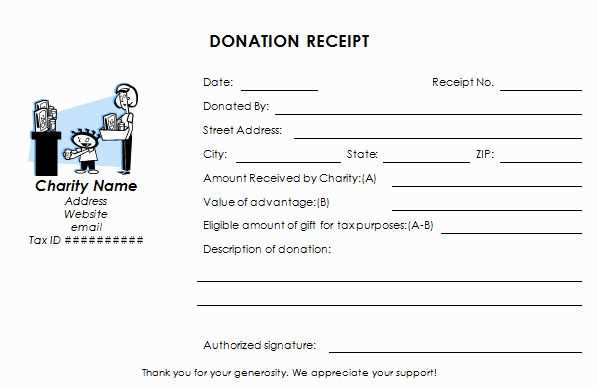

A well-structured business receipt template can streamline your nonprofit organization’s record-keeping. It ensures transparency and fosters trust with donors and vendors. When crafting a receipt, include details such as the donor’s name, date of donation, amount given, and the purpose of the donation. If applicable, reference the organization’s tax-exempt status to clarify that the donation qualifies for tax deductions.

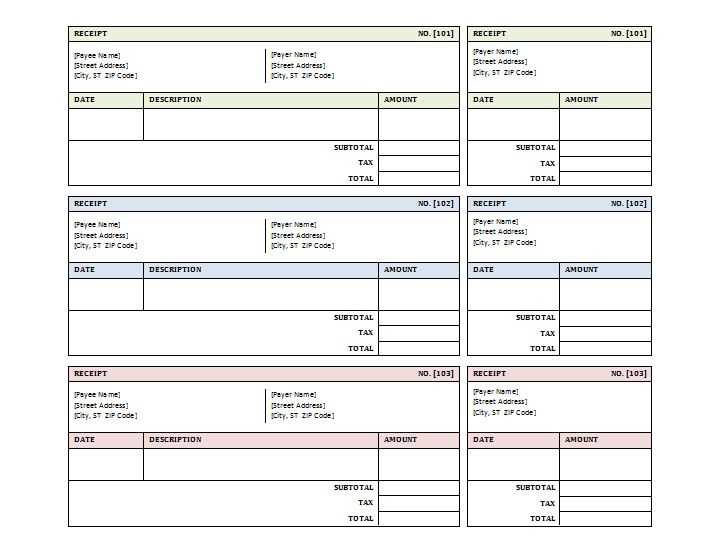

The template should also feature clear headings like “Receipt Number” and “Donation Purpose.” These elements help track payments and provide easy access to important details in the future. Use consistent formatting, such as a clear date format and a neat layout, to make the document user-friendly.

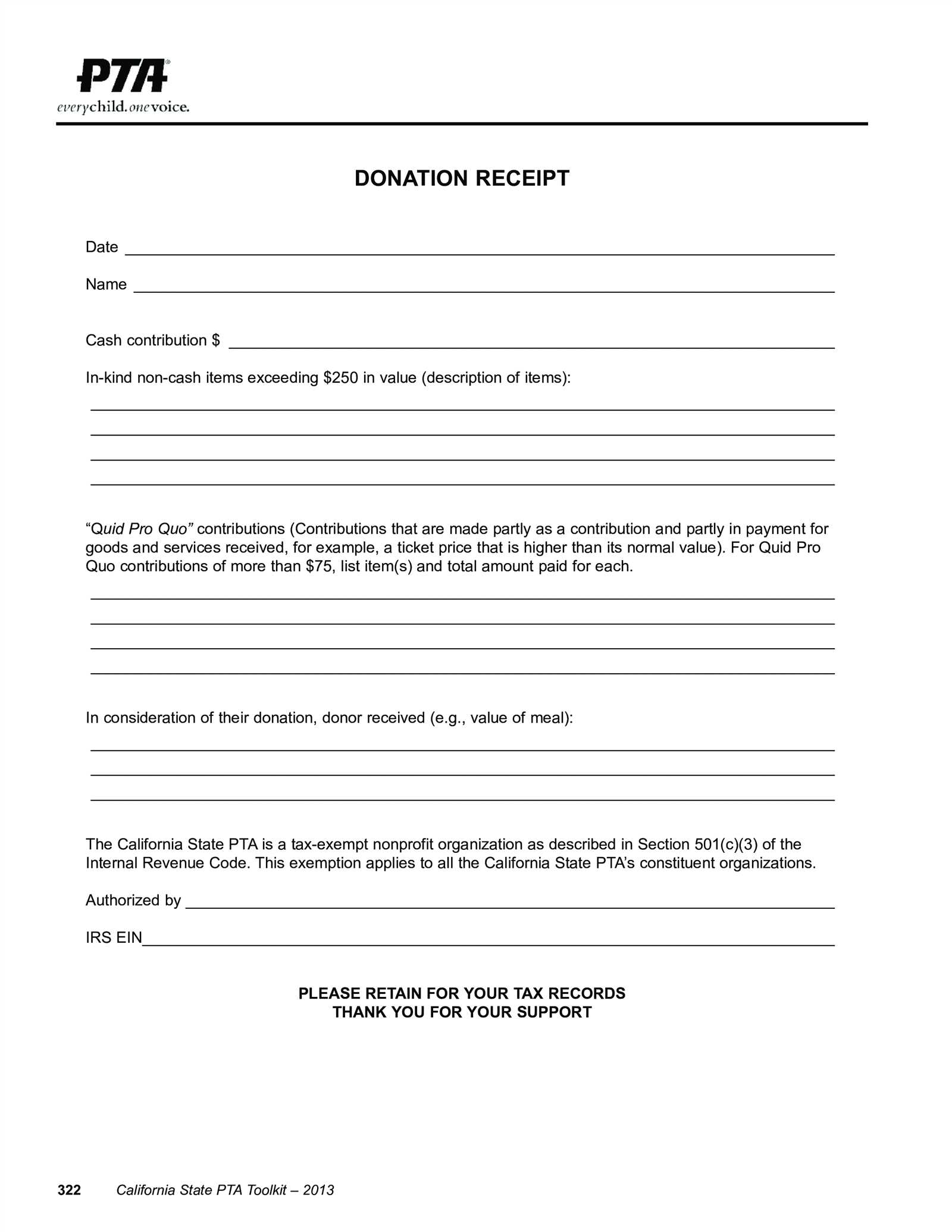

To avoid confusion during audits, provide a section for a signature or authorized representative’s initials. This ensures accountability and validates the receipt. Having a ready-to-use template will save time, reduce errors, and help your nonprofit stay organized and compliant with regulatory standards.

Business Receipt Template for Nonprofits

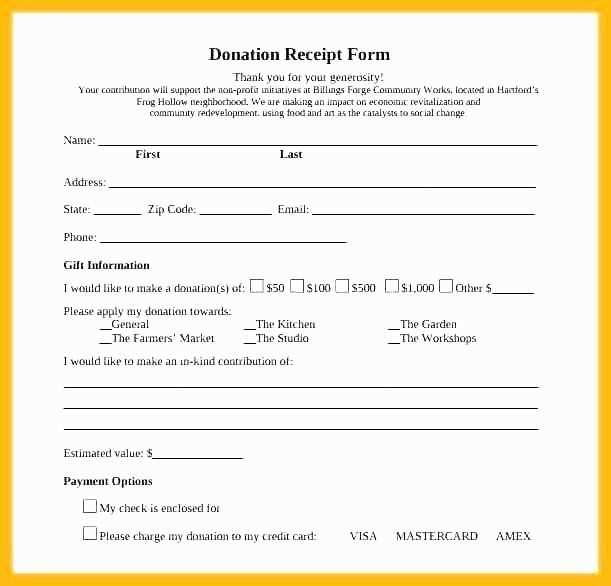

Use a clear and concise template for nonprofit business receipts to ensure transparency and maintain trust with donors and supporters. A receipt should include key details like the date of donation, the donor’s name, the amount donated, and the nonprofit’s contact information. Make sure to specify if the contribution is monetary or in-kind, and offer a brief description of the purpose of the donation, such as for a specific project or program.

Key Components of the Receipt

Each receipt should include the following elements:

- Nonprofit Name and Address: Include your organization’s legal name, address, and tax ID number.

- Date of Donation: List the date the donation was received.

- Donor Information: Include the name and contact details of the donor. This is crucial for the donor’s tax purposes.

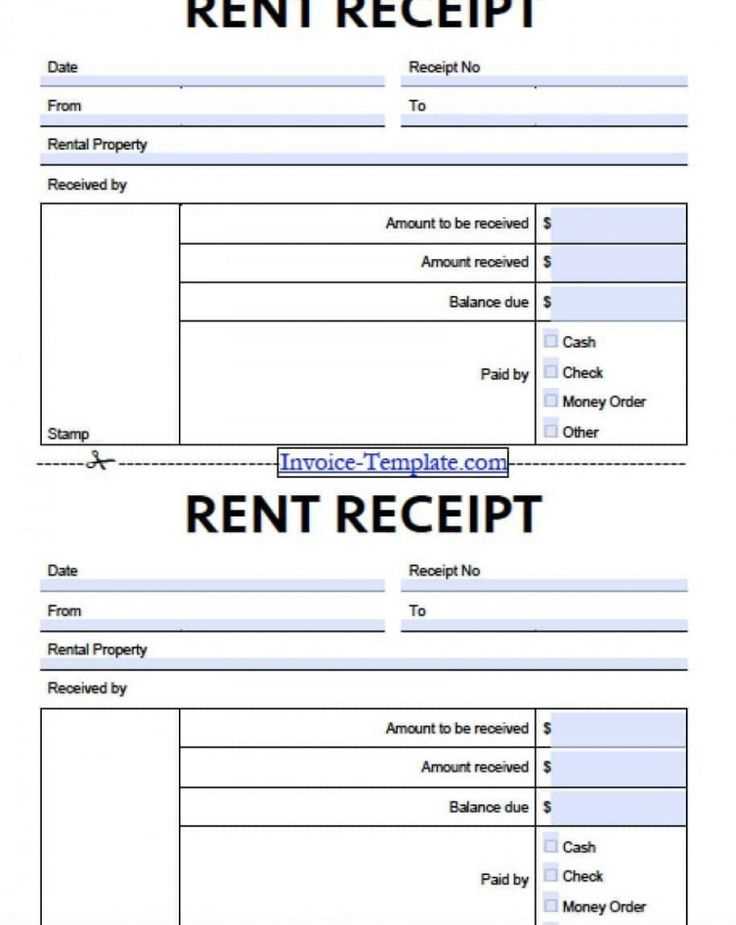

- Donation Amount: Specify the exact amount given, whether monetary or in-kind. For monetary donations, also include the method of payment (e.g., cash, check, credit card).

- Description of the Donation: If applicable, briefly describe what the donation was for, such as a specific program or event.

- Statement of Nonprofit Status: A note stating that the nonprofit is tax-exempt under section 501(c)(3) of the Internal Revenue Code (if applicable).

Customizing Your Template

Adjust the template to suit your organization’s needs. Add a personalized thank-you message or any additional instructions relevant to your nonprofit’s goals. The simpler and more straightforward the receipt, the easier it will be for both your organization and the donor to keep accurate records for tax purposes.

Choosing the Right Template for Nonprofit Organizations

For nonprofits, selecting a template that matches your needs can simplify administrative tasks and provide a professional touch. Look for designs that are clear and focused on the donor’s experience. A template with customizable fields lets you add or adjust details as necessary, ensuring accuracy in financial records.

A key factor is simplicity. Choose a format that displays essential information–such as donation amount, date, and donor details–without clutter. Avoid templates with too many graphics or complex layouts that could distract from the main message.

Ensure your template includes a space for a tax-deductible statement. Nonprofit donors expect this information for their tax returns, and having it clearly displayed will build trust. This small but necessary detail can make a significant difference in donor relations.

Consider templates that allow easy integration with accounting tools. Automation can save time and reduce errors, especially if you are handling a high volume of transactions.

Lastly, pick a template that can be easily updated. As your nonprofit grows or changes, the ability to modify the template to reflect new branding or organizational shifts is crucial for maintaining consistency.

How to Customize Your Receipt Template for Tax Compliance

Customize your receipt template to ensure it meets IRS requirements and helps donors claim tax deductions. Include key details that provide clarity and transparency.

Include Required Information

Your receipt must contain the following:

- Nonprofit Name and Address: Ensure the organization’s full legal name and address are listed.

- Donation Date: The exact date of the donation should be stated.

- Donor’s Name: Include the full name of the donor.

- Donation Amount: Specify the total donation value. If it’s non-cash, describe the item(s) donated and their estimated value.

- Statement of No Goods or Services: For cash donations, include a statement like: “No goods or services were provided in exchange for this contribution.” If applicable, note the fair market value of any goods or services provided.

- Tax Deductibility Statement: Include a clear statement like: “This donation is tax-deductible as allowed by law.”

Customize for Non-Cash Donations

If you accept non-cash donations, make space on the receipt for a description of the items, the donor’s estimate of their value, and a note that the donor is responsible for the valuation. Non-cash donations require specific IRS guidelines for valuation, so ensure your template is aligned with those rules.

Regularly update your template to reflect any changes in tax laws. This will ensure ongoing compliance and help maintain accurate records for both your organization and your donors.

Key Information to Include on Nonprofit Business Receipts

Each receipt should clearly display the nonprofit’s name and address. This makes it easy for donors to identify where their contribution went.

Include a unique receipt number. This helps maintain an organized record for both the donor and the nonprofit.

List the date of the transaction. This is critical for both accounting and for the donor to track their contributions for tax purposes.

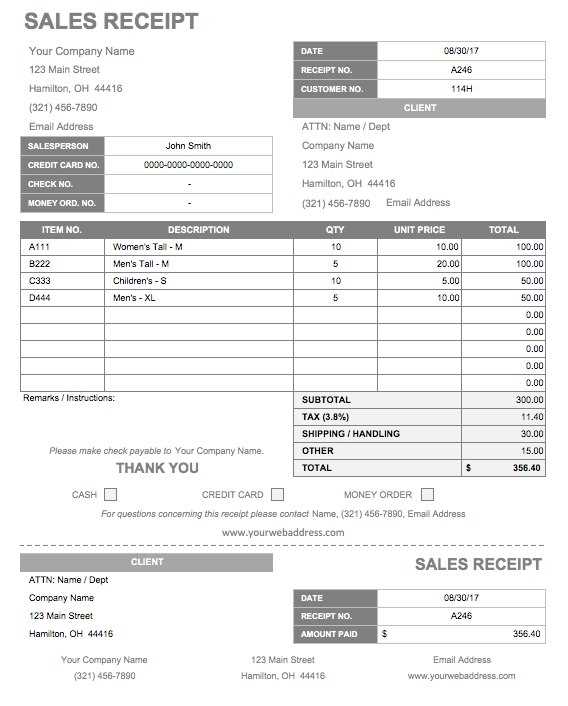

Specify the amount donated or paid. Break it down if necessary, showing any deductions or itemized costs for transparency.

If applicable, note the purpose of the donation. For example, if funds were earmarked for a specific program or event, indicate that on the receipt.

Include a statement regarding the nonprofit’s tax-exempt status. This clarifies that donations are eligible for tax deduction, if applicable.

For donations, a phrase like “no goods or services were provided in exchange for this contribution” should be added if true. This is required for tax purposes.

If the receipt is for goods or services, include a description of those along with their fair market value. This helps donors understand the value they received in return.

Finally, ensure the receipt includes a clear statement about its role as proof of donation for tax purposes, confirming the donor’s eligibility for deductions.