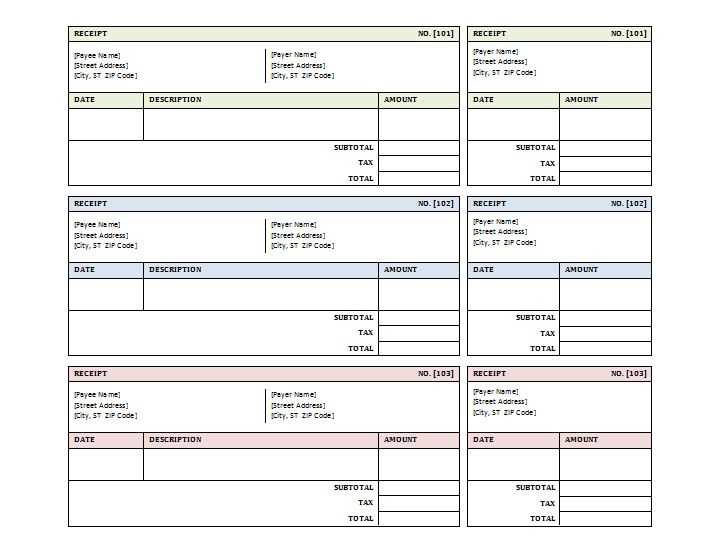

Choose a professional business receipt template that suits your industry and brand image. A well-designed template not only adds credibility but also saves time by simplifying the process of creating receipts for every transaction.

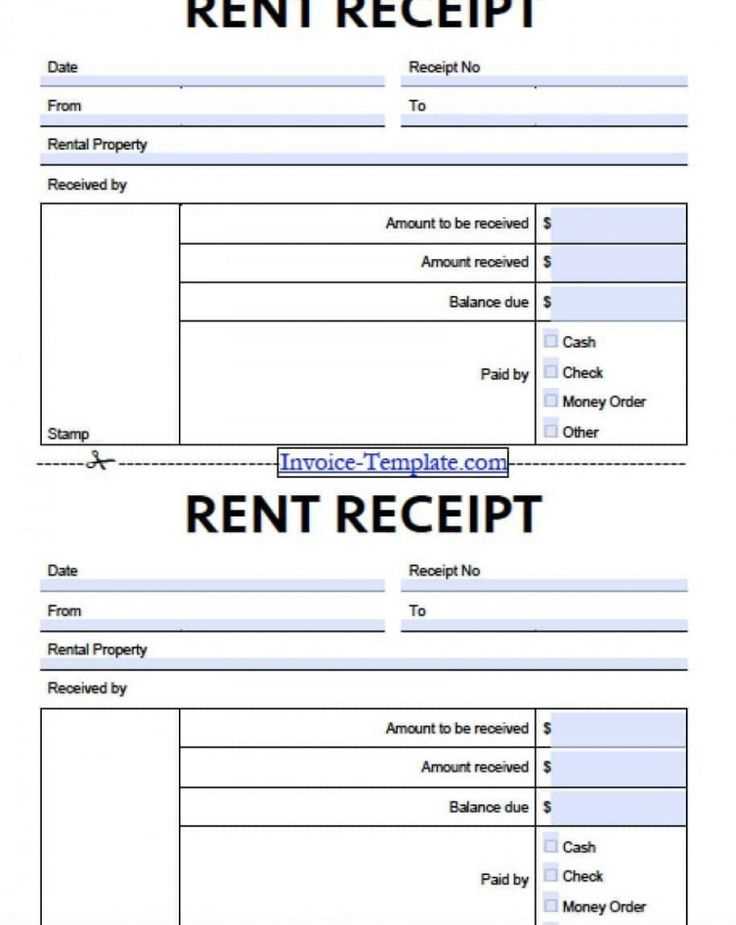

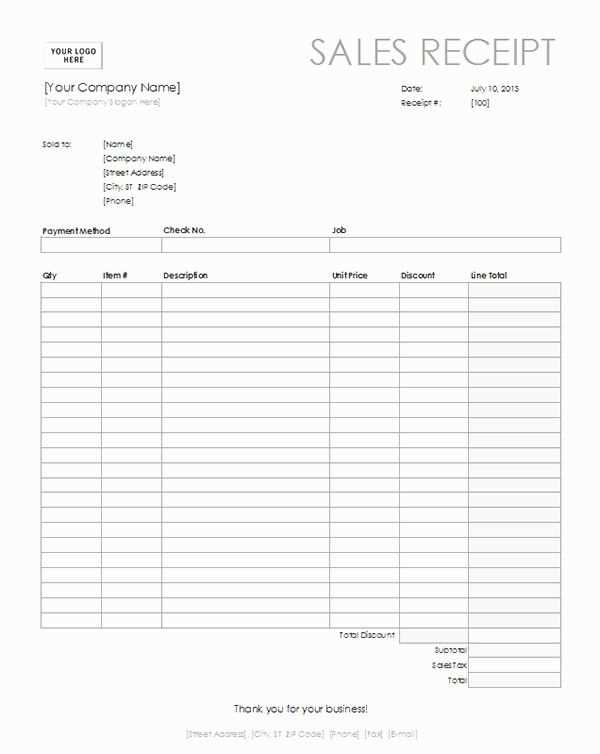

Ensure the template includes clear sections for the business name, contact information, transaction details, and a unique receipt number. This will make your receipts easy to reference and track for both your business and your clients.

Look for templates that allow customization of fields, such as item descriptions, quantities, and total prices. These templates should also have room for taxes, discounts, and payment methods to reflect the full transaction process.

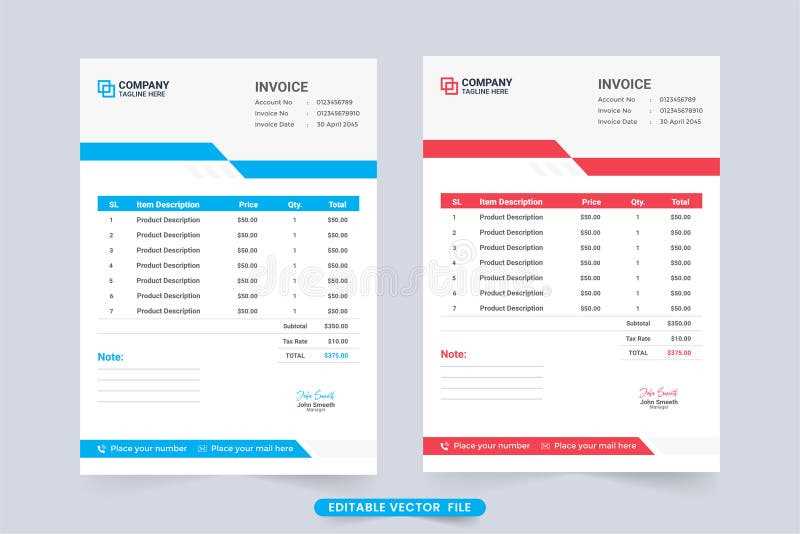

Avoid clutter by focusing on a clean and simple design. Your receipts should be easy to read and professional, reflecting the quality of your business services. If you need to include logos or branding, place them strategically to maintain a neat, uncluttered layout.

Choosing the right receipt template will streamline your business operations, keep your transactions organized, and leave a lasting impression on your clients.

Here’s the detailed plan for the article on “Professional Business Receipts Templates” in HTML format

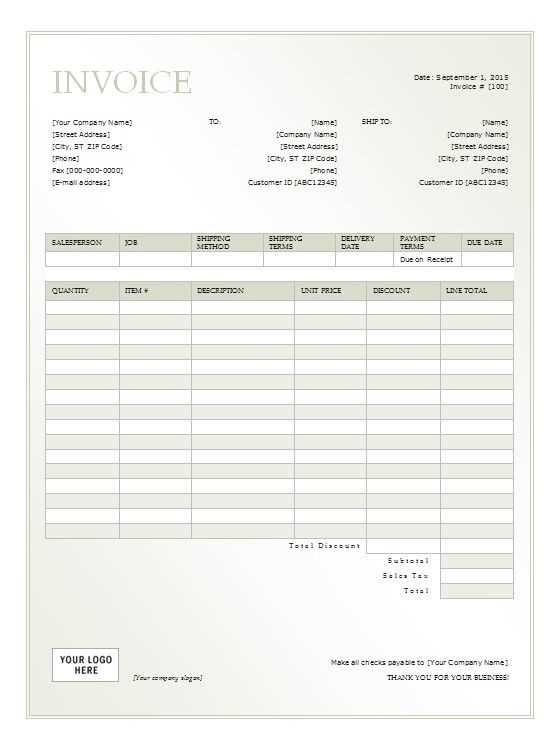

To create a functional and professional receipt template, focus on clarity and detail. Start with sections for the date, seller and buyer information, a description of products or services, and total amount. Ensure that each part is easily identifiable and well-organized. A clean layout with clearly labeled fields allows quick understanding of the transaction.

Key Elements to Include

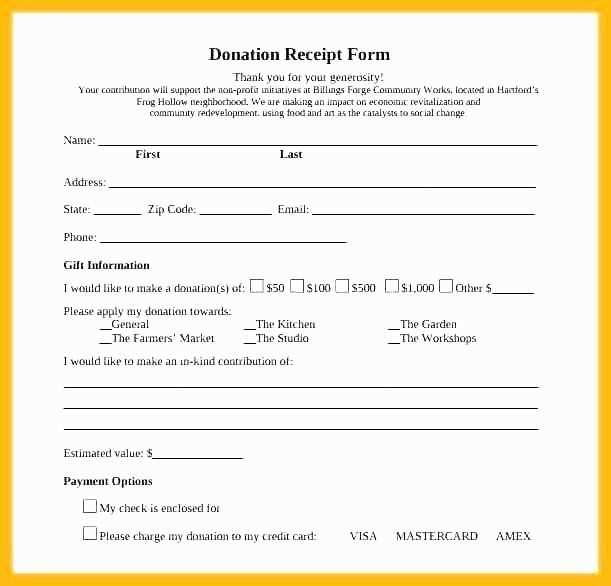

Each receipt template should include basic fields such as transaction date, itemized list of purchases, taxes, payment method, and a final total. You can also add sections for discounts, additional fees, or notes, depending on your business needs. Be sure to specify payment terms or refund policies if relevant to the transaction.

Formatting Tips

Use simple, readable fonts and sufficient spacing to make the receipt easy to navigate. Avoid clutter by limiting the amount of information per line. Break the details into logical sections, with bold headings for key categories like “Items Purchased” and “Total Due.” Keep the design consistent across templates for a unified look.

Choosing the Right Format for Different Industries

Each industry has unique requirements for business receipts. Tailor your receipt format to meet these specific needs to maintain professionalism and compliance.

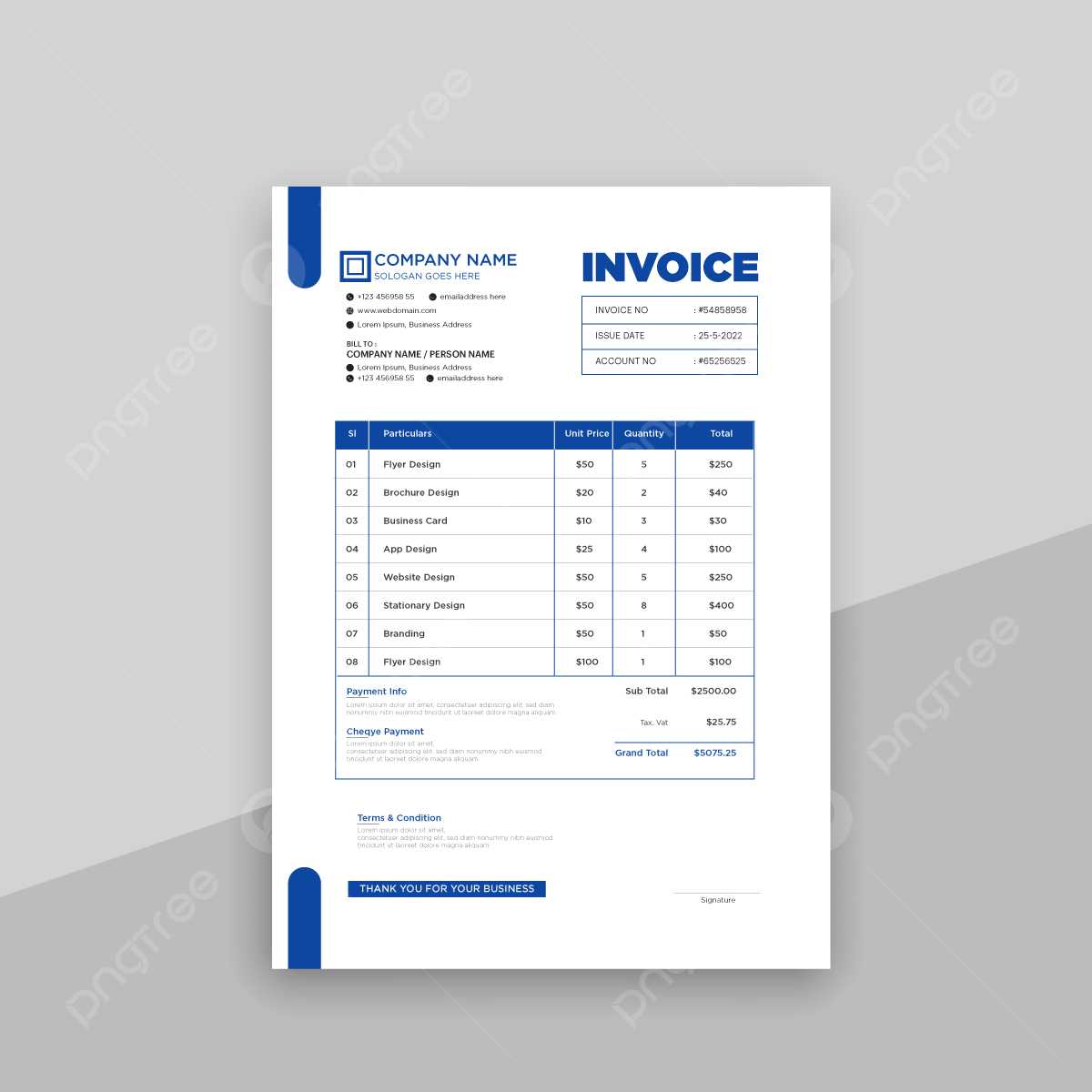

For retail businesses, clear itemized receipts are crucial. Include details like product descriptions, quantities, prices, and applicable taxes. A table format works well for displaying this information neatly:

| Item | Quantity | Price | Total |

|---|---|---|---|

| Product A | 2 | $15.00 | $30.00 |

| Product B | 1 | $10.00 | $10.00 |

| Tax | $3.00 | ||

| Total | $43.00 | ||

For services like consulting or freelance work, a more detailed breakdown may be necessary. Include hourly rates, time spent, and a short description of each service rendered. A simpler format with bullet points or a basic list can help convey this information without overwhelming the client.

| Description | Hours | Rate | Total |

|---|---|---|---|

| Consulting Session | 2 | $50.00 | $100.00 |

| Project Planning | 3 | $45.00 | $135.00 |

| Total | $235.00 | ||

In construction or contracting, invoices should focus on materials, labor costs, and project timelines. Break down each aspect clearly and include space for additional charges like permits or transportation fees. A detailed table can help your client understand the full scope of the project costs.

| Material/Service | Quantity | Unit Price | Total |

|---|---|---|---|

| Concrete | 5 bags | $25.00 | $125.00 |

| Labor | 8 hours | $40.00 | $320.00 |

| Permit Fee | 1 | $50.00 | $50.00 |

| Total | $495.00 | ||

By customizing the receipt format for your specific industry, you ensure clarity and foster trust with your clients. Make sure to include the necessary information for your sector while keeping the format clean and easy to follow.

Customizing Receipt Templates for Branding and Clarity

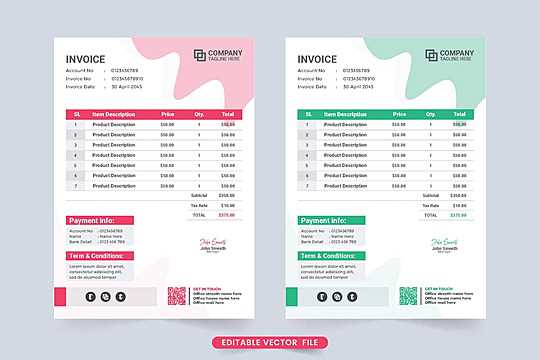

Customize your receipt templates by integrating your brand’s logo and color scheme. This immediately aligns the receipt with your company identity, creating consistency across all customer-facing materials. Select fonts that match your brand’s style, ensuring readability without sacrificing design. Avoid using overly decorative fonts that can clutter the receipt and distract from important details.

Keep the layout simple and structured. Position key information–like the company name, contact details, and transaction summary–in a clear, easy-to-read format. Use bold text for headers and italics for additional notes, making it simple for the customer to navigate the document. Minimize unnecessary elements that might overwhelm the customer with excessive data.

Consider adding a short, personalized thank-you message at the bottom of the receipt. This can enhance customer experience while reinforcing your brand’s friendly, customer-centric image. Ensure that the receipt maintains clarity in all sections–be it the product or service description, the total amount, or tax breakdown. Avoid cramming too much information into a small space; white space is key to making the document easier to digest.

Finally, tailor the language used on the receipt. A professional tone with concise phrasing ensures a polished look. Keep the text brief and direct, focusing on details that matter. A receipt should never feel cluttered with excessive text or extraneous promotional language.

Legal Considerations and Compliance for Business Receipts

Ensure your business receipts comply with local tax laws and regulations to avoid legal complications. Accuracy in recording transactions is a key factor in remaining compliant. Here are several important points to follow:

- Include mandatory information: Business receipts must include specific details like the business name, date of transaction, amount, and item description. Depending on your location, you may also need to list tax rates and identification numbers.

- Adhere to tax requirements: Confirm your receipts reflect applicable sales taxes. This can vary based on the jurisdiction and whether the sale is taxable or exempt. Keep records that align with local tax laws.

- Electronic receipts: If offering digital receipts, ensure they meet the same standards as physical ones. Make sure they are easily accessible and can be stored securely for future reference, as required by tax authorities.

- Retain receipts: Many jurisdictions require businesses to store copies of receipts for a certain period, typically 5 to 7 years. Ensure you have a system in place for efficient record-keeping.

- Legal language: Avoid vague or misleading descriptions. Each item or service sold should be clearly described to prevent confusion in the event of a dispute or audit.

- Consumer rights: Some regions require receipts to contain information about consumer rights or return policies. Be sure your receipts reflect this when applicable.

Stay up-to-date with the local legal framework and adjust your templates to meet any changes in compliance rules. This approach will help safeguard your business against potential audits or legal disputes.