To streamline your financial record-keeping, start using customized receipts log templates for your business. These templates simplify tracking purchases, sales, and expenses, helping maintain transparency and organization in your financial operations.

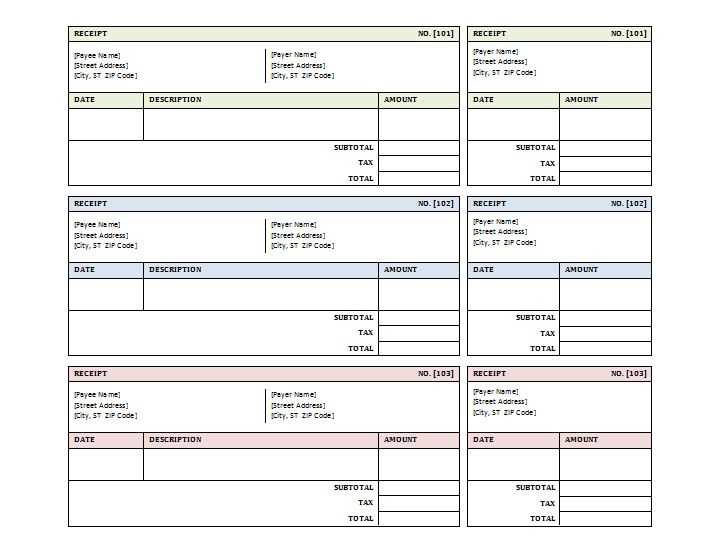

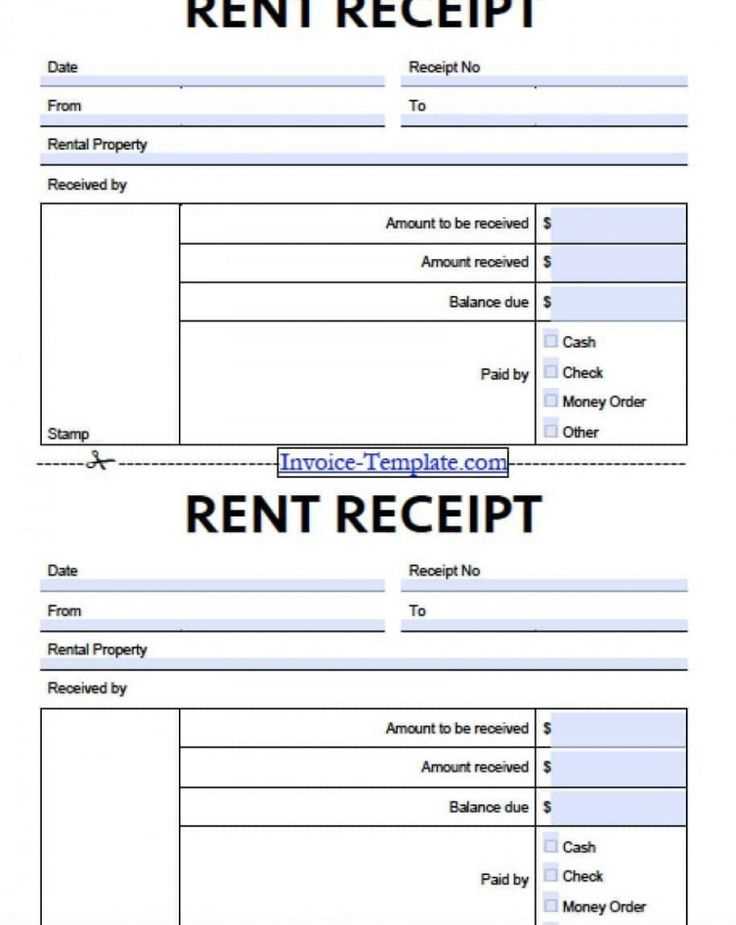

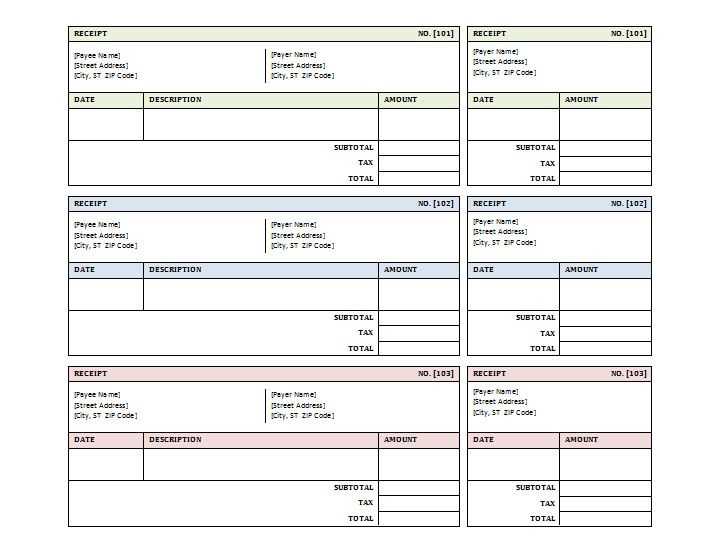

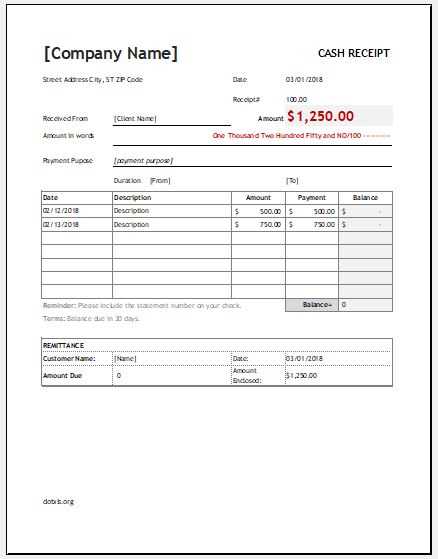

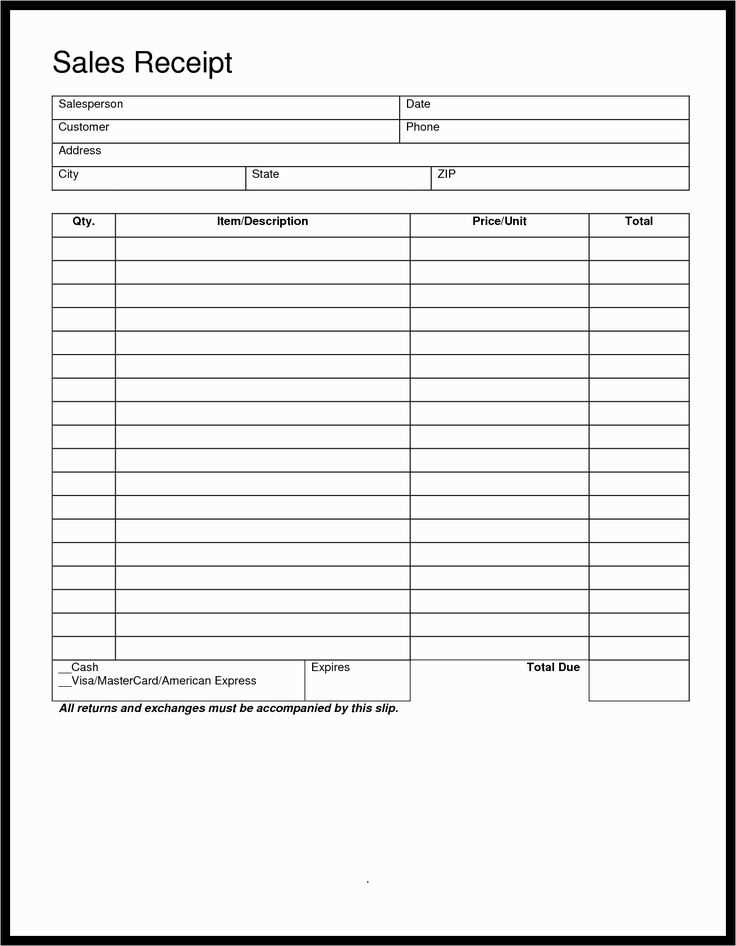

Opt for templates that clearly define all necessary fields, such as date, transaction amount, payment method, and vendor or client information. This will allow quick referencing and reduce the chances of missing key details. Depending on your business type, consider templates that also include tax information, discounts, and notes on product returns or services rendered.

To save time, use digital templates that can be easily updated, stored, and shared. Cloud-based options are highly effective for real-time access across multiple devices, ensuring team members can input data from anywhere. Automate the integration of your receipts log with accounting software to streamline the process further.

By choosing a receipt log template tailored to your business needs, you ensure accurate record-keeping and simplify future tax reporting or audits. With consistent use, this tool becomes a cornerstone of your financial management system.

Here are the corrected lines:

Make sure to include detailed information for each receipt entry. Correct the formatting and align columns consistently across the document. Ensure all fields are labeled clearly, such as date, amount, description, and payment method.

- Use proper date formats (e.g., DD/MM/YYYY or MM/DD/YYYY) depending on your region.

- Always list amounts in the same currency format, with decimals and separators as appropriate.

- Clarify the payment method field, ensuring it’s easy to read (e.g., Cash, Credit Card, Bank Transfer).

- Group similar items together (e.g., expenses, income) for better organization.

Update totals automatically using formulas to avoid manual errors. If you use software for managing receipts, ensure that it can generate summaries based on the entered data for quick tracking.

Double-check each entry for accuracy and avoid abbreviations that may confuse others. For example, write ‘purchase’ instead of ‘buy’ for clarity.

- Receipts Log Templates for Business

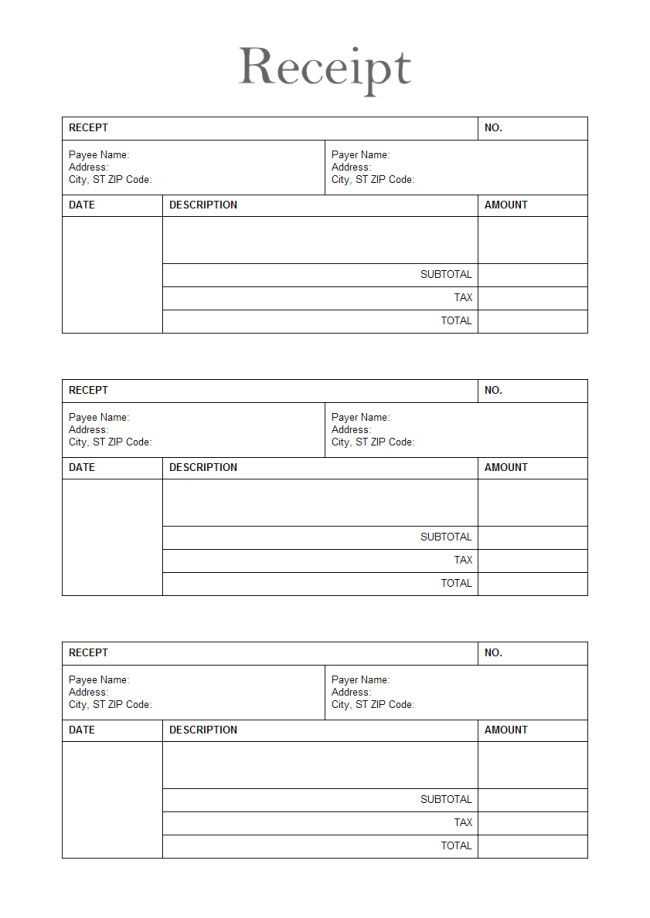

A well-structured receipts log template can streamline tracking and organizing your business transactions. It ensures clear documentation of purchases, providing transparency for tax and auditing purposes. To create an effective template, focus on key details like the transaction date, vendor name, payment method, amount spent, and purpose of the expense. These fields make it easy to analyze your financial data and avoid errors during future accounting tasks.

Key Features of a Receipts Log Template

Include the following fields for a comprehensive and easy-to-use receipts log template:

- Date of Transaction – Clearly state the exact date for each receipt to maintain chronological order.

- Vendor Name – Include the name of the business or individual from whom the purchase was made.

- Amount – List the total cost of the transaction, broken down into categories if necessary (e.g., tax, shipping).

- Payment Method – Note whether payment was made via cash, credit card, or another method.

- Purpose – A brief description of what the purchase was for, such as office supplies, travel expenses, or client services.

Why You Need Receipts Logs

Receipts logs help keep track of all business-related expenses, making it easier to manage your budget, generate reports, and claim deductions during tax season. Regularly updating this log ensures you don’t miss important expenses, which could lead to inaccuracies in financial statements. It also supports accountability, allowing for easy verification of all outgoing funds.

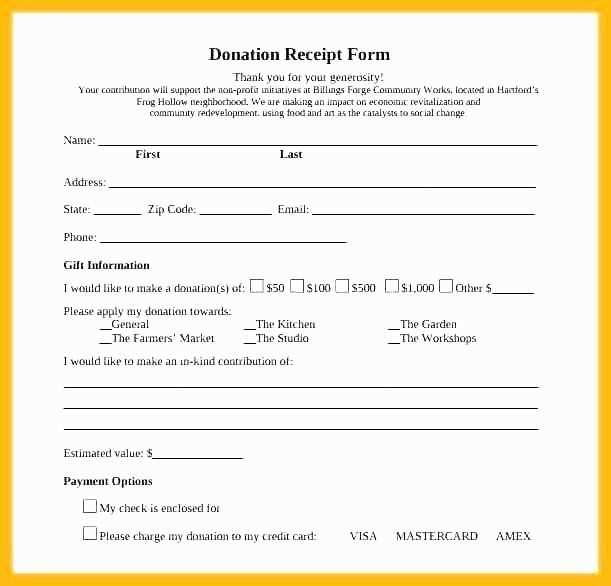

Selecting the right receipt template depends on your business type and how you handle transactions. Start by identifying the core features you need, such as tax calculations, itemization, or discounts. For small businesses or freelancers, a simple template with essential fields like date, item details, and total amount is usually enough.

Identify Key Information

Make sure the template includes fields relevant to your business. For example, a retail store might need SKU numbers, quantities, and total cost, while a service-based business may focus on hourly rates and project descriptions. Adapt the template to display only what’s necessary for your records and customer clarity.

Consider Customization Options

Choose a template that allows easy customization. Your branding should be reflected in the receipt, whether it’s with your logo, color scheme, or business name. A well-designed template will help create a consistent experience for your customers.

Lastly, think about the software or system you’re using. If you rely on accounting software, make sure the template integrates smoothly with it, or choose one that can be exported in a format compatible with your system.

To tailor receipt logs to your business, start by identifying what details are necessary for accurate tracking and reporting. Consider integrating fields such as customer name, items purchased, payment method, and timestamps to match your sales process.

- Product or Service Details: Include specific product names, quantities, and prices to maintain detailed records of each transaction. This can help with inventory management and sales analysis.

- Payment Methods: If you accept various payment types, like credit cards, cash, or digital payments, create separate sections for each method to streamline accounting and reconciliation.

- Customer Information: Depending on your business model, adding customer contact details or loyalty program IDs to the receipt log may provide insights into purchasing behavior and improve customer relations.

- Discounts and Promotions: If applicable, incorporate fields for tracking discounts or promotional offers used in each transaction. This can help evaluate the success of marketing campaigns.

Ensure your receipt logs comply with local tax and legal requirements, including VAT, taxes, and any other mandatory fields. Customizable templates should make it easier to modify or add these sections as regulations change.

- Data Formats: Choose a format that fits your internal systems–such as CSV or PDF–to easily transfer data for accounting and tax purposes.

- Automation: Automate the logging process by integrating receipt generation with your POS (Point of Sale) or invoicing system. This reduces human error and speeds up data entry.

Finally, assess how the log data will be used. For example, if your business requires detailed reports on revenue by product category or sales by region, adjust your log template to capture that information directly.

Integrate receipt logs directly into your accounting software to save time and eliminate errors. By linking receipt logs with platforms like QuickBooks or Xero, your financial data becomes more organized and accessible. This process can often be automated, ensuring that every receipt logged is reflected immediately in your accounting records.

Choose Compatible Software

Ensure that the accounting software you use supports integration with receipt logging tools. Many modern software solutions offer seamless integration with popular receipt log templates, enabling direct syncing of data between the two systems. Choose a platform that suits your business size and transaction volume for the most efficient operation.

Automate Expense Tracking

With integrated receipt logs, your business can automatically track expenses and categorize them in your accounting system. This eliminates the need for manual entry, helping you avoid discrepancies. By doing so, you’ll have up-to-date financial reports and a clearer understanding of your business’s spending.

Integration also allows for faster tax preparation and financial audits, as your receipts are already logged and categorized. This integration is a key step in simplifying your business’s financial processes while maintaining accuracy and compliance.

Receipt Log Templates for Business

To manage receipts efficiently, create a log template that includes key details: date, receipt number, description of purchase, amount, and payment method. This ensures you capture all relevant information for accounting or reimbursement purposes.

Set clear categories to organize receipts, such as office supplies, travel expenses, or utilities. Each category should be easy to access, allowing for quick review during audits or tax preparation.

For consistency, use a digital template to minimize errors. Cloud-based tools, like Google Sheets or Excel, provide real-time access and automatic backups. They also allow for calculations, making it easier to track totals over time.

| Date | Receipt Number | Description | Amount | Payment Method |

|---|---|---|---|---|

| 2025-02-12 | 00123 | Office Supplies | $50.00 | Credit Card |

| 2025-02-13 | 00124 | Travel Expense | $200.00 | Cash |

By customizing the template with these fields, you create a straightforward and effective log. The template can be shared among employees for seamless integration into your workflow.