Need a quick and professional receipt? A business receipt template creator helps you generate polished documents in minutes. Whether you run a small shop or a large enterprise, an automated tool saves time and ensures every transaction is documented properly.

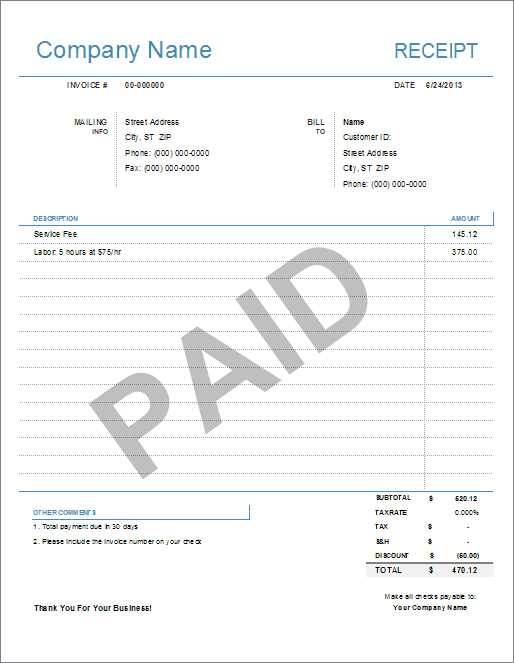

Using a template creator, you can customize receipts with your company’s name, logo, contact details, and tax information. Many tools also offer itemized breakdowns, subtotal calculations, and tax inclusions, making the process seamless.

Instead of formatting receipts manually, choose from pre-designed templates that match your branding. Most creators support multiple formats, including PDF and Excel, ensuring compatibility with accounting systems.

Accuracy matters in financial records, and a structured receipt template minimizes errors. Automated calculations prevent mistakes, while saved templates allow for consistency across transactions.

Explore a business receipt template creator that suits your needs and simplify your invoicing process today.

Business Receipt Template Creator

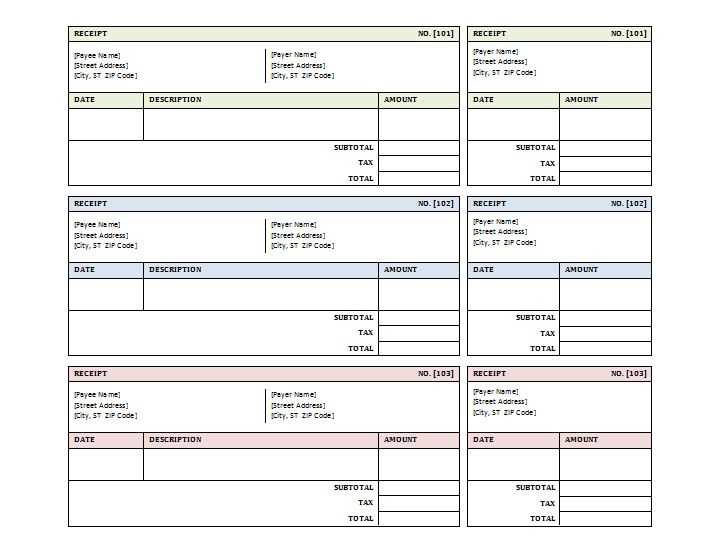

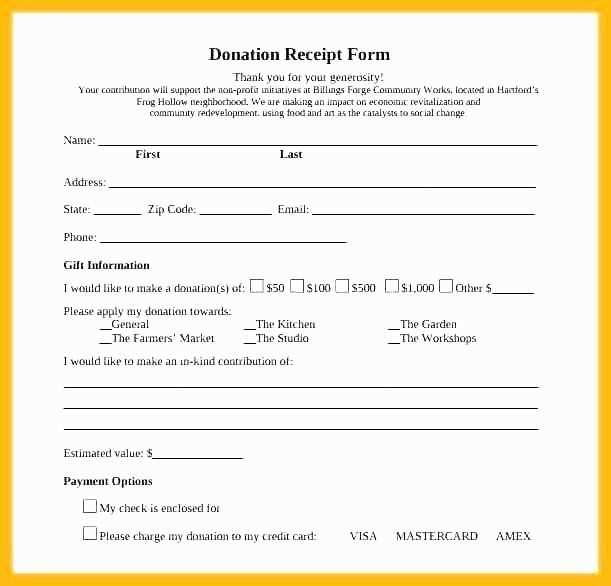

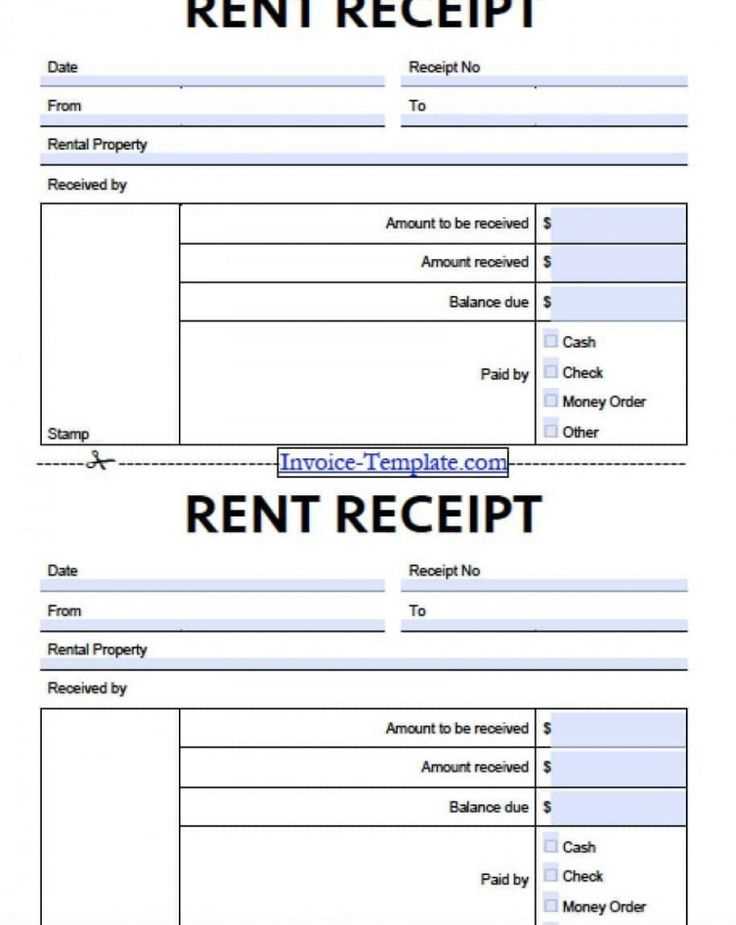

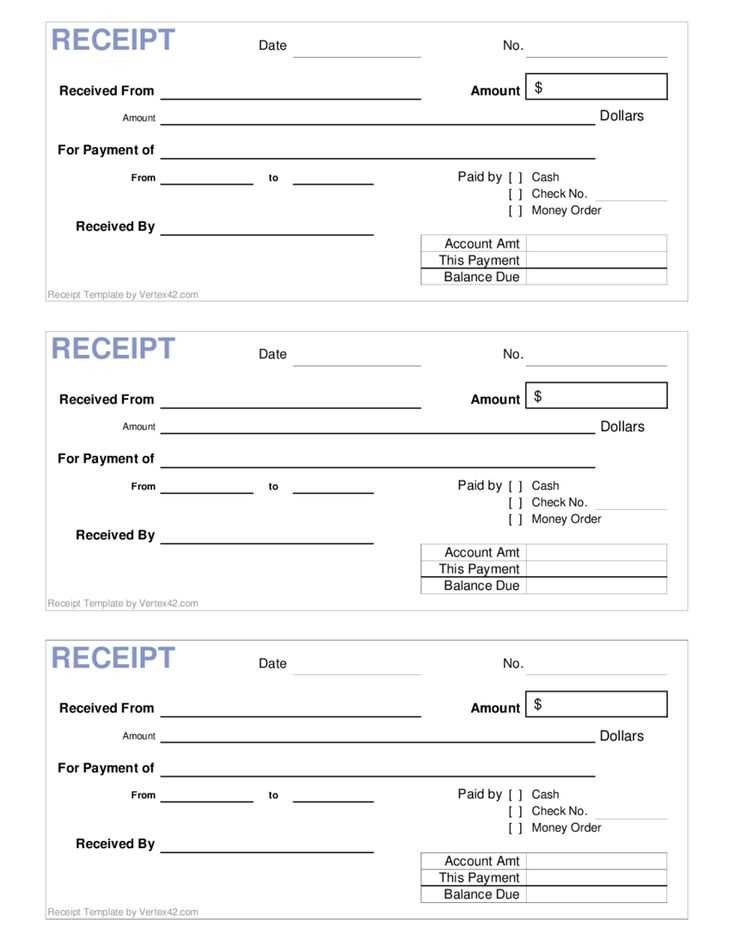

Choose a flexible template. A well-structured receipt template should include fields for date, receipt number, business details, client information, itemized charges, taxes, and total amount. Select a format that allows easy customization to match branding and industry requirements.

Ensure legal compliance. Different jurisdictions have specific regulations regarding receipt content. Verify local tax laws and include necessary disclaimers, tax identification numbers, and refund policies to avoid compliance issues.

Automate calculations. Reduce errors by incorporating automatic calculations for subtotals, taxes, and discounts. A dynamic template saves time and prevents miscalculations that could impact financial records.

Support multiple formats. Clients and accountants may require receipts in different formats, such as PDF, Word, or Excel. Choose a tool that allows exporting receipts in various file types without losing formatting or readability.

Integrate with accounting systems. A receipt template creator with direct integration into accounting software ensures seamless record-keeping. Syncing receipts with platforms like QuickBooks or Xero reduces manual data entry and improves accuracy.

Enable digital signatures. For added security and authenticity, allow electronic signatures on receipts. This is especially useful for online transactions and contract-based services.

Ensure mobile accessibility. A cloud-based tool with mobile compatibility lets users generate and send receipts on the go. Responsive design ensures that templates remain clear and professional on any device.

Include branding elements. Customize fonts, colors, and logos to maintain brand consistency. A professional-looking receipt reinforces credibility and leaves a lasting impression on clients.

Offer automated delivery. Emailing receipts directly to customers saves time and ensures timely documentation. A system with scheduled or instant delivery options enhances efficiency.

Secure stored data. Protect client information by choosing a tool with encryption and backup features. Compliance with data protection regulations prevents potential security breaches.

Key Features to Look for in a Receipt Template Creator

Choose a tool that offers full customization. Adjust fonts, colors, logos, and layout to match your brand identity. A rigid template limits flexibility, so opt for software that allows modifications without coding.

Automated Calculations

Avoid manual errors with automatic tax, discount, and total calculations. A good receipt creator updates values instantly when you enter new data, saving time and reducing mistakes.

Multiple Export Options

Ensure the tool supports formats like PDF, Excel, and Word. This guarantees compatibility with accounting software and makes sharing receipts easier. Cloud storage integration is a plus for quick access and organization.

How to Customize a Receipt Template for Different Business Needs

Adjusting a receipt template to match specific business needs ensures clarity and professionalism. Start by selecting a format that aligns with the nature of transactions. A retail store may require itemized lists, while a freelance service might prioritize a description field.

- Modify Header Details: Add a company logo, business name, and contact information. Ensure the font is legible and the layout remains clean.

- Adjust Tax and Currency Settings: Include applicable tax rates and display the correct currency based on the location of your business.

- Customize Item Descriptions: Tailor product or service descriptions to provide clarity. Include SKU numbers if necessary.

- Include Payment Methods: Specify accepted payment types such as credit card, cash, or digital transfers.

- Add Legal Disclaimers: If required, include refund policies or warranty information to prevent disputes.

- Incorporate Personalized Notes: A short thank-you message or special offer can improve customer retention.

Test the template before full implementation to confirm all details appear correctly. Save a master version to streamline future updates.

Best File Formats and Export Options for Business Receipts

For maximum compatibility and long-term accessibility, export business receipts in PDF format. PDFs maintain their layout across all devices, prevent unintended edits, and support digital signatures for authentication. Most accounting software and receipt generators offer direct PDF export, making it a reliable choice for official records.

Alternative Formats for Specific Needs

For easy data extraction, CSV files work best. They store receipt details in a structured format, allowing seamless import into spreadsheets or accounting software. If receipts require frequent editing or customization, DOCX files provide flexibility while retaining basic formatting.

Automation and Cloud Integration

Many receipt creators support direct exports to cloud services like Google Drive or Dropbox. Choosing a format compatible with these platforms ensures instant backups and remote access. Some tools also offer API integrations, enabling automatic receipt storage and synchronization with financial systems.