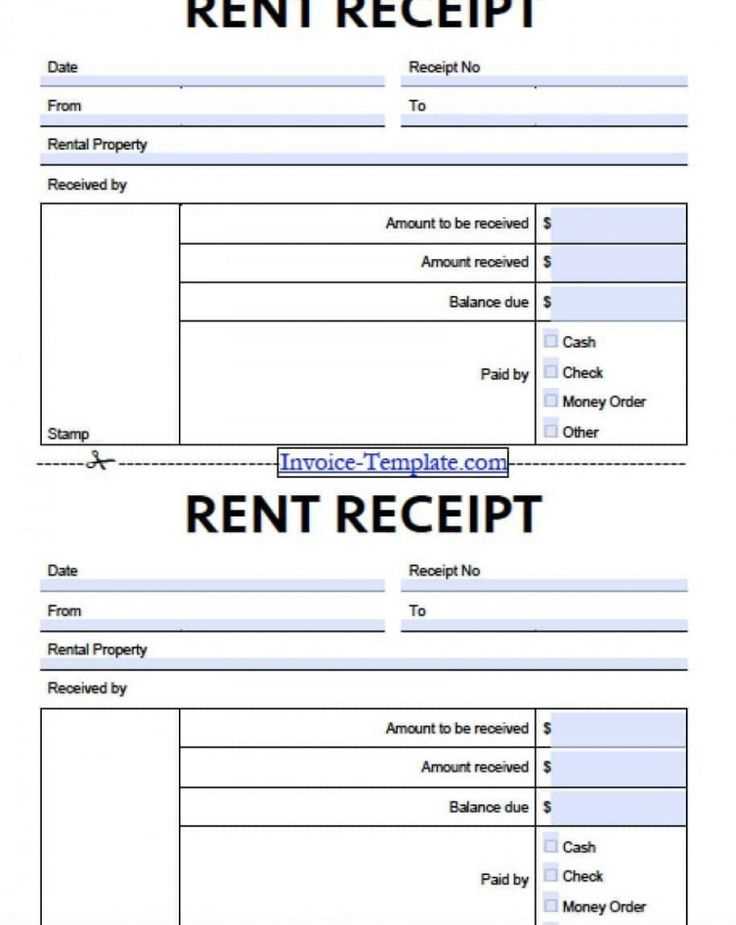

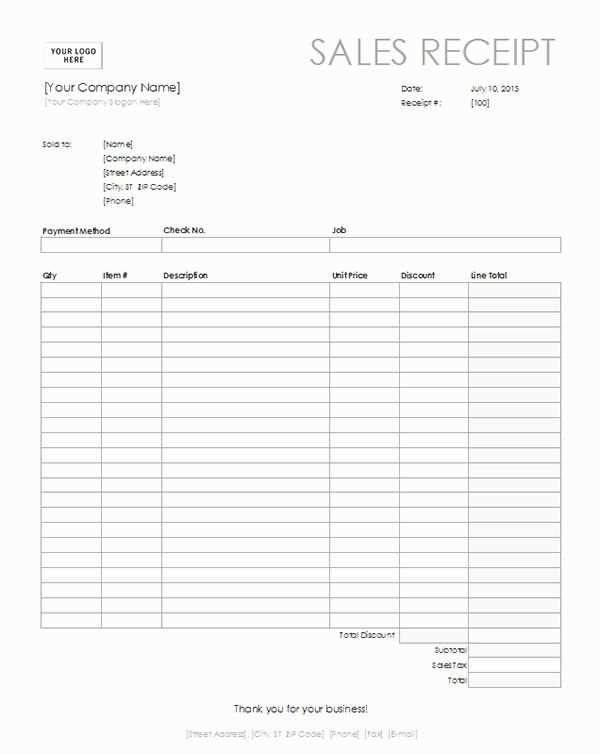

A detailed breakdown of charges, taxes, and discounts is highly recommended. This allows both parties to quickly verify the calculation of the total amount and confirms all terms were understood and agreed upon. This small but significant detail can prevent confusion in the future.

Here are the corrected lines with minimal repetitions:

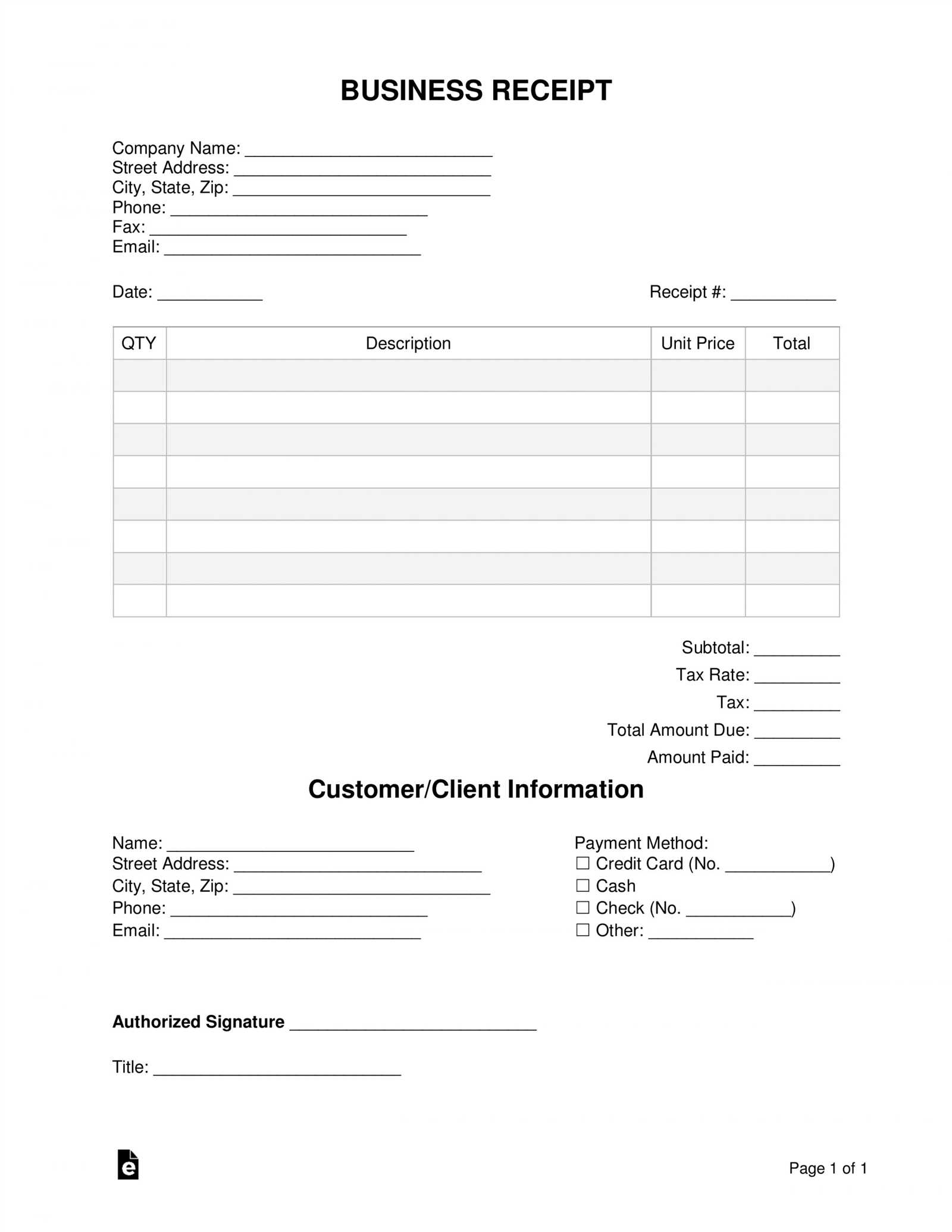

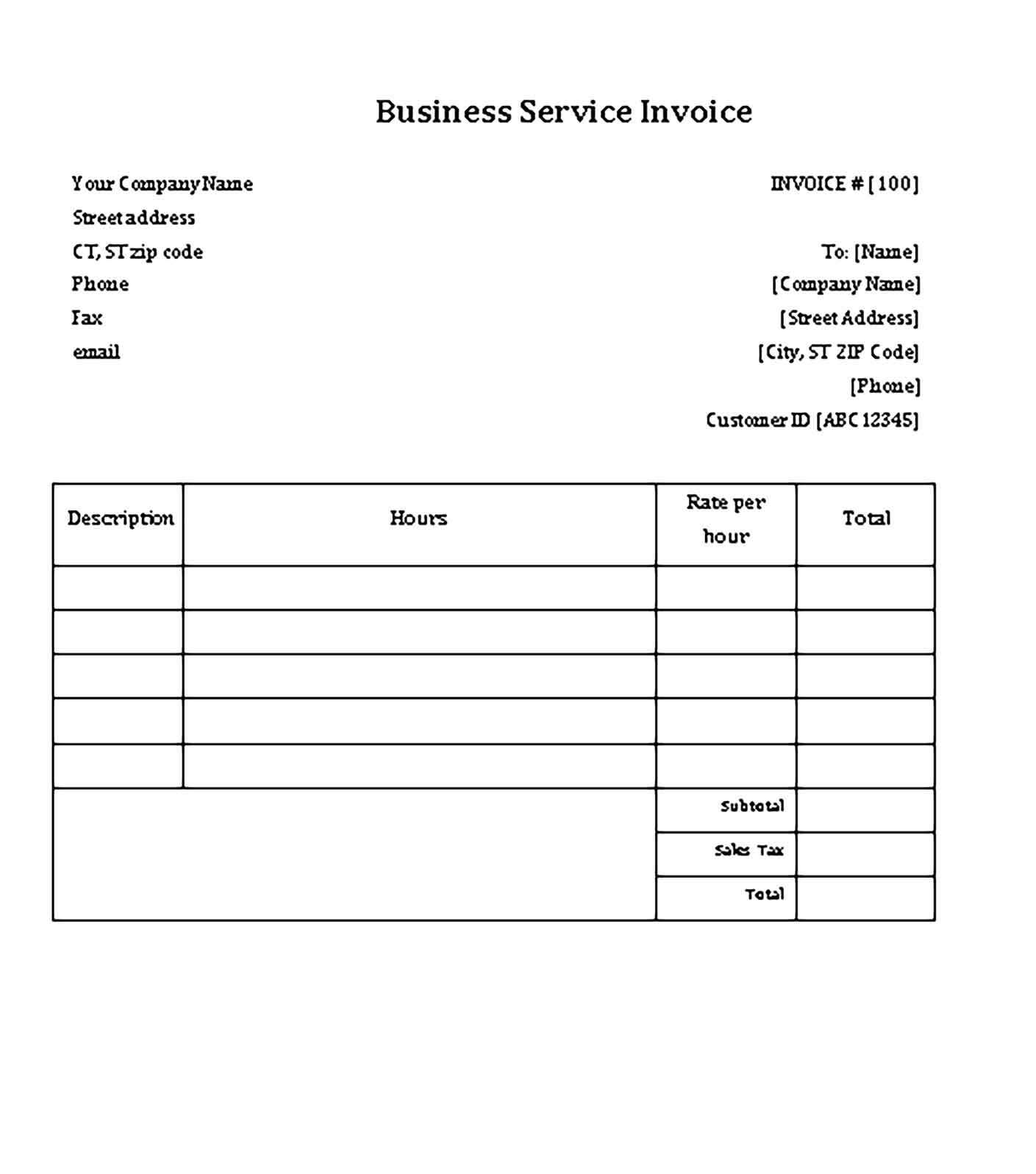

To create a streamlined business receipt template, ensure the information is clear and concise. Start with the business name, followed by contact details, and provide a brief description of the products or services sold. Avoid unnecessary information that could clutter the document. Use a straightforward layout with itemized costs and clear totals for transparency.

How to format business receipts effectively

For each item, list the quantity, price, and any applicable tax. Organize the total cost at the bottom of the receipt, including a breakdown if necessary. Ensure the formatting is clean, with readable fonts and appropriate spacing between sections for easy interpretation. A simple design helps avoid confusion.

Business Receipt Template Guide

To create a functional business receipt, include key details that serve both the customer and the business. At the very least, a receipt should feature the business name, address, and contact details, along with the customer’s information, date of transaction, and an itemized list of products or services purchased. A unique receipt number helps maintain organization and track purchases over time. Ensure that each section is clear and easy to read to avoid confusion.

Choosing the right format depends on the size of your business and the type of transactions you handle. A simple receipt might include only the essential details, while larger businesses may require more elaborate formats, including tax rates, discounts, or refund policies. Consider using a template that can easily be customized based on the needs of your business and your clients.

Personalizing a receipt template enhances the customer experience and reinforces your brand. Include your company’s logo and use a consistent color scheme or design that aligns with your business identity. Tailor the language to reflect your company’s tone, whether formal or casual. Make sure to include your return and refund policies, terms of service, and any other relevant business practices.

From a legal perspective, receipts serve as proof of purchase and can protect both the business and customer in case of disputes. Ensure that your receipts meet all local requirements, which might include displaying VAT, sales tax, or other regional fees. Being aware of specific tax regulations is critical when issuing receipts for transactions.

Clearly state the payment methods accepted on your receipt. Whether it’s cash, credit card, online payment, or mobile wallet, customers should easily identify how they paid. Including this information helps both you and your customers keep track of payment methods and ensures accuracy in accounting.

Maintaining consistency and precision is key when using a business receipt template. Ensure that every receipt includes the same level of detail and follows the same format. This practice ensures that your receipts are reliable for future reference and minimizes errors when processed for accounting or returns.